A bare trust, also known as a simple trust, is a legal arrangement where one person (the trustee) holds assets on behalf of another person (the beneficiary) without any additional powers or instructions. The trustee's role is merely to hold and manage the assets according to the beneficiary's wishes. Bare trusts are characterized by their simplicity and minimal administrative requirements. The trustee has no discretion over the trust assets, and the beneficiary has an absolute right to the trust property, including income and capital gains. Unlike discretionary or complex trusts, bare trusts provide no flexibility to the trustee in managing the assets. While discretionary trusts allow trustees to decide how to distribute assets, bare trusts require trustees to follow the beneficiary's directives. To establish a bare trust, there must be a clear intention by the settlor to create a trust, identifiable trust property, and an appointed trustee. The trust deed should clearly outline the terms and conditions governing the trust relationship. The settlor is the person who creates the trust and transfers assets to it. Their primary responsibility is to ensure the trust is properly established and that the chosen trustee is suitable for managing the trust property. Once the trust is established, the settlor loses legal ownership of the trust property. However, they may still retain some control over the assets, depending on the terms of the trust deed. The trustee holds and manages the trust property for the benefit of the beneficiary. Their main responsibility is to act in the best interests of the beneficiary and follow their instructions regarding the trust assets. Trustees owe a fiduciary duty to the beneficiary, meaning they must act honestly, diligently, and in good faith. They must also provide the beneficiary with information about the trust property and any transactions involving it. In a bare trust, the trustee's powers are limited, as they must follow the beneficiary's directions. They cannot make decisions on their own, which distinguishes bare trusts from other trust types. The beneficiary is the person who benefits from the trust assets. They have an absolute right to the trust property and can instruct the trustee on how to manage and distribute the assets. Beneficiaries have the right to communicate with the trustee about the trust property, request information, and provide instructions. It is important for both parties to maintain a clear and open line of communication. As a beneficiary of a bare trust, an individual has direct control over the trust assets, can access the trust property, and receive income or capital gains without restrictions. A trust deed is a legal document that outlines the terms and conditions of the trust. Essential elements include the names of the settlor, trustee, and beneficiary, a description of the trust property, and any specific instructions or restrictions governing the trust. It is crucial for a trust deed to have clear and unambiguous terms to avoid misunderstandings or disputes between the trustee and beneficiary. Unclear terms may also result in legal challenges, potentially invalidating the trust. When selecting a trustee, the settlor should consider factors such as the trustee's financial expertise, trustworthiness, and willingness to assume the role. It is important to choose someone capable of managing the trust property effectively and following the beneficiary's instructions. Trustees have a range of legal obligations, including fiduciary duties to the beneficiary and compliance with applicable laws and regulations. Failure to fulfill these obligations may result in legal liability and potential removal from their role. A bare trust can hold various types of assets, including cash, real estate, investments, and personal property. The specific assets held in the trust will depend on the settlor's objectives and the beneficiary's needs. To transfer assets to a bare trust, the settlor must legally transfer the assets to the trustee, who then holds the assets on behalf of the beneficiary. The process may involve signing legal documents, registering titles, or completing other formalities depending on the type of asset. Bare trusts are relatively easy to establish and maintain, with lower administrative costs and complexities compared to other trust types. They often require less legal and accounting assistance, making them an attractive option for simple asset management. In a bare trust, the beneficiary is responsible for any tax liabilities on the trust income and capital gains. This can be advantageous, as it may result in lower tax rates compared to other trust structures. Bare trusts can provide a level of asset protection by separating legal ownership from beneficial ownership. This separation may help safeguard the trust property from creditors or other financial risks faced by the settlor or beneficiary. Bare trusts can be a useful tool in estate planning, particularly for transferring assets to minors or beneficiaries with limited financial experience. Since the trustee has no discretion over the trust property, beneficiaries can take control of the assets once they reach a certain age or meet specific conditions. One of the main disadvantages of a bare trust is the limited flexibility and control it offers. Unlike other trust structures, trustees cannot make decisions regarding the trust property without the beneficiary's instruction, which may not be ideal in certain situations. While bare trusts can offer some tax advantages, there may be potential drawbacks. For example, beneficiaries may be subject to higher tax rates if their personal tax situation changes, or if the trust property generates significant income or capital gains. Bare trusts do not offer the same level of confidentiality as other trust structures. Trust deeds and other related documents may become public records, potentially exposing the settlor, trustee, and beneficiary's personal information. Since beneficiaries have direct control over the trust assets, they may be at risk of making poor financial decisions or being influenced by third parties. This could result in the mismanagement or loss of the trust property. A bare trust may be terminated for various reasons, such as the beneficiary reaching a specified age, the fulfillment of specific conditions, or the mutual agreement of the trustee and beneficiary. To terminate a bare trust, the trustee must follow any requirements outlined in the trust deed and applicable laws. This may involve transferring the trust property to the beneficiary, paying any outstanding expenses, or filing relevant legal documents. Upon termination of a bare trust, the trustee distributes the trust assets to the beneficiary. This transfer effectively ends the trust relationship, and the beneficiary assumes full ownership and control of the assets. Bare trusts are a simple and cost-effective legal arrangement, wherein a trustee holds assets for a beneficiary without discretion or additional powers. They offer various benefits, such as simplicity, tax advantages, and asset protection, but also have some drawbacks, including limited flexibility and potential risks to beneficiaries. A bare trust may be suitable in situations where the primary goal is to manage assets for a beneficiary with minimal administrative complexity. It can be particularly helpful in estate planning, asset management for minors, and real estate transactions. Depending on the specific needs and goals of the settlor and beneficiary, other types of trusts may be more appropriate. Discretionary trusts, for example, provide more flexibility and control to the trustee, while other complex trust structures may offer additional tax planning or asset protection benefits. It is essential to consult with legal and financial professionals to determine the most suitable trust structure for individual circumstances.What Is Bare Trust?

