An Unscheduled Property Floater is a specific type of insurance coverage that protects personal belongings not listed or "scheduled" on a homeowner's or renter's insurance policy. These items, often referred to as 'floaters,' are typically high-value possessions that exceed the standard coverage limits of a typical property insurance policy. Unscheduled property floaters play a crucial role in safeguarding high-value assets that are not covered under regular home or renter's insurance policies. As insurance policies often have a specific coverage limit, valuable items may not be fully covered. Hence, unscheduled property floaters bridge this gap and provide comprehensive coverage for these precious items. In the realm of property insurance, possessions are typically categorized as either 'scheduled' or 'unscheduled.' Scheduled property refers to those items that are listed specifically on an insurance policy, along with their respective value. These could include items like unique artwork, antiques, jewelry, or other high-value belongings. On the contrary, unscheduled property represents all other possessions not explicitly listed on the policy. The coverage limit for such items is typically lower, which is where an unscheduled property floater steps in to provide additional protection. In insurance parlance, a "floater" is a type of policy that covers movable property. Unlike standard homeowners or renters insurance policies that cover items in a specific location (such as the insured's home), a floater policy provides coverage for items wherever they might "float" to. This is particularly useful for items like jewelry, which you might regularly wear outside your home. A standard property insurance policy, while useful, often has inherent limitations, specifically concerning the maximum value of items it can cover. This cap may not suffice when dealing with high-value items such as luxury watches, precious stones, or rare artifacts. Moreover, the standard policy generally covers property located within the insured premises, with limited coverage for items outside the home. An unscheduled property floater is a valuable supplement in such scenarios, providing extra protection for your belongings irrespective of their location and offering peace of mind in the event of theft, loss, or damage. An unscheduled property floater covers personal belongings that aren't explicitly mentioned in your primary property insurance policy. These may include items of significant value, such as jewelry, antiques, electronics, musical instruments, sporting equipment, and more. Unlike traditional homeowners or renters insurance, an unscheduled property floater offers coverage irrespective of the location of the item. Whether the insured item is within your home, in your car, or even overseas, it can be covered under the floater. This wide-ranging coverage is one of the key benefits of an unscheduled property floater. Property valuation under an unscheduled property floater often involves the actual cash value or replacement cost of the items. Actual cash value considers depreciation, while replacement cost provides coverage for the amount it would cost to replace the item at current market prices. In the event of a claim, the policyholder is required to provide proof of ownership and, if possible, the item's value. This could be in the form of receipts, photographs, or appraisals. Upon approval, the insurer compensates the policyholder per the terms of the policy. Unscheduled property floaters are especially beneficial for high-value items such as jewelry and watches. These items often exceed the coverage limit of standard insurance policies. Floaters provide extensive protection, covering circumstances like theft, loss, or damage, and apply regardless of the location of these items. Artworks, sculptures, antique furniture, and collectibles fall under the ambit of an unscheduled property floater. Given the often irreplaceable and highly valuable nature of these items, having them covered under a floater policy can offer significant peace of mind to the policyholder. In today's technologically advanced era, gadgets and electronics can add up to a significant value. High-end laptops, smartphones, camera equipment, and other electronics can be protected under an unscheduled property floater. Unscheduled property floaters can cover a broad range of other valuables. Items such as musical instruments, designer clothing, sporting equipment, silverware, rare books, and more can be insured under this coverage. Essentially, any high-value items not listed in your standard property insurance policy can be covered, providing comprehensive protection for your prized possessions. One of the main advantages of an unscheduled property floater is the comprehensive coverage it offers for high-value items. It bridges the gap left by regular homeowners or renters insurance, which often has limited coverage for high-value items. By providing protection beyond the standard policy limits, it ensures that your valuable assets are adequately insured. Unscheduled property floaters provide coverage that moves with your property. This means that whether you're at home, traveling, or moving, your belongings remain covered. This mobility of coverage is particularly beneficial for items such as jewelry, watches, and electronics, which you may frequently carry with you. Unlike scheduled property insurance, where each item must be individually listed and valued, an unscheduled property floater covers multiple items under one policy without the need for individual listing. This makes the process simpler and more convenient, particularly if you have many items to insure. While unscheduled property floaters offer wide-ranging coverage, there may be sub-limits on certain types of property. These limits are often applied to particularly valuable or high-risk items and may not fully cover the replacement cost of the item. As unscheduled property floaters provide coverage beyond the limits of standard homeowners or renters insurance, they may come with higher premiums. This is especially true for policyholders with numerous high-value items. Certain high-risk items, such as expensive jewelry that is worn frequently or valuable antiques that are prone to damage, may have certain limitations or exclusions in the coverage. The total value of the items to be insured is a significant determinant of the premium. Generally, the higher the overall value, the more the policyholder is likely to pay in premiums. Geographical location can also play a