Relative return strategies refer to investment approaches that aim to outperform a chosen benchmark or market index. These strategies focus on generating returns that exceed the performance of the benchmark rather than targeting absolute returns regardless of market conditions. The primary objective of relative return strategies is to deliver superior returns compared to a specific benchmark. These strategies provide investors with a performance target, allowing them to gauge the effectiveness of their investment approach while managing risk within acceptable parameters. Relative return strategies often involve active management, as portfolio managers seek to exploit market inefficiencies and identify outperforming investments. These strategies typically have a benchmark-relative focus, with portfolio managers aiming to balance risk and return while outperforming the chosen benchmark. Asset allocation is a crucial component in relative return strategies, as it determines the mix of asset classes in the portfolio. Portfolio managers will adjust allocations based on their expectations of asset class performance relative to the benchmark, aiming to capitalize on perceived opportunities. Choosing the appropriate benchmark is critical in relative return strategies, as it serves as the performance target for the portfolio. The benchmark should be relevant, representative of the investment universe, and provide a clear basis for comparison against the portfolio's performance. Active management is a key aspect of relative return strategies, with portfolio managers making tactical investment decisions to generate excess returns over the benchmark. This can involve security selection, sector allocation, and market timing, among other approaches. Risk management is an essential component of relative return strategies, as it helps ensure that the portfolio's risk profile remains aligned with the investor's objectives and risk tolerance. Portfolio managers may use various techniques, such as diversification and risk analytics, to manage risk relative to the benchmark. Long-only relative return strategies involve taking long positions in securities expected to outperform the benchmark. These strategies typically focus on security selection, sector allocation, or other tactics to generate excess returns over the benchmark while maintaining a similar risk profile. Long/short relative return strategies involve taking both long and short positions in securities, aiming to generate excess returns by capitalizing on both outperforming and underperforming investments. Compared to long-only strategies, these strategies offer greater flexibility and potential for outperformance. Market neutral relative return strategies aim to minimize exposure to overall market risk by holding equal long and short positions. These strategies focus on generating returns through security selection and other active management techniques rather than relying on broad market movements. Factor-based relative return strategies seek to exploit systematic risk factors, such as value, momentum, or quality, to generate excess returns over the benchmark. By targeting specific factors, these strategies aim to capture the sources of outperformance in a systematic and disciplined manner. Tracking error measures the degree to which a portfolio's returns deviate from the benchmark's returns. In relative return strategies, a lower tracking error indicates that the portfolio's performance closely follows the benchmark, while a higher tracking error suggests greater deviation from the benchmark's performance. The information ratio is a performance measurement that assesses a portfolio's excess returns relative to its tracking error. A higher information ratio indicates that the portfolio manager has generated higher returns per unit of risk taken compared to the benchmark. Alpha generation refers to the portfolio's ability to generate excess returns above the benchmark on a risk-adjusted basis. In relative return strategies, alpha generation is a crucial performance indicator, as it demonstrates the effectiveness of the active management approach in outperforming the passive benchmark. The alpha generation process involves identifying market mispricings, exploiting them through investment strategies, and capturing the resulting profits. This can be accomplished through various techniques such as fundamental, quantitative, and technical analysis. Benchmark-relative performance is a measure of a portfolio's return compared to its chosen benchmark. In relative return strategies, this comparison is crucial for assessing the effectiveness of the portfolio manager's active management decisions. A positive benchmark-relative performance indicates that the portfolio has outperformed the benchmark, while a negative performance suggests underperformance. Relative return strategies and absolute return strategies differ in their objectives, risk profiles, and investment approaches. While relative return strategies focus on outperforming a chosen benchmark, absolute return strategies aim to generate positive returns regardless of market conditions, with a focus on capital preservation and risk management. Relative return strategies can offer the potential for outperformance through active management, while absolute return strategies may provide more stable returns and better downside protection. Both approaches have their advantages and