Asset-based long-term care insurance is a relatively new type of insurance policy that combines long-term care coverage with an investment component. It is also known as hybrid long-term care insurance because it combines two different types of insurance policies into one. With asset-based long-term care insurance, policyholders can use their premiums to build cash value over time, which can be used to cover the costs of long-term care services. The policyholder can also receive long-term care benefits from the policy's death benefit. Traditional long-term care insurance policies typically cover only the cost of long-term care services, such as home health care, nursing home care, or assisted living facilities. They require individuals to pay regular premiums for years in exchange for potential coverage in the future. However, these policies can be costly and may not provide the flexibility that many people desire. Asset-based long-term care insurance policies offer an alternative solution for individuals who want long-term care coverage but also want to build cash value over time. One of the primary benefits of asset-based long-term care insurance is that it allows policyholders to receive long-term care benefits without having to use up all their assets. Instead of having to spend down their assets to qualify for Medicaid, policyholders can use their asset-based long-term care policy to cover the costs of long-term care services. This can provide peace of mind for individuals who are concerned about protecting their assets and leaving a legacy for their loved ones. Asset-based long-term care insurance policies work by combining long-term care coverage with an investment component. Policyholders pay premiums into the policy, which can be used to cover the costs of long-term care services or to build cash value over time. The investment component of the policy typically involves investing the premiums in a fixed or variable annuity. The cash value of the policy can be used in several ways. First, policyholders can use the cash value to pay for long-term care services. This includes home health care or nursing home care. If the policyholder does not use all of the cash value for long-term care services, the remaining cash value can be passed on to their beneficiaries when they die. Additionally, if the policyholder dies before needing long-term care services, their beneficiaries will receive the death benefit of the policy, which can be used to cover funeral expenses or other end-of-life costs. Asset-based long-term care insurance policies also typically include a variety of features and options that can be tailored to the policyholder's needs. For example, policyholders can choose the amount of long-term care coverage they want, the length of time they want the coverage to last, and the type of investment component they want. Asset-based long-term care insurance policies offer several features that make them an attractive option for individuals who are interested in planning for their long-term care needs. One of the key features of these policies is that they allow policyholders to use their premiums to build cash value over time. This can provide an alternative savings option for individuals who want to build a nest egg while also protecting themselves against the costs of long-term care services. Another feature of asset-based long-term care insurance policies is that they offer a death benefit. If the policyholder dies before needing long-term care services, their beneficiaries will receive the death benefit of the policy. This can provide an additional layer of protection for individuals who are concerned about leaving a legacy for their loved ones. Asset-based long-term care insurance policies also typically offer a variety of options and features that can be tailored to the policyholder's needs. For example, policyholders can choose the amount of long-term care coverage they want, the length of time they want the coverage to last, and the type of investment component they want. This flexibility can help individuals create a policy that fits their unique needs and budget. Inflation can significantly impact the cost of long-term care services, and without inflation protection, policyholders may find that their policy does not provide enough coverage when they need it. Many asset-based long-term care insurance policies offer inflation protection, which helps ensure that policyholders' coverage keeps pace with the rising cost of long-term care services. Asset-based long-term care insurance policies offer several benefits to individuals who are interested in planning for their long-term care needs. One of the primary benefits is that they can provide peace of mind. Knowing that they have coverage in place can help individuals feel more secure about their future and their ability to pay for long-term care services if they need them. Asset-based long-term care insurance policies can also help individuals protect their assets. Without long-term care insurance, individuals may be required to spend down their assets to qualify for Medicaid. Asset-based long-term care insurance policies can help individuals avoid this requirement, allowing them to preserve their assets for their heirs. Another benefit of asset-based long-term care insurance policies is that they can provide tax advantages. Depending on the policy structure, policyholders may be able to deduct some or all of their premiums from their taxes. Additionally, the cash value of the policy grows tax-deferred, meaning that policyholders do not have to pay taxes on the growth until they withdraw it. Asset-based long-term care insurance policies also have some limitations that individuals should be aware of before purchasing a policy. One of the primary limitations is that they can be costly. Premiums for asset-based long-term care insurance policies can be significantly higher than traditional long-term care insurance policies, especially for individuals who are older or have pre-existing health conditions. Asset-based long-term care insurance policies may also have limitations on the types of long-term care services that are covered. For example, some policies may not cover all types of long-term care services, such as adult day care or in-home care. Individuals should carefully review the policy's terms and conditions to ensure that it provides the coverage they need. Finally, asset-based long-term care insurance policies may have restrictions on the amount of cash value that can be withdrawn or borrowed. Policyholders should carefully review the policy's terms and conditions to understand any limitations on accessing the cash value of the policy. Asset-based long-term care insurance policies can be an attractive option for individuals who are interested in planning for their long-term care needs. These policies offer a combination of long-term care coverage and an investment component, allowing policyholders to build cash value over time while also protecting themselves against the costs of long-term care services. However, these policies can be costly and may have limitations on the types of long-term care services that are covered. Before making any long-term care planning decisions, it is essential to seek professional advice from an insurance broker. Individuals should carefully review the policy's terms and conditions and consider seeking professional advice before making a decision. What Is Asset-Based Long-Term Care?

