An inter-vivos trust, also known as a living trust, is a legal arrangement that allows an individual (the grantor) to transfer ownership of their assets to a trust managed by a trustee for the benefit of one or more beneficiaries. The trust is established during the lifetime of the grantor and serves as a comprehensive tool in estate planning. An inter-vivos trust allows the grantor to maintain control over their assets during their lifetime while providing instructions for the distribution of assets upon their death. This type of trust can be a flexible and effective way to manage and protect assets, depending on the grantor's needs and goals. Inter-vivos trusts are an essential component of estate planning, as they offer numerous benefits, such as avoiding probate, maintaining privacy, protecting assets, and ensuring control over assets during the grantor's lifetime. These benefits help the grantor to plan for their future, reduce estate taxes, and ensure their wishes are carried out as intended. Moreover, inter-vivos trusts can provide for minor children, disabled family members, or other beneficiaries who may require financial support or protection. The flexibility of these trusts allows the grantor to customize the trust according to their specific circumstances and objectives.

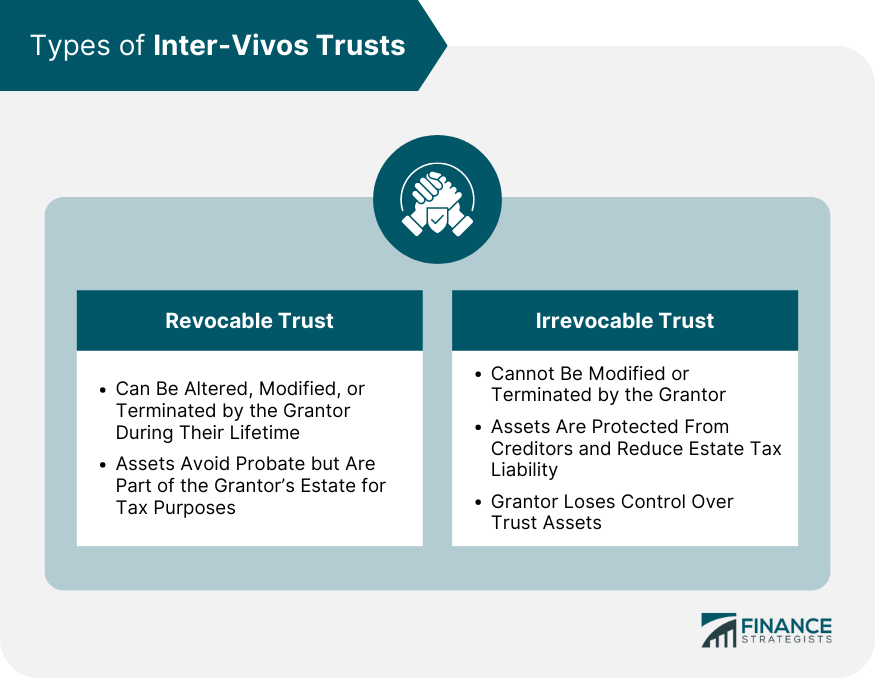

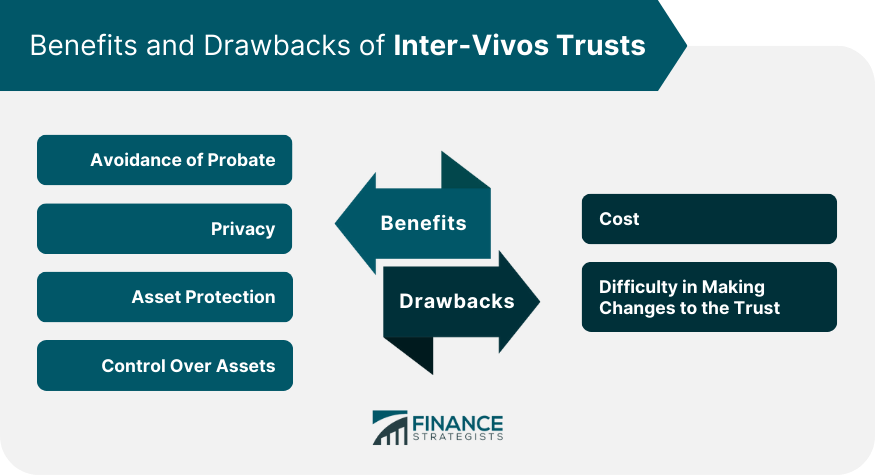

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. In a recent case, I helped a client establish an Inter-Vivos Trust to manage their estate, ensuring smooth asset transfer to their children while minimizing estate taxes. By allocating specific assets into the trust, we protected the estate from probate and reduced tax liabilities, securing the family's financial future. Let's craft your personalized trust strategy today. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation A revocable trust is a type of inter-vivos trust that can be altered, modified, or terminated by the grantor during their lifetime. This flexibility allows the grantor to adapt the trust as their circumstances change, such as adding or removing beneficiaries or modifying the terms of the trust. Upon the grantor's death, the revocable trust becomes irrevocable, and the trustee follows the instructions provided in the trust document. Assets within a revocable trust are considered part of the grantor's estate for tax purposes, but they avoid the probate process. An irrevocable trust is an inter-vivos trust that cannot be modified or terminated by the grantor once it has been established. This type of trust is commonly used for asset protection and estate tax reduction since assets in an irrevocable trust are no longer considered part of the grantor's estate. Irrevocable trusts can provide significant benefits, including shielding assets from creditors and reducing estate tax liability. However, they come with the trade-off of relinquishing control over the trust assets, which may not be suitable for all grantors. A wide range of assets can be transferred to an inter-vivos trust, including real estate, financial accounts, stocks, bonds, business interests, and personal property. It is important to properly title and transfer these assets into the trust to ensure that they are protected and managed according to the trust's terms. Careful consideration should be given to the types of assets transferred to the trust, as certain assets may have tax implications or other consequences when placed in an inter-vivos trust. The process of establishing an inter vivos trust includes: Drafting the trust agreement: This legal document outlines the terms of the trust, including the parties involved, their roles, and the distribution of trust assets. Funding the trust: The grantor transfers assets into the trust, such as real estate, bank accounts, investments, or personal property. Execution and formalities: The trust agreement must be signed by the grantor and trustee and, in some cases, notarized or witnessed. Selecting the right trust type depends on the grantor's goals, such as estate tax planning, probate avoidance, or asset protection. The grantor is responsible for creating the trust, selecting the trustee and beneficiaries, and transferring assets into the trust. Additionally, the grantor must ensure the trust complies with applicable laws and regulations and consult with legal and financial professionals as needed. The trustee has a fiduciary duty to manage the trust assets for the benefit of the beneficiaries. Key responsibilities and duties include: Duty of Loyalty: The trustee must act in the best interests of the beneficiaries and avoid conflicts of interest. Duty of Care: The trustee must manage the trust assets prudently and responsibly, adhering to the terms of the trust agreement. Duty of Impartiality: The trustee must treat all beneficiaries fairly and without favoritism. Duty to Account: The trustee must provide regular updates and reports to the beneficiaries regarding the trust's administration and asset management. Beneficiaries have the right to receive trust distributions according to the terms of the trust agreement. They also have the right to information about the trust's administration, including regular reports and updates from the trustee. The ability to modify or amend an inter vivos trust depends on the type of trust and its terms. Revocable trusts can generally be modified or terminated by the grantor at any time. However, irrevocable trusts can only be modified or terminated under specific conditions, such as with the consent of all beneficiaries or through a court order. The process for modifying, amending, or terminating an inter vivos trust typically involves drafting and executing a legal document outlining the changes, obtaining any necessary consents, and adhering to the formalities required by the trust agreement