Annuity classes categorize different variations of annuities offered by insurance companies. Each class has its unique features and fee structures, allowing individuals to select the option that aligns best with their financial goals and preferences. Annuity classes, including L Share, B Share, and C Share, provide investors with a range of choices based on factors such as surrender periods, fees, and liquidity options. The L Share Annuity Class is known for its specific set of characteristics that distinguish it from other annuity classes. These characteristics may include lower surrender charges, shorter surrender periods, enhanced liquidity options, and potential for higher investment growth. Understanding these features is essential for individuals considering the L Share Annuity Class. Compared to other annuity classes, the L Share Annuity Class typically offers lower surrender charges and shorter surrender periods. This feature allows individuals to access their funds more quickly and with reduced penalties if they need to make withdrawals. The L Share Annuity Class often provides investors with more flexible liquidity options. This may include features like penalty-free withdrawals or the ability to access a certain percentage of funds annually without incurring surrender charges. These liquidity options provide individuals with greater control over their finances and the ability to respond to unexpected expenses or changes in financial circumstances. L Share Annuity Class may offer the potential for higher investment growth compared to other annuity classes. This is achieved through the allocation of funds to underlying investment options that have the potential for greater returns. However, it's important to note that higher growth potential also comes with increased investment risk. Some L Share Annuity Class contracts may provide enhanced death benefit options. These options allow beneficiaries to receive a greater payout in the event of the annuitant's death. This feature can provide added financial security and peace of mind for individuals concerned about leaving a legacy for their loved ones. The L Share Annuity Class is often suitable for investors with short-term investment horizons who prioritize liquidity and flexibility. Individuals who anticipate needing access to their funds in the near future or who have shorter timeframes for their financial goals may find the L Share Annuity Class to be a suitable choice. While the L Share Annuity Class offers enhanced liquidity options, it's important to carefully consider the impact of early withdrawals penalties and surrender charges. Making withdrawals before the end of the surrender period may result in penalties that can erode the potential benefits of this annuity class. Like any financial product, the L Share Annuity Class comes with fees and expenses. It is crucial for individuals to thoroughly understand these costs, such as administrative fees, management fees, and underlying investment fees. A clear understanding of the fee structure allows individuals to evaluate the overall value proposition of the L Share Annuity Class and make informed decisions. Investors should assess their risk tolerance and investment objectives when considering the L Share Annuity Class. The potential for higher investment growth is accompanied by increased investment risk. Individuals must evaluate their comfort level with market fluctuations and align their investment objectives with the risk profile of the L Share Annuity Class. The B Share Annuity Class is another commonly offered annuity class. It differs from the L Share Annuity Class in terms of surrender charges, surrender periods, and fee structures. By comparing the features and characteristics of the two classes, individuals can make an informed decision based on their specific needs and preferences. The C Share Annuity Class is another option within the annuity landscape. It may have distinct features and fee structures compared to the L Share Annuity Class. Understanding the differences between the two classes helps individuals determine which aligns better with their financial goals and risk tolerance. Consulting with financial advisors and retirement planning professionals can provide valuable insights and guidance when considering the L Share Annuity Class. These professionals can assess individual circumstances, provide personalized advice and help individuals navigate the complexities of annuity options, including the L Share Annuity Class. Annuity company websites and product literature offer valuable resources for individuals interested in the L Share Annuity Class. These sources provide detailed information about the features, benefits, and considerations of the class, allowing individuals to conduct their research and make informed decisions. Regulatory bodies and organizations provide resources and guidelines related to annuity products. Individuals can access information on regulatory requirements, consumer protection measures, and industry standards. These resources assist in understanding the regulatory framework surrounding annuities, including the L Share Annuity Class. The L Share Annuity Class presents investors with a unique set of features and benefits within the annuity landscape. With lower surrender charges, shorter surrender periods, enhanced liquidity options, and potential for higher investment growth, this class offers individuals flexibility and growth potential for their retirement planning needs. It is important to carefully evaluate the suitability of the L Share Annuity Class based on individual financial goals, risk tolerance, and investment time horizon. The class may be particularly suitable for investors with short-term investment horizons and liquidity needs. However, individuals must consider the impact of early withdrawals and surrender charges on their overall financial strategy. Understanding the fee structures and expenses associated with the L Share Annuity Class is crucial for making informed decisions. By reviewing product literature, consulting with financial advisors, and staying informed about regulatory guidelines, individuals can gain a comprehensive understanding of the costs and value proposition of this annuity class. In conclusion, the L Share Annuity Class provides investors with opportunities for flexibility and growth potential. By carefully considering individual circumstances, risk tolerance, and investment objectives, individuals can determine if this annuity class aligns with their financial goals. Being well-informed, conducting thorough evaluations, and seeking guidance from professionals are key to maximizing the benefits and minimizing the risks associated with the L Share Annuity Class.Annuity Classes: Overview

