A Retirement Plan Investment Advisor is a financial professional who specializes in providing investment advice and services related to retirement plans. These advisors work closely with individuals, employers, and plan sponsors to design, implement, and manage retirement plans that align with their clients' goals and objectives. The importance of RPIAs cannot be overstated. With an increasing number of people relying on their retirement savings for financial security in their golden years, having a professional who can guide them through the complex world of retirement planning is crucial. RPIAs assist clients in navigating the myriad of investment options, tax implications, and regulatory requirements associated with retirement plans. By doing so, they help clients maximize their retirement savings, minimize risk, and ensure that they are in compliance with all applicable laws and regulations. Becoming a Retirement Plan Investment Advisor typically requires a strong educational background in finance, economics, or a related field. Many RPIAs hold a bachelor's degree or higher in these areas. In addition to formal education, RPIAs must also have a solid understanding of investment principles, financial markets, and retirement plan regulations. Training and experience are essential for RPIAs, as they must be able to analyze complex financial information and provide sound advice to their clients. Many RPIAs gain experience through internships, entry-level positions in financial services, or working closely with experienced advisors. Retirement Plan Investment Advisors are often required to hold various licenses and certifications to demonstrate their expertise and competence in their field. The specific requirements vary depending on the jurisdiction and the services offered by the advisor. Common licenses include the Series 65 or Series 66, which allow advisors to provide investment advice. In addition to these licenses, many RPIAs choose to obtain professional certifications to further enhance their credibility and expertise. Some of the most well-respected certifications include the Certified Financial Planner (CFP) designation, the Chartered Retirement Plans Specialist (CRPS) designation, and the Accredited Investment Fiduciary (AIF) designation. RPIAs provide a range of investment advisory services to help clients build and maintain their retirement savings. These services may include asset allocation recommendations, investment selection, and ongoing portfolio monitoring and adjustments. By providing tailored investment advice based on the client's goals, risk tolerance, and time horizon, RPIAs help to ensure that their clients' retirement portfolios are well-diversified and aligned with their long-term objectives. Retirement Plan Investment Advisors also offer consulting services to employers and plan sponsors. They assist in the design and implementation of retirement plans that meet the needs of both the organization and its employees. RPIAs can provide guidance on plan selection, investment options, employee education, and more. By working closely with employers, RPIAs help create retirement plans that promote employee satisfaction and retention while ensuring compliance with applicable regulations. Once a retirement plan has been designed, RPIAs play a crucial role in its implementation and ongoing management. They may assist with plan enrollment, investment selection, and employee education to ensure that participants understand their options and make informed decisions. Additionally, RPIAs monitor the performance of the retirement plan and its investments, making adjustments as needed to keep the plan on track to meet its goals. They also work closely with plan sponsors to ensure compliance with all relevant regulations, helping to mitigate potential legal and financial risks. One of the primary benefits of hiring an RPIA is the customized investment advice and solutions they provide. RPIAs take the time to understand each client's unique financial situation, goals, and risk tolerance, allowing them to develop personalized strategies that align with the client's objectives. By offering tailored advice and solutions, RPIAs help clients build retirement portfolios that are well-suited to their needs, increasing the likelihood of achieving a secure and comfortable retirement. Retirement planning involves numerous risks, including market volatility, inflation, and longevity risk. RPIAs help clients navigate these risks by recommending diversified investment strategies, monitoring portfolio performance, and adjusting the plan as needed to ensure it remains on track to meet its goals. By actively managing risk, RPIAs help clients protect their retirement savings and achieve their long-term financial objectives. Retirement plans are subject to numerous laws and regulations, making compliance a critical aspect of plan administration. RPIAs have extensive knowledge of these regulations and work closely with plan sponsors to ensure their plans are in compliance. By providing compliance assistance, RPIAs help employers avoid costly penalties and potential legal issues, while also ensuring that their employees have access to a well-structured and compliant retirement plan. Defined benefit plans, also known as pension plans, are one type of retirement plan that RPIAs can help design and manage. These plans provide employees with a predetermined monthly benefit upon retirement, based on factors such as salary and years of service. RPIAs can assist employers in developing a funding strategy for their defined benefit plans, selecting investments, and ensuring the plan complies with all relevant regulations. Another type of retirement plan handled by RPIAs is the defined contribution plan, which includes 401(k), 403(b), and 457 plans. In these plans, employees contribute a portion of their salary to a retirement account, and employers may also make matching contributions. RPIAs work with employers to design and implement defined contribution plans that meet the organization's objectives and provide a valuable benefit to employees. They can also advise on investment options, employee education, and ongoing plan management. Employee Stock Ownership Plans (ESOPs) are another type of retirement plan that RPIAs may work with. ESOPs allow employees to own a portion of the company through a trust, providing them with an additional source of retirement income. RPIAs can help design and implement ESOPs, providing guidance on plan structure, funding, and compliance with applicable regulations. Retirement Plan Investment Advisors play a crucial role in helping individuals and organizations navigate the complex world of retirement planning. With their expertise in investment advice, retirement plan design, and regulatory compliance, RPIAs provide valuable services that can significantly impact the financial security of their clients in retirement. By hiring a qualified and experienced RPIA, clients gain access to customized investment solutions, risk management strategies, and compliance assistance that can ultimately enhance the overall success of their retirement plans.What Is a Retirement Plan Investment Advisor (RPIA)?

