Water Damage Legal Liability Insurance is a type of insurance coverage that protects property owners and renters from financial losses resulting from water damage claims brought against them due to their alleged negligence. This coverage typically includes protection against claims arising from negligence-related water damage, water backup and overflow, mold and mildew damage, and legal defense costs associated with water damage lawsuits. It is an essential component of risk management for both residential and commercial properties, providing financial protection and peace of mind in the event of water damage incidents. CGL coverage typically includes protection against water damage claims that result from business operations. This type of insurance is essential for businesses that own or lease commercial property, as it provides coverage for potential damages resulting from water leaks, pipe bursts, or other water-related incidents. A BOP is a package policy designed for small to medium-sized businesses that combines property and liability coverage. Water damage legal liability insurance may be included as part of the BOP's liability section, offering protection against water damage claims arising from business operations. Commercial property insurance policies may include water damage legal liability insurance as an optional endorsement. This type of coverage can be especially important for commercial property owners, as it can provide protection against water damage claims made by tenants or other third parties. Homeowners insurance policies typically include coverage for water damage legal liability as part of their standard package. This coverage protects homeowners from potential claims brought against them due to water damage caused by their alleged negligence, such as not maintaining their property adequately. Renters insurance policies often include water damage legal liability insurance as part of their liability coverage. This type of insurance is essential for renters, as it offers protection against potential claims made by landlords or other third parties for water damage caused by the renter's negligence. Water damage legal liability insurance generally covers claims arising from the policyholder's negligence. This may include incidents such as failing to repair a leaking pipe or not maintaining a property's gutter system, which could result in water damage to a neighboring property. Many policies include coverage for water backup and overflow, which occurs when water escapes from a sewer, drain, or sump pump. This coverage can provide protection against claims resulting from water damage caused by these types of incidents. Mold and mildew damage can often result from water damage incidents, and some policies may include coverage for mold remediation as part of their water damage legal liability insurance. This coverage can be especially important for property owners or managers, as mold damage can lead to costly remediation efforts and potential health issues for occupants. Water damage legal liability insurance typically covers the cost of legal defense in the event a policyholder is sued for water damage-related claims. This can include attorney fees, court costs, and other expenses associated with defending against a lawsuit. Gradual water damage, such as damage caused by slow leaks or seepage over time, is generally not covered by water damage legal liability insurance policies. Policyholders should be aware of this exclusion and take proactive measures to detect and repair any gradual water damage issues. Water damage legal liability insurance does not typically cover damage resulting from flooding. Flood insurance is a separate policy that property owners or renters may need to purchase to protect against flood-related damages. Water damage legal liability insurance does not cover damage caused by intentional acts, such as intentionally flooding a property or causing water damage to another person's property. Water damage legal liability insurance policies generally exclude coverage for water damage caused by earth movement, such as earthquakes or landslides, or foundation issues like settling or cracking. In some cases, separate coverage may be available for these types of risks. The location of a property can significantly impact water damage legal liability insurance premiums. Properties in areas with a high risk of water damage, such as those near bodies of water or with a history of frequent water damage claims, may have higher premiums. Older properties or those in poor condition may be more susceptible to water damage, leading to higher insurance premiums. Regular maintenance and updates to a property can help mitigate these risks and potentially reduce insurance costs. The amount of coverage a policyholder chooses, and the deductible they select can influence water damage legal liability insurance premiums. Higher coverage limits and lower deductibles generally result in higher premiums, while lower coverage limits and higher deductibles can lead to lower premiums. A policyholder's claims history can also impact their water damage legal liability insurance premiums. A history of frequent claims or a pattern of water damage incidents may result in higher premiums, as insurers may view the policyholder as a higher risk. Implementing risk mitigation measures, such as installing water leak detection systems or implementing a water damage response plan, can help reduce the likelihood of water damage incidents and may result in lower insurance premiums. In the event of a water damage incident, policyholders should report the claim to their insurance provider as soon as possible. Timely reporting can help expedite the claims process and ensure that any necessary repairs or remediation efforts are addressed promptly. Once a claim is reported, the insurance provider will typically investigate the incident and assess the extent of the damage. This may involve inspecting the property, reviewing maintenance records, and determining the cause of the water damage. Based on the investigation and assessment, the insurance provider will determine the appropriate settlement amount for the claim. This may include the cost of repairs, remediation efforts, and any legal expenses incurred by the policyholder. If a policyholder disagrees with the insurance provider's claim decision, they may have the option to appeal the decision. This can involve providing additional documentation or evidence to support their claim or working with an independent claims adjuster to reevaluate the damages. Routine maintenance can help identify and address potential water damage risks before they become significant problems. This may include regularly inspecting plumbing systems, gutters, and roofs for signs of wear or damage. Water leak detection systems can help alert property owners or managers to potential water damage risks, allowing for timely repairs and reducing the likelihood of extensive damage. These systems can be especially beneficial in commercial properties or multi-unit residential buildings. Proper insulating pipes can help prevent water damage caused by frozen or burst pipes. This is particularly important in regions with cold winters and can help reduce the likelihood of costly water damage claims. Developing and implementing a water damage response plan can help property owners and managers respond quickly and effectively to water damage incidents. A comprehensive plan should include steps for identifying the source of the water damage, mitigating further damage, and coordinating repair and remediation efforts. When considering water damage legal liability insurance, it is essential to assess your specific risks. This may involve evaluating the location, age, and condition of your property, as well as identifying any unique factors that could increase the likelihood of water damage incidents. Research and compare different policies and insurance providers to find the best coverage for your needs. Look for providers with a strong reputation for handling claims fairly and efficiently, and consider factors such as policy inclusions, exclusions, and premium costs when comparing coverage options. Consulting with an experienced insurance broker or agent can be invaluable in choosing the right water damage legal liability insurance. These professionals can help you navigate the complex insurance landscape, assess your specific needs, and recommend the most suitable coverage options. Before purchasing water damage legal liability insurance, it is crucial to thoroughly review the policy terms and conditions. Understand the policy inclusions, exclusions, and any potential limitations to ensure the coverage meets your specific needs and offers adequate protection. Water Damage Legal Liability Insurance is a crucial component of risk management for property owners and renters, providing financial protection against potential water damage claims. This insurance coverage typically covers negligence-related water damage, water backup and overflow, mold and mildew damage, and legal defense costs. It is essential to assess your specific risks, compare policies and providers, and work with an experienced insurance broker or agent to choose the right coverage for your needs. Regular property maintenance, installing water leak detection systems, and implementing a water damage response plan can help mitigate potential risks and reduce insurance premiums. Given the complexity of insurance policies and the importance of having adequate coverage, it is highly recommended to seek professional services to ensure you have the right Water Damage Legal Liability Insurance to safeguard your property and financial assets.Definition of Water Damage Legal Liability Insurance

