High-net-worth financial planning is a specialized area of financial planning that focuses on the unique needs and goals of high-net-worth individuals (HNWIs). These individuals typically have investable assets exceeding $1 million, excluding their primary residence. The primary aim of this type of financial planning is to help HNWIs preserve and grow their wealth while addressing the distinct challenges they face. Financial planning for HNWIs is essential due to the complexity of their financial situations, the need for advanced tax planning, and the desire to preserve their wealth for future generations. This specialized approach helps HNWIs navigate the unique risks and opportunities that come with significant wealth. The primary objectives of high-net-worth financial planning include wealth preservation, wealth growth, tax minimization, risk management, and intergenerational wealth transfer.

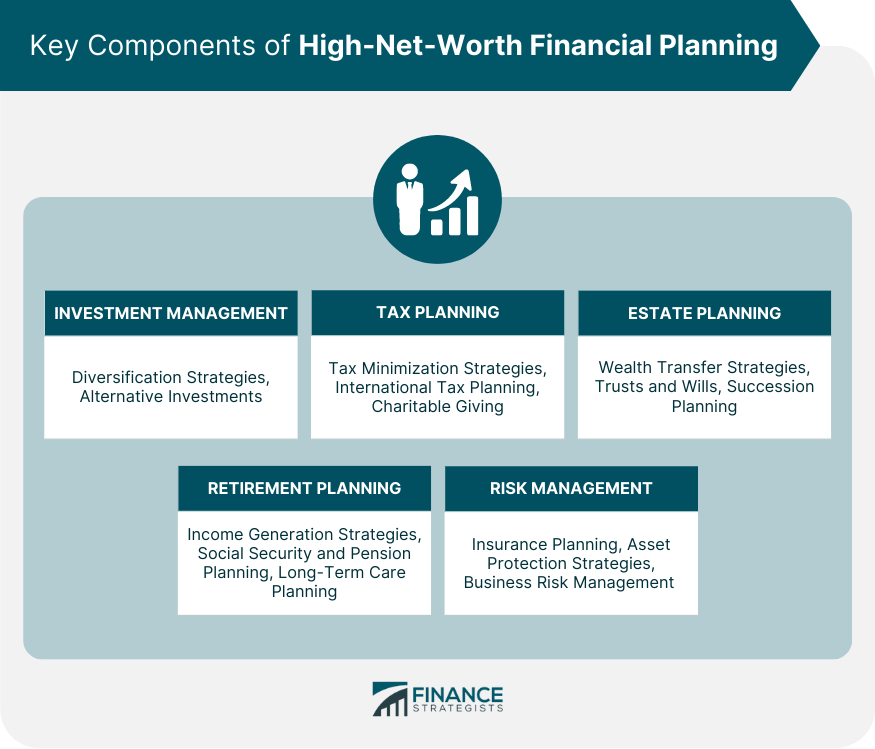

HNWIs come from diverse backgrounds and industries, including entrepreneurs, executives, athletes, entertainers, and inheritors of family wealth. Understanding the demographics and unique circumstances of these individuals is essential for effective financial planning. HNWIs often have more complex financial needs and goals than the average individual, including: 1. Diversified investment portfolios 2. International assets 3. Philanthropic endeavors 4. Family businesses and succession planning HNWIs face distinct challenges, such as: 1. Increased exposure to market risks 2. Higher tax burdens 3. Complex estate planning issues 4. Maintaining privacy and security To mitigate risk and optimize returns, HNWIs should diversify their investment portfolios across various asset classes, industries, and geographic regions. HNWIs often invest in alternative investments such as private equity, hedge funds, real estate, and collectibles to further diversify their portfolios and enhance returns. To reduce their tax burden, HNWIs should employ tax minimization strategies, such as tax-efficient investment vehicles, tax-loss harvesting, and tax-deferred accounts. HNWIs with international assets should engage in international tax planning to ensure compliance with foreign tax laws and minimize their global tax liability. Charitable giving not only benefits society but also provides HNWIs with tax benefits, such as income tax deductions and estate tax reductions. HNWIs should establish wealth transfer strategies, such as gifting assets to family members or trusts, to reduce estate taxes and ensure a smooth transfer of wealth. Trusts and wills are essential tools for HNWIs to control the distribution of their assets and minimize estate taxes. Succession planning ensures the smooth transition of a family business or the management of a family's wealth to the next generation. HNWIs should develop income generation strategies, such as annuities, dividend-paying stocks, and rental properties, to maintain their desired lifestyle during retirement. Social security and pension planning are critical components of retirement planning for HNWIs, ensuring they maximize their benefits and optimize their retirement income sources. Long-term care planning is essential for HNWIs to ensure they have the necessary financial resources and support in place for potential healthcare needs as they age. Insurance planning is crucial for HNWIs to protect their assets and financial well-being. This includes life insurance, disability insurance, long-term care insurance, and property and casualty insurance. HNWIs should employ asset protection strategies, such as establishing trusts or holding companies, to safeguard their wealth from potential creditors, lawsuits, or other risks. For HNWIs with business interests, business risk management helps to identify, assess, and mitigate potential risks that may impact the value of their business holdings. A financial planner or advisor helps HNWIs develop and implement a comprehensive financial plan tailored to their unique needs and goals. An estate planning attorney assists HNWIs with the legal aspects of estate planning, including the drafting of wills, trusts, and other essential documents. A tax specialist helps HNWIs navigate complex tax laws and develop strategies to minimize their tax liabilities. An insurance agent assists HNWIs in selecting the appropriate insurance products to protect their assets and financial well-being. An investment manager oversees the investment portfolios of HNWIs, implementing strategies to optimize returns and manage risk. Regular reviews and updates to the financial plan are necessary to ensure it remains aligned with the HNWI's goals, needs, and changing circumstances. As HNWIs experience changes in their lives, such as career transitions, family growth, or new business ventures, their financial plan must be adjusted to reflect these changes. Maintaining open lines of communication with the financial planning team is vital for HNWIs to ensure their financial plan stays on track and adapts to their evolving needs. A comprehensive and customized financial plan plays a pivotal role in helping high-net-worth individuals preserve and grow their wealth. By addressing their unique financial challenges and objectives, HNWIs can effectively manage their assets, minimize risks, and create a lasting legacy. Tailored financial planning also ensures that HNWIs can navigate the complexities of their financial situations, including advanced tax planning, estate planning, and diversified investment strategies. By engaging in high-net-worth financial planning and assembling a team of specialized professionals, HNWIs can set themselves up for long-term financial success. This approach not only helps HNWIs achieve their personal financial goals but also safeguards their wealth for future generations. Through careful planning, ongoing adjustments, and open communication with their financial planning team, HNWIs can establish a strong financial foundation, ensuring stability, prosperity, and security for themselves and their loved ones.What Is High-Net-Worth Financial Planning?

