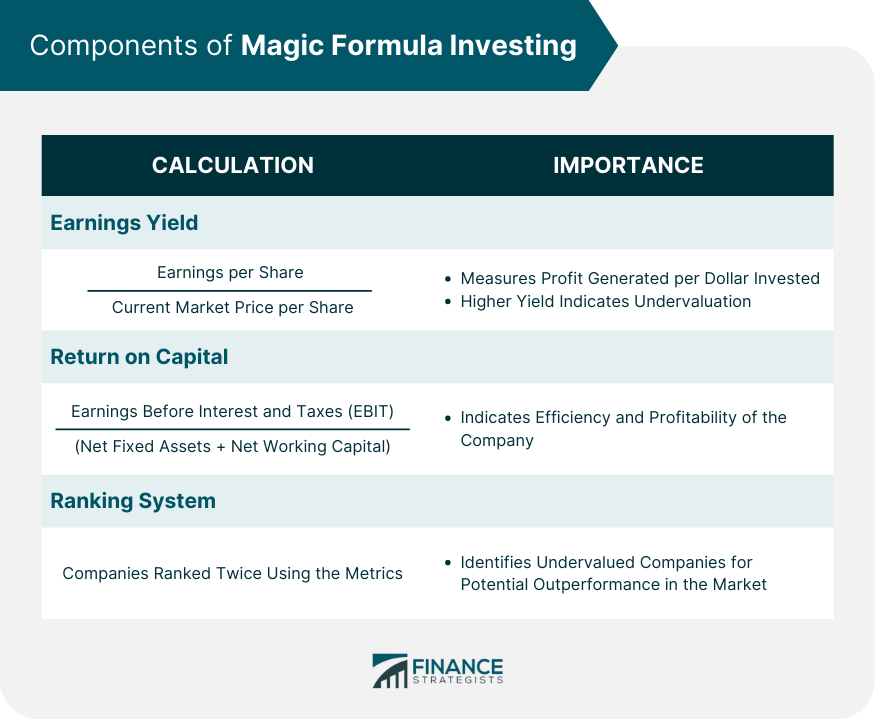

Magic Formula Investing is an investment technique that uses a set of quantitative metrics to identify quality businesses available at a discount. It is a systematic approach that employs screening for specific financial ratios to determine the attractiveness of a company. The intention is to create a diversified portfolio of undervalued companies that are financially sound and profitable. The Magic Formula was introduced by Joel Greenblatt, a successful hedge fund manager and adjunct professor at Columbia Business School, in his 2005 book "The Little Book That Beats the Market." The Magic Formula's principle is to invest in good companies at bargain prices. It combines the two fundamental aspects of investing—quality, and value. The formula uses two key financial metrics, earnings yield and returns on capital, to rank companies. The assumption is that companies with high earnings yield and high return on capital are quality businesses selling at a discount. The earnings yield is a financial solvency ratio that compares the earnings per share for the most recent 12-month period to the current market price per share. Essentially, it shows how much profit a company generates for each dollar invested in the company's stock. Higher earnings yield is generally better as it signifies a company is undervalued. The earnings yield plays a crucial role in the Magic Formula as it measures the price paid for a share relative to the profit earned by the company. The formula favors companies with a high earnings yield, which indicates more earnings for the price paid, hence undervaluation. Return on capital is a profitability ratio. It measures a company's ability to create profits from its capital. It's calculated by dividing the company's Earnings Before Interest and Taxes (EBIT) by the sum of its net fixed assets and net working capital. A high return on capital signifies a company that efficiently uses its capital to generate profits. Return on capital is a measure of the quality of a company in the Magic Formula. Companies that generate a high return on capital are efficient and profitable, making them attractive investments. The Magic Formula ranks companies based on their earnings yield and return on capital. Each company is ranked twice, once for each metric. The two ranks are then added together, and the companies are sorted based on this combined rank. The companies with the lowest combined ranks are deemed the most attractive. The ranking system is the heart of the Magic Formula. It helps identify quality, undervalued companies. By focusing on the top-ranked companies, investors can potentially outperform the market over the long term. The first step in Magic Formula Investing is to determine the universe of stocks. This universe should include a wide range of stocks to ensure diversification. Generally, the universe includes all listed stocks above a certain market capitalization. For example, Greenblatt suggests excluding companies with a market capitalization of less than $50 million. Once the universe of stocks is established, the next step is to calculate and apply the Magic Formula metrics—earnings yield and return on capital—to each company. This process helps to identify the companies that offer the best value for money. After calculating the metrics, companies are ranked based on the combination of their earnings yield and return on capital. The top-ranked companies are then selected for inclusion in the portfolio. Greenblatt recommends buying 20-30 top-ranked companies to ensure adequate diversification and mitigate specific company risks. The Magic Formula Investing strategy is a long-term approach. It requires patience as the formula's effectiveness tends to manifest over several years. Frequent trading can undermine potential benefits as it may lead to higher transaction costs and potential tax implications. Greenblatt recommends holding each stock for at least one year. The Magic Formula Investing strategy has the potential for higher returns compared to the broader market. This is because the strategy identifies undervalued, high-quality companies that have the potential