Yes, auto loans are possible while in bankruptcy, although the process can be complex and challenging. Despite being in the midst of bankruptcy proceedings, individuals might need to secure a vehicle for essential transportation. However, obtaining an auto loan during this time requires a few key steps. First, one must consult with a bankruptcy attorney to understand the implications. Next, it's important to find a willing lender, which can be difficult due to the inherent risk. Lastly, court approval is necessary to incur new debt during bankruptcy, so the individual would need to file a motion with the court. The type of bankruptcy (Chapter 7 or Chapter 13) also plays a significant role in the feasibility of securing an auto loan. It's critical to remember that while it's possible, it's not without potential hurdles, such as high-interest rates and loan denial. The first steps for anyone considering an auto loan while in bankruptcy. Bankruptcy laws can be complicated, and the ramifications of acquiring additional debt during this time need to be thoroughly understood. A bankruptcy attorney can provide valuable guidance during this process. Not all lenders are willing to offer auto loans to individuals in bankruptcy due to the increased risk of non-repayment. It may take time and effort to find a lender who is not only willing to extend an auto loan but also offers reasonable terms. This step is necessary as bankruptcy law generally prohibits incurring new debt without court approval. The judge will review the motion and consider factors such as the individual's ability to repay the loan and the necessity of the vehicle before making a decision. Chapter 7 bankruptcy is a liquidation bankruptcy where a debtor's non-exempt assets are sold to repay creditors. Because of its nature, getting an auto loan during a Chapter 7 bankruptcy can be challenging. The process often requires a reaffirmation agreement, which makes the debtor legally obligated to pay the auto loan even after bankruptcy discharge. It's a complicated process and requires careful deliberation and legal advice. In contrast, Chapter 13 bankruptcy is a reorganization bankruptcy where debtors propose a repayment plan to make installments to creditors over three to five years. The court typically allows debtors to take on new debt for a necessary expense, such as an auto loan, during this period. However, the debtor must get court approval and demonstrate that the new loan payments will not interfere with their ongoing bankruptcy repayment plan. Reliable transportation is crucial in modern life, especially for those trying to navigate the waters of financial recovery. An auto loan can facilitate this by providing the means to purchase a reliable vehicle. This can have a profound impact on an individual's quality of life, potentially securing or maintaining employment and providing a reliable means of transportation to essential places like schools, hospitals, and grocery stores. While taking on new debt during bankruptcy might seem counterintuitive, it can actually provide an opportunity for credit enhancement. By securing an auto loan and making consistent, on-time payments, an individual can start rebuilding their credit score. This sends a positive signal to future lenders that the borrower is financially responsible and can manage their debts effectively, opening doors for better financial opportunities down the line. Due to the perceived risk of lending to someone in bankruptcy, lenders often impose high-interest rates on auto loans. Over the life of the loan, this can significantly increase the total amount repaid, adding additional financial burden to an already challenging situation. Unfortunatvely, the reality for many people in bankruptcy is the risk of loan rejection. A bankruptcy on your credit report is a significant red flag for lenders. If rejected, one may need to consider alternatives, such as purchasing a cheaper car in cash or relying on public transportation, both of which can have their own sets of challenges. Before taking on an auto loan during bankruptcy, it's critical to take a hard look at your financial capability. You need to ensure that you can handle regular loan payments, insurance, maintenance, and other associated costs of car ownership. Overextending yourself financially can lead to further financial problems and potential legal issues. Bankruptcy laws are complex and vary by jurisdiction. It's crucial to understand the laws and regulations that apply to your situation and to ensure that you're in full compliance. Non-compliance can lead to serious consequences, including dismissal of your bankruptcy case or criminal charges. Working with a knowledgeable bankruptcy attorney can be invaluable in navigating these complexities. Securing an auto loan while in bankruptcy, although challenging, is certainly possible. This process can provide essential transportation for maintaining employment or accessing necessary services during a financially turbulent period. The process involves consulting with a bankruptcy attorney, finding a suitable lender, and obtaining court approval. However, this venture comes with significant hurdles, such as potentially high-interest rates and loan rejection. The type of bankruptcy - Chapter 7 or Chapter 13 - can significantly impact the ease of obtaining an auto loan. While this endeavor can be complex, it offers a unique opportunity to enhance one's credit by maintaining consistent loan repayments. It is critical to thoroughly evaluate one's financial capability before proceeding and to fully understand the associated legal aspects. In navigating the complexities of auto loans in bankruptcy, proper advice and planning can make a significant difference.Are Auto Loans Possible While in Bankruptcy?

