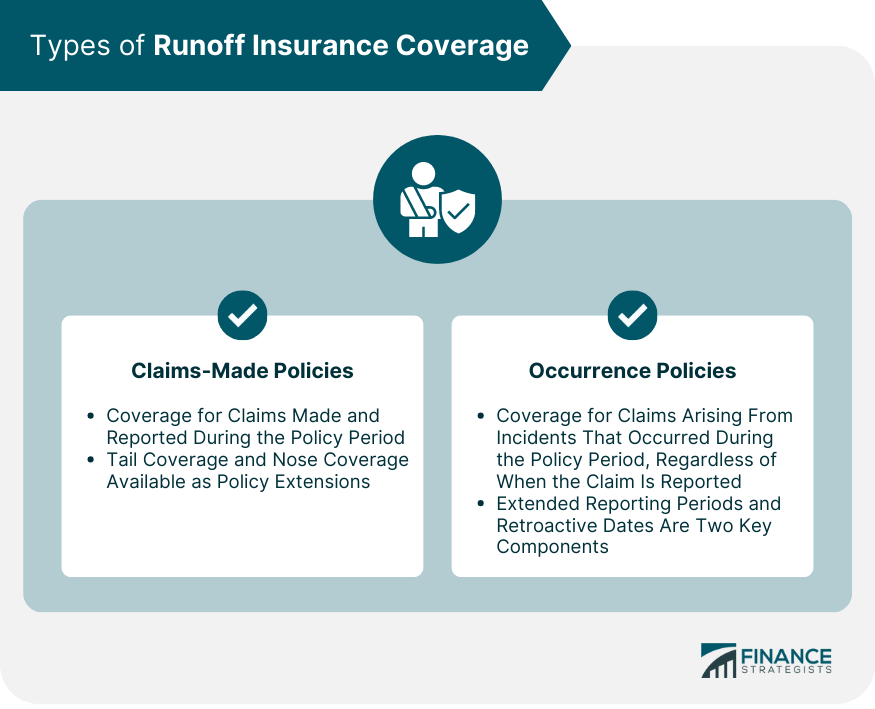

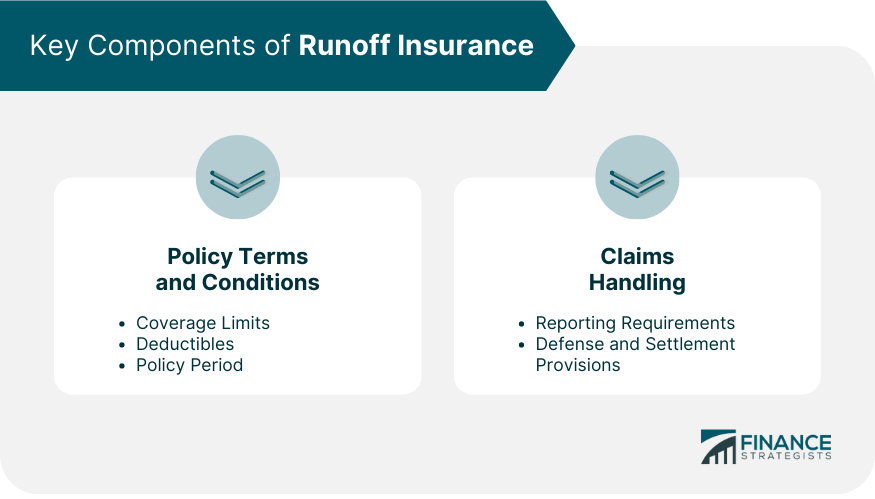

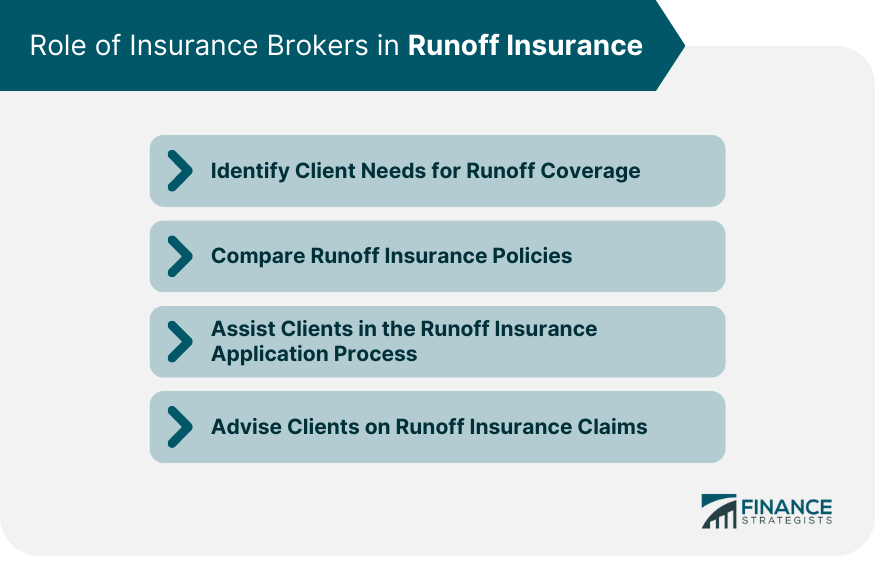

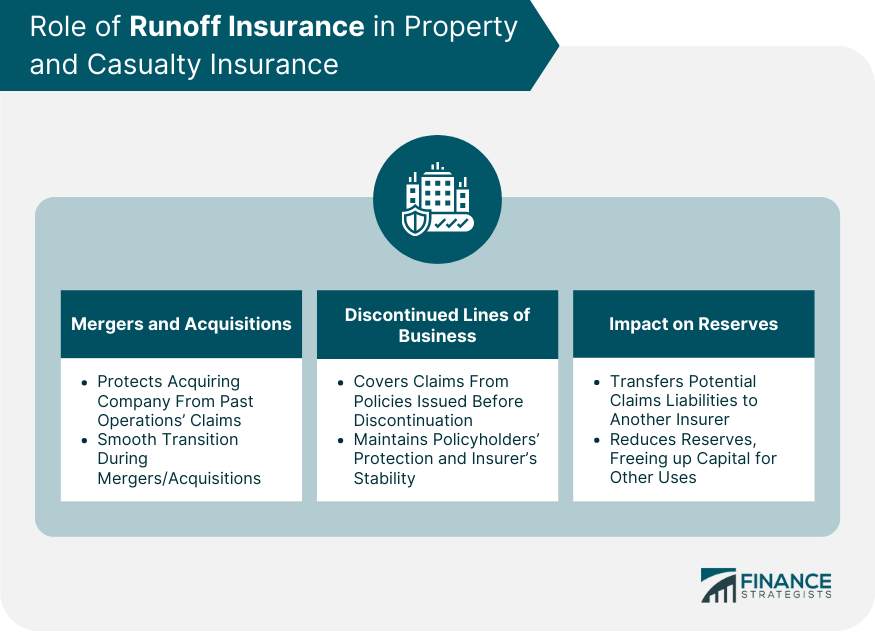

Runoff Insurance is a specialized form of insurance coverage designed to protect businesses and professionals from potential financial losses arising from claims made after a policy has expired, been canceled, or from discontinued lines of business. This coverage is particularly important in situations such as mergers and acquisitions, business closures, and professional retirements, as it helps mitigate the risk of unforeseen liabilities and provides continuous protection against potential claims. Claims-made policies are a common form of runoff insurance coverage. They provide protection for claims that are made and reported during the policy period. Two types of coverage extensions are available for claims-made policies: tail coverage and nose coverage. Tail coverage, also known as an extended reporting period (ERP), allows policyholders to report claims after the policy has expired or been canceled. This coverage is particularly useful for professionals who retire or sell their businesses, as it protects them from potential claims that may arise after they have ceased operations. Nose coverage, or prior acts coverage, is another type of extension for claims-made policies. It covers claims that arise from incidents that occurred before the policy's inception date but were not reported until after the policy began. This coverage is essential for professionals who switch insurance carriers or start a new business, as it ensures continuous protection from past incidents. Occurrence policies are another type of runoff insurance coverage. They cover claims that arise from incidents that occurred during the policy period, regardless of when the claim is reported. Extended reporting periods and retroactive dates are two critical aspects of occurrence policies. ERPs are similar to tail coverage in claims-made policies. They provide additional time for policyholders to report claims after the policy has expired or been canceled. ERPs are vital for professionals who need ongoing protection from potential claims that may surface after their policy has ended. The retroactive date is a critical component of occurrence policies. It specifies the earliest date from which the policy will cover incidents. Any claims arising from incidents that occurred before the retroactive date will not be covered under the policy. It is crucial for policyholders to ensure that their retroactive date provides adequate protection for potential claims. Runoff insurance policies contain various terms and conditions that policyholders must understand and adhere to. Coverage