for significant price appreciation. The Magic Formula Investing strategy is simple and accessible to investors of all experience levels. With just two metrics, it eliminates the need for complex financial analysis. Moreover, all the necessary information is readily available in the company's financial statements. The Magic Formula strategy focuses on quality companies that are efficient and profitable. This can reduce risk as these companies are more likely to withstand economic downturns and generate consistent earnings. By using a systematic approach, the Magic Formula Investing strategy can help mitigate the impact of emotional decision-making. Investors follow the formula rather than trying to time the market or follow market trends. Critics argue that the impressive returns generated by the Magic Formula in back-tests may not be replicated in the future. This is because back-testing involves a look at past data, and past performance is not indicative of future results. While the simplicity of the Magic Formula is an advantage, it could also be a limitation. The formula does not consider other important aspects, such as the company's management quality, industry trends, or macroeconomic conditions. The Magic Formula does not account for market conditions or company-specific factors that may impact the stock's performance. This means investors could end up investing in companies facing significant headwinds. The Magic Formula can sometimes lead to overvaluation and underperformance. If many investors follow the formula, the demand for the top-ranked companies could drive their prices up, leading to overvaluation. Moreover, there's no guarantee that the formula will always outperform the market. Like the Magic Formula, value investing also seeks to find undervalued companies. However, value investing typically involves more detailed analysis, including understanding the company's business model, management quality, and industry conditions. Growth investing, on the other hand, is primarily concerned with investing in companies that are expected to grow at an above-average rate compared to other companies in the market. This strategy doesn't focus on the current price of the companies, unlike the Magic Formula. It instead focuses on the future potential of the company, even if the current price is high. Passive investing is a strategy that aims to mirror the returns of a specific market index. It involves minimal buying and selling, contrasting with the Magic Formula, which requires yearly reconstitution of the portfolio based on the ranking system. While passive investing offers the advantage of lower costs, it does not aim to outperform the market, unlike the Magic Formula Investing strategy. Magic Formula Investing is a systematic investing strategy introduced by Joel Greenblatt. It seeks to identify quality, undervalued companies by ranking them based on earnings yield and return on capital. This simple yet effective strategy offers the potential for higher returns, accessibility to all types of investors, focus on quality companies, and mitigation of emotional investing. However, it's not without its criticisms and limitations. Concerns include the reliability of back-testing, potential issues with the formula's simplicity, and the disregard of market conditions and company-specific factors. Additionally, there is potential for overvaluation and underperformance. It's crucial to compare it with other strategies like value investing, growth investing, and passive investing to understand its place within a broader investment plan. As with any investment strategy, Magic Formula Investing requires a clear understanding of its workings, benefits, and limitations. It is a tool in the hands of investors, and like all tools, it is only as good as the skill of the person using it. Therefore, if you're considering Magic Formula Investing, it may be beneficial to seek advice from wealth management services to tailor this strategy according to your specific financial goals and risk tolerance. Remember, investing should always align with your financial objectives and personal circumstances.What Is Magic Formula Investing?

