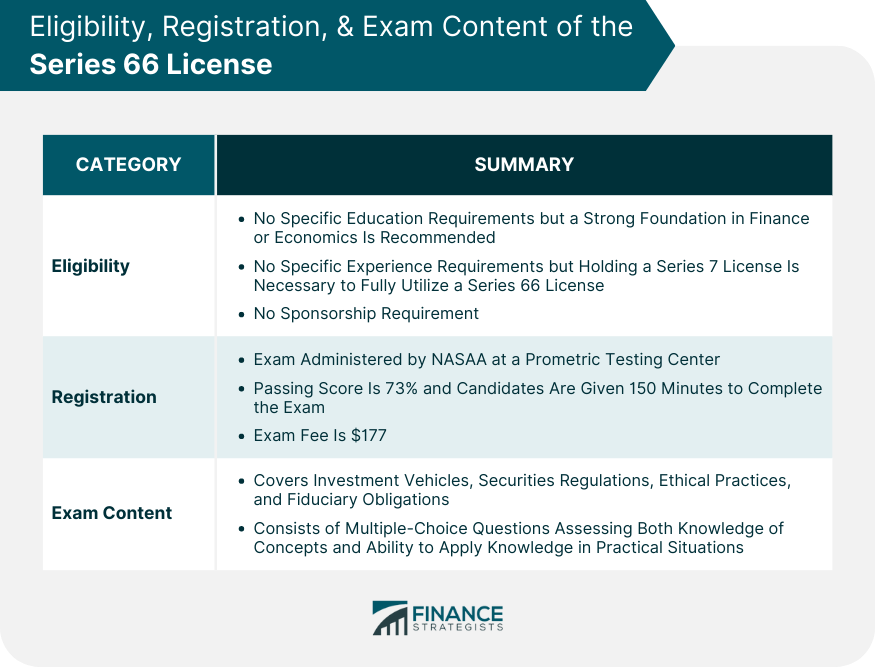

The Series 66 license, also known as the Uniform Combined State Law Examination, is a securities exam administered by the Financial Industry Regulatory Authority (FINRA). This license qualifies individuals to provide both investment advice and effect securities transactions on behalf of clients. The Series 66 exam is designed to test candidates on their knowledge of investment vehicles, securities regulations, ethical practices, and fiduciary obligations. Upon successful completion of the exam, candidates are considered registered investment advisor representatives and securities agents who can offer a wider range of services to clients, including investment advice, financial planning, and the sale of securities. The primary purpose of the Series 66 license is to ensure that financial professionals providing investment advice and effecting securities transactions are knowledgeable and competent in their field. Achievable’s FINRA Series 66 course guides you through a personalized learning experience, reinforcing what you’ve learned and giving you certainty that you’re ready to pass your exam. Achievable FINRA Series 66 is all you need to pass, and include an easy-to-understand online textbook, dozens of videos on key topics, 2,100+ chapter review questions backed by their memory-enhancing algorithm, and 26+ full-length practice exams. Achievable’s course content is produced by Brandon Rith, who was formerly Fidelity’s top instructor nationwide. Achievable has industry leading pass rates on all of their FINRA courses, and they will give you a full refund if you don’t pass on your first try. While there are no specific education requirements for the Series 66 license, it is generally recommended that candidates have a strong foundation in finance, economics, or a related field. Many candidates hold a bachelor's degree or higher in these areas to better prepare for the exam. In addition to formal education, it is beneficial for candidates to have a solid understanding of investment principles, financial markets, and securities regulations. Self-study materials and exam prep courses are also available to help candidates gain the knowledge required to pass the exam. There are no specific experience requirements to sit for the Series 66 exam. However, it is important to note that holding a Series 66 license alone does not qualify an individual to work as a registered investment advisor or securities agent. Candidates must also hold a Series 7 license, or another license that permits securities transactions, in order to fully utilize their Series 66 license. Unlike other exams, such as the Series 7 or Series 79, the Series 66 exam does not have a sponsorship requirement. Individuals can directly register and apply for the exam without needing sponsorship from a FINRA-member firm. The application process typically involves submitting the required application form, payment of fees, and scheduling the exam appointment at an approved testing center. Once the application is processed, candidates can prepare for the exam and take the necessary steps to achieve their licensing goals. The Series 66 exam is administered by the North American Securities Administrators Association (NASAA) and is taken at a Prometric testing center. The exam consists of 110 multiple-choice questions, of which 100 are scored. The remaining 10 questions are pretest questions that do not count toward the candidate's score. Candidates are given 150 minutes to complete the exam, and the passing score is 73%. Test-takers are notified of their results immediately upon completion of the exam. There is a fee associated with taking the Series 66 exam. The exam fee is $177. This fee is subject to change, so candidates should verify the current fee before registering for the exam. In addition to the exam fee, there may be additional costs associated with study materials, exam prep courses, and any required continuing education courses after obtaining the license. The Series 66 exam covers a wide range of topics related to investment vehicles, securities regulations, ethical practices, and fiduciary obligations. Some of the primary areas covered on the exam include: Economic Factors and Business Information Investment Vehicle Characteristics Client Investment Recommendations and Strategies Laws, Regulations, and Guidelines, Including Prohibition on Unethical Business Practices The exam content is designed to test candidates on their ability to apply their knowledge to real-world scenarios and make appropriate recommendations to clients. The Series 66 exam consists of multiple-choice questions that assess a candidate's understanding of the subject matter. The questions are designed to measure both the candidate's knowledge of specific concepts and their ability to apply that knowledge in practical situations. Some questions may require the candidate to analyze a scenario, determine the appropriate