Types of Water Damage Legal Liability Insurance

Commercial General Liability (CGL) Coverage

Business Owners Policy (BOP) Coverage

Commercial Property Insurance Coverage

Homeowners Insurance Coverage

Renters Insurance Coverage

Understanding Water Damage Legal Liability Insurance Policies

Policy Inclusions

Negligence-Related Water Damage

Water Backup and Overflow

Mold and Mildew

Legal Defense Costs

Policy Exclusions

Gradual Water Damage

Flood Damage

Intentional Acts

Earth Movement and Foundation Issues

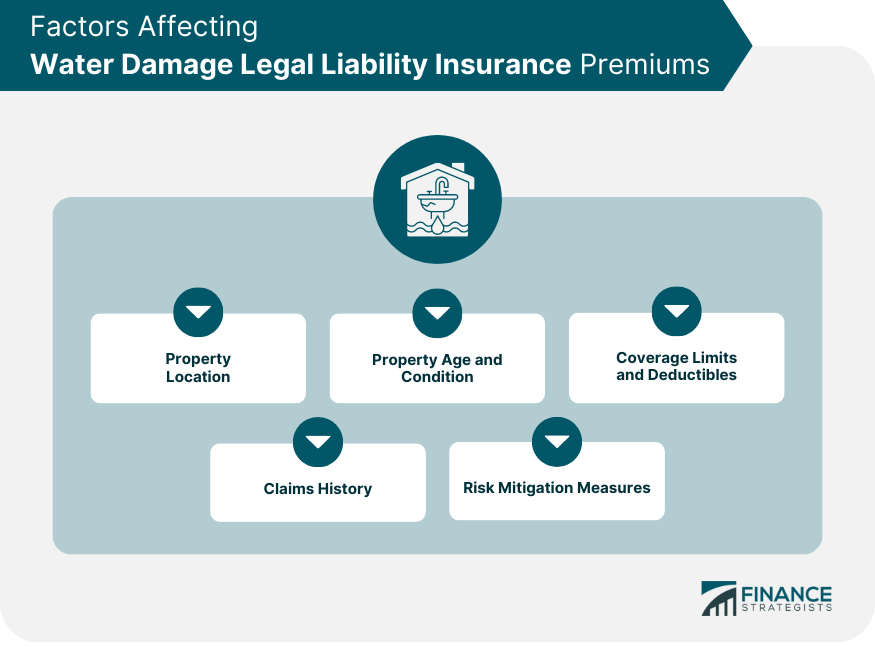

Factors Affecting Water Damage Legal Liability Insurance Premiums

Property Location

Property Age and Condition

Coverage Limits and Deductibles

Claims History

Risk Mitigation Measures

Claims Process for Water Damage Legal Liability Insurance

Reporting a Claim

Investigation and Assessment

Settlement and Repairs

Appealing a Claim Decision

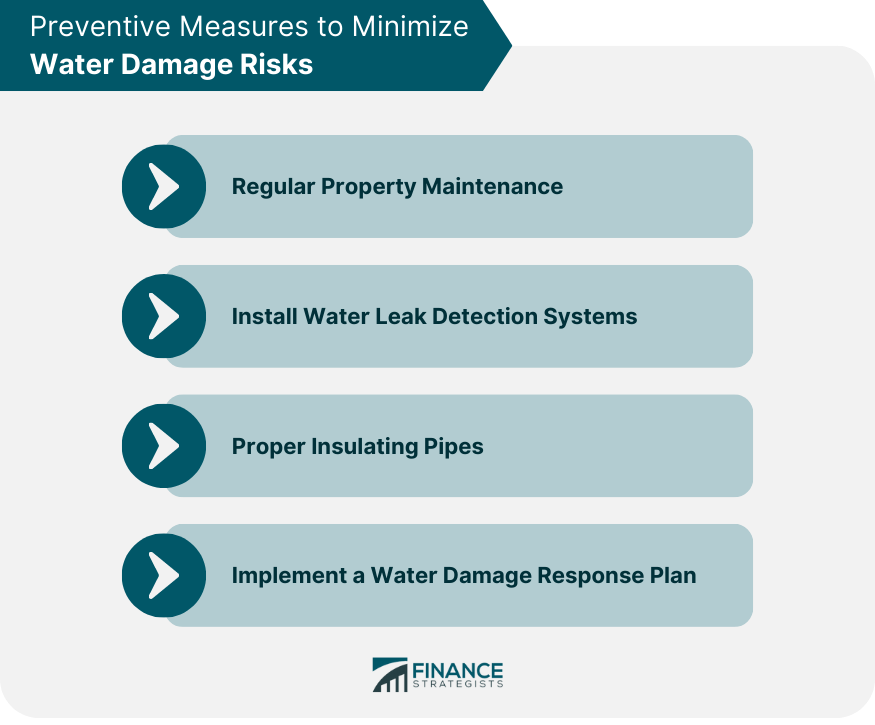

Preventive Measures to Minimize Water Damage Risks

Regular Property Maintenance

Installing Water Leak Detection Systems

Proper Insulating Pipes

Implementing a Water Damage Response Plan

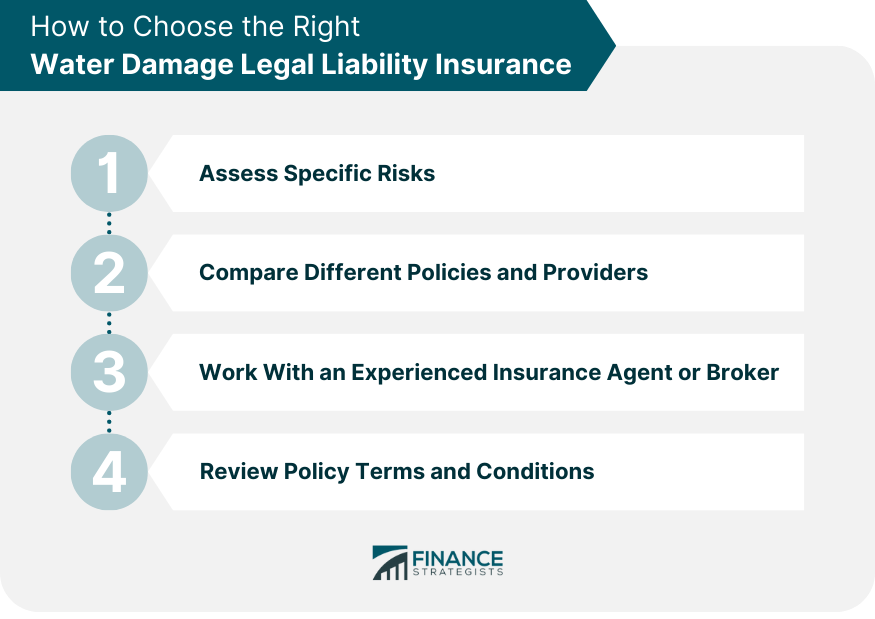

How to Choose the Right Water Damage Legal Liability Insurance

Assessing Your Specific Risks

Comparing Different Policies and Providers

Working With an Experienced Insurance Broker or Agent

Reviewing Policy Terms and Conditions

Conclusion

Water Damage Legal Liability Insurance FAQs

Water Damage Legal Liability Insurance typically covers claims arising from the policyholder's negligence, water backup and overflow, mold and mildew, and legal defense costs. This type of insurance protects property owners and renters from potential financial losses resulting from water damage claims.

Yes, common exclusions in Water Damage Legal Liability Insurance policies include gradual water damage, flood damage, intentional acts, and earth movement or foundation issues. Policyholders should be aware of these exclusions and consider additional coverage if necessary.

Premiums for Water Damage Legal Liability Insurance are influenced by factors such as property location, property age and condition, coverage limits and deductibles, claims history, and risk mitigation measures. Implementing preventative measures and maintaining your property can help reduce premium costs.

In many cases, Water Damage Legal Liability Insurance is already included as part of standard property or liability insurance policies, such as homeowners, renters, or commercial property insurance. However, additional endorsements or riders may be available to enhance coverage for specific water damage risks.

To choose the right Water Damage Legal Liability Insurance for your needs, start by assessing your specific risks, comparing different policies and providers, working with an experienced insurance broker or agent, and reviewing policy terms and conditions. This will help ensure you have adequate coverage for your property and potential water damage-related liabilities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.