disadvantages, and the choice between them depends on the investor's objectives and risk tolerance. Investors should consider their investment goals, risk tolerance, and preferences when choosing between relative and absolute return strategies. A combination of both approaches may also be appropriate for investors seeking to balance the potential for outperformance with capital preservation and risk management. Relative return strategies provide investors with a clear performance target, typically based on a benchmark index's performance. This target allows investors to assess the performance of their portfolio in comparison to a relevant benchmark and determine whether their active management approach is delivering the desired results. Relative return strategies provide the potential for outperformance through active management. By identifying mispricings in the market and exploiting them through investment strategies, portfolio managers can generate excess returns above the benchmark on a risk-adjusted basis. This potential for outperformance is an attractive feature for investors seeking higher returns than those offered by passive investments. Relative return strategies provide a structured approach to risk management. Portfolio managers carefully analyze each investment's risk and return characteristics and adjust the portfolio accordingly to maintain an appropriate level of risk. This approach can help investors avoid excessive risk-taking and mitigate losses during market downturns. Relative return strategies provide a framework for monitoring and evaluating portfolio performance. The portfolio's performance is compared to a relevant benchmark, allowing investors to track the success of their active management approach and make adjustments as needed. Relative return strategies also face the potential for underperformance due to active management decisions. While active management can potentially lead to outperformance, it can also result in underperformance if investment decisions are not well-informed or if market conditions are unfavorable. This risk of underperformance can be a concern for investors seeking consistent returns. Relative return strategies require active management, which can result in increased costs compared to passive investments. Portfolio managers must continuously monitor and adjust the portfolio, which can lead to higher fees and expenses. These increased costs can eat into investment returns and reduce the attractiveness of relative return strategies for some investors. Relative return strategies rely on a suitable benchmark for comparison. If the benchmark is not appropriate, it can be difficult to assess the portfolio's performance accurately. Additionally, the benchmark can change over time, which can make it challenging to evaluate the success of the active management approach over the long term. Relative return strategies may not be well-suited for investors seeking absolute returns regardless of market conditions. These investors may prefer absolute return strategies, which aim to generate positive returns regardless of market conditions, rather than relative return strategies, which focus on outperforming a benchmark. Selecting the right relative return strategy involves assessing the investor's objectives, risk tolerance, and investment preferences. This process may involve evaluating different types of relative return strategies, such as long-only, long/short, or factor-based approaches, and selecting the one that best aligns with the investor's goals. Constructing a portfolio that implements a relative return strategy involves asset allocation, security selection, and risk management decisions based on the chosen strategy. Portfolio managers will seek to build a well-diversified portfolio designed to outperform the benchmark while maintaining an acceptable level of risk. Ongoing monitoring and adjustments are essential for maintaining the effectiveness of a relative return strategy. This process includes tracking performance, evaluating risk, and making tactical investment decisions to capitalize on opportunities and manage risks relative to the benchmark. Investment professionals, such as portfolio managers and financial advisors, can play a crucial role in implementing relative return strategies. Their expertise and insights can help investors select the right strategy, construct a well-diversified portfolio, and make informed decisions based on market developments and performance analysis. Relative return strategies are important in modern portfolio management, as they provide the potential for outperformance through active management. These strategies focus on generating returns that surpass a chosen benchmark, allowing investors to achieve their investment goals while managing risk. Combining both relative and absolute return strategies may offer the optimal mix of performance potential and risk management for many investors. Continuous evaluation and adjustment of investment strategies are crucial to ensure long-term success. Wealth management professionals can provide valuable guidance, customized portfolio construction, and ongoing monitoring to help investors achieve their financial goals while managing risk. As market conditions and investor goals change, reassessing strategies and making necessary adjustments is essential to maintain alignment with objectives and risk tolerance.What Are Relative Return Strategies?