How Asset-Based Long-Term Care Works?

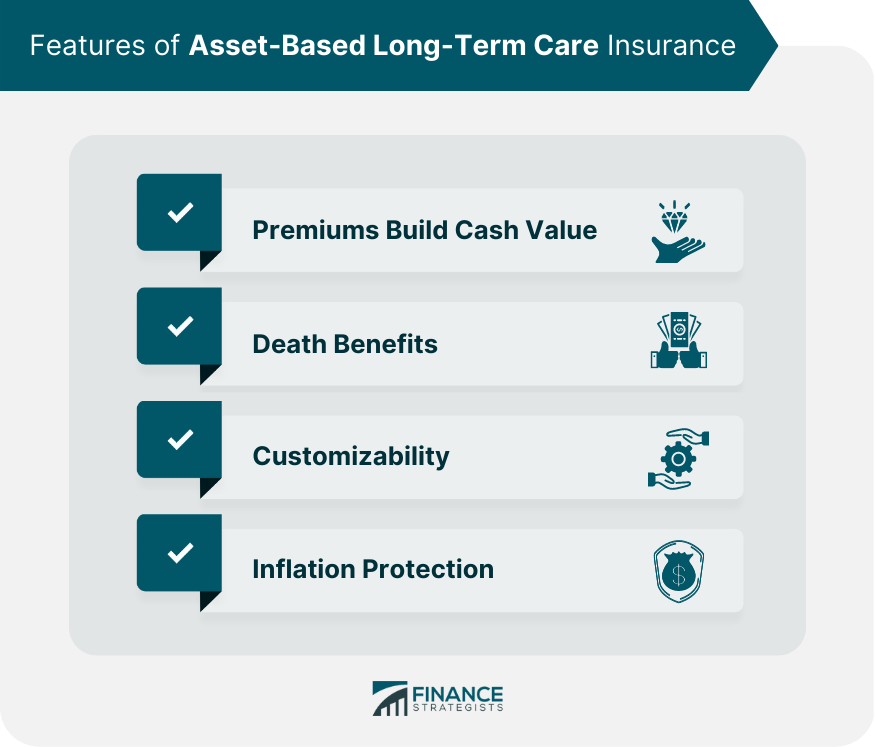

Features of Asset-Based Long-Term Care

Premiums Build Cash Value Over Time

Death Benefit

Customizability

Inflation Protection

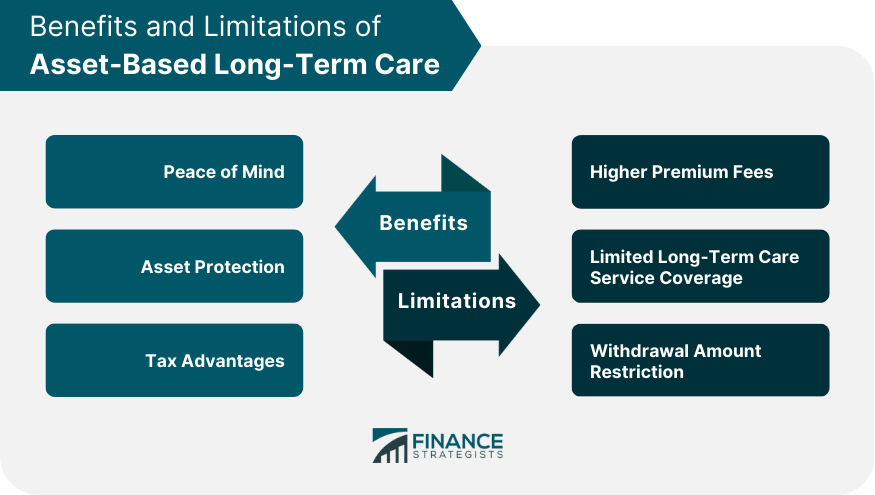

Benefits of Asset-Based Long-Term Care

Peace of Mind

Asset Protection

Tax Advantages

Limitations of Asset-Based Long-Term Care

Higher Premium Fees

Limited Long-Term Care Service Coverage

Withdrawal Amount Restriction

Final Thoughts

Asset-Based Long-Term Care FAQs

Asset-based long-term care insurance is a type of insurance policy that combines long-term care coverage with an investment component, allowing policyholders to use their premiums to build cash value over time.

Asset-based long-term care insurance works by combining long-term care coverage with an investment component. Policyholders pay premiums into the policy, which can be used to cover the costs of long-term care services or to build cash value over time.

Asset-based long-term care insurance policies can provide peace of mind, protect assets, and offer tax advantages. They can also provide long-term care coverage without having to spend down assets or rely on Medicaid.

Asset-based long-term care insurance policies can be costly and may have limitations on the types of long-term care services that are covered. Additionally, there may be restrictions on the amount of cash value that can be withdrawn or borrowed.

Yes, it is essential to seek professional advice from a financial advisor before making any long-term care planning decisions. A qualified professional can help individuals navigate the complex decisions involved in long-term care planning and make informed choices about their coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.