International investing refers to investing in assets outside of one's domestic market, such as stocks, bonds, and real estate in other countries. It is a way to diversify one's portfolio and potentially gain exposure to new markets and opportunities. However, it also comes with risks, such as currency risk and political risks, that should be considered before investing. Investing directly in foreign stocks allows investors to have a direct stake in a specific company. This approach requires thorough research and understanding of the company and its industry. American Depository Receipts (ADRs) are a more accessible way for U.S. investors to invest in foreign stocks, as they are traded on U.S. stock exchanges and are priced in U.S. dollars. These funds invest in stocks from countries outside the fund's home country, providing exposure to a diversified portfolio of international stocks. Global funds invest in stocks from around the world, including the fund's home country, offering a mix of domestic and international investments. Regional funds focus on a specific geographic region, such as Asia or Europe, providing targeted exposure to a particular area. These funds invest primarily in stocks from a single country, allowing investors to concentrate their investments in a particular market. Exchange-Traded Funds (ETFs) provide a convenient and cost-effective way to invest in international markets, as they track the performance of an index or a basket of stocks. Foreign governments issue sovereign bonds and can offer attractive yields and diversification benefits. Corporate bonds are issued by foreign companies, providing exposure to the credit risk and performance of these companies. Eurobonds are bonds issued in a currency other than the issuer's home currency, providing additional currency diversification. Investing in international real estate through direct ownership or real estate investment trusts (REITs) can provide exposure to foreign property markets and potential income streams. Commodities such as gold, oil, and agricultural products can be traded on international markets, offering exposure to global supply and demand dynamics. Index funds are a cost-effective way to gain exposure to international markets, as they track the performance of a specific market index. Exchange-traded funds provide a convenient way to invest in international markets, offering diversification, liquidity, and cost advantages. Investors can actively select individual foreign stocks, requiring thorough research and analysis of the companies and industries involved Actively managed mutual funds can offer professional management and targeted exposure to specific countries, regions, or industries within international markets. Investors must consider their risk tolerance, investment objectives, and time horizon when determining the appropriate level of international exposure within their portfolio. Regularly rebalancing the portfolio ensures that the desired level of international exposure is maintained, preventing overconcentration or underallocation in certain markets. Investing internationally provides diversification benefits, as it spreads risk across various countries and regions. This helps reduce the impact of a downturn in a specific country or region on the overall portfolio. Some foreign markets, particularly in emerging and developing economies, are growing at a faster pace than developed markets. By investing in these markets, investors can potentially benefit from higher growth rates. International investments offer higher returns compared to domestic investments, as foreign markets may present unique opportunities with lower valuations or higher growth prospects. International investing allows investors to access industries and companies not available in their domestic market, providing exposure to new technologies, sectors, and business models. Investing in foreign assets provides currency diversification, which can help mitigate currency risk and potentially improve overall portfolio performance. Investing in foreign assets exposes investors to currency risk, as fluctuations in exchange rates can impact the value of investments. Currency hedging and diversification strategies can help mitigate this risk. Political instability, policy changes, and regulatory uncertainty in foreign countries can impact the performance of international investments. Researching and understanding the political environment of the countries in which you invest is crucial for risk mitigation. Economic factors such as interest rates, inflation, and economic growth can influence the performance of international investments. Monitoring these factors and diversifying across multiple economies can help manage this risk. Differences in regulations, legal systems, and tax regimes between countries can affect the returns and risks associated with international investments. Familiarizing yourself with these factors and seeking professional advice can help you navigate these complexities. Investing in less liquid international markets can make buying or selling investments at the desired price or time more difficult. Diversifying across different market capitalizations and investment vehicles can help manage liquidity risk. Understanding your investment objectives, such as income generation, capital appreciation, or preservation, is essential when selecting appropriate international investments. Knowing your risk tolerance is crucial when deciding the level of international exposure and the types of investments to include in your portfolio. Analyzing factors such as GDP growth, inflation, interest rates, and current trends can help identify attractive international investment opportunities. Understanding the dynamics of specific industries within foreign markets can provide insights into potential investment opportunities and risks. Analyzing financial statements, management teams, competitive advantages, and growth prospects of individual companies can help identify attractive international stocks. Evaluating fund managers' performance and track record can provide insights into the quality and consistency of actively managed international mutual funds. Creating a well-diversified international portfolio involves selecting investments that align with your objectives, risk tolerance, and desired level of exposure. Regularly reviewing and monitoring your international investments can help identify emerging risks, performance trends, and potential rebalancing needs. Tracking Key Performance Indicators (KPIs) such as returns, volatility, and risk-adjusted performance can help evaluate the success of your international investments. Comparing the performance of your international investments against relevant benchmarks or indices can provide valuable insights into their relative performance. Making adjustments to your international portfolio, such as adding or reducing exposure to specific investments or markets, can help maintain your desired risk and return profile. Financial advisors can provide expert guidance, personalized advice, and ongoing support to help investors navigate the complexities of international investing. Various types of financial advisors specialize in different aspects of international investing, including wealth managers, financial planners, and investment advisors. Financial advisors may charge fees based on assets under management (AUM), hourly rates, or flat fees. Understanding these fee structures can help you select an advisor that best fits your needs and preferences. When selecting a financial advisor, factors include experience, credentials, communication style, and alignment with your investment goals and objectives. Environmental, Social, and Governance (ESG) criteria evaluate a company's environmental, social, and governance practices, providing investors with insights into their investments' sustainability and ethical impact. Socially Responsible Investing (SRI) involves selecting investments based on specific ethical, social, or environmental criteria, often excluding companies or industries that do not meet these standards. Impact investing aims to generate measurable positive social or environmental impact alongside financial returns, often focusing on specific themes or issues such as clean energy, poverty alleviation, or gender equality. International investing is vital to a diversified investment portfolio, offering potential benefits such as higher returns, exposure to faster-growing economies, and access to unique opportunities. What Is International Investing?