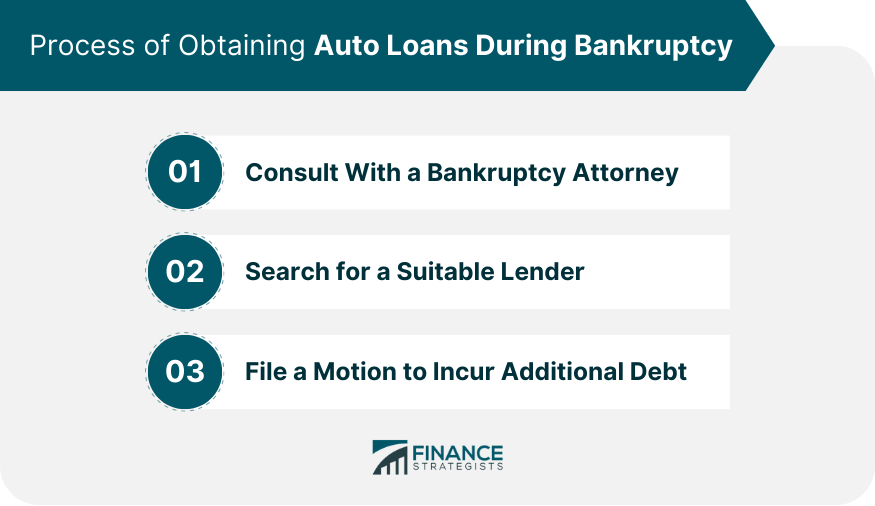

Process of Auto Loans During Bankruptcy

Consult With a Bankruptcy Attorney

Search for a Suitable Lender

File a Motion to Incur Additional Debt

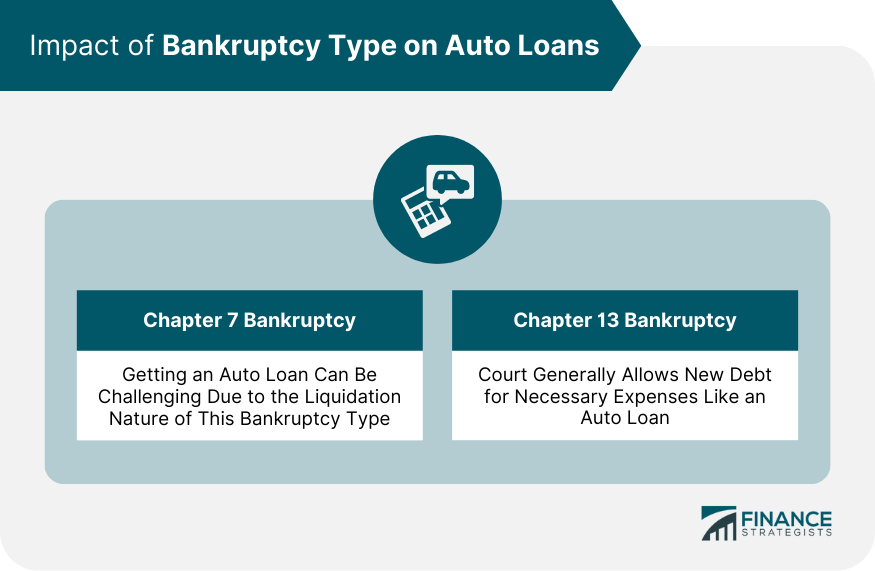

Impact of Bankruptcy Type on Auto Loans

Chapter 7 Bankruptcy and Its Implications

Chapter 13 Bankruptcy and Its Implications

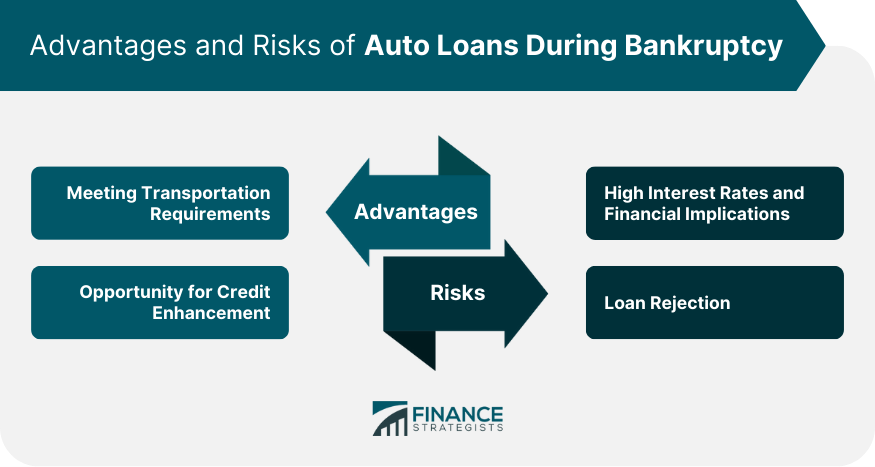

Advantages of Auto Loans During Bankruptcy

Meeting Transportation Requirements

Opportunity for Credit Enhancement

Risks of Auto Loans During Bankruptcy

High-Interest Rates and Financial Implications

Loan Rejection

Essential Factors When to Apply for Auto Loans During Bankruptcy

Evaluating Financial Capability

Comprehending Legal Aspects

Conclusion

Are Auto Loans Possible While in Bankruptcy? FAQs

An auto loan, while in bankruptcy, is a scenario where an individual, currently in the process of bankruptcy, needs to finance a vehicle purchase and secures a loan for that purpose.

The process involves consulting a bankruptcy attorney, finding a lender willing to provide a loan, and filing a motion to incur new debt with the bankruptcy court. It's important to remember that court approval is necessary to take on new debt during bankruptcy.

Yes, the type of bankruptcy does impact the likelihood of securing an auto loan. In Chapter 7 bankruptcy, the process can be more challenging and often requires a reaffirmation agreement. Conversely, with Chapter 13 bankruptcy, the court typically allows for new debt like auto loans, provided it does not interfere with the bankruptcy repayment plan.

The primary advantage is the ability to meet essential transportation needs, which can be critical for maintaining employment and accessing necessary services. Additionally, by making consistent loan repayments, you have an opportunity to improve your credit score, which can be beneficial for future financial prospects.

The main challenges include potentially high-interest rates due to the perceived risk by lenders and the possibility of loan denial due to bankruptcy status. It's also crucial to understand the complex legal aspects involved and to ensure you can comfortably handle the regular payments and other associated costs of car ownership.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.