limits, deductibles, and policy periods are three essential aspects of these terms and conditions. Coverage limits dictate the maximum amount that an insurance carrier will pay for a claim under the policy. Policyholders should choose a limit that provides adequate financial protection for their business, taking into account potential legal expenses and settlement costs. Deductibles are the amounts that policyholders must pay out-of-pocket before the insurance carrier covers any expenses. Policyholders should select a deductible that aligns with their risk tolerance and financial capabilities. The policy period is the duration of time during which the insurance coverage is in effect. Policyholders must ensure that their coverage remains active and up-to-date to avoid potential gaps in protection. Claims handling is a critical aspect of runoff insurance policies. Reporting requirements and defense and settlement provisions are two key components of this process. Policyholders must adhere to specific reporting requirements when submitting a claim. These requirements may include deadlines for reporting incidents and providing supporting documentation. Failure to meet these requirements can result in the denial of a claim. Runoff insurance policies often include defense and settlement provisions that outline the insurer's responsibilities in defending and settling claims. Policyholders should be familiar with these provisions to understand their rights and responsibilities Insurance brokers play a crucial role in the runoff insurance process. They assist clients in identifying their coverage needs, comparing policies, and navigating the application and claims processes. Insurance brokers must work closely with their clients to determine their need for runoff insurance. By assessing the client's industry, business operations, and potential risks, brokers can recommend the most suitable coverage options to protect against future claims. Brokers should be familiar with the different types of runoff insurance policies available in the market. They can help their clients evaluate and compare various policy options, considering factors such as coverage limits, deductibles, and policy periods, to find the best fit for their needs. Insurance brokers should guide their clients through the application process for runoff insurance. This may involve gathering the necessary documentation, completing application forms, and liaising with insurers to obtain the most favorable terms and conditions for their clients. When a client needs to make a claim under their runoff insurance policy, the broker should provide guidance on the claims process, ensuring that the client adheres to reporting requirements and understands