Trust Preferred Securities (TruPS) are hybrid financial instruments possessing qualities of both debt and equity securities. Created by banks and other financial institutions, these securities pay regular dividends and possess long-term maturity periods like preferred stocks, while their dividends are tax-deductible like debt securities, and can be redeemed before maturity. These securities are callable, giving the issuer the right to redeem them before maturity. Furthermore, they are counted as Tier 1 capital for banks, enhancing their capital ratios. TruPS are structured as debt securities issued by a special purpose entity (SPE) or trust, which holds the underlying assets. These assets typically consist of debt securities, such as subordinated bonds or debentures, issued by the parent company or its subsidiaries. The income generated from these assets is used to pay interest or dividends to the TruPS holders. TruPS emerged in the mid-1990s as a means for banks and corporations to raise Tier 1 capital without diluting their common equity. This innovative financing tool offered an attractive combination of high yields for investors and tax benefits for issuers. The popularity of TruPS continued to grow in the early 2000s as financial institutions, particularly smaller banks, found them to be an attractive financing option. However, the tax landscape for TruPS changed in 2003 when the Jobs and Growth Tax Relief Reconciliation Act was passed. The Act eliminated the tax advantages associated with TruPS, leading to a decline in their appeal. The 2008 financial crisis also had a profound impact on TruPS. Many financial institutions faced severe financial difficulties, and TruPS holders experienced significant losses. To stabilize the financial system, the Troubled Asset Relief Program (TARP) was introduced. As part of TARP, participating banks were required to convert TruPS into common equity to enhance their capital adequacy and restore market confidence. In subsequent years, regulatory changes further diminished the issuance of TruPS. The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 restricted the ability of banks to include TruPS in Tier 1 capital, reducing their appeal as a capital-raising instrument. As a result of these factors, the issuance of TruPS significantly declined, and their role as a financing tool for financial institutions diminished over time. TruPS are issued through a two-step process. First, the financial institution creates a trust and sells its debt securities to it. Then, the trust issues preferred securities, backed by the debt securities, to investors. This unique structure provides a hybrid security with aspects of both debt and equity. While similar in many ways to traditional preferred stocks, TruPS offer unique advantages. Like preferred stocks, they pay a fixed dividend and rank above common equity in terms of claims on the issuer's assets. However, unlike traditional preferred stocks, dividends on TruPS are tax-deductible for the issuer, which can lower the issuer's overall cost of capital. To issue TruPS, a corporation or bank first creates a trust, then sells subordinated debt to this trust. The trust then issues preferred securities to investors. These securities are collateralized by the underlying debt securities, which pay interest to the trust, funding the dividends on the TruPS. TruPS have long-term maturities, often up to 30 years, and pay fixed dividends, usually quarterly. They are callable, meaning the issuer can redeem them before maturity, and dividends are tax-deductible for the issuer. Additionally, they are considered Tier 1 capital for banks, which enhances their capital ratios. The trust acts as an intermediary between the issuer and investors. It holds the issuer's subordinated debt securities, which back the TruPS. The trust ensures that interest payments from these debt securities are used to fund dividends for TruPS holders. For banking institutions, TruPS have been a popular method to raise Tier 1 capital without diluting common equity. Tier 1 capital is the core capital of a bank, including common stock and retained earnings. Including TruPS in Tier 1 capital helps improve a bank's capital adequacy ratio, which is crucial for regulatory compliance and financial stability. The Basel III regulations, implemented after the 2008 financial crisis, changed the landscape for TruPS. The new rules exclude TruPS from counting as Tier 1 capital for larger banking institutions. This has led to a decline in the issuance of TruPS by large banks, but they continue to be used by smaller banks that are not subject to these rules. Investing in TruPS can offer several advantages. They often provide higher yields compared to common stocks and bonds from the same issuer. Additionally, they pay regular, fixed dividends, offering a predictable income stream for investors. Lastly, in the event of the issuer's liquidation, TruPS rank above common equity in terms of claims on the issuer's assets. However, investing in TruPS also entails risks. While they rank above common equity, they are subordinate to all other debt of the issuer. If the issuer defaults or goes bankrupt, holders of TruPS may not receive their full investment back. Also, the issuer has the right to defer dividend payments for up to five years, which can create uncertainty for income-focused investors. TruPS are regulated by banking authorities and securities commissions. They must comply with disclosure requirements and other rules. The change brought by Basel III has also had a significant impact on the regulation of TruPS. Before investing in TruPS, investors should carefully review the terms of the issuance. These can include provisions for deferring dividend payments, calling the securities, and converting the securities into another form of capital. Investors should also understand the risks and consult with a financial advisor if needed. In recent years, the market for TruPS has undergone significant changes. The Basel III regulations have reduced their appeal for larger banks, leading to a decline in issuance. However, smaller banks and other corporations continue to issue TruPS. The market for existing TruPS remains active, with investors attracted by their higher yields. Looking ahead, the market for TruPS will likely continue to evolve. The regulatory landscape, economic conditions, and investor appetite for risk and yield will shape the future of this unique security. Research and careful monitoring of market trends will be essential for both issuers and investors in TruPS. Trust Preferred Securities (TruPS) are distinctive financial instruments exhibiting characteristics of both equity and debt. They are typically issued by financial institutions and function as a mechanism to raise capital without diluting common equity. The mechanics of TruPS involve the establishment of a trust by the issuing entity, which then offers subordinated debt to the trust. The trust subsequently issues preferred securities to investors, creating a unique, hybrid security. Key features of TruPS include long-term maturities, regular dividend payments, tax-deductibility of dividends for issuers, and their inclusion as Tier 1 capital for banks. While TruPS have had a notable historical background and served a specific purpose for banks in the past, the changing regulatory environment and market conditions have reduced their prominence. Nonetheless, they remain an interesting part of financial history, highlighting the creativity and adaptability of financial institutions in raising capital during challenging times.What Are Trust Preferred Securities (TruPS)?

