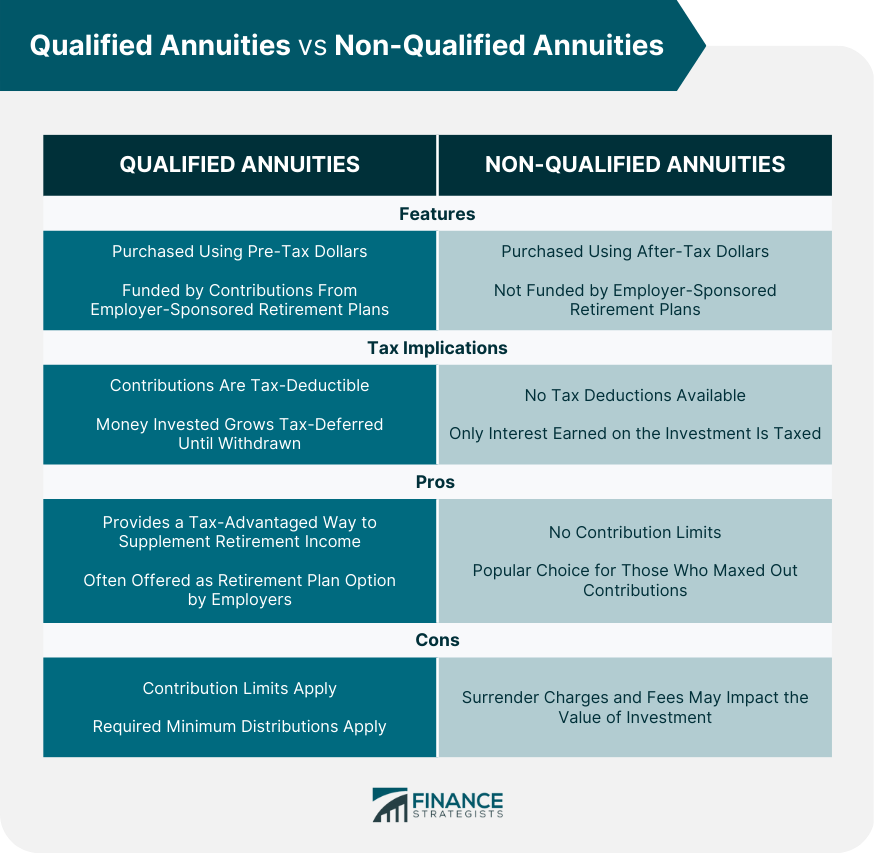

Non-Qualified and Qualified Annuities are two different types of annuities that are designed to help individuals plan for their retirement. A non-qualified annuity is typically purchased with after-tax dollars, and the money invested in the annuity grows tax-deferred until it is withdrawn. Non-qualified annuities do not have any contribution limits, which means that individuals can invest as much money as they want in the annuity. However, non-qualified annuities are not eligible for tax deductions or other tax benefits. Non-qualified annuities are a popular choice for individuals who have already maximized their contributions to other retirement accounts, such as 401(k) plans or individual retirement arrangements (IRAs). Qualified annuities, on the other hand, are purchased with pre-tax dollars. They are typically funded with contributions from employer-sponsored retirement plans such as 401(k) plans, 403(b) plans, and IRAs. The money invested in a qualified annuity grows tax-deferred until it is withdrawn, and contributions to a qualified annuity are tax-deductible. However, once individuals begin taking withdrawals from a qualified annuity, they will be taxed on the money they receive at their ordinary income tax rate. Qualified annuities are subject to contribution limits. Individuals cannot invest an unlimited amount of money. Qualified annuities are a popular choice for individuals who are looking to supplement their retirement income with tax-advantaged savings, as well as for employers who want to provide their employees with a retirement plan option. Have questions about annuities? Click here. Below are some details on qualified annuities: Qualified annuities are a type of annuity that is purchased using pre-tax dollars and is typically funded by contributions from an employer-sponsored retirement plan, such as a 401(k) plan, 403(b) plan, or IRA. Contributions to a qualified annuity are tax-deductible, which means that individuals can lower their taxable income by contributing to the annuity. The money invested in a qualified annuity grows tax-deferred until it is withdrawn, at which point it is taxed at the individual's ordinary income tax rate. One advantage of qualified annuities is that they provide a tax-advantaged way for individuals to supplement their retirement income. In addition, qualified annuities are often offered as a retirement plan option by employers, making them a convenient way for employees to save for retirement. Contributions to qualified annuities are subject to contribution limits, which means that individuals cannot invest an unlimited amount of money in the annuity. Withdrawals from qualified annuities are also subject to required minimum distributions (RMDs). The following are some characteristics of non-qualified annuities: They are purchased using after-tax dollars and are not funded by an employer-sponsored retirement plan. The money invested in a non-qualified annuity grows tax-deferred until it is withdrawn, at which point only the interest earned on the investment is taxed at the individual's ordinary income tax rate. One advantage of non-qualified annuities is that they do not have any contribution limits, which means that individuals can invest as much money as they want in the annuity. Non-qualified annuities are often used by individuals who have already maxed out their contributions to other retirement accounts, such as 401(k) plans or IRAs. A disadvantage of non-qualified annuities is that they do not offer any tax benefits, such as tax deductions or tax-deferred growth of contributions. In addition, non-qualified annuities may be subject to surrender charges and other fees, which can impact the value of the investment. Choosing between the two can be a complex