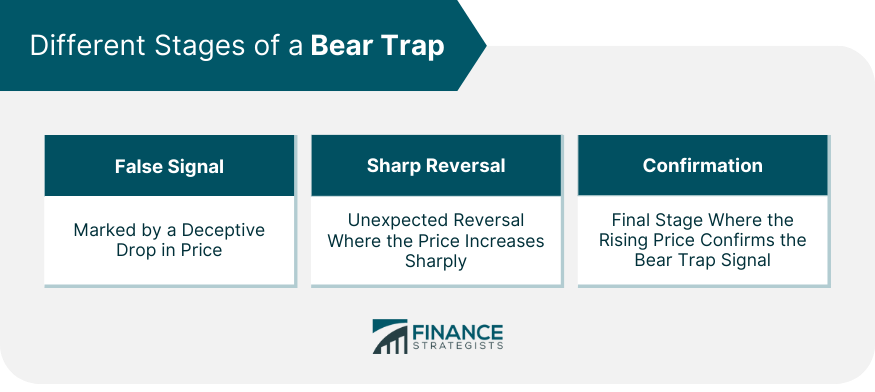

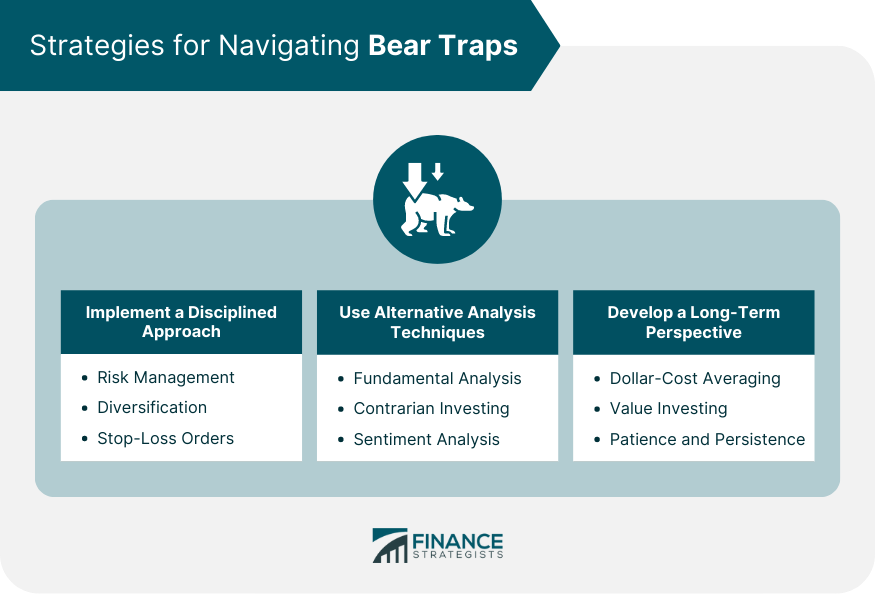

A bear trap is a technical pattern that occurs when the performance of a stock or index incorrectly signals a decline. In essence, it tricks investors into thinking the value of an asset will drop, but instead, it reverses direction, potentially leading to substantial losses for those who acted on the false signal. The bear trap gets its name because the trapped investors are those with a bearish outlook - those expecting the market to decline. Understanding bear traps is a crucial part of financial literacy for investors and traders alike. Misinterpreting a bear trap can lead to misguided decisions, financial losses, and missed opportunities. Knowledge about this phenomenon, on the other hand, can provide investors with the tools needed to avoid falling into these traps and, at times, even profit from them. Bear traps typically unfold in three stages: This is the initial stage of a bear trap, characterized by a drop in the price that breaks below a significant support level. This downward movement lures bearish traders into the market, creating the trap. The second stage is a sharp reversal in price, where the asset suddenly moves upwards. This dramatic shift traps the bears, who anticipated a further drop. The final stage is the confirmation of the trap when prices continue to rise, confirming that the bearish signal was false. Several indicators can help identify potential bear traps: An unusual spike in trading volume often accompanies a bear trap. This sudden increase in trading activity can indicate that more traders are selling their positions due to the perceived drop, fueling the bear trap's effectiveness. Multiple tools can help identify potential bear traps: Support and Resistance Levels: A false breakout below a key support level can signal a bear trap. Moving Averages: If the price dips below a significant moving average only to reverse quickly, it might indicate a bear trap. Relative Strength Index (RSI): A bear trap may be indicated when the RSI moves into oversold territory (below 30) and quickly rebounds. Excessively bearish market sentiment can often lead to bear traps. Extreme negativity may indicate that the downward movement is overdone and due for a reversal. Bear traps can trigger several psychological responses: Fear of Missing Out (FOMO): Traders, afraid to miss out on what seems to be a significant downtrend, may be tempted to join the bearish momentum, falling into the trap. Overconfidence: Investors may become overconfident in their bearish predictions, leading to hasty and risky decision-making. Panic Selling: Upon noticing the unexpected reversal, investors may panic and sell their positions to cut losses, thereby exacerbating the situation. There are significant financial consequences tied to bear traps: Losses Due to Incorrect Decisions: Acting on the false bearish signal can lead to substantial financial losses when the market reverses. Opportunity Costs: Investors who fall into the bear trap miss the opportunity to profit from the unexpected upward trend. Increased Trading Fees: The more trades an investor makes in response to the bear trap, the higher the trading fees they'll incur. Investments inherently carry a certain level of risk. However, a strategic investor can lessen these risks by establishing predefined limits on potential losses. This strategic approach is crucial in preventing significant damages stemming from the sudden unexpected occurrence of a bear trap. One of the tenets of a prudent investment approach is diversification. By maintaining a diverse portfolio that encompasses different sectors and asset classes to reduce the sting of a bear trap on overall investment performance. In essence, shouldering your investments on more than one investment or asset class reduces the potential risks associated with a downturn in any area. Stop-loss orders act as your safety net when a bear trap is sprung. By defining a limit on how much loss one is willing to accept, it can effectively prevent significant financial fallout. The stop-loss order, in essence, prevents further loss by selling the asset once its price hits a predetermined level. A disciplined approach can help investors navigate bear traps: Investors can also employ alternative analysis techniques: Evaluating the intrinsic value of a company can provide insight beyond the technical indicators that might suggest a bear trap. By analyzing financial statements, market conditions, and industry trends, investors can get a sense of a company's true value, often revealing discrepancies with current market prices. Adopting a contrarian approach—buying when others are selling and vice versa—can provide opportunities in the face of bear traps. This strategy relies on the belief that market sentiment