Historical Background

Structure of Trust Preferred Securities (TruPS)

Understanding the Components of Trust Preferred Securities (TruPS)

Trust Preferred Securities (TruPS) vs Traditional Preferred Stocks

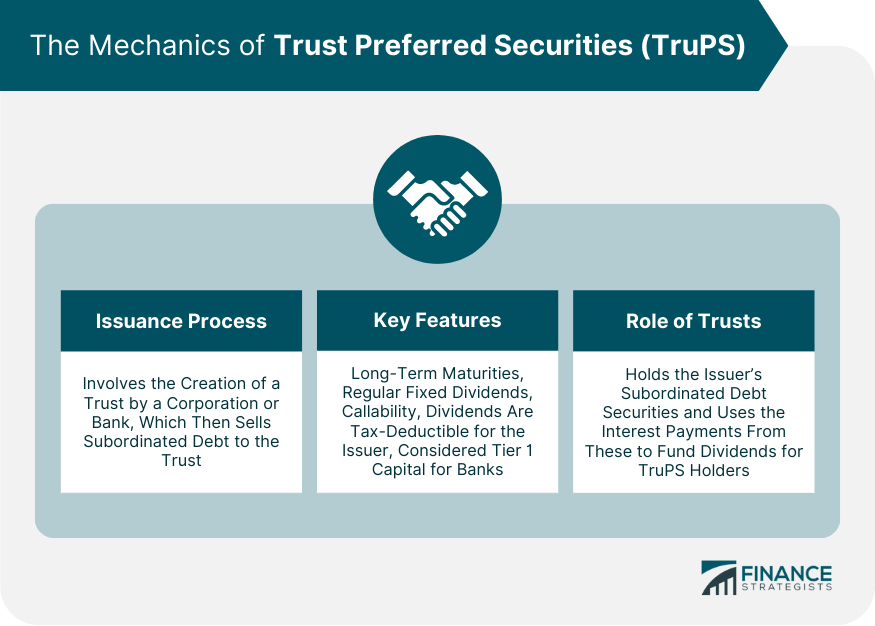

Mechanics of Trust Preferred Securities (TruPS)

