Grid trading is a systematic trading strategy that involves placing orders at pre-determined intervals in a grid-like pattern. These orders consist of both buy and sell positions, usually equidistant from one another. The primary goal of grid trading is to capture profits from market fluctuations within a specific price range. Grid trading is designed to take advantage of short-term price fluctuations in range-bound markets. By placing buy and sell orders at regular intervals, traders can capitalize on market moves without needing to predict the direction of the trend. This approach is particularly effective in markets characterized by high volatility and periods of consolidation. The grid size refers to the distance between each buy and sell order in the grid. The size determines the profit potential and risk exposure for each trade. A smaller grid size increases the number of trades and potential profits, while a larger grid size reduces the frequency of trades and potential risks. Grid levels are the pre-defined price points at which the buy and sell orders are placed. The number of grid levels determines the overall size of the grid and its ability to capture market movements. More grid levels increase the opportunities for profit, but also increase the complexity of managing the grid. The grid range is the span of price levels covered by the grid. It is determined by the highest and lowest price points within the trading range. A wider range allows the grid to capture more significant price fluctuations, while a narrower range can lead to fewer opportunities for profit. Entry and exit points are the price levels at which the trader enters and exits the market. These points are usually set based on a combination of technical and fundamental analysis. By setting appropriate entry and exit points, traders can maximize their profits and minimize their risk exposure. In symmetrical grid trading, the grid is centered around a starting price, with equal distances between buy and sell levels. This strategy assumes that the market is equally likely to move up or down. Traders can benefit from price fluctuations in both directions, but they may face increased risk during strong trends. Asymmetrical grid trading involves setting different distances between the buy and sell levels. This strategy can be useful when the trader anticipates a particular direction of the market movement. The grid can be skewed to favor either buy or sell orders, depending on the trader's market outlook. Multi-grid trading involves setting up multiple grids for different price ranges. This strategy can capture broader market movements and increase profit potential. However, it also requires more careful management and higher capital outlay. Automated grid trading systems use algorithms to place and manage orders. These systems can be programmed to adjust the grid size, levels, and range based on real-time market conditions. Automated grid trading can reduce the need for constant monitoring, but it also requires a thorough understanding of the strategy and its underlying algorithms. Grid trading takes advantage of market volatility by placing orders at various price levels. This allows traders to profit from price fluctuations without needing to predict the direction of the trend. As prices move up and down, traders can realize profits on both the buy and sell side of the grid. In range-bound markets, where prices oscillate within a narrow range, grid trading can be highly effective. By placing buy and sell orders at regular intervals, traders can capitalize on price movements without needing to identify the direction of the trend. This strategy is especially suitable for markets characterized by high volatility and periods of consolidation. Grid trading is a relatively straightforward strategy that can be adapted to various market conditions. The grid can be adjusted by changing the grid size, levels, and range to fit the current market environment. Additionally, the strategy can be applied to different asset classes, including forex, cryptocurrencies, and commodities. Since grid trading involves placing multiple orders at various price levels, the risk exposure for each trade is relatively low. This reduces the impact of a single adverse trade on the trader's overall portfolio. Moreover, the grid can be adjusted to mitigate risks further by employing effective risk management techniques. During strong trending markets, grid trading can result in increased market exposure and potential losses. As prices move in one direction, traders may experience consecutive losses on one side of the grid. This risk can be mitigated by employing proper risk management techniques and adapting the grid strategy to fit the current market environment. Grid trading can incur high transaction costs due to the large number of trades executed within the grid. These costs include spreads and commissions charged by brokers. Traders must take these costs into account when setting their profit targets and risk thresholds. Managing risk in a grid trading strategy can be complex due to the large number of open positions at any given time. It requires ongoing monitoring and adjustments to the grid to prevent excessive losses. Furthermore, the use of stop-loss orders and other risk management tools can be challenging in a grid trading environment. While grid trading can be effective in range-bound markets, its effectiveness decreases in trending or sideways markets. Without significant price movements, opportunities for profit are limited, and the risk of losses increases. Traders must be aware of market conditions and adjust their strategies accordingly. The first step in implementing a grid trading strategy is to analyze the market and select the appropriate asset. Traders should consider factors like market volatility, trading volume, and the asset's historical price movements. Next, traders need to determine the grid size and levels. This involves setting the distance between the buy and sell orders and the number of grid levels. These parameters should be based on the trader's risk tolerance and profit targets. After setting up the grid, traders need to establish their entry and exit points. These are the price levels at which they will enter and exit the market. These points should be set based on a combination of technical and fundamental analysis. Once the grid is set up, it needs to be constantly monitored and adjusted based on market conditions. This includes adjusting the grid size, levels, and range, as well as managing open positions. Risk management is crucial in grid trading. Traders should set stop-loss and take-profit levels for each trade, and they should have a plan for managing the overall risk of their portfolio. The profitability ratio is a key performance metric that measures the profitability of a trading strategy. It is calculated as the total profit divided by the total loss. A higher profitability ratio indicates a more profitable strategy. The win-loss ratio measures the number of winning trades compared to the number of losing trades. A higher win-loss ratio indicates a more successful trading strategy. Maximum drawdown measures the largest loss from a peak to a trough in a trading account. It is a key measure of risk in a trading strategy. Risk-adjusted return measures the return of an investment relative to the risk taken to achieve that return. It is a key measure of the effectiveness of a trading strategy. Forex grid trading involves buying and selling currency pairs at pre-defined levels within a grid. Given the high liquidity and volatility in the forex market, grid trading can be particularly effective. Cryptocurrency grid trading involves trading digital currencies within a grid. With the high volatility in cryptocurrency markets, this strategy can be profitable. However, it also comes with increased risk due to the highly speculative nature of these markets. Commodity grid trading involves trading commodities like oil, gold, and agricultural products within a grid. This strategy can be effective considering the cyclical nature and high volatility of commodity markets. Grid trading is most effective in volatile, range-bound markets. Traders should carefully analyze market conditions before implementing a grid trading strategy. Risk management is crucial in grid trading. Traders should establish clear rules for setting stop-loss and take-profit levels, and for managing the overall risk of their portfolio. In grid trading, it's important to balance the potential reward of each trade with the associated risk. This involves carefully setting the grid size, levels, and range to maximize profit potential while minimizing risk. Traders should regularly evaluate the performance of their grid trading strategy. This includes monitoring key performance metrics like the profitability ratio, win-loss ratio, maximum drawdown, and risk-adjusted return. In conclusion, grid trading is a systematic trading strategy that involves placing buy and sell orders at regular intervals within a grid. It is designed to capitalize on market volatility and short-term price fluctuations. The success of grid trading depends on careful market analysis, effective risk management, and ongoing monitoring and adjustment of the grid. While the strategy has its benefits, such as the ability to profit in volatile, range-bound markets, it also has limitations, including the potential for high transaction costs and increased market exposure during strong trends. For those interested in implementing a grid trading strategy, it can be beneficial to seek professional guidance. Financial advisors or experienced traders can provide valuable insights and guidance on setting up and managing a grid, as well as managing the risks associated with grid trading.What Is Grid Trading?

