An Investment Management Agreement (IMA) is a legally binding contract between an investor and an investment manager, outlining the terms and conditions of their relationship. The IMA sets forth the responsibilities of the investment manager, which may include managing the investor's portfolio, selecting and monitoring investments, and making decisions about buying, holding, and selling securities. The agreement typically specifies the investment objectives, risk tolerance, and other relevant factors that the investment manager must consider when making investment decisions on behalf of the investor. An IMA must clearly identify the involved parties, which typically include the investment manager and the client. This section should provide the legal names, addresses, and contact information of both parties. The scope of services section outlines the specific services that the investment manager will provide to the client. This may include portfolio management, asset allocation, and performance reporting. This section specifies the client's investment objectives, such as risk tolerance, return expectations, and investment horizon. The investment guidelines provide a framework for the manager to make investment decisions on behalf of the client. Investment restrictions outline any limitations or constraints on the investment manager's decision-making authority, such as restrictions on specific asset classes, industries, or investment types. The fees and expenses section details the compensation structure for the investment manager, including management fees, performance fees, and any other applicable charges. This section should also outline the payment terms and frequency. This section specifies the methods and frequency of performance measurement and reporting, including the benchmarks and performance metrics that will be used to evaluate the investment manager's performance. The IMA should address the risk management strategies and processes that the investment manager will employ to mitigate risks and protect the client's investments. This section outlines the confidentiality obligations of the parties, as well as the measures taken to protect the client's personal and financial information. The termination and dispute resolution section provides the terms and conditions under which the IMA may be terminated by either party and the procedures for resolving disputes that may arise during the agreement. This section addresses the investment manager's responsibility to comply with all applicable laws, regulations, and industry standards in the management of the client's investments. The investment manager is responsible for the day-to-day management of the client's portfolio, making investment decisions in line with the client's objectives and guidelines. The investment manager must determine the appropriate allocation of assets across different investment categories to achieve the client's objectives while managing risk. The investment manager must provide regular performance reports to the client, detailing the portfolio's performance against the agreed-upon benchmarks and metrics. The client is responsible for communicating their investment objectives, risk tolerance, and time horizon to the investment manager. The client must maintain open lines of communication with the investment manager, addressing any concerns or changes in their investment objectives. The client is responsible for reviewing the performance reports provided by the investment manager and assessing the manager's performance against the agreed-upon benchmarks and metrics. In a discretionary investment management arrangement, the investment manager has the authority to make investment decisions on behalf of the client without seeking their approval for each transaction. In a non-discretionary investment management arrangement, the investment manager provides recommendations but requires the client's approval before executing any transactions. In an advisory investment management arrangement, the investment manager provides advice and guidance to the client, who retains full decision-making authority and responsibility for their investments. Investment managers have a fiduciary duty to act in the best interest of their clients, putting the client's interests ahead of their own and ensuring that investment decisions are made in accordance with the client's objectives and guidelines. Investment managers must comply with all applicable laws, regulations, and industry standards governing investment management, including securities and financial regulations. Investment managers must adhere to KYC and AML regulations, which require them to verify the identity of their clients and ensure that the funds being invested are not derived from illegal activities. Investment managers must ensure that they obtain the best possible execution for their clients' transactions, taking into account factors such as price, speed, and likelihood of execution. Investment managers must identify, disclose, and manage any conflicts of interest that may arise in the course of managing their clients' investments. The negotiation process involves both parties discussing and agreeing on the terms and conditions of the IMA, including fees, services, and investment guidelines. Before entering into an IMA, the client should conduct thorough due diligence on the investment manager, evaluating their qualifications, experience, performance history, and regulatory compliance. Once the terms have been negotiated, a formal contract should be drafted and reviewed by both parties, with any necessary revisions made before the IMA is executed. The IMA is finalized and executed when both parties sign the agreement. The investment manager then begins managing the client's investments in accordance with the terms of the IMA. Both parties should regularly review the IMA to ensure that it remains aligned with the client's objectives and market conditions. In response to changing market conditions, the parties may need to adjust the investment guidelines or other provisions of the IMA to better serve the client's needs. The client should regularly assess the investment manager's performance against the agreed-upon benchmarks and metrics, addressing any concerns or issues as they arise. If necessary, the parties can negotiate and execute amendments to the IMA to address any changes in circumstances, objectives, or market conditions. The IMA should include termination clauses outlining the circumstances under which either party may terminate the agreement, such as breach of contract, poor performance, or a change in the client's circumstances. Upon termination, the parties must follow the procedures outlined in the IMA to unwind the relationship, including the transfer of assets and the settlement of any outstanding fees or expenses. Following termination, the investment manager must assist the client in transferring their assets to a new investment manager or another designated account, and closing the client's account with the manager. An Investment Management Agreement plays a crucial role in defining the relationship between an investor and an investment manager. By ensuring that the IMA is well-structured and clearly communicates the expectations of both parties, clients can enjoy a more effective and transparent investment management experience. Continuous monitoring, assessment, and improvement of the IMA can lead to optimal results and help maintain a strong working relationship between the client and the investment manager. By understanding the different types of IMA arrangements, legal and regulatory considerations, and the processes involved in establishing, monitoring, amending, and terminating an IMA, investors can make informed decisions when selecting and working with an investment management firm. Ultimately, a well-executed IMA benefits both parties by fostering trust, transparency, and a mutual understanding of the goals and expectations for their investment partnership.What Is Investment Management Agreement (IMA)?

