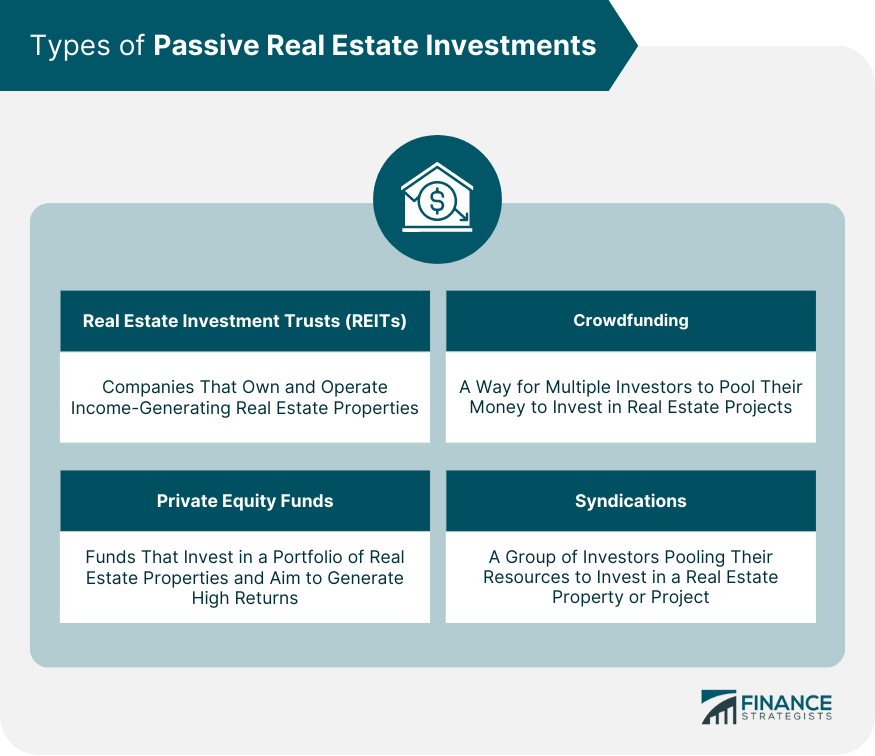

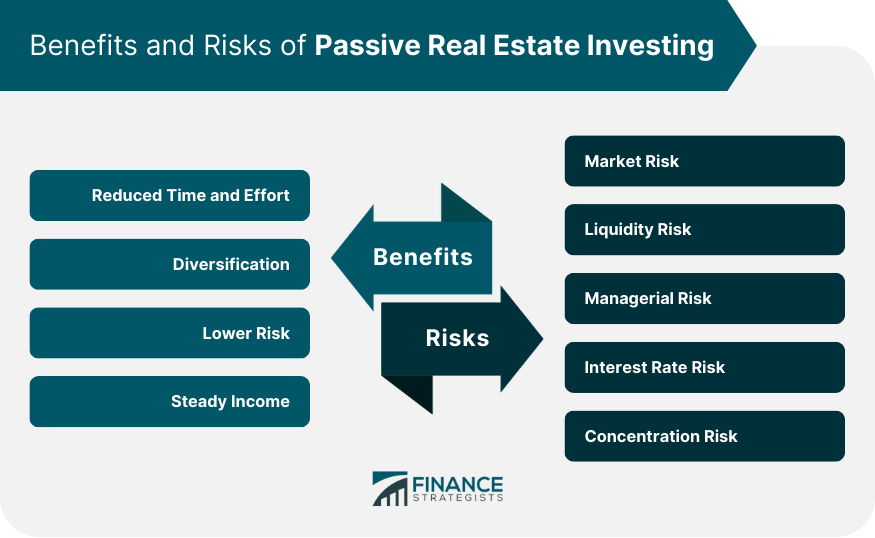

Passive real estate investing involves investing in real estate projects without active involvement in the day-to-day operations. This is in contrast to active real estate investing, where investors take on a more hands-on role in the acquisition, management, and operation of real estate properties. Passive real estate investing can be a valuable way to diversify a portfolio and generate steady income without the need for active involvement in property management. This can be particularly beneficial for investors who do not have the time, resources, or expertise to undertake active real estate investing. Real Estate Investment Trusts (REITs) are investment vehicles that allow investors to invest in a portfolio of real estate properties through a publicly traded company. REITs offer the benefit of regular dividend payments and provide a level of diversification not available through direct real estate investments. Private equity funds are investment vehicles that allow investors to pool their capital to invest in real estate projects. These funds are typically managed by professional real estate operators, who handle the day-to-day operations of the projects. Real estate crowdfunding platforms allow investors to invest in specific real estate projects alongside other investors. These platforms provide access to a range of real estate projects, with lower minimum investment requirements than traditional real estate investments. Real estate syndications involve a group of investors pooling their capital to invest in a specific real estate project. The syndicate is typically managed by a lead investor, who oversees the day-to-day operations of the project. One of the main benefits of passive real estate investing is the reduced time and effort required compared to active real estate investing. Passive investors can benefit from the expertise of professional real estate managers and operators, without the need to handle day-to-day operations. Passive real estate investing can offer a level of diversification not available through other types of investments. By investing in a range of real estate projects across different geographies and property types, investors can reduce their exposure to risk and benefit from the stability of the real estate market. Passive real estate investments often carry lower risk compared to active investments. This is because passive investors typically invest in professionally managed real estate projects, which are subject to stringent regulations and oversight. Passive real estate investing can provide a steady source of income through rental yields or dividend payments, which can help to diversify an investment portfolio and provide a reliable source of passive income. One of the primary risks associated with passive real estate investing is market risk. Changes in the real estate market can affect the value of properties, as well as the income generated from rental properties. Factors such as shifts in population, changes in consumer preferences, and economic conditions can all impact the real estate market. For example, a sudden increase in interest rates could cause housing prices to decline, which could negatively impact the value of real estate investments. Another risk associated with passive real estate investing is liquidity risk. Many passive real estate investments, such as private equity funds and syndications, may have limited liquidity. This means that it could be difficult to sell these investments if an investor needs to liquidate their assets quickly. Investors may need to wait until a specific time, such as the end of a fund's term, before they can receive their capital back. Passive real estate investments also carry the risk of managerial risk. Investors are relying on the expertise of real estate managers and operators to make sound investment decisions and manage properties effectively. However, there is always the risk that managers may make poor investment decisions or mismanage properties, which could negatively impact the value of the investment. Investors should carefully evaluate the track record of investment sponsors and real estate managers before investing in a passive real estate vehicle. Interest rate risk is another risk associated with passive real estate investing. Changes in interest rates can impact the value of real estate investments, as well as the income generated from rental properties. For example, if interest rates rise, it could cause a decline in property values and rental income. This could negatively impact the returns generated from passive real estate investments. Finally, passive real estate investors should be aware of concentration risk. Concentration risk refers to the risk of investing too heavily in one asset class or property type. For example, investing solely in a single-family rental property could expose an investor to the risks associated with that specific property, such as changes in the local real estate market or tenant turnover. To mitigate concentration risk, investors should consider diversifying their real estate investments across