Portfolio recovery time refers to the period it takes for an investment portfolio to regain its value after a significant decline, such as during a market downturn. It is a crucial concept in investment management, as investors need to understand how long it may take for their investments to bounce back following a market correction or crash. Understanding portfolio recovery time helps investors make informed decisions on asset allocation, risk management, and investment strategies. It allows them to better prepare for potential market fluctuations and create a resilient investment plan that can withstand market volatility. Several factors impact portfolio recovery time, including market conditions, asset allocation, rebalancing strategies, risk management techniques, and investor psychology. By understanding these factors, investors can take steps to minimize their portfolio's recovery time. Bear markets are characterized by a prolonged period of falling asset prices, often driven by economic recession, high unemployment, and negative investor sentiment. In these conditions, portfolio recovery times are generally longer, as it takes more time for markets to rebound and regain lost value. In a bear market, investors can shorten their portfolio recovery time by employing defensive strategies, such as increasing allocation to bonds or other fixed-income investments, focusing on dividend-paying stocks, or investing in sectors that are less sensitive to economic downturns. Bull markets are characterized by a sustained period of rising asset prices, often driven by economic growth, low unemployment, and positive investor sentiment. In these conditions, portfolio recovery times are generally shorter, as markets are more likely to rebound quickly after a temporary decline. In a bull market, investors can optimize their portfolio recovery time by maintaining a diversified portfolio, regularly rebalancing their assets, and staying disciplined in their investment approach to avoid making impulsive decisions based on short-term market fluctuations. Diversification, or spreading investments across a wide range of asset classes and sectors, plays a crucial role in minimizing portfolio recovery time. A well-diversified portfolio can help reduce the impact of a decline in any single asset or sector, ultimately leading to a faster recovery. To minimize recovery time, investors should balance the risk and return of their portfolio by allocating assets according to their risk tolerance, investment objectives, and time horizon. A portfolio with an appropriate mix of high-risk, high-return assets and low-risk, low-return assets can help minimize recovery time. Equities, or stocks, have historically offered higher returns but also come with higher risk. Recovery times for equity-heavy portfolios can be longer during bear markets but shorter during bull markets. Bonds are generally considered lower-risk investments, offering stable income and lower volatility. A higher allocation to bonds can help shorten recovery time during market downturns but may limit returns during bull markets. Real estate investments can offer diversification benefits and help to reduce recovery time. However, the recovery time for real estate investments can be longer in periods of economic distress. Commodities, such as gold or oil, can provide a hedge against inflation and market volatility. Including commodities in a portfolio can help to reduce recovery time during periods of economic uncertainty. Alternative investments, such as hedge funds, private equity, or venture capital, can offer diversification benefits and potentially reduce recovery time. However, these investments often come with higher fees and greater complexity, which may not be suitable for all investors. Regular rebalancing involves adjusting a portfolio's asset allocation at fixed intervals, such as annually or quarterly, to maintain the desired risk and return profile. This