The term "One Night Stand Investment" might evoke an array of interpretations, given its rather unusual connotation in the realm of finance. In essence, it refers to an investment strategy characterized by a short holding period, typically no more than a day. Short-term investment strategies encompass a broad spectrum of tactics aimed at capitalizing on quick market movements. These strategies often involve higher risk due to market volatility but are also known for their potential to yield substantial returns. Day trading, swing trading, momentum trading, and arbitrage are some of the common short-term investment strategies. Each of these tactics carries its own set of risks and rewards, making them suitable for different types of investors. One Night Stand Investment operates on the principle of rapid engagement and disengagement with the market. The strategy is predicated on the idea that significant profits can be made from sharp market movements within a very short time frame. One Night Stand Investment is characterized by high risk and high potential return. It requires constant monitoring of market trends and swift decision-making. Investors using this strategy often employ technical analysis tools to predict market movements and use leverage to amplify potential gains. However, the use of leverage can also amplify losses, making this investment strategy unsuitable for risk-averse investors. Investing in high-risk stocks forms a significant part of the One Night Stand Investment strategy. These stocks, often from volatile sectors or startups, have the potential for significant price movements within a single trading day. A well-timed investment in such stocks can lead to substantial profits. Leveraged ETFs offer another avenue for One Night Stand Investment. These financial instruments use debt to amplify the returns of an underlying index. While they can lead to magnified profits in the short term, the losses can be equally magnified, adding to the strategy's risk profile. Options trading is an integral part of One Night Stand Investment. By purchasing a call option, an investor can bet on a stock's price rising within a specific timeframe. Alternatively, a put option allows an investor to profit from a stock's decline. The leveraged nature of options trading can result in substantial gains or losses. Futures contracts, agreements to buy or sell a specific asset at a predetermined price at a future date, are another tool for One Night Stand Investors. These contracts can be bought and sold within the same trading day, making them suitable for this high-risk strategy. The dynamic and high-risk nature of One Night Stand Investment makes it a thrilling and potentially profitable strategy. However, it requires a deep understanding of market mechanisms, technical analysis, and a tolerance for risk. As such, it is not recommended for inexperienced or risk-averse investors. As with any investment strategy, due diligence and sound risk management are crucial for success. One of the most enticing aspects of One Night Stand Investment is the potential for high returns. Due to the strategy's focus on high-risk, high-reward assets and the use of leverage, investors can realize substantial profits from relatively small market movements. One Night Stand Investment can provide an opportunity for portfolio diversification. By participating in various high-risk trades across different asset classes, investors can spread their risk and potentially enhance returns. Market volatility, often a deterrent for long-term investors, can be advantageous for One Night Stand Investment. High volatility can create significant price swings, providing ample opportunities for short-term profits. The very nature of One Night Stand Investment exposes investors to high risk. The emphasis on high-risk assets and the use of leverage means that the potential for losses is equally high. Investors must be prepared to absorb these losses. While market volatility can offer opportunities, it also presents significant risks. Rapid and unpredictable market movements can lead to substantial losses, particularly when leverage is involved. The short holding period and high-risk nature of One Night Stand Investment mean that the risk of capital loss is considerable. Investors may lose all of their initial investment, particularly if they fail to employ effective risk management strategies. In-depth research and due diligence are crucial to the success of One Night Stand Investment. Investors must possess a deep understanding of the assets they invest in and the broader market dynamics at play. Risk management techniques are vital in mitigating potential losses. These may include setting stop-loss orders, diversifying investments, and only investing money that one can afford to lose. Successful One Night Stand Investment relies heavily on timing. Investors must accurately predict short-term market movements and act swiftly to capitalize on these opportunities. Having a clear exit strategy is equally crucial. Knowing when to cut losses and exit a position can prevent further capital erosion and help maintain a positive investment portfolio. One Night Stand Investment offers an exciting venture into the realm of high-risk, short-term trades. This strategy relies on swift engagements and disengagements in the market to capitalize on quick, significant market movements. Investors must demonstrate a high-risk tolerance and a deep understanding of market trends. Typical investment types include high-risk stocks, leveraged ETFs, options trading, and futures contracts, each carrying substantial potential returns but equally high risks. Benefits include high return potential, diversification opportunities, and benefit from market volatility. However, risks involve high exposure, market volatility, and a significant risk of capital loss. Success in this strategy calls for careful research, effective risk management techniques, precise market timing, and well-planned exit strategies. While thrilling, it's crucial to remember that One Night Stand Investment is not suitable for risk-averse or inexperienced investors due to its high-risk nature and the potential for significant losses.What Is a One Night Stand Investment?