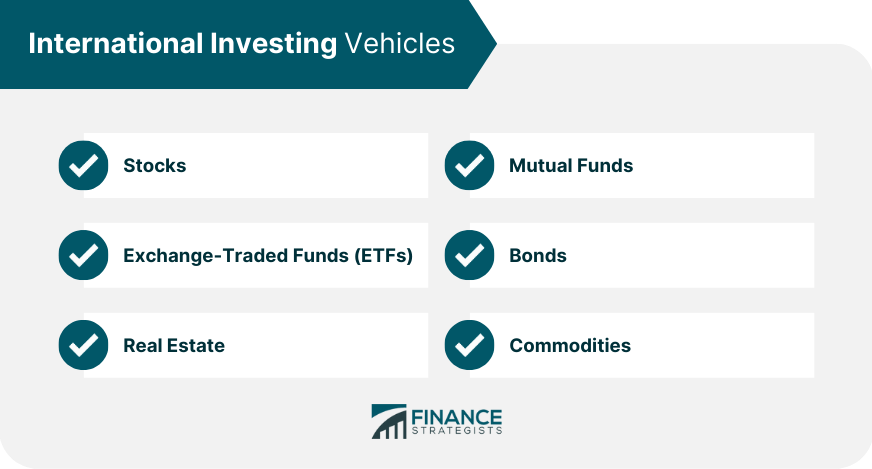

International Investing Vehicles

Stocks

Individual Stocks

American Depository Receipts (ADRs)

Mutual Funds

International Mutual Funds

Global Mutual Funds

Regional Mutual Funds

Country-Specific Funds

Exchange-Traded Funds (ETFs)