approach can help reduce recovery time by ensuring that the portfolio remains diversified and aligned with the investor's objectives. Threshold rebalancing involves adjusting a portfolio's asset allocation when the portfolio's actual allocation deviates from the target allocation by a predetermined percentage. This approach can help maintain the desired risk and return profile while potentially reducing the frequency of rebalancing, which can help lower transaction costs and tax implications. Tactical asset allocation is a more active investment strategy that involves adjusting a portfolio's asset allocation based on short-term market conditions or opportunities. This approach can help minimize recovery time by capitalizing on market inefficiencies, but it requires a higher level of skill and monitoring than more passive strategies. Rebalancing can help reduce portfolio recovery time by ensuring that the portfolio remains diversified and aligned with the investor's risk tolerance and investment objectives. However, the specific impact of rebalancing on recovery time will depend on the chosen rebalancing strategy and the investor's ability to execute it effectively. Stop-loss orders can help investors limit their losses during periods of market volatility. By setting a predetermined price at which to sell a security, investors can exit a losing position before it significantly impacts their portfolio, potentially reducing the recovery time. Hedging strategies, such as using options or futures contracts, can help protect a portfolio against market downturns and reduce recovery time. These strategies involve taking positions in financial instruments that are expected to move in the opposite direction of the assets in the portfolio, thereby offsetting potential losses. Portfolio insurance involves setting aside a portion of the portfolio in low-risk, liquid investments that can be easily accessed during periods of market turmoil. This strategy can help provide a cushion against losses and reduce the recovery time of a portfolio. Investors should maintain a long-term perspective and focus on their investment objectives, rather than reacting to short-term market fluctuations. By staying focused on their long-term goals, investors can avoid making impulsive decisions that may lengthen their portfolio's recovery time. Investor psychology plays a significant role in portfolio recovery time. By managing emotions such as fear, greed, and overconfidence, investors can make more rational decisions and avoid actions that may prolong their portfolio's recovery. A disciplined investment approach involves adhering to a well-defined investment plan, regularly reviewing and adjusting the plan as needed, and avoiding impulsive decisions based on market sentiment. This approach can help investors minimize their portfolio's recovery time. Understanding and managing portfolio recovery time is crucial for successful long-term investing. By employing strategies such as diversification, rebalancing, risk management techniques, and maintaining a disciplined approach, investors can minimize their portfolio's recovery time and better prepare for market fluctuations. A well-structured investment plan, tailored to the investor's risk tolerance, investment objectives, and time horizon, is essential for effectively managing portfolio recovery time. Investors should continuously monitor their portfolios and adjust their strategies as needed to optimize recovery time. This may involve revisiting asset allocation, rebalancing strategies, risk management techniques, and evaluating the overall investment plan. By understanding the factors that influence recovery time and employing appropriate strategies, investors can create a more resilient portfolio that can withstand market volatility and recover more quickly from downturns, ultimately helping them achieve their long-term financial goals.Definition of Portfolio Recovery Time