Components of Magic Formula Investing

Earnings Yield

Definition and Calculation

Importance in the Magic Formula

Return on Capital

Definition and Calculation

Importance in the Magic Formula

Ranking System

How Companies are Ranked Using the Magic Formula

Importance of Ranking in the Strategy

Steps to Implement Magic Formula Investing

Select the Universe of Stocks

Apply the Magic Formula Metrics

Rank Stocks and Portfolio Creation

Importance of Patience and Long-Term Investing

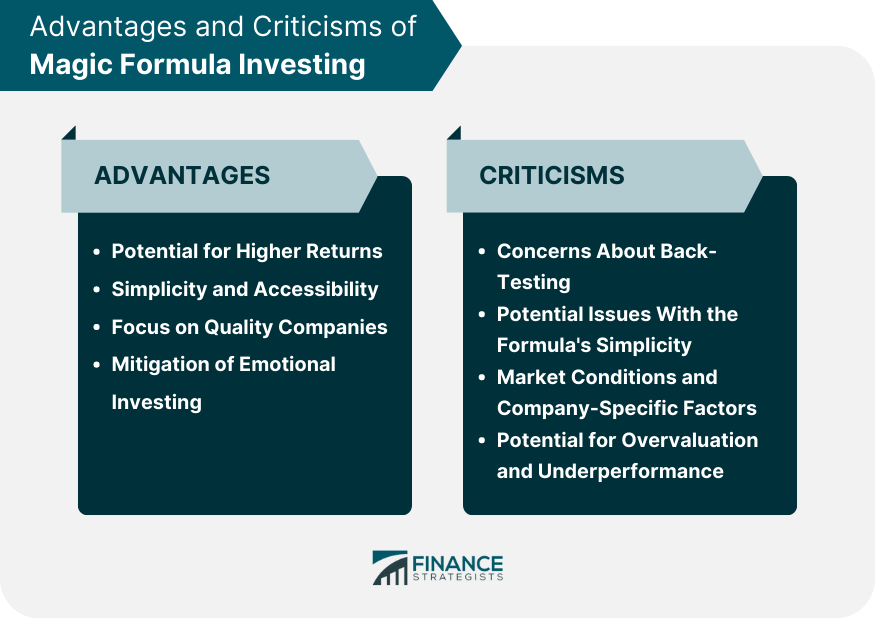

Advantages of Magic Formula Investing

Potential for Higher Returns

Simplicity and Accessibility

Focus on Quality Companies

Mitigation of Emotional Investing

Criticisms and Limitations of Magic Formula Investing

Concerns about Back-Testing

Potential Issues With the Formula's Simplicity

Market Conditions and Company-Specific Factors

Potential for Overvaluation and Underperformance

Comparisons of Magic Formula Investing With Other Strategies

Value Investing

Growth Investing

Passive Investing

Final Thoughts

Magic Formula Investing FAQs

Magic Formula Investing is an investment strategy that uses specific financial metrics to find quality companies that are undervalued. Developed by Joel Greenblatt, it ranks companies based on their earnings yield and return on capital, aiming to create a portfolio of good companies available at bargain prices.

Magic Formula Investing works by ranking companies based on two financial metrics: earnings yield and return on capital. Companies with the highest combined rank for these two metrics are considered the best investment opportunities. These top-ranked companies are then included in the investment portfolio.

The key components of Magic Formula Investing are earnings yield and return on capital. Earnings yield measures the company's profitability relative to its stock price, while return on capital evaluates how efficiently the company uses its capital to generate profits. The formula ranks companies based on these two metrics to identify the most attractive investment opportunities.

Advantages of Magic Formula Investing include the potential for higher returns, its simplicity and accessibility, its focus on quality companies, and mitigation of emotional investing. Disadvantages include concerns about the validity of back-testing, potential oversights due to the formula's simplicity, disregard for market conditions and company-specific factors, and the potential for overvaluation and underperformance.

Magic Formula Investing is a value strategy focusing on quality and undervalued companies. In contrast, growth investing emphasizes current performance over future potential. It is more active than passive investing, requiring yearly portfolio reconstitution. Simpler than traditional value investing, it involves an in-depth analysis of business models and industry conditions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.