Market-linked Certificates of Deposit (CDs) are a type of certificate of deposit that offer the potential for higher returns by linking the performance of the investment to a market index. They provide investors with the stability of a traditional CD while also allowing for greater potential gains. CDs have long been popular among conservative investors seeking safety and predictable returns. However, with the emergence of Market-Linked CDs, investors can now access a wider range of investment opportunities while still benefiting from the security of a traditional CD. One of the most attractive features of Market-Linked CDs is their principal protection. This means that, at maturity, investors are guaranteed to receive at least their initial investment back, even if the underlying assets perform poorly. This feature particularly appeals to risk-averse investors looking for a relatively safe investment option. Market-Linked CDs offer higher returns than traditional CDs, as their interest is tied to the performance of specific underlying assets. If the underlying assets perform well, the interest earned can be significantly higher than that of a traditional CD. However, it is important to note that there is no guarantee of earning any interest, and returns can be lower than traditional CDs if the assets do not perform well. Investors have a wide range of choices when it comes to terms and maturities of Market-Linked CDs. They can select CDs with maturities as short as a few months or as long as several years. This flexibility allows investors to match their investment horizon to their individual needs and goals. Market-Linked CDs provide exposure to various asset classes, such as stocks, bonds, commodities, and currencies. Investing in CDs linked to different assets can diversify their portfolios and potentially reduce the overall risk. Market-Linked CDs derive their interest from the performance of various underlying assets, which can include: Stock Indices: These CDs are linked to the performance of a specific stock index, such as the S&P 500 or Dow Jones Industrial Average. Bonds: Some CDs are linked to the performance of bond indices or individual bonds. Commodities: CDs can also be linked to the performance of commodities, such as oil, gold, or agricultural products. Currencies: Currency-linked CDs are tied to the exchange rate movements of a specific currency or a basket of currencies. There are several methods used to calculate the interest earned on Market-Linked CDs: Point-to-Point: This method compares the value of the underlying asset at the beginning and end of the term. The interest earned is based on the percentage change between these two points. Average: The average method calculates the interest by comparing the average value of the underlying asset during the term to its initial value. High Watermark: This method uses the highest value of the underlying asset during the term as a reference point for calculating the interest earned. The participation rate is the percentage of the underlying asset's performance that is passed on to the investor as interest. For example, a 50% participation rate means that investors will receive 50% of the underlying asset's performance. A cap is the maximum interest rate that can be earned on a Market-Linked CD, regardless of the underlying asset's performance. As mentioned earlier, principal protection is one of the main advantages of Market-Linked CDs. Investors can rest assured that their initial investment is safe, even in the case of poor market performance. Market-Linked CDs provide investors access to various asset classes and market sectors. This allows investors to benefit from the growth and performance of various markets, which can lead to potentially higher returns compared to traditional CDs. Investing in CDs linked to different underlying assets can diversify their portfolios, spreading their risk across various market segments. This can help to reduce the overall volatility and risk of their investments. Market-Linked CDs can offer certain tax advantages for investors. The interest earned on these CDs is typically taxed as ordinary income, but in some cases, it may be deferred until the CD reaches maturity. This can be beneficial for investors looking to manage their tax liabilities. Like traditional CDs, Market-Linked CDs are typically insured by the Federal