A Real Estate Limited Partnership (RELP) is a collaboration involving one or more general and limited partners aiming to invest in real estate to yield profits. General partners manage the day-to-day operations, make strategic decisions, and bear unlimited liability, while limited partners, contributing capital, have limited liability and typically minimal management involvement. Profit sources include rental income, property appreciation, and eventual property sales. The RELP structure caters to different types of properties, such as commercial buildings, apartment complexes, and undeveloped land. Engaging in a RELP offers an opportunity for investors to participate in real estate ventures without the need for direct property management, thereby providing a potentially lucrative and less hands-on investment strategy. However, it's crucial to understand the risks involved and the importance of the partners' roles and responsibilities within the partnership. Forming a RELP involves drafting a Limited Partnership Agreement specifying the partners' roles, responsibilities, and profit-sharing structure. This agreement is typically complex and requires the expertise of a lawyer experienced in real estate law and partnerships. The partnership must also be registered with the state where it operates, fulfilling all local requirements and fees. The roles and responsibilities of the general and limited partners vary significantly. The general partners control the partnership's operations and carry the liability for the partnership. They are responsible for acquiring properties, managing tenants, conducting repairs and improvements, and ultimately selling the properties. Limited partners are primarily investors who contribute capital but have limited involvement in management. Their responsibilities may involve approving significant decisions depending on the terms of the Limited Partnership Agreement. Real Estate Limited Partnerships (RELPs) can include many real estate assets in their investment portfolio. Here, we elaborate on the various types of properties that RELPs might consider. Residential properties are the most recognizable form of real estate investment. This category includes single, multi-family homes, townhouses, condos, and apartment buildings. These properties generate income through rent paid by tenants. Investing in residential properties involves many considerations, including location, the potential for rent growth, and the cost of maintenance and management. Additionally, residential properties are often subject to local laws and regulations, including landlord-tenant laws that protect tenants' rights and can influence the landlord's responsibilities and potential profitability. Commercial buildings refer to properties used for business purposes. These include office buildings, warehouses, and industrial properties. Commercial properties generally yield higher rents than residential properties and often involve longer lease agreements, which can provide a steady and reliable income stream. However, commercial properties may be more sensitive to economic conditions than residential properties. For example, businesses may downsize or close during an economic downturn, leading to vacancies. Retail spaces include properties like shopping centers, malls, and standalone retail stores. The income from retail spaces comes from rent paid by businesses that occupy the space. The profitability of retail spaces depends largely on consumer spending habits, making it subject to economic fluctuations. Additionally, the rise of e-commerce poses a unique challenge for retail space investments, with many consumers shifting their shopping habits online. Investing in raw land involves buying a piece of undeveloped land to sell at a future profit or developing it for rent or sale. The potential for profits can be substantial, especially if the land is in or near an area that experiences significant growth. However, investing in raw land also comes with risks. It generates income once it is developed or sold, and there are often costs associated with holding onto the land, such as property taxes. Additionally, the value of raw land can be influenced by various factors, including zoning laws, environmental regulations, and market demand. RELP and REITs are both popular investment vehicles in the real estate industry, but they differ in several key aspects. RELPs are typically formed by a general partner who manages the partnership and limited partners who provide the capital. In contrast, REITs are publicly traded companies that pool investors' funds to invest in various real estate properties. RELPs offer more flexibility in terms of investment strategies, allowing partners to have direct involvement and control over property