Chapter 13 bankruptcy, often referred to as a "wage earner's plan," allows individuals with regular income to develop a plan to repay all or part of their debts over three to five years. Buying a house involves several steps, starting from saving for a down payment, securing a mortgage loan, searching for a suitable property, negotiating the price, home inspection, and finally, closing the deal. Each stage requires significant financial commitment and prudence, which can be more challenging during a Chapter 13 bankruptcy. You can buy a house while in Chapter 13 bankruptcy under some restrictions. However, you must obtain approval from the court overseeing your case and you must find a willing lender. Most loans, including FHA loans, require that you have been in the case for at least one year and that all the payments on your repayment plan are current. The rules governing the purchase of a home during Chapter 13 bankruptcy are complex, intertwining bankruptcy law, lender requirements, and local regulations. The U.S. Bankruptcy Code places certain restrictions on obtaining new debt during Chapter 13 bankruptcy, including mortgage debt. Typically, debtors must receive permission from the bankruptcy court before taking on new financial obligations. Mortgage lenders often have strict criteria for lending to individuals in bankruptcy. These requirements can include demonstrating a sufficient period of timely bankruptcy plan payments, having a steady income, and showing a satisfactory credit score. Local laws and regulations can also impact the home buying process. This includes zoning laws, property taxes, homeowners association rules, and more. Familiarizing oneself with these regulations is crucial to avoid potential legal complications. The intersection of Chapter 13 bankruptcy and homeownership involves several considerations. These include restrictions on new credit, court permissions, and the necessity of demonstrating financial stability. The terms of Chapter 13 bankruptcy typically restrict debtors from obtaining new credit without the bankruptcy trustee's approval. Therefore, securing a mortgage, which constitutes new credit, would necessitate such approval. In addition to trustee approval, buying a house while in Chapter 13 bankruptcy usually requires permission from the bankruptcy court. This process entails demonstrating to the court that the new mortgage payments will not compromise your ability to make your Chapter 13 repayment plan payments. Before allowing you to take on new debt, the court and potential lenders will want to see evidence of financial stability. This typically involves demonstrating a regular income, a track record of making bankruptcy plan payments on time, and an ability to handle additional financial obligations. Before plunging into the housing market, consider these critical factors: financial readiness, the impact on your bankruptcy repayment plan, and affordability. Financial readiness is a critical aspect of buying a house. It entails having a stable income, a good credit score, and sufficient savings for down payment, closing costs, and potential emergencies. Taking on new debt could significantly impact your Chapter 13 repayment plan. It's essential to assess how new mortgage payments will interact with your existing repayment obligations. Buying a house is a long-term financial commitment. Beyond the mortgage payments, you must also consider additional costs such as property taxes, homeowners insurance, maintenance costs, and homeowners association fees. An experienced bankruptcy attorney can help you understand the potential impacts of a home purchase on your bankruptcy case. They can guide you through the process of seeking court approval, and help you navigate the complexities of bankruptcy law. A real estate agent knowledgeable about buying homes during bankruptcy can be a valuable asset. They can help find properties that fit your budget, assist with negotiations, and guide you through the closing process. Not all lenders will be willing to provide a mortgage to someone in Chapter 13 bankruptcy, so researching your options is crucial. Some lending programs, such as those offered by the Federal Housing Administration, may have more lenient requirements for people in bankruptcy. You can sell a house while in Chapter 13 bankruptcy under a few conditions. First, you must receive approval from the court overseeing your case. You must also notify your creditors, who will have the option to object. Barring any objections, you are free to sell, however, the proceeds from the sale will become a part of the bankruptcy estate and will be used to pay back your creditors. Buying a house while in Chapter 13 bankruptcy is possible, but it involves navigating a complex set of rules and requirements. To ensure a smooth process, it is essential to consult with an experienced bankruptcy attorney who can provide guidance on the potential impacts on your bankruptcy case. Working with a knowledgeable real estate agent specializing in buying homes during bankruptcy is also recommended. Researching mortgage options is crucial, as not all lenders are willing to provide mortgages to individuals in Chapter 13 bankruptcy. Compliance with local regulations, such as zoning laws and property taxes, is necessary to avoid legal complications. It is important to consider factors such as financial readiness, the impact on your bankruptcy repayment plan, and affordability before making a home purchase. Overview of Chapter 13 Bankruptcy

