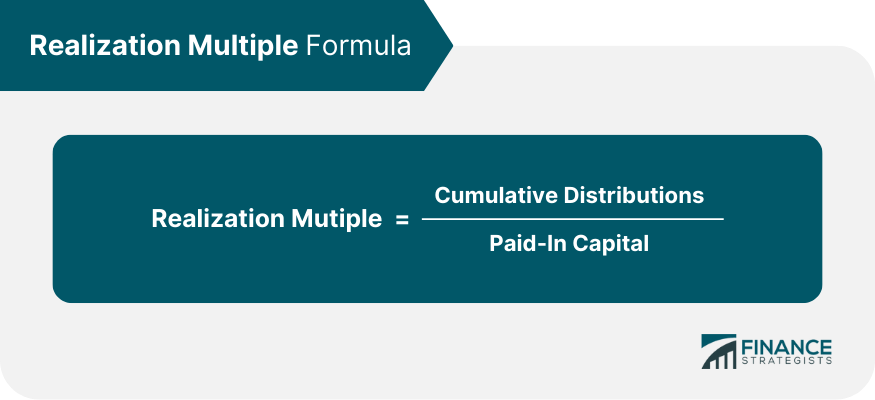

The realization multiple is a key metric in the world of finance that measures the return on investment. Specifically, it is the ratio of the total value returned to the investor at the end of an investment period to the total amount invested initially. This multiple measures the cumulative monetary gain or loss from an investment, expressed as a factor of the original investment. In financial analysis, the realization multiple is vital because it allows for a quick, straightforward assessment of an investment's performance. The multiple provides a broad-brush picture of the return an investor has realized from an investment over a specific period. By comparing realization multiples across a portfolio, investors can evaluate their investments relative success and adjust their strategies accordingly. The realization multiple is calculated by dividing the cumulative distributions from a fund, company, or project by the paid-in capital. The cumulative distributions are the total amount of money that has been paid out to investors, including both capital gains and dividends. The paid-in capital is the amount of money that investors have invested in the fund. The formula for calculating the realization multiple is straightforward: For example, if a fund has paid out $100 million in cumulative distributions to investors and has a paid-in capital of $50 million, then the realization multiple would be 2.0. This means that for every $1 invested in the fund, investors have received $2 in cumulative distributions. The realization multiple is a key metric for private equity investors, as it helps them to assess the performance of their investments. A high realization multiple indicates that an investment has performed well, while a low realization multiple indicates that an investment has performed poorly. The realization multiple is not without its limitations. One limitation is that it does not take into account the time value of money. This means that a realization multiple of 2.0 for a fund that has been invested in for 5 years is not necessarily the same as a realization multiple of 2.0 for a fund that has been invested in for 10 years. A fast-growing market can lead to a higher realization multiple as the company can rapidly increase its revenues and profits. The competitive landscape can affect the realization multiple. A company in a less competitive industry may achieve a higher realization multiple due to higher profit margins. The regulatory environment can also impact the realization of multiple. Companies in heavily regulated industries may face challenges that could lower their realization multiples. Rapid revenue and earnings growth can lead to a higher realization multiple as it may indicate a successful business model and a well-run company. Higher profitability and margins can result in a higher realization multiple. Profitable companies can often return more money to investors, leading to a higher return on investment. A company's management's quality and track record can significantly influence multiple realizations. Good management can often lead to better financial performance and, thus, a higher realization multiple. A higher realization multiple indicates that an investment has performed well, returning a multiple of the original investment. It signifies good returns and may suggest a successful investment strategy. There can be several reasons for a higher realization multiple, such as high growth rates, a successful business model, and favorable market conditions. It may also be due to the company's ability to generate high profits, leading to more substantial returns to investors. A lower realization multiple indicates that the investment has not performed as well, returning less than or just the original investment. This could suggest issues with the company's performance or unfavorable market conditions. A lower multiple could result from factors such as a slower growth rate, a less successful business model, lower profit margins, or adverse market conditions. The P/E ratio is another valuation metric often used in public markets. It is the ratio of a company's market capitalization to its annual net income. While both the P/E ratio and the realization multiple provide insights into an investment's performance, they serve different purposes. The P/E ratio is typically used for the relative valuation of public companies, while the realization multiple is more applicable for assessing return on individual investments. The DCF analysis is a more complex method of valuation that involves forecasting future cash flows and discounting them back to present value. Unlike the realization multiple, which is a backward-looking measure of past performance, the DCF analysis is forward-looking and considers future cash flow generation. However, the realization multiple can supplement the DCF analysis by measuring past investment performance. One of the main limitations of the realization multiple is that it does not account for future cash flows. It is a historical measure that only considers the cash returned to the investor up to the present. The realization multiple is sensitive to the assumptions used in the calculation, including the timing and amount of cash inflows and outflows. Market conditions can heavily influence the realization multiple, with volatility potentially leading to inaccurate representations of an investment's performance. The realization multiple can also be influenced by market sentiment and investor behavior. For instance, during a market upswing, investors may be more likely to invest, leading to higher realization multiples. During a market downturn, investor pessimism can lower realization multiples. In real estate, the realization multiple can be used to evaluate property investment returns. It can help investors compare the performance of different properties and decide which ones to hold or sell. Private equity firms often use the realization multiple to assess their investments' performance in portfolio companies. It lets them determine which investments have provided the best returns and informs their future investment decisions. Venture capitalists also use the realization multiple to evaluate their startup investments. Given the high-risk nature of venture capital, the realization multiple can be a useful measure of how much return the VC firm has received relative to the risk taken. The realization multiple is a vital metric in the world of finance, providing a measure of the return on an investment relative to the original investment amount. It is critical in financial analysis, valuation, and investment decision-making. As investment strategies evolve with changing economic and market conditions, the importance of the realization multiple will likely continue to grow. Further advancements in financial modeling and data analytics may lead to more nuanced applications of the realization multiple, enhancing its value in investment analysis. Understanding the realization multiple and its implications is crucial to effective wealth management. It empowers investors to make informed decisions and optimize their investment returns. As you navigate your financial journey, consider leveraging this powerful tool to gauge your investments' performance and refine your wealth management strategy.What Is the Realization Multiple?