Relative Return Strategy Components

Asset Allocation

Benchmark Selection

Active Management

Risk Management

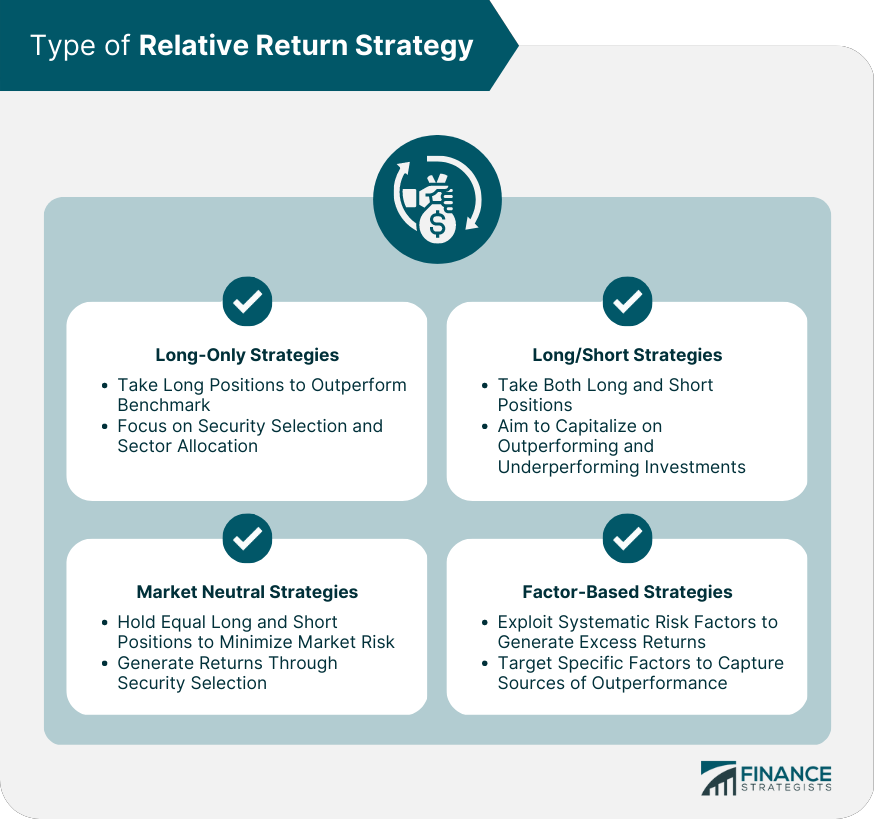

Types of Relative Return Strategies

Long-Only Strategies

Long/Short Strategies

Market Neutral Strategies

Factor-Based Strategies

Performance Measurement and Evaluation of Relative Return Strategies

Tracking Error

Information Ratio

Alpha Generation

Benchmark-Relative Performance

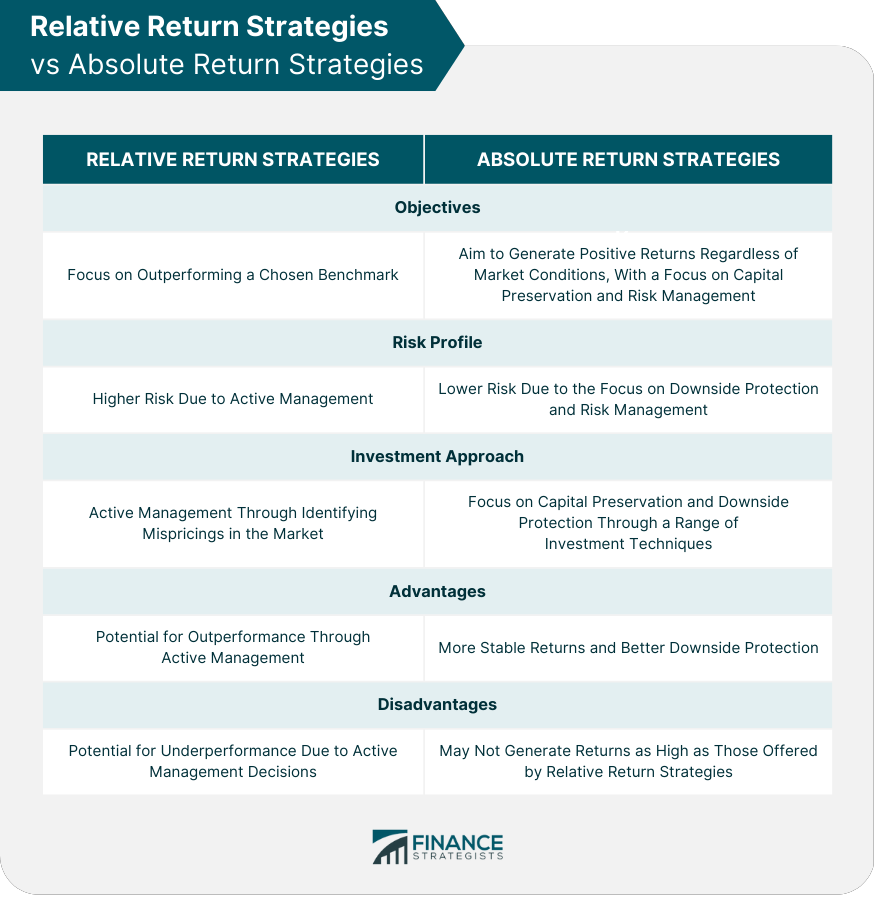

Relative Return Strategies vs Absolute Return Strategies

Key Differences

Comparative Advantages and Disadvantages

Choosing the Appropriate Strategy Based on Investor Goals and Risk Tolerance

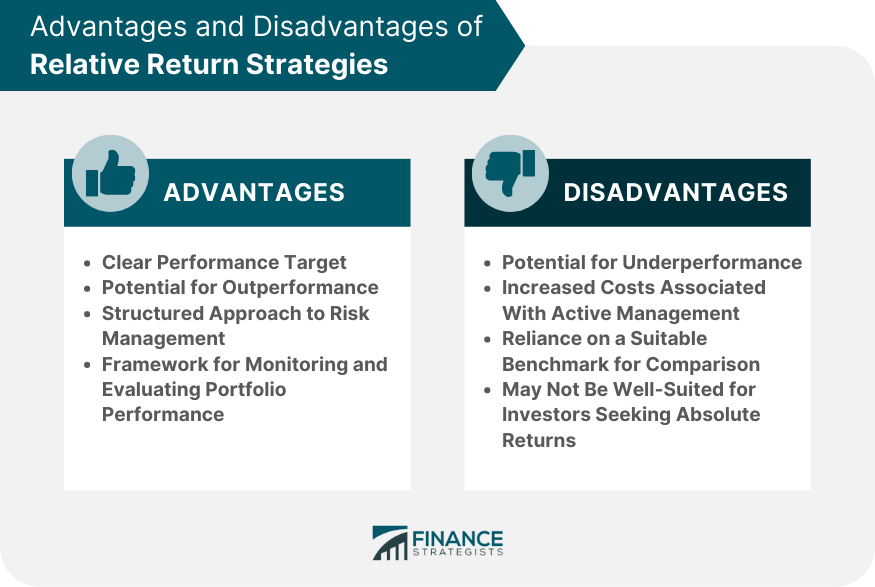

Advantages of Relative Return Strategies

Clear Performance Target

Potential for Outperformance

Structured Approach to Risk Management

Framework for Monitoring and Evaluating Portfolio Performance

Disadvantages of Relative Return Strategies

Potential for Underperformance

Increased Costs Associated With Active Management

Reliance on a Suitable Benchmark for Comparison

May Not Be Well-Suited for Investors Seeking Absolute Returns

Implementing Relative Return Strategies

Selecting the Right Strategy

Portfolio Construction

Monitoring and Adjusting the Strategy

Role of Investment Professionals

Final Thoughts

Relative Return Strategies FAQs

Relative return strategies are investment approaches that aim to outperform a chosen benchmark or market index by generating returns that exceed the performance of the benchmark rather than targeting absolute returns regardless of market conditions.

The types of relative return strategies include long-only strategies, long/short strategies, market neutral strategies, and factor-based strategies.

Relative return strategies focus on outperforming a chosen benchmark, while absolute return strategies aim to generate positive returns regardless of market conditions, with a focus on capital preservation and risk management.

Relative return strategies provide investors with a clear performance target, offer the potential for outperformance through active management, provide a structured approach to risk management, and provide a framework for monitoring and evaluating portfolio performance.

Relative return strategies face the potential for underperformance due to active management decisions, increased costs associated with active management, and the reliance on a suitable benchmark for comparison. Additionally, these strategies may not be well-suited for investors seeking absolute returns regardless of market conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.