Maximum Drawdown is a risk metric used in finance to quantify the largest decline in an investment's value over a specified time period. It measures the percentage loss from the peak value of an investment to its lowest point (trough) before a new peak is attained. Investors and fund managers commonly use MDD to assess the historical risk of various assets and investment strategies. MDD is an important risk assessment tool because it captures the worst-case scenario for an investment, providing insight into the potential magnitude of losses during periods of market turmoil. This information is crucial for investors when evaluating the riskiness of an investment and making asset allocation decisions. MDD plays a significant role in investment strategies and portfolio management, as it helps investors understand the historical risk of their investments. By incorporating MDD into their decision-making process, investors can better assess their risk tolerance and make informed choices about asset allocation and risk management strategies. Historical Price or Return Data: To calculate MDD, historical price or return data for the investment in question is needed. Time Period Under Consideration: The time period for which the MDD is to be calculated must also be specified. 1. Identify Peak Values: The first step in calculating MDD is to identify the peak values of the investment within the chosen time period. These are the highest points in the investment's value before a decline occurs. Sample Dataset: Suppose an investor wants to calculate the MDD for a particular stock over a one-year period. The investor would gather historical price data for the stock during that time. Calculation Walkthrough: The investor would then identify the peak and trough values, calculate the percentage drops from peak to trough, and identify the largest percentage drop as the MDD. Interpretation of Results: The resulting MDD value represents the worst decline in the stock's value over the one-year period, providing insight into the investment's historical risk. MDD is a valuable tool for measuring the risk of a portfolio, as it captures the largest historical decline in value. By understanding the MDD of various assets in a portfolio, investors can better assess their overall risk exposure and make more informed decisions about asset allocation and risk management strategies. Lack of Information on Frequency and Duration of Drawdowns: MDD only provides information on the largest historical decline in value if it gives insight into the frequency or duration of drawdowns. Insensitivity to the Shape of the Loss Distribution: MDD does not account for the shape of the loss distribution, which means it may not fully capture the investment's risk profile. Value at Risk (VaR): VaR is a widely used risk metric that estimates the maximum loss an investment or portfolio can experience over a specified time horizon with a given probability. Conditional Value at Risk (CVaR): CVaR, also known as Expected Shortfall, is another risk measure that captures the average loss in the worst-case scenarios exceeding the VaR level. Standard Deviation and Other Volatility Measures: Volatility measures, such as standard deviation, provide additional insight into the riskiness of an investment by quantifying the variability of returns. Risk-Averse Investors: Investors with low-risk tolerance should prioritize investments with low MDDs, which indicate a lower likelihood of experiencing large losses. Risk-Seeking Investors: On the other hand, risk-seeking investors may be willing to accept investments with higher MDDs in pursuit of higher potential returns. Diversification to Reduce Portfolio Drawdown: One way to mitigate the impact of MDD on a portfolio is through diversification. Tactical Allocation Based on Drawdown Thresholds: Investors can also use MDD to inform tactical asset allocation decisions. Stop-Loss Orders: Investors can use stop-loss orders to limit the potential losses on individual investments. A stop-loss order automatically sells an investment when its value declines to a predetermined level, thereby reducing the risk of further losses. Portfolio Insurance: Portfolio insurance strategies, such as options or futures contracts, can be used to hedge against potential losses in a portfolio. By purchasing insurance-like instruments, investors can protect their portfolios from significant declines in value. Dynamic Asset Allocation: Dynamic asset allocation involves adjusting the portfolio's asset mix in response to changing market conditions or the investor's risk tolerance. Performance Comparison Using MDD: MDD can be used to compare the performance of different investment managers or funds. MDD-Adjusted Return Metrics: Investors can also use MDD-adjusted return metrics, such as the Calmar or Sterling ratios, to compare the risk-adjusted performance of different investment options. Stress Testing and MDD: Financial regulators may require institutions to conduct stress tests, which involve simulating the impact of adverse market conditions on their portfolios. Capital Adequacy Standards: Regulatory bodies, such as the Basel Committee on Banking Supervision, set capital adequacy standards for financial institutions. Retirement Planning: MDD is an important consideration for individual investors, especially when planning for retirement. Investment Horizon Considerations: The investment horizon, or the length of time an investor plans to hold an investment, also influences the importance of MDD. MDD is a critical risk metric in finance, providing investors with valuable information about the historical risk of their investments. While MDD is an important tool for measuring investment risk, it is crucial to use a comprehensive approach to risk management by considering additional risk metrics, such as VaR, CVaR, and standard deviation. Incorporating MDD into investment decision-making can help investors better manage their risk exposure, allocate assets more effectively, and implement appropriate risk management strategies. What Is a Maximum Drawdown (MDD)?

Calculation of Maximum Drawdown

Data Requirements

This data can be obtained from various financial data sources, such as stock exchanges, financial news websites, or commercial data providers.