Importance of Understanding Recovery Time in Investment Management

Factors Influencing Recovery Time

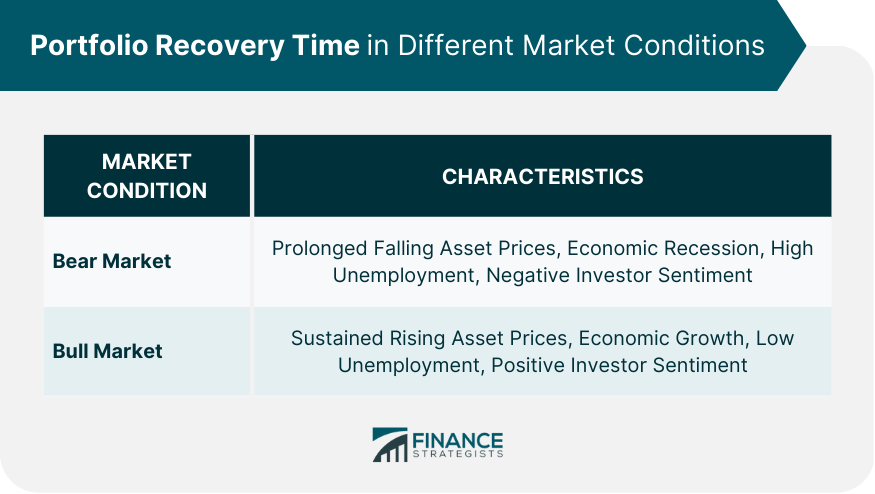

Portfolio Recovery Time in Different Market Conditions

Bear Markets

Characteristics of Bear Markets

Strategies for Shortening Recovery Time

Bull Markets

Characteristics of Bull Markets

Strategies for Optimizing Recovery Time

Asset Allocation and Recovery Time

Role of Diversification in Recovery Time

Balancing Risk and Return to Minimize Recovery Time

Different Asset Classes and Their Impact on Recovery Time

Equities

Bonds

Real Estate

Commodities

Alternative Investments

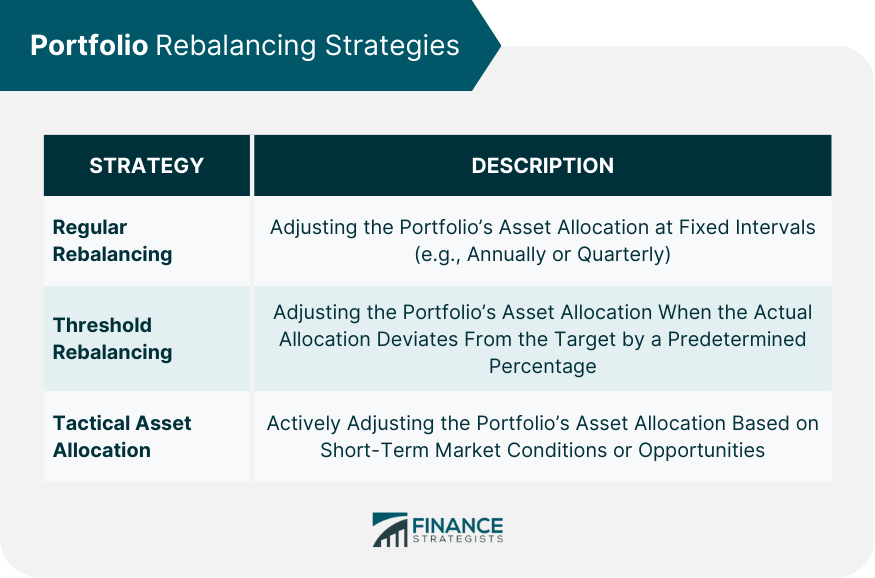

Portfolio Rebalancing Strategies

Regular Rebalancing

Threshold Rebalancing

Tactical Asset Allocation

Impact of Rebalancing on Recovery Time

Risk Management Techniques

Stop-Loss Orders

Hedging Strategies

Portfolio Insurance

Importance of Investor Psychology

Maintaining a Long-Term Perspective

Managing Emotions During Market Fluctuations

Developing a Disciplined Investment Approach

Conclusion

Portfolio Recovery Time FAQs

Portfolio recovery time refers to the period it takes for an investment portfolio to regain its value after a significant decline, such as during a market downturn. Understanding portfolio recovery time is important for investors, as it helps them make informed decisions on asset allocation, risk management, and investment strategies to minimize the time it takes for their investments to bounce back after a market correction or crash.

Diversification, or spreading investments across a wide range of asset classes and sectors, plays a crucial role in minimizing portfolio recovery time. A well-diversified portfolio can help reduce the impact of a decline in any single asset or sector, ultimately leading to a faster recovery.

In a bear market, investors can minimize portfolio recovery time by employing defensive strategies, such as increasing allocation to bonds or other fixed-income investments, focusing on dividend-paying stocks, or investing in sectors that are less sensitive to economic downturns. In a bull market, investors can optimize their portfolio recovery time by maintaining a diversified portfolio, regularly rebalancing their assets, and staying disciplined in their investment approach to avoid making impulsive decisions based on short-term market fluctuations.

Rebalancing strategies can help reduce portfolio recovery time by ensuring that the portfolio remains diversified and aligned with the investor's risk tolerance and investment objectives. Regular rebalancing, threshold rebalancing, and tactical asset allocation are different approaches that investors can use to maintain their desired risk and return profile, ultimately affecting the portfolio's recovery time.

Investor psychology plays a significant role in managing portfolio recovery time. By maintaining a long-term perspective, managing emotions during market fluctuations, and developing a disciplined investment approach, investors can make more rational decisions and avoid actions that may prolong their portfolio's recovery time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.