Delisting is the process where a company's stock is removed from a stock exchange, making it no longer available for public trading. This transition is crucial as it impacts how the stock is traded and can significantly alter a company’s financial strategy and investor relations. The complexity of delisting lies in its various causes and implications, involving a diverse array of stakeholders including the company, its shareholders, potential investors, and regulatory bodies. Stock exchanges set financial thresholds that companies must maintain, such as minimum share price and market capitalization. Falling short of these benchmarks can trigger delisting, signaling potential trouble within the company and possibly leading to decreased investor confidence and a decline in stock value. Poor financial performance and the risk of delisting create a vicious cycle, often exacerbating the company's financial challenges. This situation demands investor vigilance and underscores the importance of monitoring financial health indicators as part of an investment strategy. Exchanges enforce rules to ensure fair trading and transparency, and failure to comply with these can result in delisting. These regulations cover various aspects, including financial reporting, disclosure, and corporate governance. Non-compliance not only risks delisting but also erodes investor trust. It highlights the importance of regulatory adherence in maintaining market integrity and protecting investor interests, making compliance a critical aspect of corporate operations. Corporate actions, such as decisions to go private, mergers, or acquisitions, can lead to delisting. These actions reflect a company's strategic planning and long-term vision. While potentially beneficial for the company, they can create short-term market volatility and uncertainty for investors. Understanding the motivations behind corporate actions is vital for investors. These actions often signal significant changes in a company’s structure and strategy, requiring a re-evaluation of their investment’s potential in the new context. Voluntary delisting occurs when a company chooses to remove its stock from an exchange. This decision might stem from various reasons, including cost reduction or strategic shifts. For investors, voluntary delisting can be ambiguous – it might indicate a company's confidence in its future or suggest reduced transparency and liquidity. Investors need to assess the reasons and potential implications of voluntary delisting carefully. It requires a nuanced understanding of the company’s strategic objectives and its potential impact on shareholder value. An exchange enforces involuntary delisting due to a company’s failure to meet listing standards. This type of delisting is often perceived negatively, indicating serious issues within the company, and can lead to significant market uncertainty and a loss of investor confidence. For investors, involuntary delisting is a red flag, signaling potential risks and the need for cautious evaluation. It often necessitates a thorough reassessment of the investment’s viability and the company’s future prospects. Delisting due to mergers or acquisitions is a unique scenario where a company's stock is removed from the exchange as a direct result of corporate restructuring. This can happen when a company is acquired by another, or during the merger of two entities, creating a new corporate identity. In such cases, the original stock is replaced by that of the acquiring company or the newly formed entity. For investors, this type of delisting requires a comprehensive re-evaluation of their holdings. They should assess the strategic rationale behind the merger or acquisition, considering how it might enhance or diminish the value of their investment. The delisting process begins when a company's board of directors makes a strategic decision to delist its shares from a stock exchange. This decision can be motivated by various factors, such as the desire to go private, undertake a strategic restructuring, or address regulatory compliance issues. Whether voluntary or involuntary, the company's decision marks the first crucial step in the process. Following the company's decision, it must formally notify the relevant stock exchange of its intent to delist. In the notification, the company provides a detailed explanation of the reasons for delisting and specifies the proposed delisting date. This communication serves to initiate the formal process and ensure transparency with regulatory authorities and stakeholders. In some instances, particularly for voluntary delisting, the company may be required to seek approval from its shareholders. Shareholder