A trading book is a record of all trading activity conducted by a bank or financial institution. It comprises a variety of financial instruments like stocks, bonds, derivatives, foreign exchange, and commodities, which are actively bought and sold in the financial markets. The primary purpose of a trading book is to facilitate the buying and selling of securities to make profits from short-term price fluctuations. The trading book helps banks and financial institutions manage their market risk and report their trading activities accurately. Through the trading book, banks and financial institutions can assess their exposure to financial risks, such as market, credit, and liquidity risks, at any given point in time. It also aids financial regulators in evaluating the risk-taking activities of banks and financial institutions. This helps in maintaining the overall health and stability of the financial system. Equities, or stocks, are a common class of assets in a trading book. These are shares of ownership in a company and represent a claim on the part of the company's assets and earnings. Equities can provide substantial returns in the form of capital gains and dividends, but they also come with higher risks compared to other asset classes. Trading strategies for equities can range from short-term day trading to long-term value investing. Fixed-income securities, such as bonds and treasury bills, are another type of asset commonly found in a trading book. These are essentially loans made by an investor to a borrower, usually a corporate or governmental entity. Fixed-income securities provide a steady stream of income in the form of interest payments and offer a lower risk compared to equities. Traders use a variety of strategies for fixed-income securities, such as interest rate trading and credit spread trading. Derivatives are financial contracts whose value is derived from an underlying asset. The most common types of derivatives in a trading book are futures, options, and swaps. Derivatives can be used for a variety of purposes, such as hedging risk, speculation, and gaining access to otherwise hard-to-trade assets or markets. Given their complexity, trading derivatives requires a high level of expertise and understanding of the underlying asset and market conditions. Foreign exchange, or forex, refers to the trading of currencies. With a massive daily trading volume, the forex market is the largest and most liquid financial market in the world. Forex trading can provide diversification benefits to a trading book. However, it also comes with significant risks due to factors such as exchange rate volatility and geopolitical uncertainties. Commodities include physical assets like oil, gold, natural gas, agricultural products, and more. Commodity trading can be done through spot markets, futures contracts, options, and swaps. Commodities add diversity to a trading book and can offer opportunities for significant profits due to their price volatility. However, they can also pose considerable risks, largely stemming from unpredictable factors such as weather patterns, geopolitical events, and supply-demand imbalances. Mark-to-market (MTM) is a method of accounting that values securities at their current market prices. The MTM approach ensures that a trading book reflects the true value of its assets and liabilities at a given point in time. MTM accounting allows banks and financial institutions to have a real-time view of their risk exposure, aiding in better risk management. However, it can also introduce volatility into financial statements, as asset values can fluctuate with market conditions. The fair value hierarchy is a framework used in financial accounting to determine the reliability of the inputs used in the valuation of assets and liabilities. It categorizes valuation inputs into three levels, with Level 1 being the most reliable and Level 3 being the least reliable. Understanding the fair value hierarchy is crucial in the valuation of assets and liabilities in a trading book, as it impacts the accuracy and reliability of valuations. Level 1 inputs refer to quoted prices for identical assets or liabilities in active markets. These are the most reliable inputs for valuation and require the least amount of judgment and estimation. For instance, the valuation of listed equities or exchange-traded derivatives in a trading book typically relies on Level 1 inputs. Level 2 inputs include quoted prices for similar assets or liabilities in active markets or identical or similar assets or liabilities in markets that are not active. They also encompass inputs other than quoted prices that are observable for the asset or liability, such as interest rates and yield curves. Fixed-income securities and over-the-counter (OTC) derivatives in a trading book are often valued using Level 2 inputs. Level 3 inputs are unobservable inputs for the asset or liability. These are typically used when observable inputs are not available, requiring the use of complex mathematical models and significant judgment. The valuation of complex derivatives or illiquid securities in a trading book often relies on Level 3 inputs. Market risk refers to the risk of losses in a trading book due to movements in market prices. These price movements can be caused by various factors such as changes in interest rates, exchange rates, equity prices, and commodity prices. Effective management of market risk involves identifying, measuring, and monitoring market risk factors and implementing appropriate risk mitigation strategies. Credit risk is the risk of loss arising from a borrower or counterparty's failure to meet their contractual obligations. Credit risk can arise from various sources, such as the default of an issuer of a security or the counterparty in a derivative contract. Managing credit risk requires rigorous counterparty credit assessment, setting of credit limits, and close monitoring of credit exposures. Liquidity risk refers to the risk that a bank or financial institution may not be able to meet its financial obligations without affecting market prices or its regular operations. This can be due to an inability to sell assets quickly at a reasonable price (market liquidity risk) or an inability to fund increases in assets or meet obligations as they come due (funding liquidity risk). Liquidity risk management involves maintaining sufficient liquid assets, diversifying funding sources, and implementing robust liquidity stress testing and contingency planning. Operational risk is the risk of loss resulting from inadequate or failed internal processes, people, systems, or external events. In a trading book context, operational risk can arise from trading errors, system failures, or fraud. Operational risk management involves implementing effective internal controls, robust information systems, and strong risk culture. RoRWA is a measure of a bank's profitability, taking into account the level of risk involved in generating profits. It is calculated as net income divided by risk-weighted assets. RoRWA provides a comprehensive view of a bank's performance, as it measures not just the amount of profit but also the level of risk taken to generate that profit. Trading revenue is the income generated from a bank's trading activities. It includes gains and losses from buying and selling financial instruments, as well as income from trading-related services, such as market making and proprietary trading. Monitoring trading revenue helps banks assess the performance of their trading activities and make strategic decisions about resource allocation. The cost of capital is the minimum return that a bank requires to make a capital investment, such as lending money or investing in securities. It serves as a benchmark for evaluating the profitability of investment opportunities. In the context of a trading book, the cost of capital can help assess the risk-return trade-off of trading activities. Risk-adjusted performance measures, such as the Sharpe ratio or the Sortino ratio, are used to evaluate the performance of trading activities by considering both returns and risk. These measures provide a more comprehensive view of performance than absolute returns, as they take into account the level of risk involved in generating returns. A trading book is a detailed record of all trading activity. It plays a crucial role in risk management, regulatory compliance, and strategic decision-making. A trading book can include a wide range of assets, from equities and fixed-income securities to derivatives, foreign exchange, and commodities. Each asset class carries its unique risk-return characteristics and requires specialized trading strategies. Accounting and valuation for a trading book involve marking assets to their current market prices and using a fair value hierarchy for valuation inputs. Managing risk in a trading book involves assessing and mitigating a variety of risks, including market, credit, liquidity, and operational risks. This requires robust risk management processes, systems, and culture.What Is a Trading Book?