critical role. Areas with higher rates of theft or damage, for example, can result in higher premiums. Insurers take into account the perceived risk associated with the insured items. If the items are deemed likely to be lost or damaged—owing to their nature, usage, or other circumstances—the premiums may be higher. In terms of pricing, there's a distinction to be made between unscheduled property floaters and scheduled property insurance. Typically, unscheduled property floaters have higher premiums than standard property insurance. However, they can actually prove to be more cost-effective for policyholders with numerous high-value items. This is because such policies cover multiple items under one umbrella policy, eliminating the need for individual listing or separate policies for each item. There are several strategies that policyholders can employ to reduce the premiums for their unscheduled property floaters. A history of few or no insurance claims can favorably affect premiums, as it demonstrates to insurers that the policyholder is low-risk. By installing security systems, policyholders can significantly reduce the risk of theft, which can, in turn, lower the premiums for their insurance policy. Regular appraisal of the insured items ensures that their value is accurately reflected in the policy. Overvaluing items can unnecessarily inflate premiums, while undervaluing can lead to inadequate coverage. So, it's essential to adjust the value of insured items periodically. The claims process for an Unscheduled Property Floater, like most insurance claims, involves several critical steps that policyholders must follow for a successful claim. Understanding these steps can make the claims process smoother and increase the likelihood of claim approval. When filing a claim for an Unscheduled Property Floater, the first step involves promptly notifying the insurer about the loss or damage. The policyholder must provide the insurance company with detailed information about the incident leading to the claim and a thorough description of the item or items involved. In case of theft or vandalism, it is highly recommended to report the incident to the police and provide a copy of the police report to the insurance company. Timely reporting not only helps to expedite the claims process but is often a requirement of many insurance companies. To support a claim, the insurance company often requires specific documents. The policyholder must provide proof of ownership for the insured item or items. This proof can come in various forms, such as original purchase receipts or photographs that clearly show the item in the policyholder's possession. Similarly, proof of the item's value is also necessary. Appraisals or valuation certificates can provide this information. If such documentation isn't readily available, the policyholder may need to obtain a professional evaluation. Even with the best intentions and efforts, policyholders sometimes face claim rejection. Among the common reasons for claim rejection are insufficient documentation, delayed reporting of the loss or damage, and claim circumstances not covered under the policy. To avoid such pitfalls, it's essential to maintain comprehensive and up-to-date documentation for all items covered under the policy. This documentation should include information about the item's acquisition, ownership, and value. Policyholders should also report any loss or damage to their insurance provider as soon as possible to avoid any claim denial due to late reporting. Moreover, policyholders must fully understand their policy's coverage, including any exclusions or limitations. Understanding these details can help avoid submitting claims for incidents or circumstances not covered under the policy. Consulting with an insurance advisor or the insurance provider can clarify any ambiguities and ensure a better grasp of the policy's terms and conditions. Selecting an insurance provider for an unscheduled property floater requires careful consideration of various factors. These factors are critical to ensuring the provider can offer comprehensive coverage for your valuable belongings and deliver quality service. The insurer's reputation in the industry is a crucial factor. A reputable insurer is often associated with reliability, integrity, and financial stability. You can assess the insurer's reputation by looking at factors such as years of operation, financial strength ratings, customer reviews, and history of claim settlement. An insurance provider should offer a range of coverage options to suit your specific needs. The coverage should be flexible enough to accommodate the unique nature and value of your items. It's essential to understand the specifics of the coverage, including any exclusions, sub-limits, and optional coverages that the insurer provides. Effective customer service is vital in insurance relationships. A provider with excellent customer service is responsive, helpful, and accessible through multiple channels. Check the insurer's customer service reviews and ratings to gain insight into their customer support effectiveness. Understanding the insurer's claim process before choosing them is crucial. A straightforward and efficient claim process can make a significant difference when it comes to filing a claim. It's beneficial to choose an insurer known for its quick, fair, and hassle-free claims settlement. Lastly, the premium rates charged by the insurer are a significant consideration. It's important to compare the rates of different insurers to ensure you're getting the best value for your money. However, keep in mind that the cheapest option may not always offer the best coverage. Aim for a balance between affordability and comprehensive coverage. An unscheduled property floater is insurance coverage for high-value items not included in standard homeowners or renters insurance. It offers comprehensive coverage for items like jewelry, art, electronics, and more, regardless of their location. Advantages include comprehensive coverage and the convenience of insuring multiple items without listing them individually. However, premiums may be higher, and sub-limits on certain items could apply. Premiums are influenced by factors like item value, location, and perceived risk. To make a claim, notify the insurer promptly, provide a detailed description of the incident, and submit the required documentation. Consulting a reputable insurance broker is recommended for navigating this type of coverage effectively.What Is an Unscheduled Property Floater?

