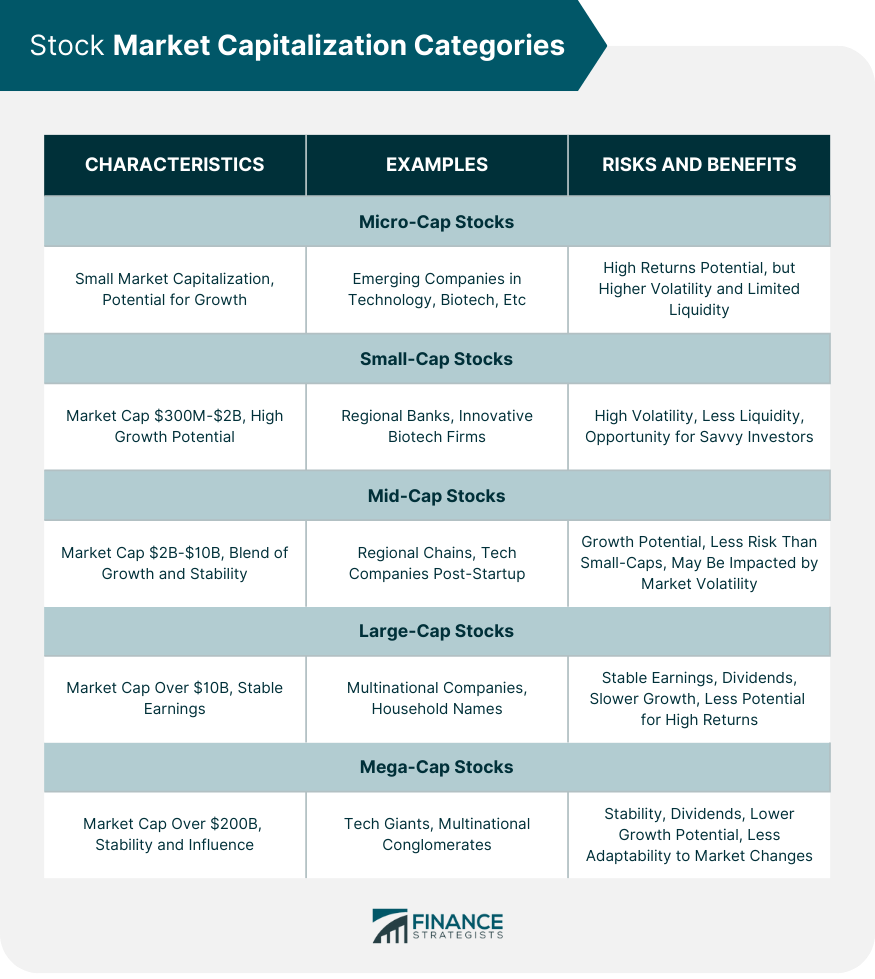

Market capitalization, or market cap, is the combined value of a company's outstanding stock. It is an estimate of the total value of a company. It denotes the total dollar market value of a company's outstanding shares of stock. It is calculated by multiplying a company's outstanding shares by the current market price of one share People often divide companies into different size categories based on their market caps: Some have also used the terms mega-cap to refer to companies over $200 billion, and nano-cap for companies under $50 million. However, there are no exact definitions for any of these categories, so the cutoffs can vary greatly. These divisions allow for easier comparison between companies and can aid investors in developing diversified portfolios. Market cap categories also influence an investment portfolio's diversification. Different categories carry varying degrees of risk, return potential, and correlation with the broader market. Micro-cap stocks are characterized by their small market capitalization, typically ranging from a few million to a few hundred million dollars. These stocks represent companies with relatively low levels of market capitalization and are often considered to be at the lower end of the investment spectrum in terms of size. Micro-cap stocks are known for their potential to deliver high returns due to their growth prospects and the possibility of being undervalued by the market. Examples of micro-cap stocks include emerging companies in sectors such as technology, biotechnology, and renewable energy. These companies may be in the early stages of development or operating in niche markets, offering unique products or services. Some well-known micro-cap stocks include NovaGold Resources Inc., Everspin Technologies Inc., and Resonant Inc. On the one hand, the potential for significant returns exists, as these stocks have room for substantial growth. However, micro-cap stocks are also associated with higher volatility, limited liquidity, and the potential for fraudulent activities or corporate governance issues. Therefore, careful research, due diligence, and diversification are essential when considering investments in micro-cap stocks. Small-cap stocks represent companies with a market capitalization ranging from $300 million to $2 billion. These are typically younger companies that serve niche markets or are in the early stages of development. Such companies are often characterized by high growth potential but also high volatility and risk, due to less predictable earnings and a lack of extensive financial history. Small-cap companies tend to be underfollowed by Wall Street analysts, which can lead to less efficient pricing and opportunities for savvy investors. They often have less liquidity than larger cap stocks, which can lead to wider bid-ask spreads and price volatility. Companies in the small-cap category are numerous and span various sectors. Examples might include a regional bank expanding into new markets, an innovative biotech firm in the initial stages of product development, or a local retailer venturing into e-commerce. Examples could be Plug Power Inc., a provider of alternative energy technology, or Stamps.com, an online postage service. Investing in small-cap stocks carries a blend of risks and rewards. On the upside, they offer high growth potential, as they serve niche or emerging markets, and can grow rapidly. These stocks also provide a great deal of diversification, as they often move independently of larger market trends. On the downside, small-cap stocks are often more volatile and riskier than their larger counterparts. They are more likely to be impacted by economic downturns and have less predictable earnings. Moreover, these companies often have less access to capital, which can inhibit their ability to weather financial downturns. Mid-cap stocks represent companies with a market capitalization between $2 billion and $10 billion. They fall between small and large-cap stocks, offering a blend of growth and stability. Mid-cap companies are often in a phase of expansion and growth, making them attractive to investors looking for growth potential but with less risk compared to small-cap stocks. Mid-cap stocks often receive less attention from analysts and the media, providing opportunities for astute investors to identify undervalued stocks. These companies may also offer more room for growth compared to large-cap stocks, which are typically already established in their markets. Mid-cap stocks span a range of industries and sectors. Examples include regional chains poised to become national brands, tech companies that have successfully navigated the start-up phase, or manufacturing firms expanding their production capabilities. A few examples are Crocs Inc., a footwear company, or Logitech International, a provider of personal peripherals for digital