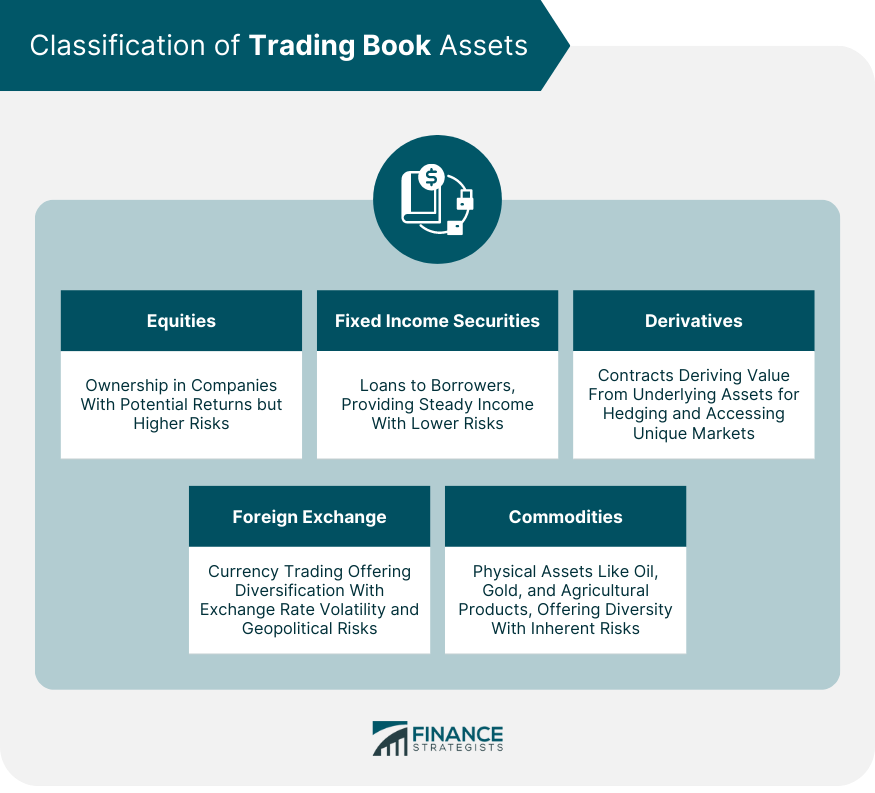

Classification of Trading Book Assets

Equities

Fixed Income Securities

Derivatives

Foreign Exchange

Commodities

Trading Book Accounting and Valuation

Mark-to-Market (MTM) Accounting

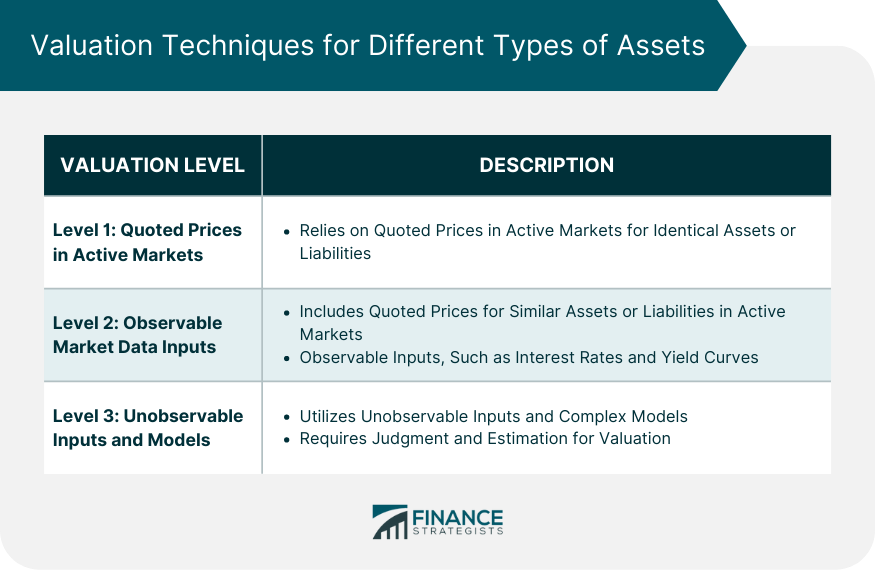

Fair Value Hierarchy

Valuation Techniques for Different Types of Assets

Level 1: Quoted Prices in Active Markets

Level 2: Observable Market Data Inputs

Level 3: Unobservable Inputs and Models

Risk Management for Trading Books

Market Risk

Credit Risk

Liquidity Risk

Operational Risk

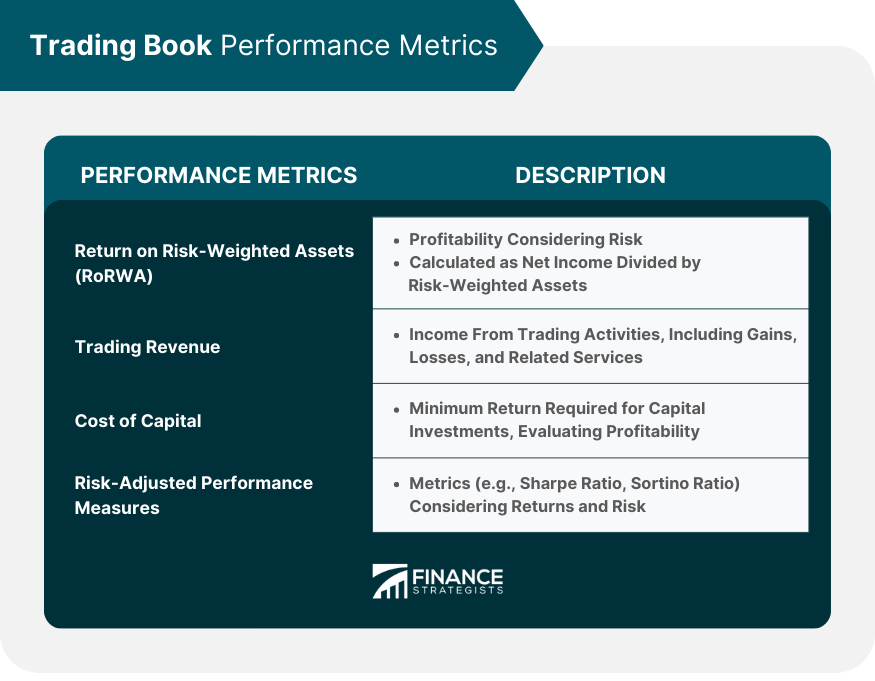

Trading Book Performance Metrics

Return on Risk-Weighted Assets (RoRWA)

Trading Revenue

Cost of Capital

Risk-Adjusted Performance Measures

Conclusion

Trading Book FAQs

A trading book is a record of all trading activities conducted by a bank or financial institution. It includes assets such as equities, fixed-income securities, derivatives, foreign exchange, and commodities.

A trading book can include a wide range of assets such as equities, fixed-income securities, derivatives, foreign exchange, and commodities. Each type of asset carries unique risk-return characteristics

Mark-to-market is an accounting method that values securities at their current market prices. It ensures the trading book reflects the true value of assets and liabilities at any given time.

A trading book can be exposed to various risks, including market risk, credit risk, liquidity risk, and operational risk. These risks need to be effectively managed to ensure the stability and profitability of trading activities.

Performance measures for a trading book can include return on risk-weighted assets (RoRWA), trading revenue, cost of capital, and risk-adjusted performance measures. These measures provide insights into the profitability, risk, and efficiency of trading activities.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.