Characteristics and Differentiating Factors of the L Share Annuity Class

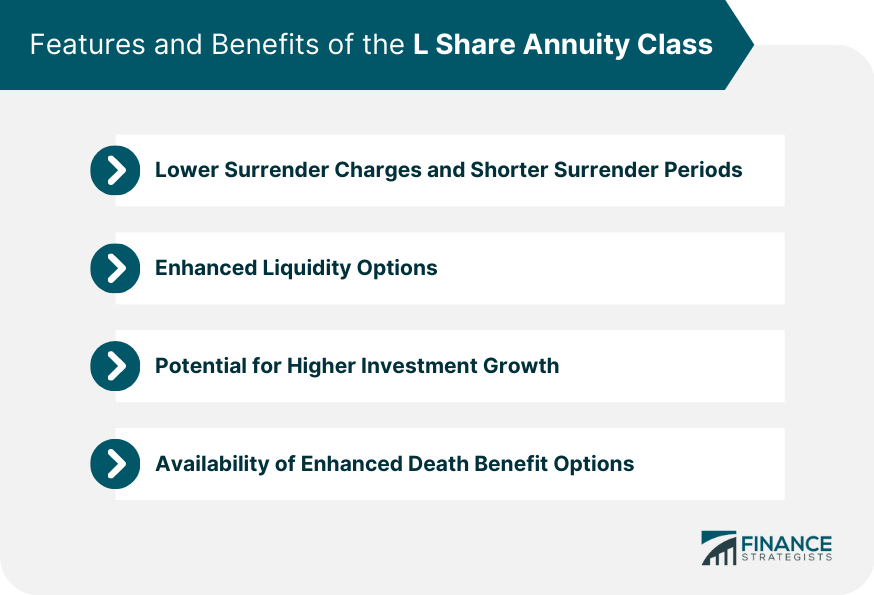

Features and Benefits of the L Share Annuity Class

Lower Surrender Charges and Shorter Surrender Periods

Enhanced Liquidity Options

Potential for Higher Investment Growth

Availability of Enhanced Death Benefit Options

Suitability and Considerations for the L Share Annuity Class

Ideal for Investors With Short-Term Investment Horizons

Considerations for Early Withdrawals and Surrender Charges

Importance of Understanding Fees and Expenses

Assessment of Risk Tolerance and Investment Objectives

L Share Annuity Class vs Other Annuity Classes

B Share Annuity Class

C Share Annuity Class

Resources and Tools for the L Share Annuity Class

Financial Advisors and Retirement Planning Professionals

Annuity Company Websites and Product Literature

Regulatory Resources and Guidelines

Final Thoughts

L Share Annuity Class FAQs

The L Share Annuity Class is a specific category or variation of annuity offered by insurance companies. It is characterized by features such as lower surrender charges, shorter surrender periods, enhanced liquidity options, and the potential for higher investment growth.

The L Share Annuity Class differs from other annuity classes based on factors such as surrender charges, surrender periods, and fee structures. Compared to other classes like B Share or C Share, L Share annuities may have lower surrender charges, shorter surrender periods, and offer enhanced liquidity options.

The L Share Annuity Class is generally suitable for investors with short-term investment horizons, as well as those who prioritize flexibility and liquidity. Individuals who anticipate needing access to their funds in the near future or have shorter timeframes for their financial goals may find the L Share Annuity Class to be a suitable choice.

Like any investment product, the L Share Annuity Class comes with certain risks. While it offers potential for higher investment growth, this is accompanied by increased investment risk. Individuals should assess their risk tolerance and align it with the characteristics of the L Share Annuity Class before making investment decisions.

Yes, it is possible to withdraw funds from an L Share Annuity before the end of the surrender period. However, early withdrawals may incur surrender charges, which can erode the potential benefits of this annuity class. It is important to carefully evaluate the impact of surrender charges and consider the associated costs before making any early withdrawals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.