approval is typically obtained through a special meeting where the delisting proposal is presented, and shareholders vote on the decision. The requirement for shareholder approval may be outlined in the exchange's rules or the company's corporate bylaws. Once the exchange receives the delisting request or identifies non-compliance issues (in the case of involuntary delisting), it conducts a thorough review. This review assesses whether the company's actions align with the exchange's rules and regulations. The exchange evaluates the company's financial health, compliance with listing requirements, and overall rationale for delisting before making a formal decision to approve or deny the request. In cases of involuntary delisting, the company is given a specific timeframe to respond to the exchange's notification of non-compliance. The company's response may take various forms, including submitting a compliance plan detailing how it plans to address the identified issues, filing appeals, or engaging in negotiations with the exchange to reach a mutually agreeable resolution. After approval (for voluntary) or the exchange's final decision (for involuntary), the company publicly announces the official delisting date. This date marks the point at which trading of the company's shares on the exchange will cease. It is a critical milestone that impacts investors, as they need to prepare for the transition away from the exchange. Upon announcement, the stock typically experiences a spike in volatility, with prices fluctuating dramatically as investors rush to reassess their positions. These short-term movements are fueled by a mix of speculation, uncertainty, and the sudden need to recalibrate investment strategies in light of the new development. The initial reaction to delisting can significantly affect investor sentiment, often leading to a sharp sell-off. The urgency to liquidate positions, especially in cases of involuntary delisting, can result in substantial financial losses for shareholders. Once a stock is delisted, it typically moves to a less regulated market, which may result in reduced liquidity and higher transaction costs. This shift can make it more challenging for investors to sell their shares and may lead to a prolonged period of holding onto an underperforming or stagnant investment. Factors such as the company’s operational health, its future potential, and the overall market conditions become critical in deciding whether to retain, sell, or buy more shares. The primary strategy for investors facing a delisting scenario involves evaluating the specific reasons behind the delisting and its potential impact on the stock’s value and liquidity. Investors should analyze the company’s financial statements, market conditions, and any underlying issues that might have led to the delisting. Effective risk management also includes preparing for different scenarios, such as a further decline in stock value or difficulties in selling the shares. Investors should consider setting stop-loss orders to minimize losses or reallocating their assets to balance their portfolios. Diversification can reduce the risk of significant losses from any one investment and provides a buffer against the volatility and uncertainty associated with such events. Adjusting the portfolio in response to delisting involves reassessing the investment's role and potential in the broader context of the investor's goals and risk tolerance. It might be prudent to replace the delisted stock with more stable and liquid securities investments or to rebalance the portfolio to align with the changed investment landscape. Professional advice can be particularly valuable in interpreting the nuances of the delisting process, assessing the company’s future prospects, and strategizing for long-term financial goals. Advisors can offer insights into market trends, alternative investment opportunities, and risk management techniques, aiding investors in making informed and strategic decisions. Delisting is a significant event in the life cycle of a publicly traded company and has far-reaching implications for investors. It’s essential to understand the causes and types of delisting, the process involved, and the roles of regulatory bodies. The impact of delisting on investors varies, encompassing immediate market reactions, long-term investment considerations, and a spectrum of opportunities and risks. It underscores the importance of continuous learning, proactive risk management, and strategic portfolio adjustment. Embracing a diversified investment approach and seeking professional advice when needed are key strategies for navigating the uncertainties of delisting. What Is Delisting?