Deposit Insurance Corporation (FDIC) up to the applicable limits. This means that, in the event that the issuing bank fails, investors are protected up to the FDIC coverage limits. The potential returns on Market-Linked CDs are often capped, limiting the possible gains for investors. This cap can restrict the overall returns, even when the underlying assets perform exceptionally well. Market-Linked CDs are more complex than traditional CDs due to their link to various underlying assets and interest calculation methods. Investors need to understand these products and their associated risks before investing thoroughly. Market-Linked CDs often have longer terms and limited secondary markets, making them less liquid than traditional CDs. This means that investors may need help to sell their CDs before maturity or incur penalties for early withdrawals. If the underlying assets do not perform well, the interest earned on Market-Linked CDs can be lower than that of traditional CDs. In some cases, investors may receive no interest at all, even though their principal is protected. Investors must also consider the credit risk of the bank issuing the Market-Linked CD. If the bank encounters financial difficulties, it could affect the timely payment of interest and principal. Investors can purchase Market-Linked CDs directly from brokerage firms and banks that issue them. It is essential to compare offerings from different institutions to find the best fit for individual investment goals and risk tolerance. Market-Linked CDs can also be bought and sold in the secondary market through a broker-dealer network or online platforms. However, the secondary market may have limited liquidity, and investors may not always be able to sell their CDs at the desired price or time. The interest earned on Market-Linked CDs is typically taxed as ordinary income at the investor's marginal tax rate. However, the tax treatment may vary depending on the specific CD structure and the investor's tax situation. In some cases, Market-Linked CDs may be issued at a discount known as the Original Issue Discount. The OID is generally taxed as interest income, and investors may be required to report it annually, even if they have not received any interest payments. If an investor sells a Market-Linked CD in the secondary market before maturity and realizes a gain, the gain may be subject to capital gains tax. The tax rate depends on the investor's tax bracket and the holding period of the CD. Investors should consult with a tax advisor to develop an appropriate tax planning strategy when investing in Market-Linked CDs. This can help minimize tax liabilities and optimize investment returns. Market risk refers to the possibility that the underlying assets linked to the CD will perform poorly, resulting in lower returns or no interest at all. While the principal is protected, investors must consider this risk when evaluating potential returns. Credit risk is the risk that the issuing bank may encounter financial difficulties, which could affect its ability to pay interest and return the principal to investors. Investors should research the bank's financial stability and credit rating to minimize credit risk before investing. As mentioned earlier, Market-Linked CDs often have limited liquidity. This means that investors may need help selling their CDs before maturity or may incur penalties for early withdrawals. The opportunity cost refers to the potential returns investors may miss out on by investing in Market-Linked CDs instead of other investment options. If the underlying assets do not perform well, investors may have been better off investing in traditional CDs or other assets with higher returns. Investors are exposed to currency risk for Market-Linked CDs linked to foreign assets or currencies. This refers to the potential losses that may arise due to fluctuations in exchange rates. Investors should consider their exposure to currency risk when evaluating foreign-linked CDs. Market-Linked CDs allow investors to earn higher returns while potentially preserving their principal. However, these investments come with unique risks and complexities. Investors need to understand Market-Linked CDs thoroughly, align them with their personal financial goals and risk tolerance, and perform due diligence on the issuing bank before investing.What Are Market-Linked CDs?