Characteristics of One Night Stand Investment

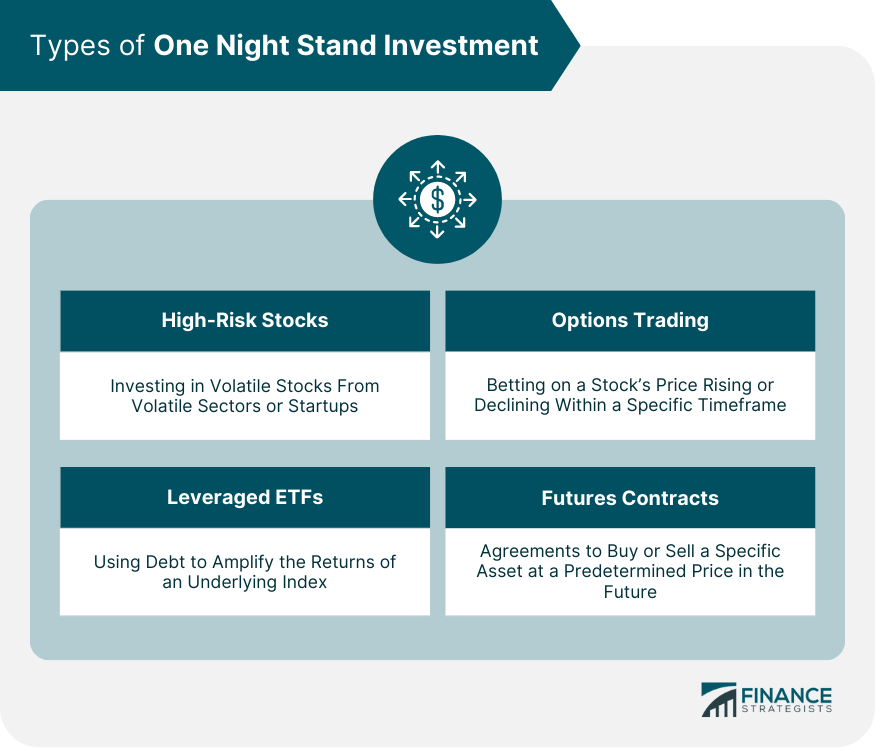

Types of One Night Stand Investment

High-Risk Stocks

Leveraged ETFs

Options Trading

Futures Contracts

Benefits of One Night Stand Investment

Potential for High Returns

Opportunity for Diversification

Benefits From Market Volatility

Risks of One Night Stand Investment

High-Risk Exposure

Market Volatility

Risk of Capital Loss

Strategies for One Night Stand Investment

Due Diligence and Research

Risk Management Techniques

Timing the Market

Exit Strategies

Final Thoughts

One Night Stand Investment FAQs

A One Night Stand Investment is a high-risk, short-term investment strategy that involves entering and exiting financial positions within a single trading day.

One Night Stand Investments often involve high-risk stocks, leveraged ETFs, options trading, and futures contracts.

One Night Stand Investment can offer high potential returns, opportunities for diversification, and benefits from market volatility.

One Night Stand Investment involves high risk exposure, market volatility, and a significant risk of capital loss.

Success in One Night Stand Investment requires thorough research, effective risk management, accurate market timing, and clear exit strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.