their rights and responsibilities under the policy. Runoff insurance plays a significant role in property and casualty insurance, particularly in the context of mergers and acquisitions, discontinued lines of business, and its impact on reserves. In mergers and acquisitions, runoff insurance can help protect the acquiring company from potential claims arising from the acquired company's past operations. By purchasing runoff coverage, the acquiring company can mitigate the risk of unforeseen liabilities and ensure a smoother transition during the merger or acquisition process. When an insurer decides to discontinue a line of business, runoff insurance can provide protection for claims arising from policies issued before the discontinuation. This coverage ensures that policyholders are not left without protection and helps maintain the insurer's financial stability during the transition. Runoff insurance can affect property and casualty insurers' reserves, as it allows them to transfer potential claims liabilities to another insurer. By purchasing runoff coverage, insurers can reduce the amount they need to hold in reserves for future claims, freeing up capital for other purposes. Runoff insurance is subject to various state and federal regulations and industry best practices that insurers, brokers, and policyholders must be aware of. Each state has its own insurance regulations governing runoff insurance, including licensing requirements, solvency standards, and reporting obligations. Insurance brokers and carriers must ensure that they comply with these regulations to maintain their licenses and avoid penalties. In addition to state regulations, runoff insurance may also be subject to federal regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act. Insurers and brokers must be familiar with these regulations and ensure compliance to avoid potential sanctions. Runoff insurance is a specialized form of coverage that protects businesses and professionals from potential financial losses. It is crucial in situations like mergers and acquisitions, discontinued lines of business, and ensuring reserves in property and casualty insurance. Claims-made and occurrence policies are the two primary types of runoff insurance, offering tail coverage, nose coverage, extended reporting periods, and retroactive dates. Key components include policy terms and conditions, coverage limits, deductibles, and policy periods. Insurance brokers play a vital role in identifying client needs, comparing policies, assisting in applications, and advising on claims. Runoff insurance is subject to state and federal regulations, requiring compliance to maintain licenses and meet reporting obligations.Definition of Runoff Insurance