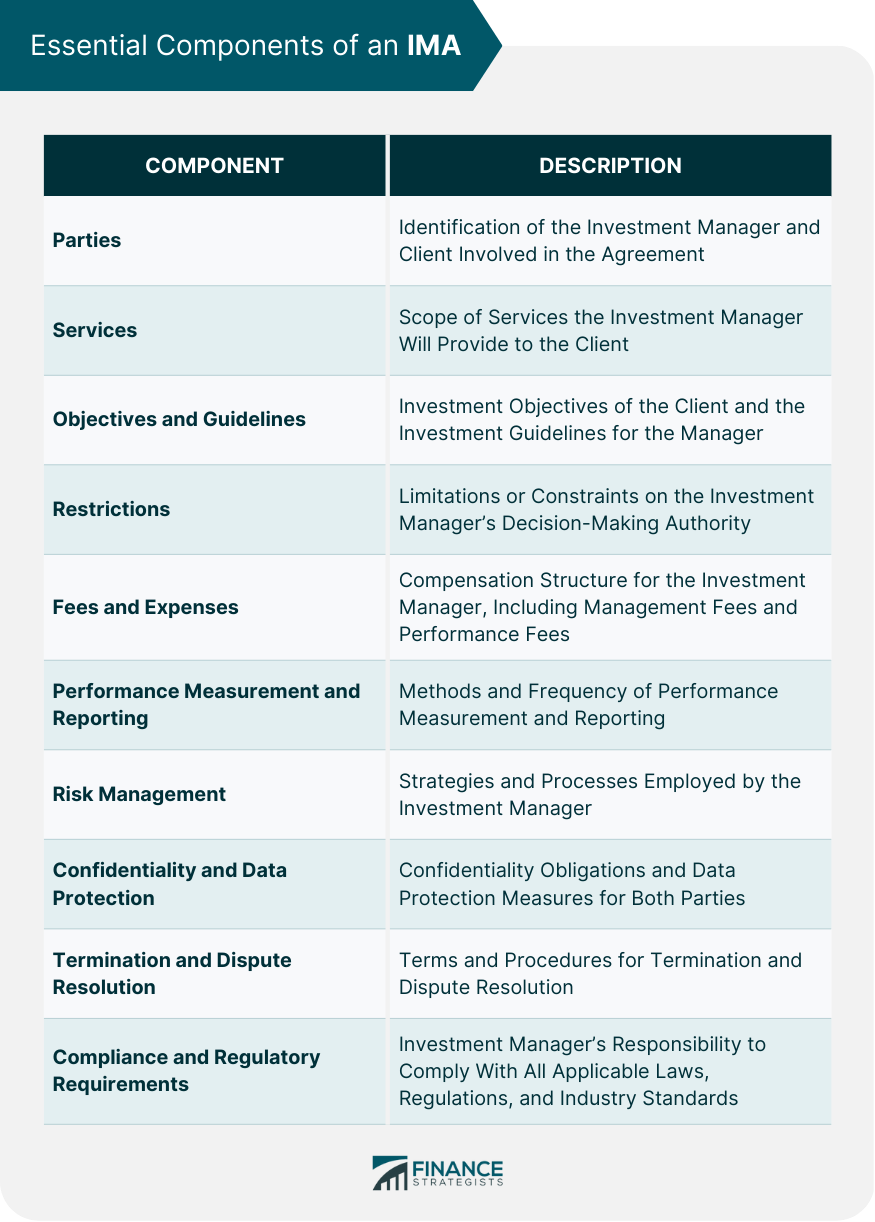

Essential Components of an IMA

Identification of Parties

Scope of Services

Investment Objectives and Guidelines

Investment Restrictions

Fees and Expenses

Performance Measurement and Reporting

Risk Management

Confidentiality and Data Protection

Termination and Dispute Resolution

Compliance and Regulatory Requirements

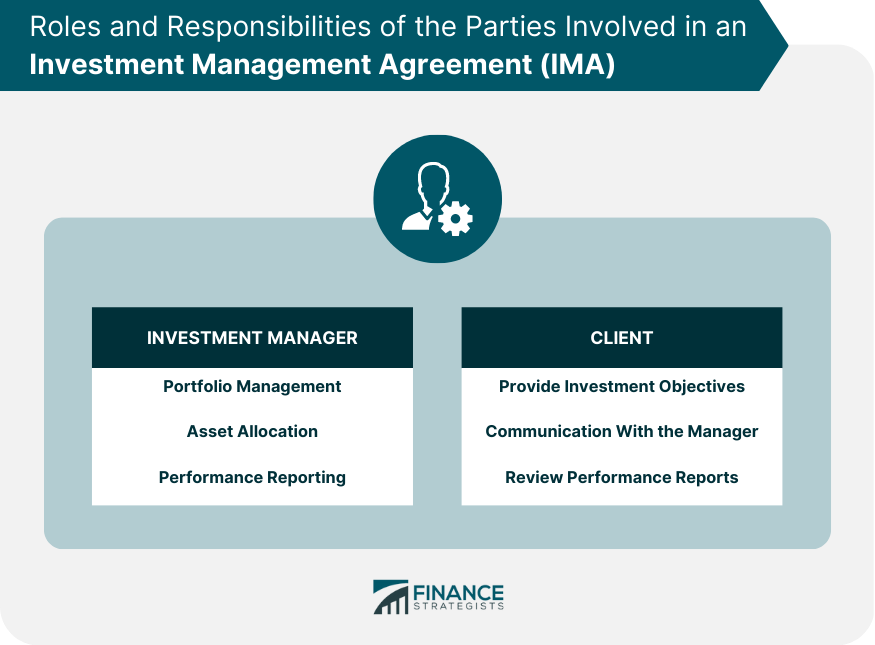

Roles and Responsibilities of the Parties

Role of the Investment Manager

Portfolio Management

Asset Allocation

Performance Reporting

Role of the Client

Providing Investment Objectives

Communication with the Manager

Reviewing Performance Reports

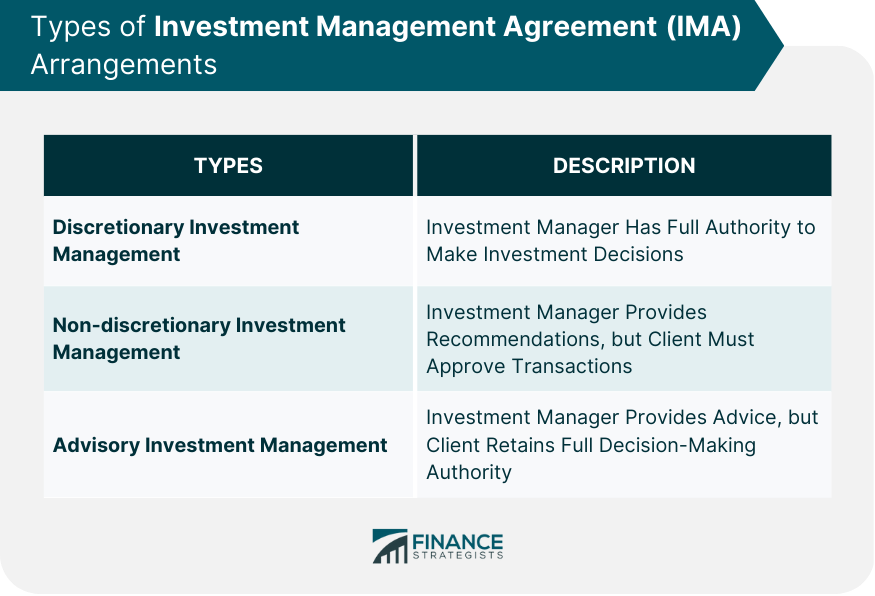

Types of IMA Arrangements

Discretionary Investment Management

Non-discretionary Investment Management

Advisory Investment Management

Legal and Regulatory Considerations

Fiduciary Duties

Investment Management Regulation

Know Your Client (KYC) and Anti-Money Laundering (AML) Regulations

Best Execution Policies

Conflicts of Interest

Establishing an IMA

Negotiation Process

Due Diligence

Contract Drafting and Review

Execution and Implementation

Monitoring and Amending the IMA