products. Mid-cap stocks carry both risk and reward for investors. On the positive side, they offer growth potential as they may be in a phase of expansion. These stocks often offer more stability and predictability compared to small-cap stocks but more room for growth compared to large-cap stocks. However, mid-cap stocks can also be riskier than large-cap stocks. They may be more susceptible to market volatility and may have less access to capital compared to larger companies. Their earnings may also be less predictable than those of larger companies, adding to their risk profile. Large-cap stocks represent companies with a market capitalization of over $10 billion. They are often household names with well-established market positions and stable earnings. Such stocks are frequently considered more conservative investments because they tend to grow more slowly and steadily compared to smaller companies. Large-cap companies often pay dividends, making them attractive to income-focused investors. Moreover, they usually have more international exposure, which can provide some protection against domestic market downturns. Large-cap companies are typically household names that operate across multiple geographies and sectors. Examples could be Microsoft, a multinational technology company, or Johnson & Johnson, a global healthcare firm. These companies typically have robust financial profiles and are leaders in their respective industries. Large-cap stocks offer certain benefits but also carry potential downsides. The benefits include stability and predictability. As large, established companies, they are often less volatile during market downturns. Many large-cap stocks pay dividends, providing a steady stream of income in addition to potential capital appreciation. However, large-cap stocks also have their disadvantages. They often grow slower than smaller companies, which can limit their potential returns. They are also more closely followed by analysts, which can make it harder to find undervalued stocks in this category. Mega-cap stocks are defined as companies with a market capitalization of over $200 billion. These are the largest and most established companies in the world. They are often industry leaders and can exert significant influence on global economies and markets. Because of their size, mega-cap companies often have more stable and predictable earnings compared to smaller companies. They also frequently pay dividends, which can be an attractive feature for income-focused investors. Their size and stability can make them a solid foundation for a diversified investment portfolio. Mega-cap companies often have a global reach and operate across multiple sectors. Examples include tech giants like Apple and Amazon, as well as multinational conglomerates like Berkshire Hathaway. Investing in mega-cap stocks offers a unique blend of risks and rewards. On the plus side, these stocks are generally considered to be stable and reliable investments. They are less likely to be affected by short-term market volatility, and their size allows them to weather economic downturns better than smaller companies. Many mega-cap companies also pay dividends, providing a consistent income stream for investors. On the downside, mega-cap stocks may offer lower growth potential than smaller companies. Their size can make it difficult for them to adapt quickly to market changes or to innovate. They are also closely watched by market analysts, which can make it harder for investors to find undervalued stocks in this category. Market capitalization categories can be influenced by a variety of factors, including company size and revenue, market performance and investor sentiment, and industry and sector trends. Company size and revenue are key determinants of a company's market capitalization. As a company grows in size and increases its revenue, its market cap is likely to increase. This can cause a company to move from one market cap category to another. For example, a successful small-cap company may grow into a mid-cap or even a large-cap company over time. On the flip side, if a company's revenue declines or it experiences a contraction in its business, its market cap can decrease, causing it to drop into a lower market cap category. Therefore, tracking a company's growth and revenue trends can provide insights into potential changes in its market cap category. Market performance and investor sentiment can significantly influence a company's market capitalization. A bull market, characterized by rising stock prices, can increase a company's market cap. Conversely, a bear market, characterized by falling stock prices, can decrease a company's market cap. Investor sentiment, or the overall attitude of investors towards a particular company or the market as a whole, can also impact market cap. Positive sentiment can drive up stock prices, increasing a company's market cap, while negative