decision that requires a careful analysis of an individual's financial situation and retirement goals. Non-qualified Annuities are typically purchased with after-tax dollars, making them a suitable option for individuals who have already maximized their contributions to other tax-advantaged retirement accounts. They also offer more flexibility when it comes to contribution limits, allowing investors to invest as much money as they want. However, non-qualified annuities do not offer any tax benefits, such as tax deductions or tax-deferred growth of contributions. Additionally, they may be subject to surrender charges and other fees, which can impact the value of the investment. Qualified Annuities, on the other hand, are purchased with pre-tax dollars, making them an ideal choice for individuals who want to reduce their taxable income while saving for retirement. They offer tax deductions for contributions made to the annuity, and the money invested grows tax-deferred until it is withdrawn. However, qualified annuities have contribution limits and are subject to required minimum distributions. When deciding, individuals should consider their current and future tax situation, as well as their investment goals and risk tolerance. Those who are in a higher tax bracket may benefit from the tax deductions offered by qualified annuities. While those in a lower tax bracket may find that non-qualified annuities are a more attractive option. Additionally, individuals who are looking for flexibility in their retirement savings plan may prefer non-qualified annuities. Annuities are financial products that provide a stream of income over a specific period, typically for retirement. Non-qualified and qualified annuities differ in how they are funded, tax implications, and contribution limits. Qualified Annuities are purchased with pre-tax dollars and offer tax deductions and benefits but have contribution limits and are subject to required minimum distributions. Non-qualified annuities are purchased with after-tax dollars and offer no tax benefits but have no contribution limits and offer more flexibility. Choosing between non-qualified and qualified annuities depends on an individual's financial situation, retirement goals, and risk tolerance. Consulting an insurance broker is recommended to determine the best annuity type. Factors to consider include an individual's current and future tax situations, investment goals, and contribution limits. Overview of Non-Qualified and Qualified Annuities

Qualified Annuities

Features

Tax Implications

Pros and Cons

Non-Qualified Annuities

Features

Tax Implication

Pros and Cons

Choosing Between Non-Qualified and Qualified Annuities

Final Thoughts

Non-Qualified vs Qualified Annuities FAQs

A non-qualified annuity is a type of annuity purchased with after-tax dollars, which offers tax-deferred growth until withdrawal. It does not offer tax deductions or benefits.

A qualified annuity is a type of annuity purchased with pre-tax dollars, which offers tax-deferred growth until withdrawal. It offers tax deductions and benefits.

The pros of a non-qualified annuity include no contribution limits and flexibility in contributions. The cons include no tax benefits and possible fees or charges.

The pros of a qualified annuity include tax deductions and benefits and being offered as a retirement plan option by employers. The cons include contribution limits and required minimum distributions.

No, there are no contribution limits for non-qualified annuities. Individuals can invest as much money as they want in a non-qualified annuity. However, it is important to note that non-qualified annuities do not offer any tax benefits, such as tax deductions or tax-deferred growth of contributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.