Impact investing is an approach to investing that seeks to achieve positive social or environmental outcomes alongside financial returns. The goal of impact investing is to use capital to support solutions to some of the world's most pressing problems, such as climate change, poverty, and inequality. Impact investors are intentional in their investment decisions, seeking out opportunities that align with their values and goals. Impact investing has gained popularity in recent years, with more investors seeking to align their investments with their social and environmental values. The triple bottom line approach of impact investing is one of the key principles behind it. This approach seeks to achieve social and environmental outcomes alongside financial returns. The three components of the triple bottom line are people, planet, and profit. Impact investors seek to balance all three of these components in their investment decisions. Intentionality is another important principle in impact investing. This involves a deliberate approach to achieving social and environmental impact through investment decisions. Impact investors are intentional in their investments, seeking out opportunities that align with their values and goals. The principle of additionality is also essential in impact investing. It refers to investments that would not have been possible without impact investing. These are investments that are designed to achieve specific social or environmental outcomes that would not have been achievable through traditional investment methods. Measurement is another critical principle in impact investing. Impact investors are focused on measuring the social and environmental outcomes of their investments. This is essential to ensure that the investments are achieving the desired outcomes and to make adjustments if necessary. Thematic investing is a popular strategy in impact investing. It involves investing in specific sectors or themes, such as renewable energy or sustainable agriculture. Thematic investing allows investors to focus on the areas that are most important to them. Geographic investing is another strategy in impact investing. It involves investing in specific regions or countries. This strategy allows investors to target areas that are in the most need of investment for social and environmental impact. Asset class investing is another approach to impact investing. It involves investing in specific asset classes, such as private equity or debt. This strategy allows investors to choose the asset class that best aligns with their values and investment goals. Blended finance is a strategy that involves combining public and private capital for social and environmental impact. This approach allows investors to pool their resources with government or nonprofit organizations to achieve common goals. Education is a critical sector in impact investing. It is an area that has a significant impact on society and the environment. Impact investors can invest in education in various ways, including supporting educational initiatives in underserved communities, providing financial assistance for students, and investing in educational technology. Renewable energy is another sector in impact investing. Investing in renewable energy is a powerful way to address climate change and reduce our reliance on fossil fuels. Impact investors can invest in renewable energy in various ways, including financing wind farms and solar projects. Healthcare is a sector that has a significant impact on society. Impact investors can invest in healthcare in various ways, including funding research and development for new treatments, investing in healthcare technology, and supporting healthcare providers in underserved communities. Affordable housing is another sector in impact investing. This is an area that has a significant impact on society and the environment. Impact investors can invest in affordable housing in various ways, including financing the construction of affordable housing units and supporting organizations that provide housing assistance to low-income families. Sustainable agriculture is a critical sector in impact investing. Investing in sustainable agriculture is a way to address food security and climate change. Impact investors can invest in sustainable agriculture in various ways, including supporting small-scale farmers, investing in regenerative agriculture practices, and financing organic food companies. One of the challenges in impact investing is measuring the social and environmental impact of investments. Unlike financial returns, impact measurement can be subjective and challenging to quantify. Impact investors must develop clear metrics and standards to ensure that their investments are achieving the desired outcomes. Another challenge in impact investing is limited scalability. Impact investments are often smaller in size and may not have the same economies of scale as traditional investments. This can make it challenging to achieve significant impact on a large scale. The balance between achieving social and environmental impact and financial returns is also a challenge in impact investing. Impact investors must carefully consider the risk and return of their investments to ensure that they are achieving both their financial and impact goals. Microfinance is a successful impact investing story. It involves providing financial services to low-income individuals who lack access to traditional banking services. Microfinance institutions have helped millions of people around the world to access credit and improve their financial well-being. Green bonds are another successful impact investing story. These are bonds that are issued to finance environmental projects, such as renewable energy and sustainable transportation. Green bonds have grown in popularity in recent years, with investors seeking to support climate change mitigation efforts. Community development finance institutions (CDFIs) are also a successful impact investing story. These are nonprofit organizations that provide financial services and support to underserved communities. CDFIs have helped to finance affordable housing, small businesses, and community development projects in low-income areas. Think about the social or environmental issues that matter to you and what impact you want to achieve through your investments. Research different impact investment opportunities, including impact funds, individual investments, and social enterprises. Learn about the principles and strategies involved in impact investing. Consider working with a financial advisor who specializes in impact investing. They can help you identify investment opportunities that align with your values and goals. Evaluate the potential social or environmental impact of an investment, as well as the potential financial returns. Consider the risks and benefits of each investment opportunity. Consider starting with a small investment and gradually increasing your involvement as you become more familiar with impact investing. Track the social and environmental outcomes of your investments to ensure that they are achieving the desired impact. Impact investing is a powerful way to achieve both financial and social or environmental impact. It allows investors to align their investment goals with their values and make a difference in the world. While impact investing faces challenges, such as measuring impact and achieving scalability, there are successful impact investing stories that demonstrate the potential for positive change. With continued innovation and collaboration, impact investing has the potential to become a mainstream investment approach that helps to create a more sustainable and equitable world.What Is Impact Investing?