Issuance of Trust Preferred Securities (TruPS)

Key Features of Trust Preferred Securities (TruPS)

Role of Trusts in Trust Preferred Securities (TruPS)

Trust Preferred Securities (TruPS) and Banking Institutions

The Role of Trust Preferred Securities (TruPS) in Banking Capital

Impact of Basel III Regulations on Trust Preferred Securities (TruPS)

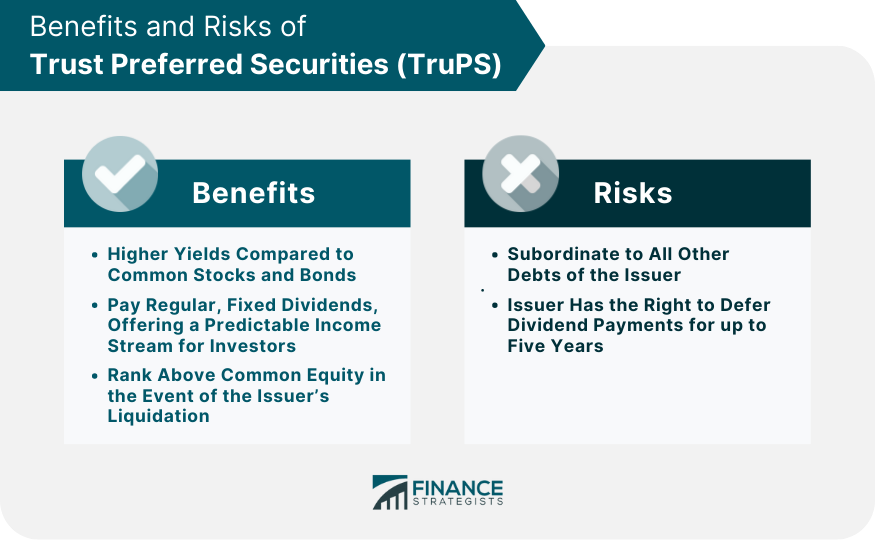

Trust Preferred Securities (TruPS) in the Investment Landscape

Benefits of Investing in Trust Preferred Securities (TruPS)

Risks Associated With Trust Preferred Securities (TruPS)

Legal Aspects of Trust Preferred Securities (TruPS)

Regulatory Oversight of Trust Preferred Securities (TruPS)

Legal Considerations for Investors in Trust Preferred Securities (TruPS)

Current Trends and Future Developments

Recent Market Trends for Trust Preferred Securities (TruPS)

Future Predictions for the Trust Preferred Securities (TruPS) Market

Conclusion

Trust Preferred Securities (TruPS) FAQs

Trust Preferred Securities (TruPS) are hybrid financial instruments that possess characteristics of both debt and equity securities. Issued by banks and other financial institutions, TruPS pay regular dividends and have long-term maturities.

The issuance of TruPS involves a two-step process. Initially, a financial institution creates a trust and sells its debt securities to it. Then, the trust issues preferred securities, backed by these debt securities, to investors.

Key features of TruPS include their long-term maturities, often up to 30 years, and regular, fixed dividends. They are also callable, meaning the issuer can redeem them before maturity. Additionally, they're considered Tier 1 capital for banks.

Although TruPS offer higher yields, they carry risks. They are subordinate to all other debt of the issuer, and if the issuer defaults, TruPS holders may not receive their full investment back. Additionally, the issuer can defer dividend payments for up to five years.

The Basel III regulations have significantly impacted TruPS. They exclude TruPS from counting as Tier 1 capital for larger banks, leading to a decrease in TruPS issuance by such institutions. However, smaller banks not subject to these rules continue to issue TruPS.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.