Calculation of Realization Multiple

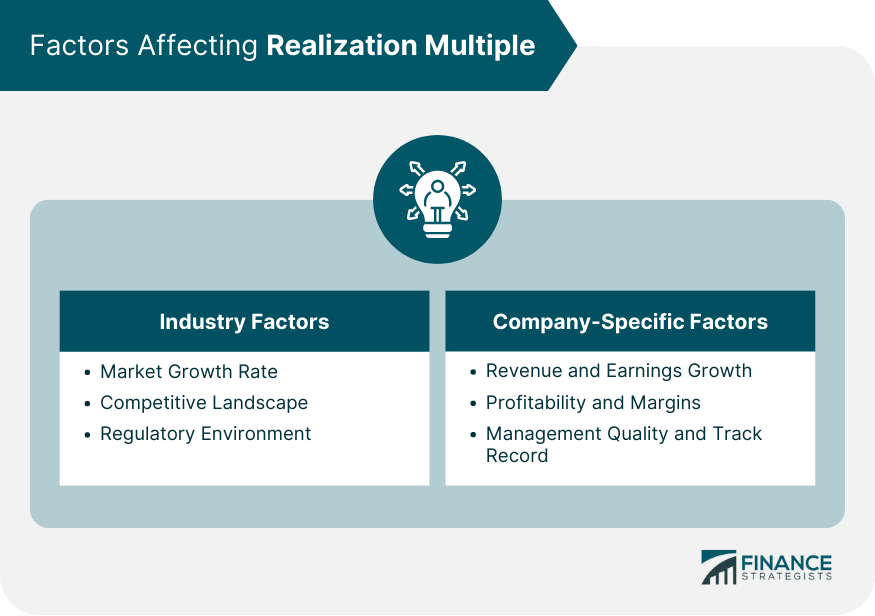

Factors Affecting Realization Multiple

Industry Factors

Market Growth Rate

Competitive Landscape

Regulatory Environment

Company-Specific Factors

Revenue and Earnings Growth

Profitability and Margins

Management Quality and Track Record

Interpreting Realization Multiple

Higher Realization Multiple

Lower Realization Multiple

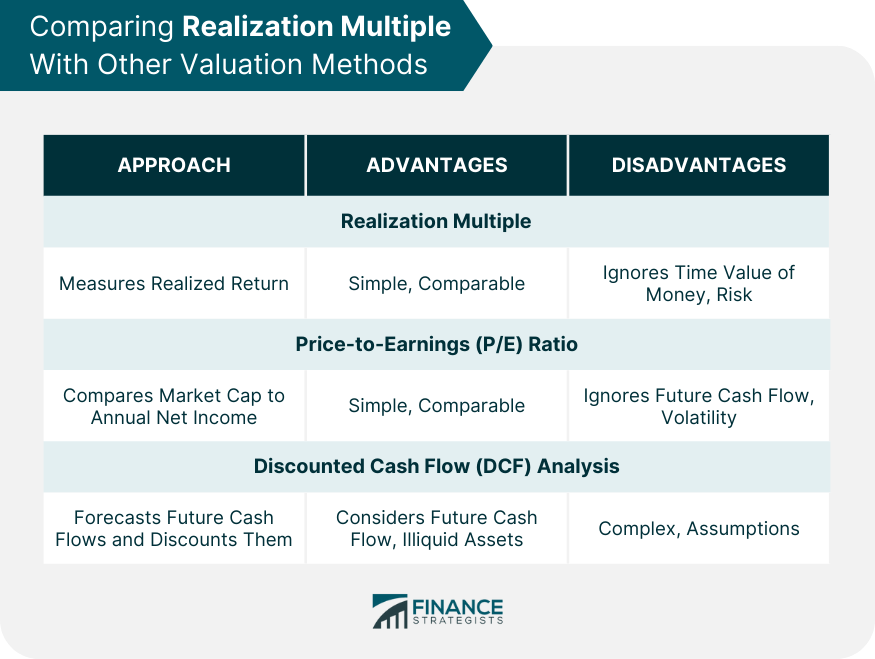

Comparing Realization Multiple With Other Valuation Methods

Price-to-Earnings (P/E) Ratio

Discounted Cash Flow (DCF) Analysis

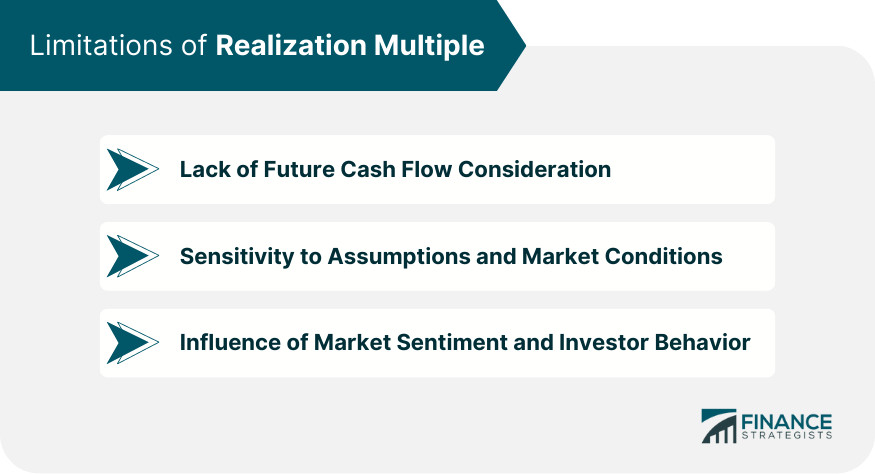

Limitations of Realization Multiple

Lack of Future Cash Flow Consideration

Sensitivity to Assumptions and Market Conditions

Influence of Market Sentiment and Investor Behavior

Realization Multiple in Different Investment Types

Real Estate Investments

Private Equity Investments

Venture Capital Investments

Conclusion

Realization Multiple FAQs

A good realization multiple varies based on the type of investment and the investor's expectations. Generally, a realization multiple greater than 1 indicates a profitable investment.

While both metrics provide insight into investment performance, they do so in different ways. The realization multiple measures the total return relative to the initial investment. At the same time, the IRR calculates the annualized return rate that sets the net present value of cash flows equal to zero.

Yes, the realization multiple can be negative if the total value returned is less than the total investment, indicating a loss on the investment.

The realization multiple is a historical measure that needs to consider future cash flows, making it insufficient as a standalone valuation tool. It's often used in conjunction with forward-looking valuation methods like the DCF analysis.

While the realization multiple is most commonly used in private equity and venture capital, it can be applied to any investment type with an initial investment and a return value. This includes real estate, stocks, and even bond investments.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.