course of action, and select the correct answer from several options. Other questions may test the candidate's understanding of specific regulations, investment vehicles, or financial concepts. Candidates are given 150 minutes to complete the Series 66 exam. This time frame allows for approximately 1.5 minutes per question, including the 10 pretest questions. Candidates should manage their time carefully to ensure they have enough time to read and answer each question. The passing score for the Series 66 exam is 73%. This means that candidates must correctly answer at least 73 of the 100 scored questions in order to pass the exam. The exam results are provided immediately upon completion, allowing candidates to know whether they have passed or failed. If a candidate fails the Series 66 exam, they must wait 30 days before retaking the exam. If a candidate fails the exam three times in succession, they must then wait 180 days before they can attempt the exam again. It is important for candidates to review their exam results and identify areas where they need improvement. This can help guide their study efforts as they prepare to retake the exam. Holding a Series 66 license opens up a variety of career opportunities within the financial services industry. With this license, financial professionals can work as investment advisor representatives, providing investment advice and managing client portfolios. They can also work as securities agents, selling a variety of investment products, such as stocks, bonds, and mutual funds. By obtaining a Series 66 license, financial professionals can provide a more comprehensive range of services to their clients. This may include offering financial planning services, advising on retirement strategies, or managing clients' investment portfolios. This broader scope of services can help professionals better meet the needs of their clients and develop long-term relationships. Financial professionals with a Series 66 license may enjoy higher earning potential compared to those without the license. The ability to offer a wider range of services and products to clients can result in increased revenue for both the professional and their firm. Obtaining a Series 66 license demonstrates a financial professional's commitment to their career and adherence to high ethical standards. This can enhance their credibility with clients, employers, and colleagues, and may help them establish a reputation as a trusted and knowledgeable advisor. Holding a Series 66 license can open doors to leadership roles and career advancement within the financial services industry. Professionals with this license may be more likely to be considered for management positions, as they have demonstrated their commitment to their career and their knowledge of the industry. The Series 66 License is a financial industry credential that enables professionals to offer investment advice and manage client accounts. To be eligible for the license, you need to have passed the Series 7 exam and meet certain education and experience requirements. The exam covers a range of topics and consists of 100 multiple-choice questions. Obtaining a Series 66 License can lead to numerous benefits, such as expanded career opportunities, increased earning potential, and greater professional credibility in the financial industry. By meeting the eligibility requirements, registering for the exam, and successfully passing the test, professionals can demonstrate their expertise in investment advice and securities transactions.What Is the Series 66 License?

Our Trusted Partner

Achievable

Eligibility for Series 66 License

Education Requirements

Experience Requirements

Registration for Series 66 License

Application Process

Examination Process

Fees Associated With Registration

Exam Content of Series 66 License

Topic Areas Covered in the Exam

Types of Questions on the Exam

Time Allowed for the Exam

Passing the Series 66 License Exam

Score Requirements for Passing

Retaking the Exam

Benefits of Series 66 License

Expanded Career Opportunities

Ability to Offer Broader Financial Advice

Increased Earning Potential

Professional Credibility

Potential for Advancement in the Financial Industry

The Bottom Line

Series 66 License FAQs

It is a license that allows professionals to offer investment advice and manage client accounts, combining the Series 63 and 65 exams.

You need to have completed the Series 7 exam and meet certain education and experience requirements.

The exam covers topics such as securities, ethics, and regulations. It is 100 questions long and takes 2.5 hours to complete.

It can lead to expanded career opportunities, increased earning potential, and greater professional credibility in the financial industry.

You need to complete continuing education requirements and renew your license every two years to maintain your Series 66 License.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.