Conceptual Framework of Unscheduled Property Floater

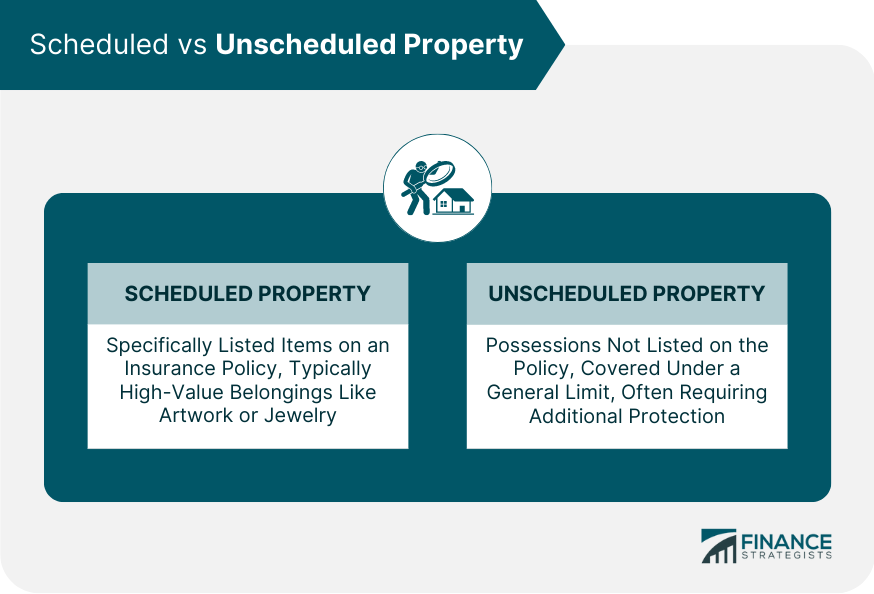

Differentiating Between Scheduled and Unscheduled Property

Understanding "Floaters" in Insurance Terms

Need for Additional Coverage - Limitations of Regular Property Insurance

How Does an Unscheduled Property Floater Work?