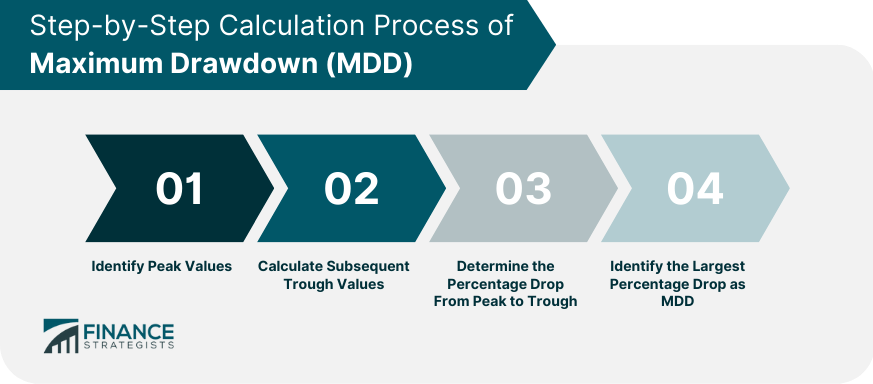

This could range from a few months to several years, depending on the investor's preferences and the nature of the investment.Step-by-Step Calculation Process

2. Calculate Subsequent Trough Values: The subsequent trough values must be determined after identifying peak values. These are the lowest points in the investment's value after a peak and before a new peak is reached.

3. Determine the Percentage Drop From Peak to Trough: The percentage drop in value from each peak to its corresponding trough must be calculated.

4. Identify the Largest Percentage Drop as MDD: The largest percentage drop among all peak-to-trough declines is considered the MDD for the investment during the specified time period.

Illustrative Example

Maximum Drawdown and Risk Management

MDD as a Measure of Portfolio Risk

Limitations of MDD as a Risk Metric

This limitation can be addressed by using complementary risk metrics, such as drawdown duration and frequency.

For example, two investments with the same MDD may have different loss distributions, with one being more prone to extreme losses than the other.Complementary Risk Measures

Unlike MDD, VaR provides a more comprehensive view of the loss distribution.

CVaR is considered a more robust measure of tail risk than VaR.Using Maximum Drawdown in Investment Strategies

Risk Tolerance and MDD

Risk-averse investors can better manage their risk exposure by focusing on assets with smaller historical drawdowns.

However, these investors should still be mindful of the potential magnitude of losses and implement appropriate risk management strategies.Incorporating MDD into Asset Allocation Decisions

Investing in a mix of assets with low or negative correlations can reduce the overall drawdown risk in their portfolios.|

By setting drawdown thresholds for individual assets or the overall portfolio, investors can rebalance their holdings when these thresholds are breached, potentially reducing the risk of large losses.Implementing Risk Management Strategies

By actively managing the portfolio, investors can mitigate the impact of MDD and other risks on their investments.Real-life Applications of Maximum Drawdown

Evaluating Investment Managers and Funds

A lower MDD indicates a better ability to manage risk during periods of market decline, which may be an attractive feature for investors seeking downside protection.

These metrics consider both returns and MDD, providing a more comprehensive view of an investment's performance.Regulatory Requirements

MDD can be used as a part of these stress tests to evaluate the resilience of an institution's portfolio during severe market downturns.

MDD can be a factor in determining the required capital reserves to protect against potential losses stemming from large drawdowns.Individual Investors and MDD

By understanding the MDD of their investments, investors can better assess the potential impact of market downturns on their retirement savings and adjust their investment strategies accordingly.

Investors with shorter investment horizons may be more sensitive to drawdown risk, as they have less time to recover from large losses.

Understanding the MDD of their investments can help these investors make more informed decisions about their asset allocation and risk management strategies.Conclusion

By understanding the MDD of various assets, investors can better assess their risk tolerance and make more informed decisions about asset allocation, investment strategies, and risk management.

By combining multiple risk measures, investors can better understand their investments' risk profiles and make better-informed decisions.

By considering MDD in conjunction with other risk measures, investors can improve their overall investment process and enhance their long-term financial outcomes.

Maximum Drawdown (MDD) FAQs

Drawdown is the maximum peak-to-trough decline in an investment or portfolio's value over a specific period.

Maximum Drawdown is calculated as the percentage difference between the peak value and the trough value of an investment or portfolio, divided by the peak value.

Maximum Drawdown is a crucial risk metric that helps investors understand the potential downside risk of an investment. A higher Maximum Drawdown indicates a higher level of risk.

No, Maximum Drawdown cannot be positive. It represents the percentage decline from the peak value, which is always negative.

Investors can use Maximum Drawdown to assess an investment's risk and make informed investment decisions. By comparing the Maximum Drawdown of different investments, investors can select the one with a lower risk profile.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.