Grid Trading Strategy Components

Grid Size

Grid Levels

Grid Range

Entry and Exit Points

Grid Trading Variations

Symmetrical Grid Trading

Asymmetrical Grid Trading

Multi-Grid Trading

Automated Grid Trading Systems

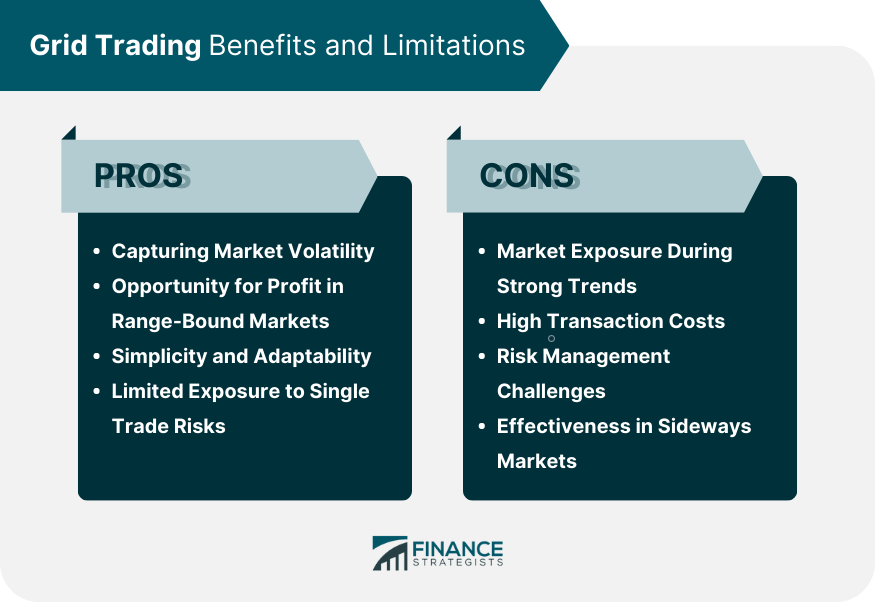

Grid Trading Benefits

Capturing Market Volatility

Opportunity for Profit in Range-Bound Markets

Simplicity and Adaptability

Limited Exposure to Single Trade Risks

Grid Trading Limitations

Market Exposure During Strong Trends

High Transaction Costs

Risk Management Challenges

Effectiveness in Sideways Markets

Steps to Implement a Grid Trading Strategy

Market Analysis and Selection

Determination of Grid Size and Levels

Setting up Entry and Exit Points

Monitoring and Adjusting the Grid

Risk Management Implementation

Grid Trading Performance Metrics

Profitability Ratio

Win-Loss Ratio

Maximum Drawdown

Risk-Adjusted Return

Grid Trading Examples

Forex Grid Trading

Cryptocurrency Grid Trading

Commodity Grid Trading

Grid Trading Tips and Best Practices

Choosing Appropriate Market Conditions

Establishing Clear Risk Management Rules

Balancing Risk and Reward

Evaluating Performance Regularly

Final Thoughts

Grid Trading FAQs

Grid trading is a trading strategy in which multiple orders are placed at predetermined intervals or price levels on both sides of the current market price. It involves buying and selling assets within a defined range to take advantage of market volatility.

In grid trading, a trader sets up a grid of buy and sell orders above and below the current market price. As the price fluctuates, these orders are executed, creating a series of trades. Profits are generated when the price moves within the grid, allowing the trader to buy low and sell high multiple times.

Grid trading has several advantages. First, it can generate profits in both trending and ranging markets. Second, it allows for systematic trading and removes the need for constant monitoring. Third, it provides a structured approach to risk management by setting predetermined stop-loss and take-profit levels for each trade.

While grid trading can be profitable, it also carries certain risks. One of the main risks is the potential for accumulating open positions if the market moves strongly in one direction. This can result in increased exposure and potential losses. It's important to carefully manage position sizing and monitor market conditions to mitigate these risks.

Yes, grid trading can be applied to various financial markets, including stocks, commodities, forex, and cryptocurrencies. The underlying principle of grid trading remains the same across these markets, but it's important to consider the specific characteristics and volatility of each market when implementing a grid trading strategy.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.