Qualifications of Retirement Plan Investment Advisor (RPIA)

Education and Training

Licenses and Certifications

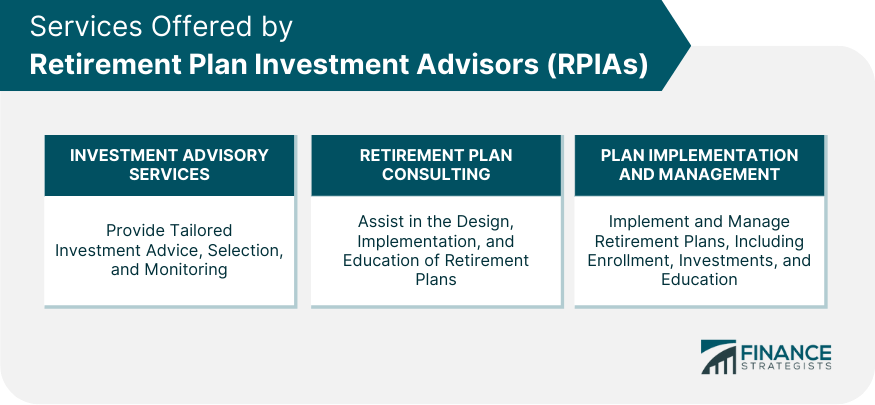

Services Offered by Retirement Plan Investment Advisor (RPIA)

Investment Advisory Services

Retirement Plan Consulting

Plan Implementation and Management

Benefits of Hiring a Retirement Plan Investment Advisor (RPIA)

Customized Investment Solutions

Risk Management

Compliance Assistance

Types of Retirement Plans Handled by Retirement Plan Investment Advisors (RPIAs)

Defined Benefit Plans

Defined Contribution Plans

Employee Stock Ownership Plans (ESOPs)

Final Thoughts

Retirement Plan Investment Advisor (RPIA) FAQs

A Retirement Plan Investment Advisor (RPIA) is a financial professional who provides investment advice and consulting services for retirement plans.

RPIAs typically have a degree in finance, accounting, or a related field, as well as licenses and certifications such as a Series 7, Series 63, and a Registered Investment Advisor (RIA) license.

RPIAs offer investment advisory services, retirement plan consulting, and plan implementation and management.

Hiring an RPIA can provide customized investment solutions, risk management, and compliance assistance for retirement plans.

RPIAs can handle various retirement plans, including defined benefit plans, defined contribution plans, and employee stock ownership plans (ESOPs).

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.