often swings to extremes of optimism and pessimism, creating opportunities to buy undervalued stocks during market downturns or sell overvalued stocks during booms. Understanding the general market sentiment can provide context for potential bear traps. By analyzing sentiment indicators, such as investor surveys or behavioral biases, traders can get a sense of the market's mood and thus anticipate potential price reversals. In addition, studying social media sentiment can help in identifying sudden shifts in investor confidence that could signal the beginning or end of a bear trap. A long-term perspective can help investors navigate bear traps: Investing a fixed amount on a regular schedule, regardless of the price, can mitigate the impact of short-term price fluctuations and bear traps. By spreading out investments over time, dollar-cost averaging can reduce the risk of making a large investment at a potentially inopportune time. Focusing on undervalued assets can provide protection against bear traps by providing a margin of safety. This investment style seeks to capitalize on inefficiencies in the market by identifying stocks that are trading for less than their intrinsic value. Sticking to an investment strategy and resisting the urge to react to every market fluctuation can prevent falling into bear traps. In tumultuous market conditions, staying patient can help prevent hasty decisions driven by fear or greed. Bear traps are deceptive financial market patterns that can lead investors and traders to believe a decline in a stock or index will continue, only for the value to reverse unexpectedly. These traps typically involve three stages: the false signal, sharp reversal, and confirmation. Falling into a bear trap can have significant impacts on both investors and traders, with psychological effects like fear of missing out, overconfidence, and panic selling. Similarly, it has financial consequences such as losses due to incorrect decisions, missed opportunities, and increased trading fees. By understanding the intricacies of bear traps, investors can better prepare themselves to navigate these tricky market scenarios, minimize the negative impacts, and make more informed decisions. It is essential for market participants to learn from the past, develop appropriate strategies, and maintain a disciplined approach when dealing with bear traps and other complex financial market phenomena.What Is Bear Trap?

Different Stages of a Bear Trap

False Signal

Sharp Reversal

Confirmation

Identifying Bear Trap Indicators

Unusual Volume Spike

Technical Analysis Tools

Market Sentiment

Impact of Bear Traps on Investors and Traders

Psychological Effects

Financial Consequences

Strategies for Navigating Bear Traps

Implementing a Disciplined Approach

Risk Management

Diversification

Stop-Loss Orders

Using Alternative Analysis Techniques

Fundamental Analysis

Contrarian Investing

Sentiment Analysis

Developing a Long-Term Perspective

Dollar-Cost Averaging

Value Investing

Patience and Persistence

Final Thoughts

Bear Trap FAQs

A bear trap is a situation in the financial markets where a declining trend in a stock or index abruptly reverses direction, tricking bearish investors into believing the value will continue to drop. When the price unexpectedly rises, these investors may incur substantial losses.

Identifying a bear trap involves recognizing certain market indicators. These can include a sudden increase in trading volume, a false breakout below key support levels, or an oversold signal on the Relative Strength Index (RSI) that quickly rebounds. Excessively bearish market sentiment can also precede a bear trap.

The effects of a bear trap can be both psychological and financial. Psychologically, investors may experience fear of missing out (FOMO), overconfidence, or panic selling. Financially, investors can face significant losses, missed opportunities for profit, and increased trading fees due to incorrect decision-making based on the bear trap's false signals.

Investors can adopt several strategies to navigate bear traps effectively. These include implementing a disciplined approach with risk management measures, diversifying investments, and using stop-loss orders. Alternative analysis techniques like fundamental analysis, contrarian investing, and sentiment analysis can also be useful. Additionally, adopting a long-term perspective with methods like dollar-cost averaging and value investing can be beneficial.

Understanding bear traps is crucial because they can lead to significant financial losses for investors who act on the false signals these traps create. By understanding and identifying bear traps, investors can avoid falling into them and potentially even capitalize on the opportunities they present.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.