and applicable laws. Modifying, amending, or terminating a trust can have various consequences, including tax implications, changes in asset protection, and potential disputes among the parties involved. It's essential to consult with legal and financial professionals before making significant changes to an inter vivos trust. One significant advantage of inter-vivos trusts is the avoidance of probate, the legal process by which a decedent's estate is administered and distributed. Probate can be a lengthy, costly, and public process that may expose the estate to challenges and disputes. By placing assets in an inter-vivos trust, the grantor ensures that these assets bypass the probate process and are distributed directly to the beneficiaries according to the terms of the trust. This can save time, money and provide peace of mind for the grantor and their beneficiaries. Unlike wills, which go through probate and become public records, inter vivos trusts enable individuals to transfer assets privately. This means that the details of the trust, including its assets and beneficiaries, remain confidential and inaccessible to the public. By maintaining privacy, inter vivos trusts provide individuals with a means to protect their financial information, preserve family privacy, and maintain confidentiality regarding their estate planning decisions. Inter vivos trusts provide asset protection by separating the assets held within the trust from the individual's personal assets. This separation creates a legal barrier that shields the trust assets from potential creditors or legal claims. As the individual no longer legally owns the assets held in the trust, those assets are generally protected from claims against the individual. By establishing an inter vivos trust, individuals can safeguard their assets from potential risks, such as lawsuits, business liabilities, or personal debts, thus preserving their wealth and ensuring it is available for the intended beneficiaries of the trust. In an inter vivos trust, individuals can retain control over their assets by serving as the trustee or by appointing a trusted individual or institution as the trustee. As the trustee, they maintain decision-making authority over the assets within the trust, including investment choices and distributions. By establishing specific terms and instructions within the trust document, individuals can dictate how the assets are managed, when and how distributions are made, and even reserve the right to amend or revoke the trust during their lifetime. The cost can be a drawback of inter vivos trusts due to the expenses associated with setting up and maintaining the trust. The initial setup costs may include legal fees, document preparation, and potential appraisal fees. Additionally, ongoing administration costs, such as trustee fees, accounting fees, and filing fees, can add up over time. For instance, legal fees for creating a trust can range from $1,000 to $3,000, while annual trustee fees can range from 1-2% of the trust's assets. These costs may deter individuals with limited financial resources from establishing and maintaining inter vivos trusts. Amending an inter-vivos trust can be more complicated than modifying a will or other estate planning documents. Depending on the terms of the trust and applicable laws, making changes to the trust may require the consent of the beneficiaries, the intervention of a court, or the cooperation of the trustee. This complexity can be a drawback for grantors who anticipate frequent changes to their estate plan or who prefer the simplicity of a will or other estate planning tools. Inter vivos trusts are subject to federal and state laws, which dictate how trusts are established, administered, and taxed. These laws can vary across jurisdictions, so it's essential to consult with an attorney experienced in trust and estate planning. Tax considerations for inter vivos trusts include income tax, estate tax, and gift tax implications. Income tax: The trust may be subject to income tax on its earnings, which can be passed through to the grantor or beneficiaries, depending on the trust type. Estate tax: Trust assets are generally excluded from the grantor's taxable estate, reducing potential estate tax liability. Gift tax: Transfers to irrevocable trusts may be subject to gift tax, though annual exclusions and lifetime exemptions may apply. Asset protection is a primary consideration for many grantors when establishing an inter vivos trust. Trusts can offer varying levels of protection against creditors and legal claims, depending on the type of trust and applicable state laws. Irrevocable trusts generally provide more robust asset protection, as the grantor relinquishes control over the trust assets. In contrast, revocable trusts typically offer limited protection, as the grantor maintains control and can modify or revoke the trust. Inter-vivos trusts, or living trusts, are powerful estate planning tools that enable the grantor to transfer ownership of their assets to a trust managed by a trustee for the benefit of one or more beneficiaries. These trusts can offer numerous benefits, such as avoiding probate, maintaining privacy, and protecting assets, depending on the grantor's needs and objectives. However, they also come with potential drawbacks, such as costs and difficulty in making changes to the trust. It is essential for the grantor to carefully weigh the benefits and drawbacks of an inter-vivos trust to determine if it is the right estate planning tool for their specific situation. By understanding the different types of inter-vivos trusts, their benefits and drawbacks, and the tax implications associated with them, the grantor can make informed decisions about their estate planning needs and ensure that their wishes are carried out as intended.What Are Inter-Vivos Trusts?

