Level 1 is a type of trading screen used in stock trading, which displays real-time quotes for the national best bid and offer (NBBO) in security. The NBBO is the highest price that buyers are willing to pay (the bid) and the lowest price sellers are willing to accept (the ask or offer) for a security at a given time. The Level 1 quote offers a snapshot of the market's current sentiment toward a particular security, providing an essential tool for investors to make informed decisions. To fully grasp the concept of Level 1, there is a need to contextualize it within the broader framework of trading levels. Beyond Level 1, there are two more tiers in the U.S. stock market—Level 2 and Level 3. The centerpiece of Level 1 quotes is the NBBO. This provides real-time data on the highest price a buyer is willing to pay for a stock (the bid) and the lowest price a seller is willing to accept (the ask or offer). By keeping an eye on the NBBO, investors can quickly assess the market's sentiment toward a particular security. In addition to the NBBO, Level 1 quotes also display volume quotes. This represents the number of shares being traded at the best bid and offer prices. Volume quotes give investors a sense of the liquidity of security—the more shares being traded, the easier it will be to buy or sell that security without impacting its price. Level 1 quotes are updated in real-time, providing investors with up-to-the-minute information on a security's market status. This allows investors to make decisions based on the latest data rather than relying on delayed or historical information. While Level 1 provides basic market data, Level 2 offers a more in-depth view. Level 2 quotes display the full range of bids and ask prices from all market participants, not just the best ones. This enables traders to see the depth of the market for a particular security, providing insights into potential price movements. However, Level 2 data is typically not free and requires a subscription. Level 3 access is usually reserved for market makers and allows them to enter or alter quotes, execute orders, and confirm trades. Level 3 data provides the most comprehensive view of market activity, but it is not necessary for average investors who are not involved in market making. While Level 1 quotes suffice for long-term investors, active traders may require the more detailed information provided by Level 2 and Level 3 quotes. Active traders often attempt to capitalize on small price movements, so understanding the full range of bid and ask prices can be critical. Investors can use Level 1 data to track a security's price over time. By monitoring changes in the best bid and ask prices, investors can gain insights into the security's performance and the overall market sentiment. Level 1 data can also be used to identify consolidation periods in the market when the best bid and ask prices stay relatively stable. Consolidation often precedes significant price movements, so spotting these periods can provide valuable trading opportunities. Ultimately, the purpose of Level 1 quotes is to provide investors with the data they need to make informed decisions. By understanding the best bid and ask prices and the volume of shares being traded, investors can gauge the market sentiment and decide when to buy or sell. For long-term investors, Level 1 quotes often provide all the necessary information. These investors are less concerned with minute-by-minute price changes and more focused on the overall direction of a stock's price. They can use Level 1 quotes to keep tabs on their investments and make decisions about when to buy or sell. With the rise of the internet and online trading platforms, Level 1 quotes are now widely available. Investors can access real-time quotes from the comfort of their homes, making it easier than ever to stay informed about the market. Many trading platforms also offer tools for analyzing Level 1 data, helping investors to interpret the information and make informed decisions. Perhaps one of the most significant benefits of Level 1 quotes is that they are often available for free. Many brokers and online trading platforms offer free access to Level 1 data, removing financial barriers and enabling a broader range of individuals to participate in the stock market. While Level 1 provides essential data, it lacks the depth of information available in Level 2 and Level 3 quotes. For example, Level 1 does not show the full range of bid and ask prices or the identities of market participants. Level 1 data might not provide enough detail for short-term traders and day traders who need to make quick decisions based on minute changes in market conditions. These traders often require Level 2 or Level 3 data to execute their trading strategies effectively. Level 1 quotes provide investors with basic market data, including the national best bid and offer (NBBO) prices and volume quotes. They offer real-time updates, enabling investors to make informed decisions based on up-to-the-minute information. While Level 1 quotes are free and widely accessible, they have limitations compared to higher levels such as Level 2 and Level 3. Level 2 provides more in-depth market information, displaying the full range of bids and asks, while Level 3 is typically reserved for market makers. Active traders may require higher-level quotes for detailed insights into bid and ask prices. For long-term investors, Level 1 quotes are suitable, allowing them to track stock performance over time and make informed investment decisions. The convenience of accessing Level 1 quotes through online platforms has made them more accessible than ever before. Overall, Level 1 quotes serve as a valuable tool for investors, providing essential market data for decision-making purposes.What Is Level 1?

Understanding the Information Provided by Level 1

Best Bid and Offer (BBO)

Volume Quotes

Real-Time Quotes

Comparing Level 1 to Other Levels

Level 1 vs Level 2

Level 1 vs Level 3

Need for Higher-Level Quotes for Active Traders

How to Use Level 1 Information for Trading

Assessing Stock Performance Over Time

Identifying Market Action Consolidation

Making Informed Investment Decisions

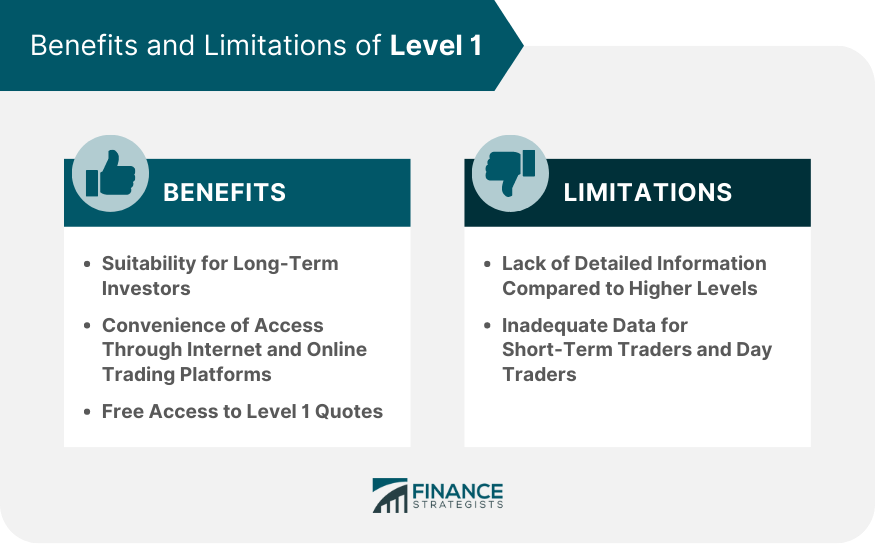

Benefits of Level 1

Suitability for Long-Term Investors

Convenience of Access Through Internet and Online Trading Platforms

Free Access to Level 1 Quotes

Limitations of Level 1

Lack of Detailed Information Compared to Higher Levels

Inadequate for Short-Term Traders and Day Traders

Final Thoughts

Level 1 FAQs

Level 1 is a type of trading screen that displays real-time quotes for the national best bid and offer (NBBO) in security.

Level 1 provides the best bid and offer prices and volume quotes. Level 2 offers a deeper view of the market with a range of bid and offer prices, while Level 3 allows market makers to enter and change quotes, execute orders, and send trade confirmations.

Level 1 quotes are generally suitable for long-term investors who want to track the overall direction of a stock's price.

While Level 1 provides essential data, it lacks the depth of information available in Level 2 and Level 3 quotes. It may not provide enough detail for short-term traders and day traders.

Yes, many brokers and online trading platforms offer free access to Level 1 quotes, making it accessible to a broad range of investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.