management decisions. On the other hand, REITs provide liquidity and diversification through their publicly traded nature, allowing investors to buy and sell shares on stock exchanges. Additionally, tax implications differ between the two, as RELPs offer potential tax benefits but also pass through any income or losses to partners, while REITs are subject to specific tax regulations. Overall, while RELPs provide more hands-on involvement and potential tax advantages, REITs offer liquidity, diversification, and ease of trading on public markets. RELPs provide several advantages, including potential high returns, diversification, and tax benefits. Potential for High Returns: RELPs often invest in commercial and residential real estate, which can generate substantial income and appreciate in value over time. Diversification: RELPs can provide diversification within an investment portfolio, reducing exposure to risks associated with other asset classes. Tax Benefits: The structure of RELPs often provides significant tax benefits, as profits are passed directly to partners and can be offset by deductions such as depreciation. Illiquidity: RELPs are usually not traded on a public exchange, making it difficult for investors to sell their stake in the partnership. This lack of liquidity can disadvantage those needing to access their investment quickly. Risk: As with all real estate investments, RELPs carry a certain degree of risk. This includes potential property devaluation and losses due to economic downturns or poor management. Limited Control: Limited partners in a RELP have little to no say in the management of the properties, which can be a disadvantage for those wanting more control over their investments. The capital for a RELP is typically sourced from the limited partners' contributions. Each partner contributes a specified amount to the partnership in exchange for an ownership stake. The general partners may also contribute capital, but their primary role is managing the partnership and its real estate assets. Managing financial risk in a RELP involves diversifying the portfolio, conducting comprehensive property and market analyses, and establishing contingency plans. The general partner is typically responsible for these risk management strategies. In a RELP, profits are usually distributed according to the agreement outlined in the Limited Partnership Agreement. Typically, profits are allocated proportionately to each partner's capital contribution after any preferred returns or management fees have been deducted. RELPs are subject to both state and federal laws. The Limited Partnership Agreement must comply with the laws of the state where the partnership is formed. The Securities and Exchange Commission (SEC) may regulate RELPs as securities at the federal level, and the IRS governs their taxation. Changes in regulations can have substantial impacts on RELPs. For instance, alterations to tax laws can affect the partnership's tax liability and attractiveness to investors. Regulatory changes can also impact the types of properties that the RELP can invest in and how it must report its financial results. Investment in RELPs carries several risk factors, including real estate market volatility, management performance, and financial risk. To mitigate these risks, general partners must adopt effective strategies such as diversification of properties, thorough due diligence, and maintaining a conservative capital structure. The returns from RELPs depend on various factors, including property value appreciation, rental income, and the effectiveness of property management. Factors that can influence these returns include economic conditions, interest rates, and local real estate market trends. Real Estate Limited Partnerships are a unique investment vehicle that allows investors to participate in real estate investments, offering potentially high returns and significant tax benefits. Compared to other investment vehicles like REITs or direct real estate ownership, RELPs offer a unique combination of potentially high returns, significant tax benefits, and portfolio diversification. However, they also come with challenges like illiquidity and a higher risk profile. Potential investors should carefully consider their risk tolerance, investment goals, and need for liquidity before investing in a RELP. It's also crucial to conduct thorough due diligence on the partnership's management team and investment strategy. Investing in a RELP is a significant decision that can substantially impact your financial future. Therefore, it's wise to engage with a knowledgeable wealth manager or investment advisor who can guide you through the complexities of this investment vehicle.What Is a Real Estate Limited Partnership (RELP)?