Types of Runoff Insurance Coverage

Claims-Made Policies

Tail Coverage

Nose Coverage

Occurrence Policies

Extended Reporting Periods

Retroactive Date

Key Components of Runoff Insurance

Policy Terms and Conditions

Coverage Limits

Deductibles

Policy Period

Claims Handling

Reporting Requirements

Defense and Settlement Provisions

Role of Insurance Brokers in Runoff Insurance

Identifying Client Needs for Runoff Coverage

Comparing Runoff Insurance Policies

Assisting Clients in the Runoff Insurance Application Process

Advising Clients on Runoff Insurance Claims

Property and Casualty Insurance and Runoff Insurance

Runoff Insurance for Mergers and Acquisitions

Runoff Insurance for Discontinued Lines of Business

Impact of Runoff Insurance on Property and Casualty Reserves

Regulatory and Compliance Issues in Runoff Insurance

State Insurance Regulations

Federal Regulations

Conclusion

Runoff Insurance FAQs

Runoff Insurance is a specialized type of insurance coverage designed to protect businesses from potential financial losses arising from claims made after a policy has expired or been canceled, or from discontinued lines of business. It is particularly important for businesses undergoing mergers and acquisitions, professionals who retire or sell their businesses, and insurers managing discontinued lines of business.

Runoff Insurance coverage can be included in both claims-made and occurrence policies. In claims-made policies, runoff insurance is often provided through tail coverage (extended reporting periods) or nose coverage (prior acts coverage). In occurrence policies, runoff insurance is typically offered through extended reporting periods and the use of retroactive dates to cover incidents occurring during the policy period.

Insurance brokers play a vital role in assisting clients with their Runoff Insurance needs by identifying the appropriate coverage, comparing policies, guiding clients through the application process, and advising on claims handling. Brokers help clients find the best policy to fit their specific needs and ensure they are adequately protected against potential claims.

Runoff Insurance is an essential aspect of property and casualty insurance, especially in situations like mergers and acquisitions, discontinued lines of business, and the management of insurance reserves. Runoff coverage can help protect acquiring companies from unforeseen liabilities, ensure policyholders are not left without protection, and allow insurers to transfer potential claims liabilities to another insurer, thus affecting their reserves.

Runoff Insurance is subject to various state and federal regulations, as well as industry best practices that insurers, brokers, and policyholders must follow. Compliance with state insurance regulations, federal regulations like the Dodd-Frank Act, and adherence to industry best practices, such as those outlined by the NAIC and IAIS, is crucial for maintaining licenses, avoiding penalties, and ensuring the long-term success of runoff insurance operations.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.