Regular Reviews and Updates

Addressing Changing Market Conditions

Assessing Investment Manager Performance

Amending the Agreement as Needed

Termination of IMA

Termination Clauses

Process of Termination

Asset Transfer and Account Closure

Conclusion

Investment Management Agreement (IMA) FAQs

An Investment Management Agreement (IMA) is a legally binding contract between an investor and an investment management firm that outlines the terms and conditions under which the manager will provide investment services to the client. It is important because it clearly defines the roles, responsibilities, and expectations of both parties, ensuring transparency, and fostering trust in the investment management relationship.

The key components of an IMA include identification of parties, scope of services, investment objectives and guidelines, investment restrictions, fees and expenses, performance measurement and reporting, risk management, confidentiality and data protection, termination and dispute resolution, and compliance with regulatory requirements.

There are three main types of IMA arrangements: discretionary investment management, non-discretionary investment management, and advisory investment management. In discretionary arrangements, the investment manager has the authority to make investment decisions without seeking the client's approval. In non-discretionary arrangements, the manager provides recommendations but requires the client's approval before executing transactions. In advisory arrangements, the manager provides advice and guidance, but the client retains full decision-making authority.

Some of the legal and regulatory considerations for an IMA include the investment manager's fiduciary duties, compliance with investment management regulations, adherence to Know Your Client (KYC) and Anti-Money Laundering (AML) regulations, best execution policies, and identification and management of conflicts of interest.

An IMA can be terminated according to the termination clauses outlined in the agreement, such as breach of contract, poor performance, or a change in the client's circumstances. Upon termination, the parties must follow the procedures outlined in the IMA to unwind the relationship, including the transfer of assets to a new investment manager or another designated account, and the settlement of any outstanding fees or expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.