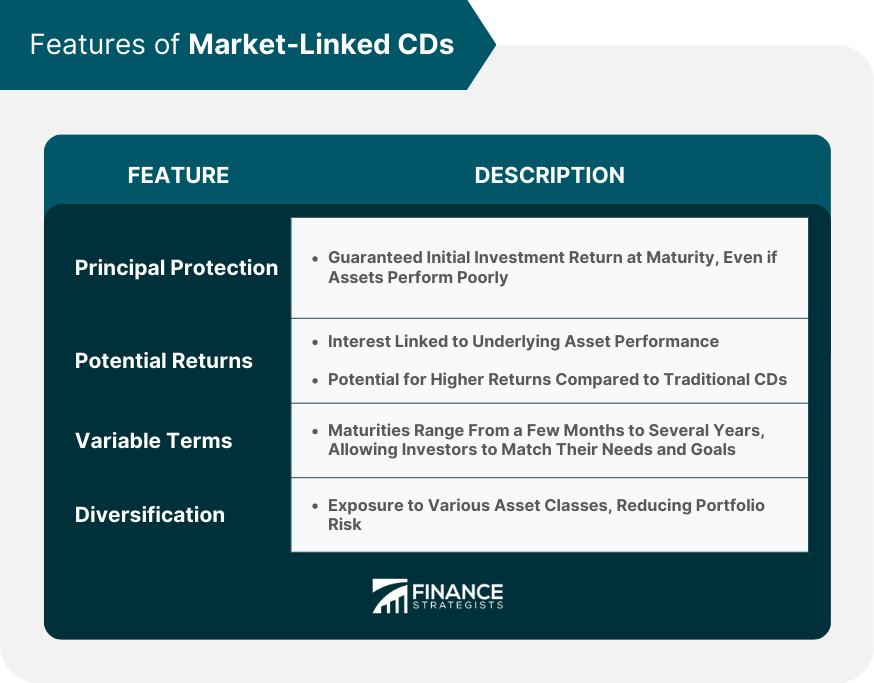

Features of Market-Linked CDs

Principal Protection

Potential for Higher Returns

Variable Terms and Maturities

Diversification Opportunities

How Market-Linked CDs Work

Types of Underlying Assets

Interest Calculation Methods

Participation Rate and Cap

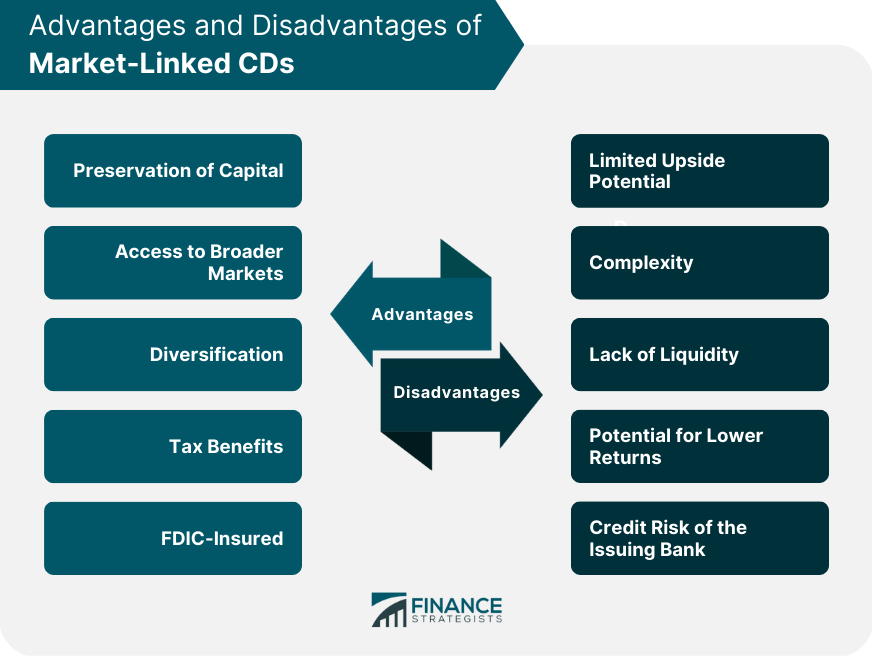

Advantages of Market-Linked CDs

Preservation of Capital

Access to Broader Markets

Diversification

Tax Benefits

FDIC-Insured

Disadvantages of Market-Linked CDs

Limited Upside Potential

Complexity

Lack of Liquidity

Potential for Lower Returns

Credit Risk of the Issuing Bank

How to Invest in Market-Linked CDs

Primary Market

Secondary Market

Tax Implications of Market-Linked CDs

Interest Income

Original Issue Discount (OID)

Capital Gains Tax

Tax Planning and Strategies

Key Risks Associated With Market-Linked CDs

Market Risk

Credit Risk

Liquidity Risk

Opportunity Cost

Currency Risk (for Foreign-Linked CDs)

Conclusion

Market-Linked CDs FAQs

Market-linked CDs are a type of certificate of deposit that allows investors to earn returns linked to the performance of an underlying market index, such as the S&P 500.

Market-linked CDs work by combining the stability of a traditional CD with the potential for higher returns based on the performance of an underlying market index. The return on investment is typically capped, and the principal is usually protected.

The benefits of investing in market-linked CDs include the potential for higher returns compared to traditional CDs, principal protection, and diversification of an investor's portfolio.

The risks associated with market-linked CDs include the possibility of earning no return, limited potential for return compared to direct investment in the underlying index, early withdrawal penalties, and the possibility of losing principal if the issuing bank fails.

Market-linked CDs may be suitable for investors willing to accept some risk in exchange for the potential for higher returns and with a moderate to long-term investment horizon. It may not be suitable for investors who prioritize liquidity and guaranteed returns.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.