Parties Involved in a Bare Trust

Settlor

Role and Responsibilities

Rights Over the Trust Property

Trustee

Role and Responsibilities

Obligations to the Beneficiary

Limitations on Trustee's Powers

Beneficiary

Role and Rights

Interaction With the Trustee

Benefits of Being a Beneficiary in a Bare Trust

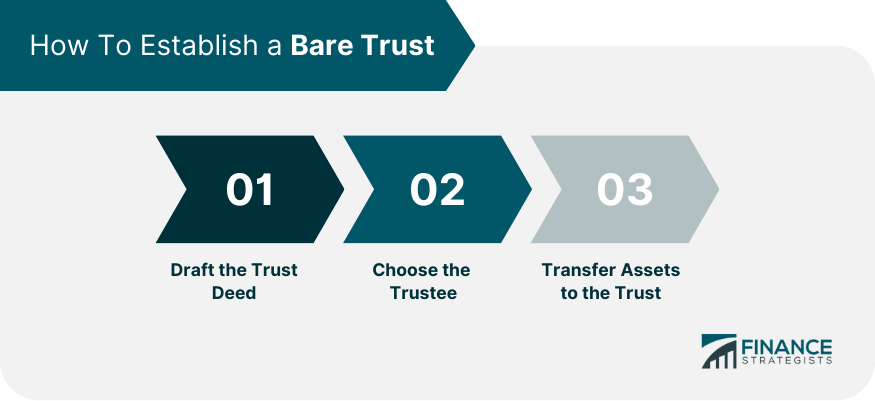

Establishing a Bare Trust

Drafting the Trust Deed

Essential Elements of a Trust Deed

Importance of Clear and Unambiguous Terms

Choosing the Trustee

Factors to Consider

Legal Obligations of the Trustee

Transferring Assets to the Trust

Types of Assets That Can Be Held in a Bare Trust

Process of Transferring Assets

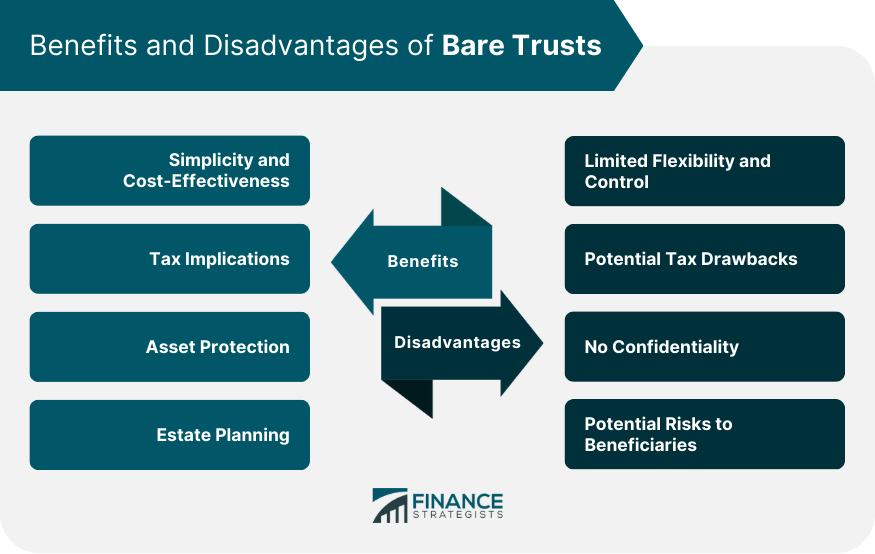

Benefits of a Bare Trust

Simplicity and Cost-Effectiveness

Tax Implications

Asset Protection

Estate Planning

Disadvantages of a Bare Trust

Limited Flexibility and Control

Potential Tax Drawbacks

No Confidentiality

Potential Risks to Beneficiaries

Terminating a Bare Trust

Reasons for Termination

Process of Termination

Distribution of Trust Assets to the Beneficiary

Final Thoughts

Bare Trust FAQs

A bare trust, also known as a simple trust, is a legal arrangement where a trustee holds assets on behalf of a beneficiary without any additional powers or instructions. Unlike other trust types, such as discretionary trusts, the trustee in a bare trust has no discretion over the trust assets and must follow the beneficiary's directives.

The primary advantages of using a bare trust include simplicity and cost-effectiveness, tax implications, asset protection, and estate planning. Bare trusts have fewer administrative requirements and lower costs compared to other trust types, and they can offer certain tax benefits and asset protection to the beneficiary.

Some disadvantages of a bare trust include limited flexibility and control, potential tax drawbacks, lack of confidentiality, and potential risks to beneficiaries. The trustee has no discretion over the trust property, which may be unsuitable in certain situations, and the trust structure may not offer the same level of confidentiality as other trusts.

To establish a bare trust, you need a clear intention to create a trust, identifiable trust property, and an appointed trustee. A trust deed should be drafted, outlining the terms and conditions governing the trust relationship. Legal requirements include transferring assets to the trust, choosing a suitable trustee, and adhering to any applicable laws and regulations.

A bare trust may be appropriate when the primary goal is to manage assets for a beneficiary with minimal administrative complexity. It can be particularly helpful in situations such as estate planning, managing assets for minors, or facilitating real estate transactions. However, it's essential to consult with legal and financial professionals to determine if a bare trust is the best option for your specific needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.