different property types and geographics. Investors should consider their investment goals before investing passively in real estate. This may include factors such as the desired level of return, investment horizon, and risk tolerance. Investors should consider their investment timeline before investing in real estate. This may include factors such as the length of time they are willing to hold the investment and the timing of expected returns. Investors should consider their risk tolerance before investing in real estate. Different types of passive real estate investments carry different levels of risk, and investors should carefully evaluate their risk tolerance before committing capital. Investors should evaluate their knowledge and experience in real estate investing before investing passively. While passive real estate investments can offer lower barriers to entry compared to active investments, investors should still be comfortable with the risks and potential returns associated with the investment. Investors should carefully evaluate the fees and expenses associated with passive real estate investments. Different types of investments may carry different fee structures, and investors should carefully consider these costs before committing capital. Investors should conduct thorough research before investing in any passive real estate vehicle. This may include evaluating the track record of the investment sponsor, the financial performance of the underlying real estate assets, and the potential risks and rewards associated with the investment. Investors should carefully evaluate their options when it comes to passive real estate investments. This may include considering factors such as the type of investment vehicle, the level of diversification offered, and the potential risks and rewards associated with each investment. Passive real estate investors should work with experienced professionals, including investment advisors, attorneys, and real estate managers. These professionals can provide valuable guidance and help investors to avoid potential pitfalls associated with passive real estate investments. Passive real estate investors should regularly monitor their investments to ensure that they are meeting their investment goals and performing as expected. This may include reviewing financial statements, attending investor meetings, and staying up-to-date on market trends. Passive real estate investors should be prepared to reassess and adjust their investment strategy as needed. This may include adjusting their investment goals, changing their investment vehicles, or reallocating capital to different types of investments. Passive real estate investing can offer a range of benefits, including reduced time and effort, diversification, lower risk, and steady income. Different types of passive real estate investments are available, including REITs, private equity funds, crowdfunding, and syndications. Investors should carefully consider their investment goals, timeline, risk tolerance, knowledge and experience, and fees and expenses before committing capital to a passive real estate investment. By working with experienced professionals, conducting thorough research, and regularly monitoring their investments, investors can increase their chances of success and meet their investment objectives.What Is Passive Real Estate Investing?

Types of Passive Real Estate Investments

Real Estate Investment Trusts (REITs)

Private Equity Funds

Crowdfunding

Syndications

Benefits of Passive Real Estate Investing

Reduced Time and Effort

Diversification

Lower Risk

Steady Income

Risks of Passive Real Estate Investing

Market Risk

Liquidity Risk

Managerial Risk

Interest Rate Risk

Concentration Risk

Factors to Consider before Investing Passively in Real Estate

Investment Goals

Investment Timeline

Risk Tolerance

Knowledge and Experience

Fees and Expenses

Strategies for Successful Passive Real Estate Investing

Conduct Thorough Research

Choose the Right Investment Vehicle

Work With Experienced Professionals

Monitor Your Investments

Reassess and Adjust Your Strategy as Needed

Conclusion

Passive Real Estate Investing FAQs

Passive real estate investing involves investing in real estate opportunities without actively managing the property.

Passive real estate investing offers reduced time and effort, diversification, lower risk, and steady income.

Passive real estate investing typically involves investing in a real estate investment trust (REIT), a real estate syndication, or a crowdfunding platform. The investor's money is pooled with others, and a professional investment manager oversees the real estate investment on behalf of the investors.

As with any investment, there are risks associated with passive real estate investing. These risks include market risk, liquidity risk, managerial risk, interest rate risk, and concentration risk.

Some strategies include conducting thorough research, choosing the right investment vehicle, working with experienced professionals, monitoring your investments, and reassessing and adjusting your strategy as needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.