Formation of RELP

Legal Requirements and Documentation

Roles and Responsibilities of Partners

RELP Investment Structures

Types of Real Estate Investments

Residential Properties

Commercial Buildings

Retail Spaces

Raw Land

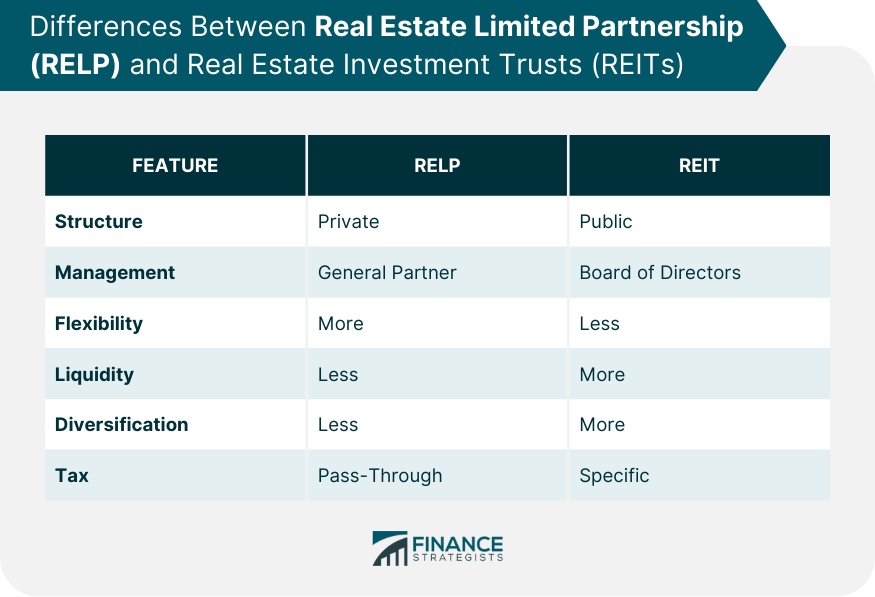

Differences Between RELP and Real Estate Investment Trusts (REITs)

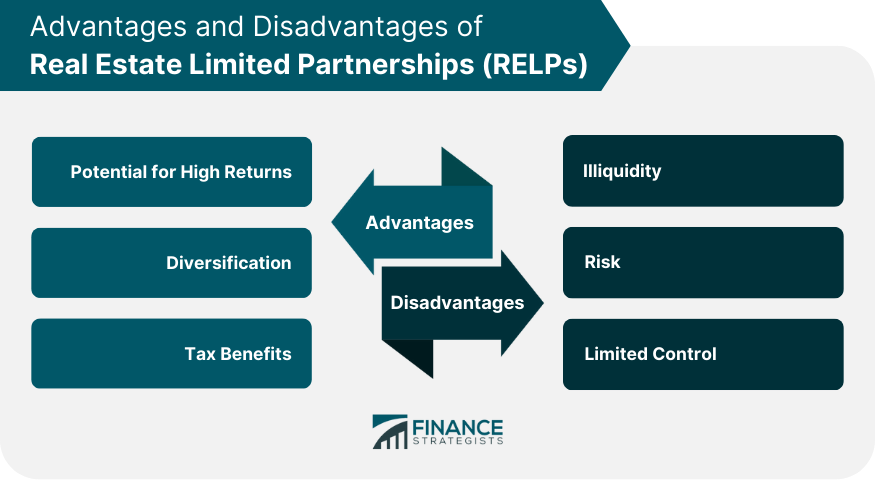

Advantages and Disadvantages of RELP

Advantages

Disadvantages

Financial Aspects of a RELP

Funding and Capital Structure

Financial Risk Management

Profit Sharing and Distribution

Legal and Regulatory Environment of RELP

Regulations at State and Federal Levels

Impact of Regulatory Changes

Risk and Return Profile of RELP

Risk Factors and Mitigation

Return Expectations and Factors Influencing Returns

Final Thoughts

Real Estate Limited Partnership (RELP) FAQs

A RELP is a partnership where one or more general partners manage the operations and bear the liability. One or more limited partners contribute capital and share in the profits but have limited liability and management input.

Investing in a RELP can provide potentially high returns, significant tax benefits, and diversification. However, RELPs are also associated with certain risks, including illiquidity and potential losses due to economic downturns or poor management.

A RELP is a private investment structure with limited partners, while a REIT is a publicly traded entity that owns income-generating real estate. RELPs offer potentially high returns and tax benefits but are generally illiquid and highly risky. In contrast, REITs are liquid and transparent and must distribute at least 90% of their taxable income to shareholders annually.

RELPs are typically structured as pass-through entities, meaning that the income generated by the partnership is passed directly to the partners, who then report this income on their individual tax returns. This structure can provide significant tax benefits but also lead to tax liabilities.

Potential investors should consider their risk tolerance, investment goals, and liquidity needs. They should also conduct thorough due diligence on the partnership's management team and investment strategy. It is highly recommended to consult with a financial advisor or wealth manager before making an investment decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.