The Present Value Interest Factor of Annuity is a financial formula used to calculate the present value of a series of equal payments or cash flows, known as an annuity. Specifically, the PVIFA is the factor used to determine the present value of an annuity per dollar of payment per period, based on a given interest rate and time period. The PVIFA considers the time value of money, which means that money received in the future is worth less than the same amount of money received today due to the effects of inflation and the opportunity cost of not having access to the money immediately. The Present Value Interest Factor of Annuity can be useful in various financial calculations, such as determining the present value of an annuity for retirement planning or evaluating the profitability of an investment that generates a series of equal cash flows. An annuity payment refers to a periodic payment, typically made at equal intervals, such as monthly, quarterly, or annually. Annuity payments can be fixed or variable, depending on the underlying terms of the annuity agreement. The interest rate, or discount rate, is the rate at which the value of money changes over time. It plays a crucial role in calculating the present value of an annuity, as it considers the time value of money – the principle that a dollar today is worth more than a dollar in the future. The number of periods, or time horizon, refers to the total number of payments made in an annuity. This factor is essential in determining the present value of an annuity, as it impacts the discounting process of future cash flows. The formula for calculating PVIFA is as follows: where PVIFA is the Present Value Interest Factor of Annuity, r is the interest rate, and n is the number of periods. 1. Convert the interest rate to a decimal by dividing it by 100. 2. Add 1 to the decimal interest rate. 3. Raise the result to the power of the negative number of periods (-n). 4. Subtract the result from 1. 5. Divide the result by the decimal interest rate to obtain the PVIFA. There are various tools available for calculating PVIFA, including financial calculators and spreadsheet software such as Microsoft Excel and Google Sheets. These tools simplify the calculation process by automating the formula and providing quick results. PVIFA and FVIFA are related concepts in finance, but they serve different purposes. While PVIFA calculates the present value of a series of annuity payments, FVIFA calculates the future value of the annuity at the end of the specified period. Both concepts help in evaluating the worth of a series of cash flows, but from different perspectives. Comparing PVIFA and FVIFA can be beneficial for financial analysts, as it allows them to analyze the value of annuity payments from different angles. For example, a high PVIFA implies a higher present value, whereas a high FVIFA indicates a higher future value. Analyzing both metrics can help in making informed investment decisions. The choice between PVIFA and FVIFA depends on the financial situation at hand. If an individual or business is more concerned with the present value of the annuity payments, PVIFA is the appropriate approach. On the other hand, FVIFA should be used when the focus is on the future value of the annuity payments. PVIFA plays a significant role in valuing investments and securities, such as bonds and preferred stocks. By calculating the present value of the expected cash flows, investors can determine the intrinsic value of an investment and compare it with the market price to identify potential investment opportunities. PVIFA helps in assessing the worth of a series of cash flows, such as rental income from a property or periodic payments from a structured settlement. By understanding the present value of these cash flows, individuals and businesses can make better financial decisions, such as whether to sell a property or hold on to it for future income. PVIFA is crucial in retirement planning and pension calculations, as it helps individuals estimate the present value of their future pension payments. This information can be used to determine the amount of savings required to maintain a desired lifestyle during retirement and make necessary adjustments to investment strategies. PVIFA is also used in loan amortization and mortgage calculations, as it helps determine the present value of the total loan or mortgage payments. Borrowers and lenders can use this information to evaluate the affordability of a loan or mortgage and make informed borrowing decisions. One of the limitations of PVIFA is the assumption of a constant interest rate throughout the annuity's life. In reality, interest rates may fluctuate over time, affecting the present value of the annuity payments. This limitation may lead to inaccurate PVIFA calculations and erroneous financial decisions. Another limitation of PVIFA is the assumption of fixed payment intervals. In practice, annuity payments might not always follow a regular schedule, which can lead to inaccuracies in the PVIFA calculations. Inflation can have a significant impact on the present value of annuity payments, as it erodes the purchasing power of money over time. PVIFA calculations do not inherently account for inflation, which may result in an overestimation of the present value of the annuity payments. In capital budgeting, PVIFA is used to calculate the Net Present Value (NPV) of a project or investment. NPV is the difference between the present value of cash inflows and outflows associated with a project. By using PVIFA, financial analysts can determine the project's NPV and decide whether to accept or reject the investment based on the project's profitability. IRR is the discount rate at which the NPV of a project becomes zero. PVIFA can be used in the IRR calculation process, as it helps in determining the present value of the annuity payments associated with a project. By comparing the IRR with the required rate of return, financial analysts can evaluate the project's attractiveness and make investment decisions accordingly. Payback period is the time it takes for a project to recover its initial investment. Discounted payback period accounts for the time value of money by calculating the payback period using the present value of cash flows. PVIFA can be used to calculate the discounted payback period, providing a more accurate measure of the project's investment recovery time. The Present Value Interest Factor of Annuity is a vital financial concept that allows individuals and businesses to evaluate the present value of a series of cash flows, considering a specific interest rate and time horizon. It plays a significant role in various financial scenarios, such as valuing investments, retirement planning, loan amortization, and capital budgeting. Having a comprehensive understanding of PVIFA and its applications enables informed decision-making and effective financial planning. By revisiting the definitions of annuity payment, interest rate, and number of periods, and understanding the differences between PVIFA and FVIFA, individuals and businesses can effectively assess the worth of future cash flows in today's terms. Additionally, being aware of the limitations and assumptions of PVIFA, such as constant interest rates and fixed payment intervals, helps ensure more accurate calculations and well-informed financial decisions.What Is the Present Value Interest Factor of Annuity (PVIFA)?