Understanding High-Net-Worth Clients

Demographics of High-Net-Worth Individuals

Unique Financial Needs and Goals

Challenges Faced by High-Net-Worth Individuals

Key Components of High-Net-Worth Financial Planning

Investment Management

Diversification Strategies

Alternative Investments

Tax Planning

Tax Minimization Strategies

International Tax Planning

Charitable Giving

Estate Planning

Wealth Transfer Strategies

Trusts and Wills

Succession Planning

Retirement Planning

Income Generation Strategies

Social Security and Pension Planning

Long-Term Care Planning

Risk Management

Insurance Planning

Asset Protection Strategies

Business Risk Management

Building a High-Net-Worth Financial Planning Team

Financial Planner/Advisor

Estate Planning Attorney

Tax Specialist

Insurance Agent

Investment Manager

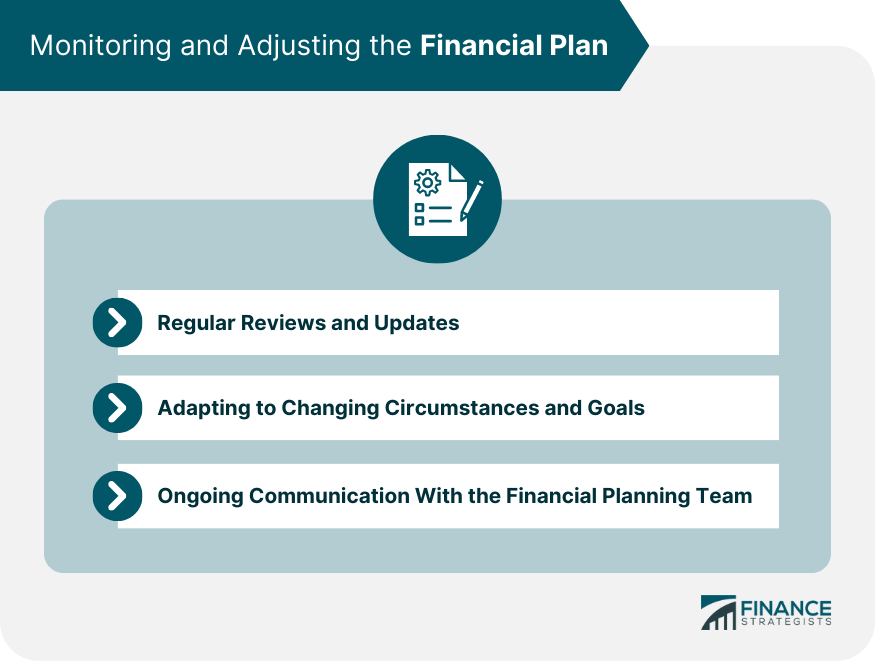

Monitoring and Adjusting the Financial Plan

Regular Reviews and Updates

Adapting to Changing Circumstances and Goals

Ongoing Communication With the Financial Planning Team

Conclusion

High-Net-Worth Financial Planning FAQs

High-net-worth financial planning is a type of financial planning that is tailored specifically to the needs of individuals with a high net worth. It focuses on preserving and growing wealth, tax planning, estate planning, philanthropy, and risk management.

High-net-worth financial planning typically includes services such as investment management, tax planning, estate planning, risk management, philanthropy, and cash flow planning. Additionally, it may involve coordinating with other professionals such as attorneys, accountants, and insurance professionals to ensure that all aspects of the client's financial situation are considered.

Working with a high-net-worth financial planner can provide numerous benefits, including a comprehensive and personalized approach to managing your wealth, access to specialized investment opportunities, and the ability to work with other professionals to ensure all aspects of your financial situation are properly considered.

High-net-worth financial planners typically charge a fee for their services, which may be based on a percentage of the assets they manage or a fixed fee. Some may also receive commissions for certain products or services they recommend, which can create potential conflicts of interest.

When choosing a high-net-worth financial planner, it's important to look for someone who is experienced in working with individuals in a similar financial situation as yourself, has a comprehensive approach to financial planning, and has a good reputation in the industry. Additionally, it's important to understand their fee structure and any potential conflicts of interest that may arise.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.