Description of Coverage

Scope of Coverage

Property Valuation and Claim Settlement Process

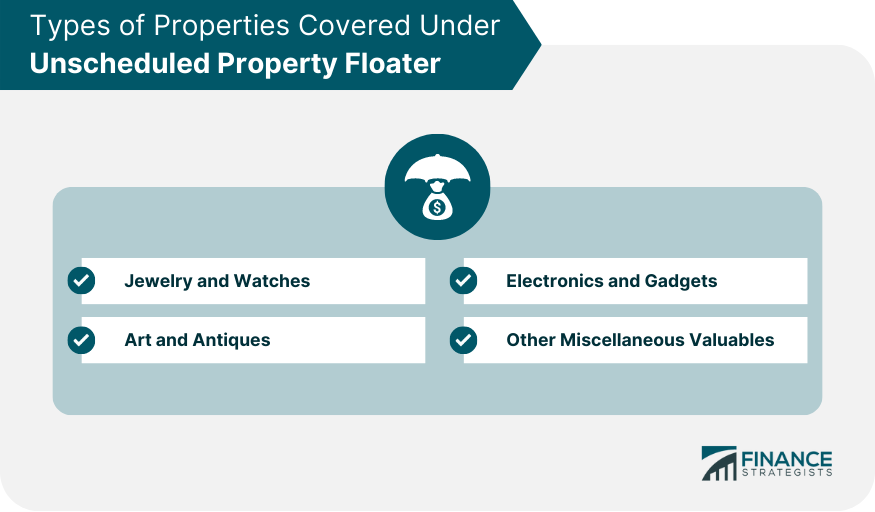

Types of Properties Covered Under Unscheduled Property Floater

Jewelry and Watches

Art and Antiques

Electronics and Gadgets

Other Miscellaneous Valuables

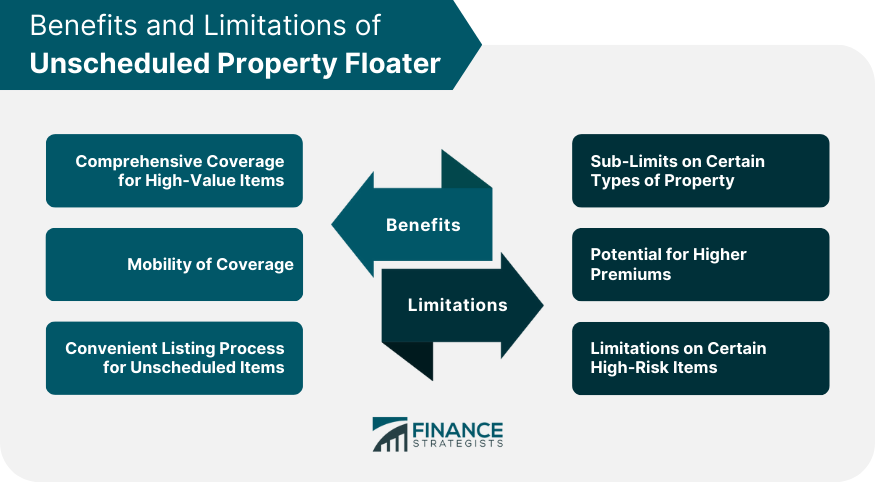

Advantages of Unscheduled Property Floater

Comprehensive Coverage for High-Value Items

Mobility of Coverage

Convenient Listing Process for Unscheduled Items

Limitations of Unscheduled Property Floater

Sub-Limits on Certain Types of Property

Potential for Higher Premiums

Limitations on Certain High-Risk Items

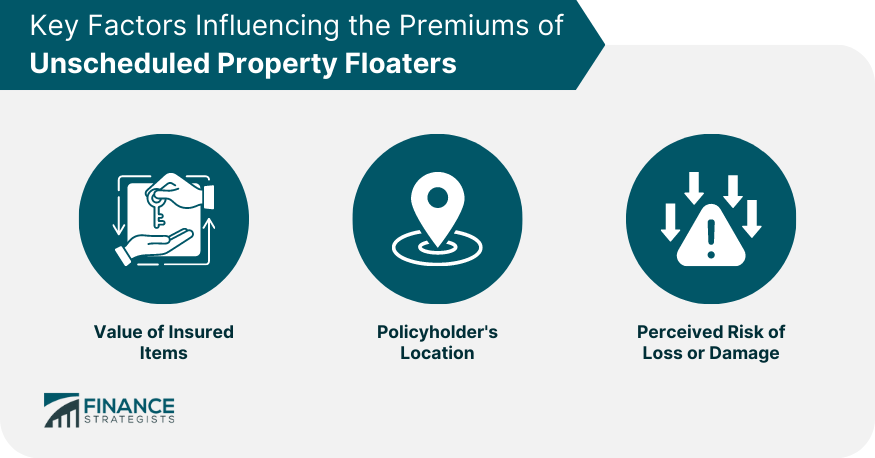

Key Factors Influencing the Premiums of Unscheduled Property Floaters

Value of Insured Items

Policyholder's Location

Perceived Risk of Loss or Damage

Comparison of Unscheduled Property Floaters and Scheduled Property Insurance

Strategies to Reduce Premiums for Unscheduled Property Floaters

Maintaining a Positive Claim History

Installing Security Systems

Regularly Appraising and Adjusting Insured Items Value

Unscheduled Property Floater Claims Process

Initiating the Claims Process: Steps to File a Claim

Role of Documentation in Unscheduled Property Claims

Understanding and Avoiding Common Reasons for Claim Rejection

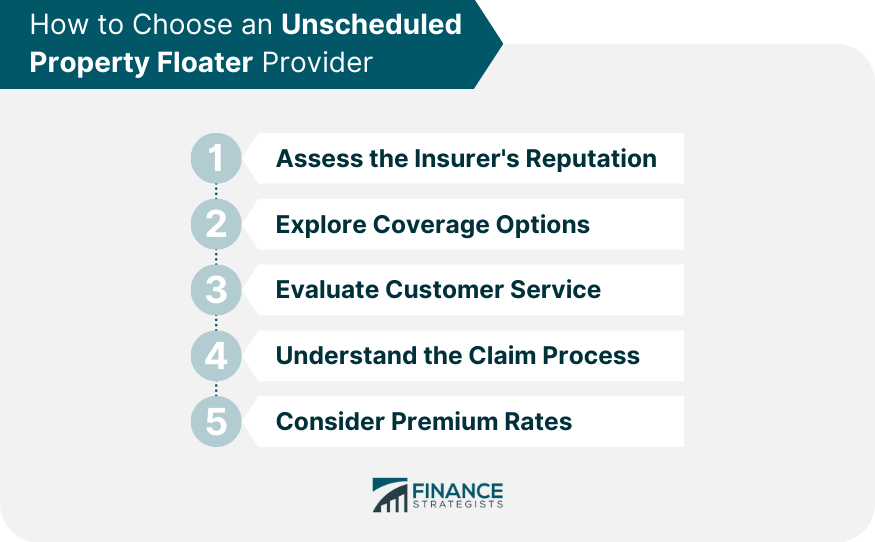

Choosing an Unscheduled Property Floater Provider

Assessing the Insurer's Reputation

Exploring Coverage Options

Evaluating Customer Service

Understanding the Claim Process

Considering Premium Rates

Final Thoughts

Unscheduled Property Floater FAQs

An unscheduled property floater is a type of insurance policy that provides coverage for high-value items that are not specifically listed or "scheduled" on a standard homeowners or renters insurance policy.

An unscheduled property floater typically covers high-value items such as jewelry, watches, art, antiques, electronics, and other valuables that exceed the coverage limits of a standard insurance policy.

An unscheduled property floater offers comprehensive coverage for high-value items and mobility of coverage. However, it may have higher premiums and impose sub-limits on certain types of property.

Premiums for unscheduled property floaters are influenced by several factors, including the total value of the insured items, the policyholder's location, and the perceived risk of loss or damage to the items.

The claim process typically involves promptly notifying the insurer of the loss or damage, providing a detailed description of the incident, and submitting any required documentation, such as proof of ownership and value.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.