Bonds

Sovereign Bonds

Corporate Bonds

Eurobonds

Real Estate

Commodities

International Investing Strategies

Passive Investing

Index Funds

ETFs

Active Investing

Stock Picking

Mutual Fund Selection

Asset Allocation

Determining the Appropriate International Exposure

Rebalancing Strategies

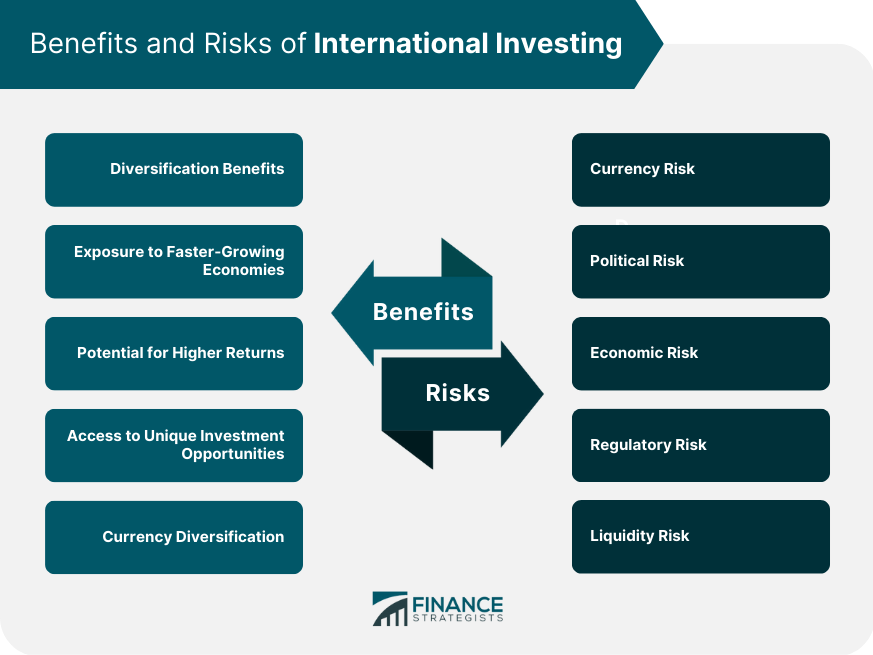

Benefits of International Investing

Diversification Benefits

Exposure to Faster-Growing Economies

Potential for Higher Returns

Access to Unique Investment Opportunities

Currency Diversification

Risks of International Investing

Currency Risk

Political Risk

Economic Risk

Regulatory Risk

Liquidity Risk

International Investing Process

Assessment of Investment Objectives

Determination of Investment Risk Tolerance

Research and Analysis

Macroeconomic Factors

Industry Analysis

Company-Specific Factors

Fund Manager Track Record

Portfolio Construction

Monitoring and Evaluation of Performance

Importance of Ongoing Monitoring

Key Performance Indicators (KPIs)

Benchmarking

Adjusting and Rebalancing

Role of Professional Financial Advisors in International Investing

Benefits of Working With a Professional

Types of Financial Advisors

Fee Structures

Selecting a Financial Advisor

Ethical and Sustainable International Investing

Environmental, Social, and Governance (ESG) Criteria

Socially Responsible Investing (SRI)

Impact Investing

Conclusion

By understanding the various types of investments, strategies, risks, and factors involved in international investing, investors can make more informed decisions and optimize their portfolios for long-term success.

It is essential to continue learning and seeking professional guidance to navigate the complex and ever-evolving world of international investing.

International Investing FAQs

International investing refers to investing in assets outside of your domestic market, such as stocks, bonds, and real estate in other countries.

International investing offers benefits such as diversification of risk, the potential for higher returns, access to emerging markets, and currency hedging opportunities.

International investing comes with risks such as currency, political, economic, and legal risks, which may affect the performance of your investment.

You can start international investing by researching and selecting a suitable investment strategy, choosing a reputable investment vehicle, and considering tax implications and currency risk.

While you can invest internationally on your own, working with a financial advisor can provide valuable guidance on developing an investment strategy, managing risks, and diversifying your portfolio effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.