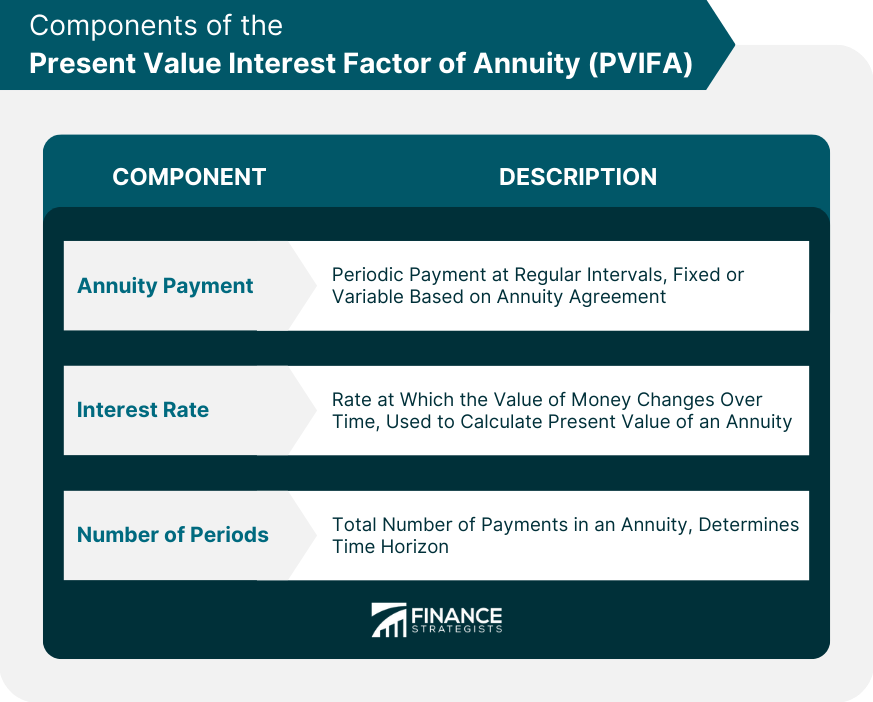

Components of the Present Value Interest Factor of Annuity

Annuity Payment

Interest Rate

Number of Periods

Calculating the Present Value Interest Factor of Annuity

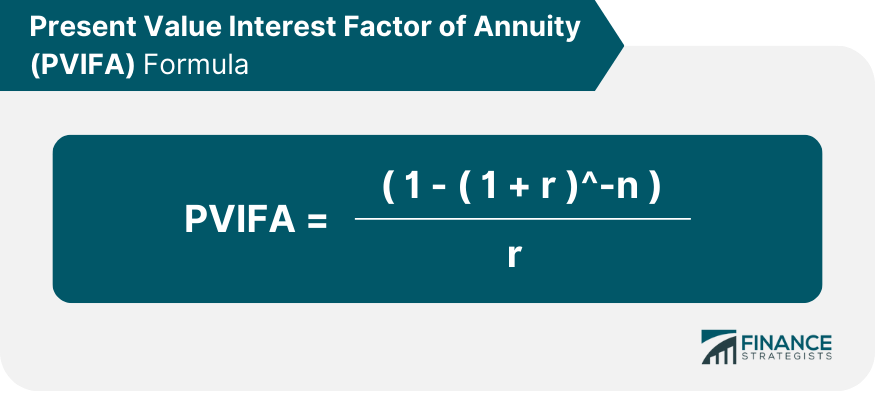

PVIFA Formula

Step-By-Step Calculation Process

Using Financial Calculators and Spreadsheet Software for PVIFA Calculations

Present Value Interest Factor of Annuity vs Future Value Interest Factor of Annuity (FVIFA)

Differences Between PVIFA and FVIFA

Comparing PVIFA and FVIFA in Financial Analysis

Choosing the Right Approach for a Specific Financial Situation

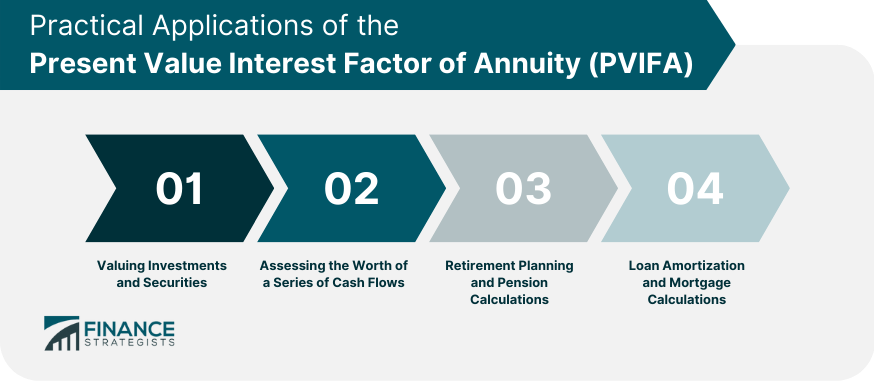

Practical Applications of the Present Value Interest Factor of Annuity

Valuing Investments and Securities

Assessing the Worth of a Series of Cash Flows

Retirement Planning and Pension Calculations

Loan Amortization and Mortgage Calculations

Limitations and Assumptions of the Present Value Interest Factor of Annuity

Constant Interest Rate Assumption

Fixed Payment Intervals

Inflation and Its Impact on PVIFA Calculations

Present Value Interest Factor of Annuity in Capital Budgeting

Net Present Value (NPV) and PVIFA

Internal Rate of Return (IRR) and PVIFA

Payback Period and Discounted Payback Period Calculations Using PVIFA

Final Thoughts

Present Value Interest Factor of Annuity (PVIFA) FAQs

PVIFA is a financial concept used to determine the present value of a series of annuity payments. It represents the present value of a series of future payments, taking into account the interest rate and the number of periods.

PVIFA is calculated using a mathematical formula that takes into account the interest rate, the number of payments, and the discount rate. The formula is: PVIFA = [1 - (1 + r)^-n]/r, where r is the interest rate and n is the number of periods.

PVIFA is important in financial analysis because it allows investors to determine the present value of a series of future cash flows. This can help them to evaluate investment opportunities, compare different investment options, and make informed investment decisions.

PVIFA can be used in financial analysis to determine the present value of a series of annuity payments. For example, an investor may use PVIFA to calculate the present value of a series of dividend payments from a stock. They can then compare this value to the current price of the stock to determine whether it is undervalued or overvalued.

One limitation of using PVIFA is that it assumes a constant interest rate over the life of the annuity. If interest rates change, the present value of the annuity payments may also change. Additionally, PVIFA does not take into account factors such as inflation, taxes, or other economic variables that may affect the value of the annuity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.