Read Taylor's Story

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Types of Inter-Vivos Trusts

Revocable Trust

Irrevocable Trust

Establishing an Inter Vivos Trust

Assets That Can Be Transferred to an Inter-Vivos Trust

Creation Process

Choosing the Appropriate Trust Type

Roles and Responsibilities of Trust Parties in Inter Vivos Trusts

Grantor's Responsibilities

Trustee's Responsibilities and Duties

Beneficiary's Rights and Interests

Modifying, Amending, or Terminating Inter Vivos Trusts

Conditions for Modification or Amendment

Process for Modification, Amendment, or Termination

Potential Consequences and Considerations

Benefits of Inter-Vivos Trust in Estate Planning

Avoidance of Probate

Privacy

Asset Protection

Control Over Assets

Potential Drawbacks of Inter-Vivos Trust

Cost

Difficulty in Making Changes to the Trust

Legal Considerations and Tax Implications of Inter Vivos Trusts

Federal and State Laws Governing Inter Vivos Trusts

Tax Implications for Grantors and Beneficiaries

Asset Protection and Creditor Issues of Inter Vivos Trusts

Final Thoughts

Inter-Vivos Trusts FAQs

An inter-vivos trust, also known as a living trust, is created during the lifetime of the trustmaker to hold and manage their assets.

Inter-vivos trusts offer benefits such as avoiding probate, ensuring privacy, protecting assets, and allowing for greater control over assets.

Assets such as real estate, investments, bank accounts, and personal property can be placed in an inter-vivos trust.

Yes, a revocable inter-vivos trust can be changed or revoked by the trustmaker during their lifetime. Irrevocable inter-vivos trusts are more difficult to change.

It is highly recommended to consult with an experienced estate planning attorney when creating an inter-vivos trust to ensure it is tailored to your specific needs and complies with state laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.