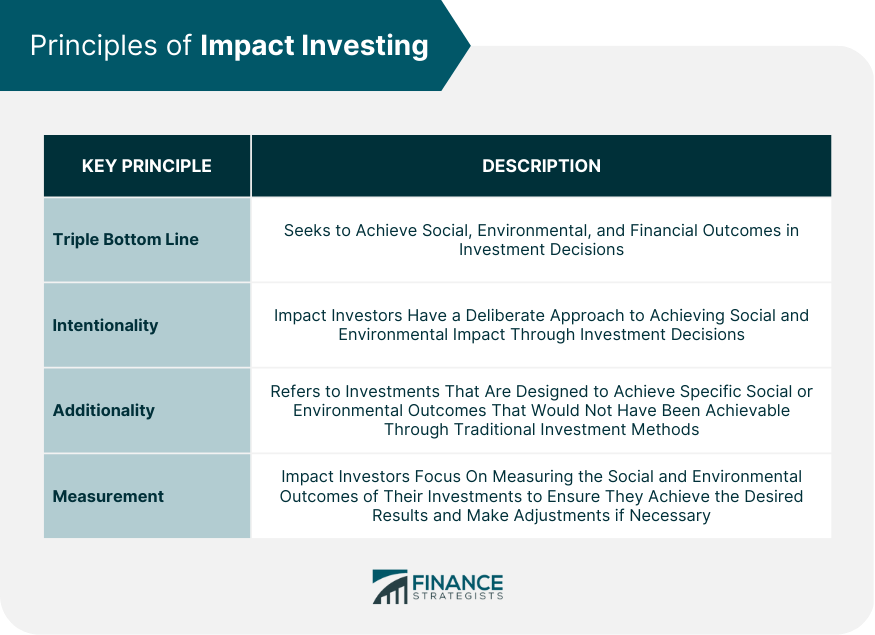

The Principles of Impact Investing

Triple Bottom Line

Intentionality

Additionality

Measurement

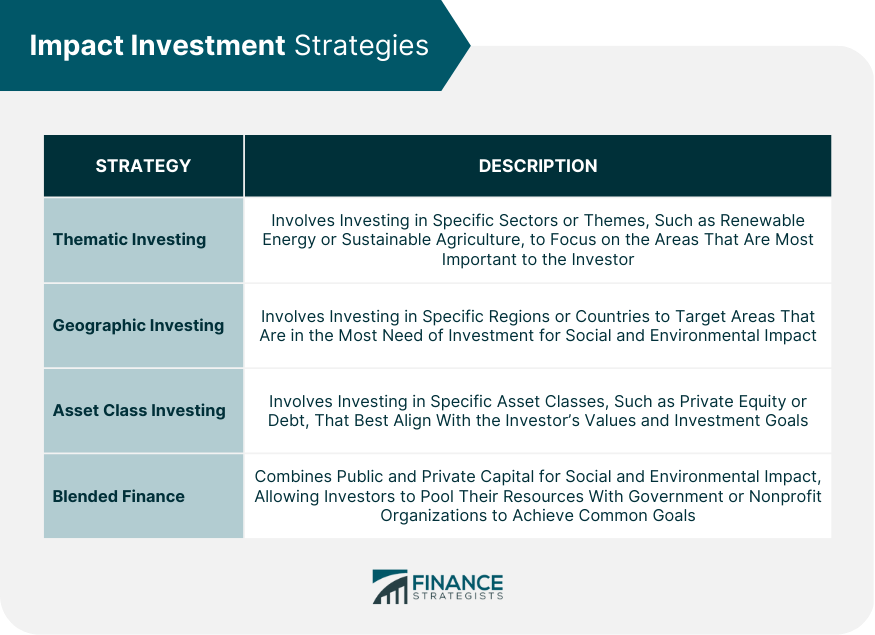

Impact Investment Strategies

Thematic Investing

Geographic Investing

Asset Class Investing

Blended Finance

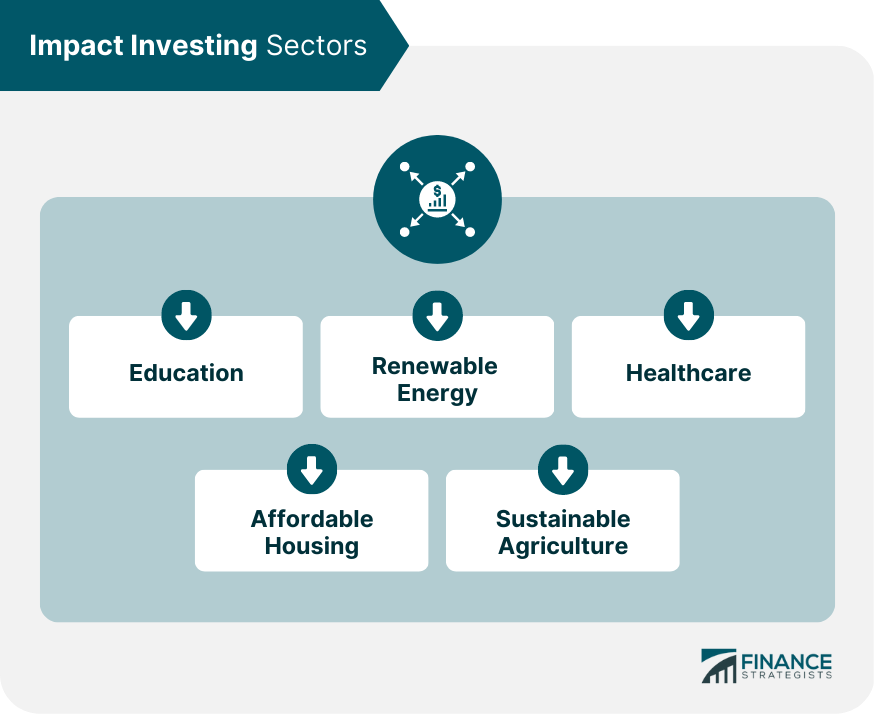

Impact Investing Sectors

Education

Renewable Energy

Healthcare

Affordable Housing

Sustainable Agriculture

Challenges in Impact Investing

Measuring Impact

Limited Scalability

Risk and Return

Impact Investing Success Stories

Microfinance

Green Bonds

Community Development Finance Institutions (CDFIs)

How to Get Started With Impact Investing

Define Your Values and Goals

Do Your Research

Seek Guidance

Assess the Impact and Financial Returns

Start Small

Measure Your Impact

Conclusion

Impact Investing FAQs

Impact investing differs from traditional investing in that it seeks to achieve both financial and social or environmental returns. Traditional investing focuses solely on generating financial returns for investors.

Impact investors measure the social and environmental impact of their investments by using metrics and standards to assess the outcomes of their investments. This can include measures such as carbon emissions reductions, job creation, and improved access to education or healthcare.

Yes, impact investing can generate competitive financial returns. While impact investors prioritize social and environmental outcomes, they also aim to generate financial returns that are comparable to traditional investments.

Impact investors focus on a variety of sectors, including renewable energy, sustainable agriculture, affordable housing, healthcare, and education. These sectors are areas where investments can have significant social or environmental impact.

To get started with impact investing, you can begin by researching impact investment opportunities and learning about the principles and strategies involved. You can also work with a financial advisor who specializes in impact investing to identify investment opportunities that align with your values and goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.