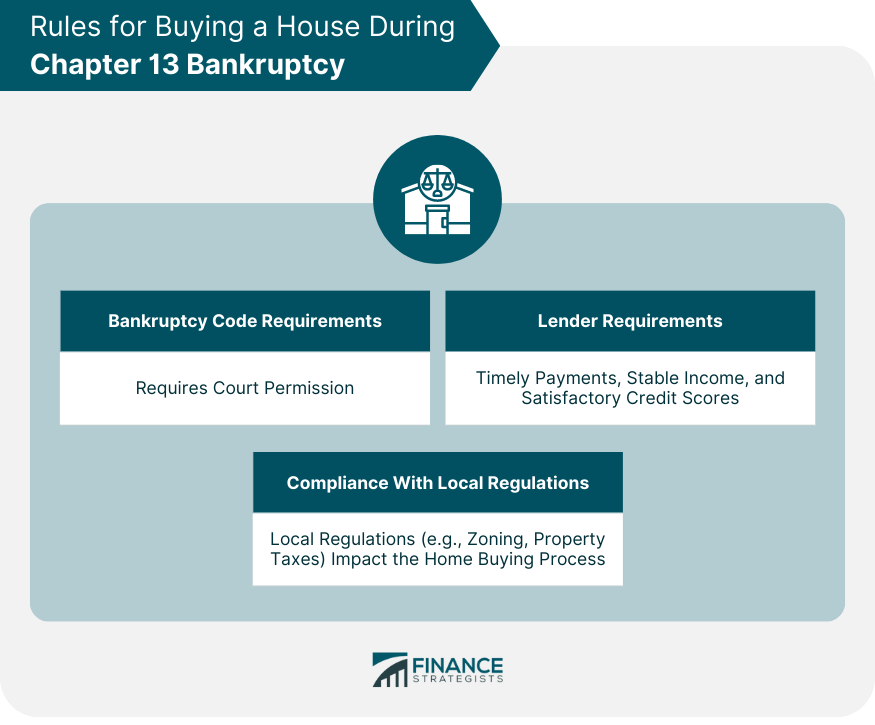

Rules for Buying a House during Chapter 13 Bankruptcy

Bankruptcy Code Requirements

Lender Requirements

Compliance With Local Regulations

Chapter 13 Bankruptcy and Homeownership

Restrictions on Obtaining New Credit

Obtaining Permission From the Bankruptcy Court

Demonstrating Financial Stability

Factors to Consider Before Buying a House

Financial Readiness

Impact on Bankruptcy Repayment Plan

Affordability and Budgeting

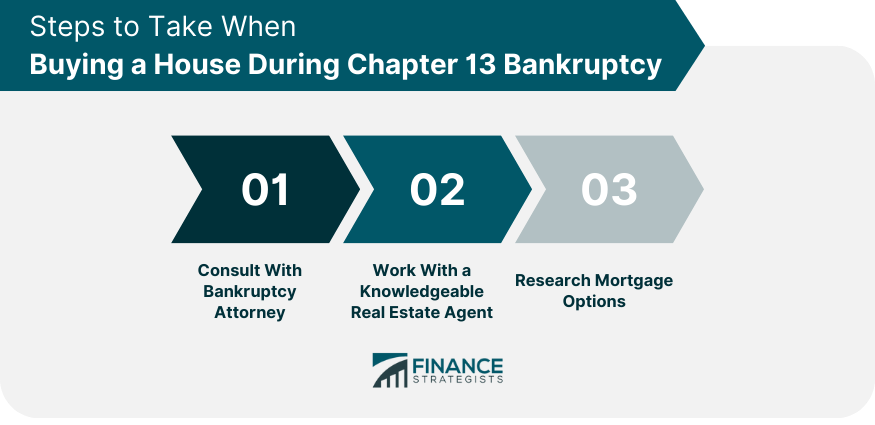

Steps to Take When Buying a House During Chapter 13 Bankruptcy

Consultation With Bankruptcy Attorney

Working With a Knowledgeable Real Estate Agent

Researching Mortgage Options

Can You Sell a House While in Chapter 13 Bankruptcy?

Conclusion

Can I Buy a House While in Chapter 13 Bankruptcy? FAQs

Yes, you may be able to purchase a house while in Chapter 13 bankruptcy. However, it is important to consult with your trustee and attorney before doing so to ensure that any new debts incurred do not interfere with your repayment plan or otherwise negatively affect your ability to discharge the debt when the bankruptcy is completed.

Yes, you will generally need approval from your trustee before you can take on any additional debt during the bankruptcy process. This includes taking out a mortgage loan for a house or other real estate property. Your attorney can help you obtain the necessary permission from your trustee in order to move forward with purchasing a home.

Individuals filing for Chapter 13 bankruptcy may be eligible for either FHA loans or conventional mortgages, depending on their financial situation and credit history. Your attorney can help determine the type of mortgage that would best suit your needs and provide guidance on how to go about obtaining one.

The timeline for being able to obtain financing for a home purchase while in Chapter 13 varies according to individual circumstances. Generally speaking, you will need to wait until at least 12 months after filing before applying for a mortgage loan or other financing.

Yes, you may be able to use the equity in your current home as a down payment when purchasing a new property during Chapter 13 bankruptcy. However, it is important to check with your trustee and attorney before doing so, as they can provide guidance on how to ensure that this does not affect your repayment plan or interfere with any other aspects of the bankruptcy process.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.