sentiment can have the opposite effect. Industry and sector trends can also influence market capitalization categories. Industries or sectors that are growing or are expected to grow may see an increase in the market cap of companies within them. Conversely, industries or sectors that are declining or facing challenges may see a decrease in the market cap of their companies. For example, during the tech boom of the late 1990s and early 2000s, many tech companies saw their market caps skyrocket. However, during the financial crisis of 2008-2009, many financial companies saw their market caps shrink dramatically. Growth investing is a strategy that focuses on companies that are expected to grow at an above-average rate compared to other companies in the market. This strategy is often used for small-cap and mid-cap stocks, which have more growth potential. Growth investors are not as concerned with a company's current valuation but are more interested in its future potential. They are willing to pay a premium for stocks that they believe will grow rapidly in the future. While this strategy can offer high returns, it can also be riskier, as growth stocks can be more volatile than the broader market. Value investing is a strategy that focuses on buying stocks that appear to be underpriced compared to their intrinsic value. This strategy is often used for large-cap and mega-cap stocks, which are more likely to be undervalued. Value investors seek out companies that are trading for less than their true value, often due to temporary setbacks or market overreactions. They believe that the market will eventually recognize the company's true value, leading to a rise in the stock price. While this strategy can offer steady returns, it requires a thorough analysis of a company's fundamentals and a patient, long-term approach. Blend investing is a strategy that combines growth and value investing. This strategy can provide a balance of risk and reward and can be used across all market capitalization categories. Blend investors look for companies that offer both growth potential and value. They believe that by diversifying across different types of stocks, they can optimize their returns while reducing risk. This approach requires a well-diversified portfolio and a willingness to adjust the balance of growth and value stocks based on market conditions. Market capitalization categories offer a way to categorize companies based on size and can provide insights into a company's risk profile and growth potential. Micro-cap stocks, with their small market capitalization, present opportunities for high returns but come with higher volatility and limited liquidity. Small-cap stocks offer high growth potential but also carry greater risk and volatility. Mid-cap stocks strike a balance between growth and stability, providing investors with growth potential and a lower risk profile compared to small-cap stocks. Large-cap stocks offer stability, predictable earnings, and dividends but may have slower growth. Mega-cap stocks, being the largest and most established companies, provide stability, global influence, and often pay dividends. Factors influencing market capitalization categories include company size and revenue, market performance, investor sentiment, and industry trends. Different investing strategies, such as growth investing for small-cap and mid-cap stocks and value investing for large-cap and mega-cap stocks, cater to different investor preferences and risk appetites. What Is Market Cap?

Market Cap Categories

Micro-Cap Stocks

Characteristics

Examples

Risks and Benefits

Small-Cap Stocks

Characteristics

Examples

Risks and Benefits

Mid-Cap Stocks

Characteristics

Examples

Risks and Benefits

Large-Cap Stocks

Characteristics

Examples

Risks and Benefits

Mega-Cap Stocks

Characteristics

Examples

Risks and Benefits

Factors Influencing Market Capitalization Categories

Company Size and Revenue

Market Performance and Investor Sentiment

Industry and Sector Trends

Investing Strategies for Different Market Capitalization Categories

Growth Investing for Small-Cap and Mid-Cap Stocks

Value Investing for Large-Cap and Mega-Cap Stocks

Blend Investing for Diversification

Conclusion

Market Capitalization Categories FAQs

Market Cap is short for Market Capitalization.

Market Capitalization is the aggregate dollar-value of all outstanding shares of a company’s stock.

A company’s market cap is the first way an investor assesses how “big” a company is.

It is important to remember that a company’s market cap may be different than the true economic worth of their assets and ability to generate profits—market cap can be viewed as what the markets perceive a company to be worth.

Market capitalization is calculated by multiplying the total number of a company's outstanding shares by their current price per share.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.