Shareholders face potential re-evaluations of their investments and altered liquidity conditions.

Potential investors may need to reassess the risk profile of the company. Regulatory bodies, meanwhile, play a crucial role in ensuring a smooth and transparent delisting process.

While delisting presents challenges, it can also be an opportunity for positive change.

Companies can leverage this moment to reassess their strategies, address underlying issues, and emerge stronger.

Investors, equipped with a comprehensive understanding of the delisting landscape, can make informed decisions regarding their holdings. Causes of Delisting

Financial Performance Issues

Regulatory Non-Compliance

Corporate Actions

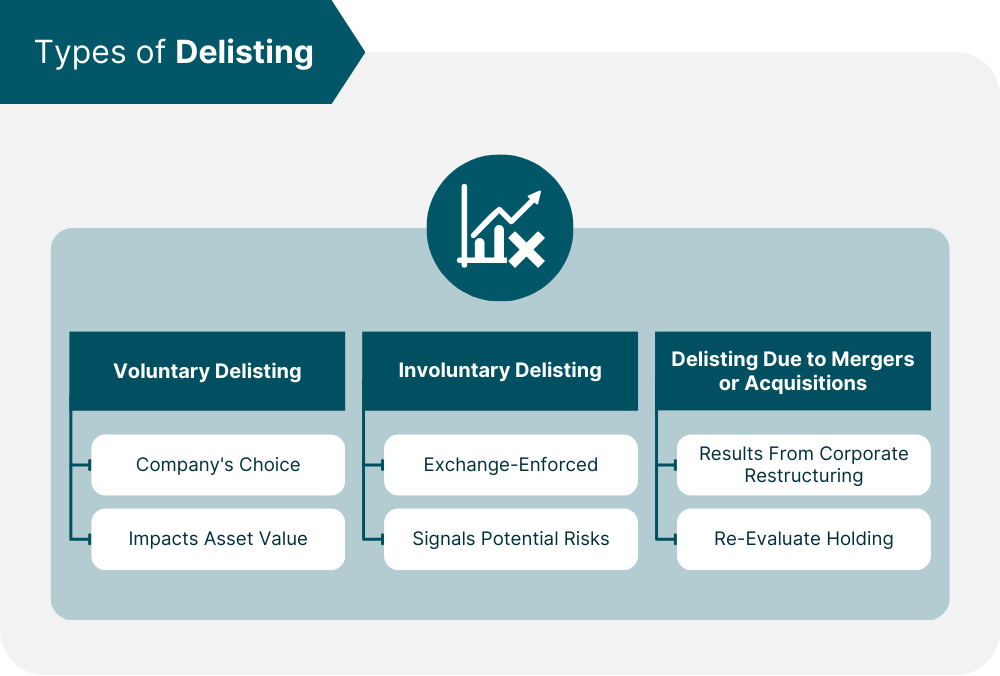

Types of Delisting

Voluntary Delisting

Involuntary Delisting

Delisting Due to Mergers or Acquisitions

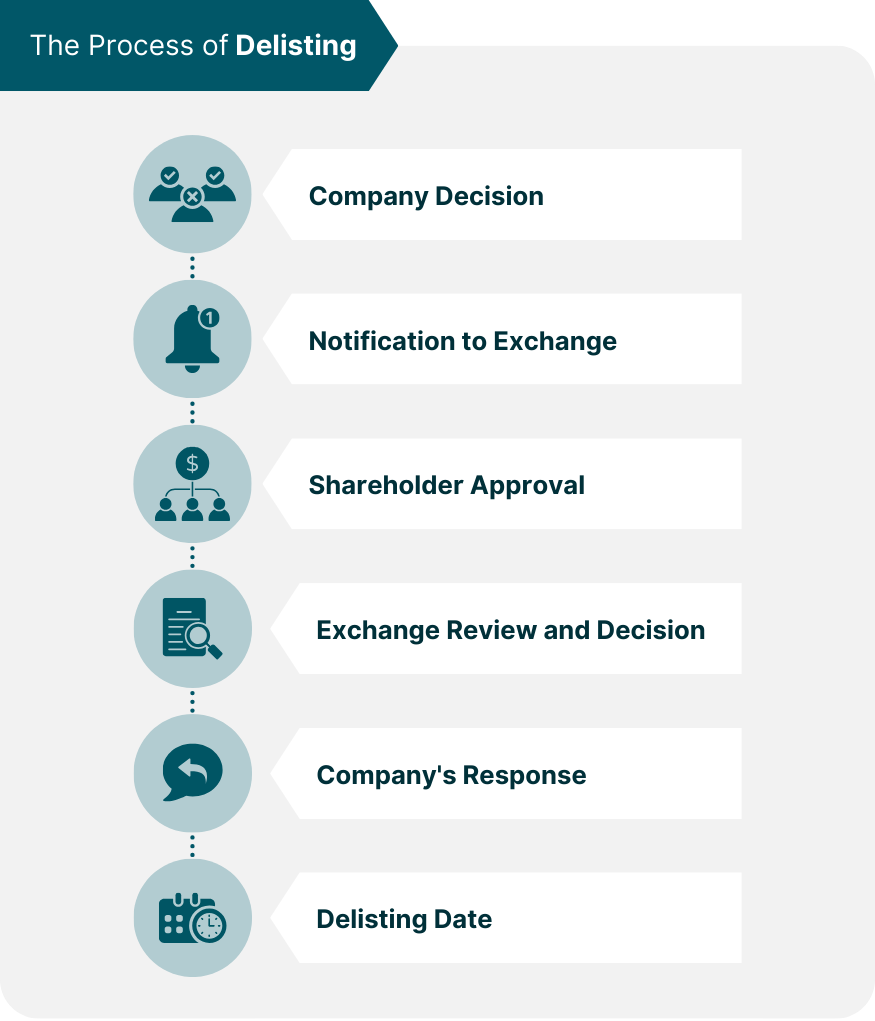

The Process of Delisting

Company Decision

Notification to Exchange

Shareholder Approval

Exchange Review and Decision

Company's Response

Delisting Date

Impact of Delisting on Investors

Short-Term Market Reactions

Long-Term Investment Considerations

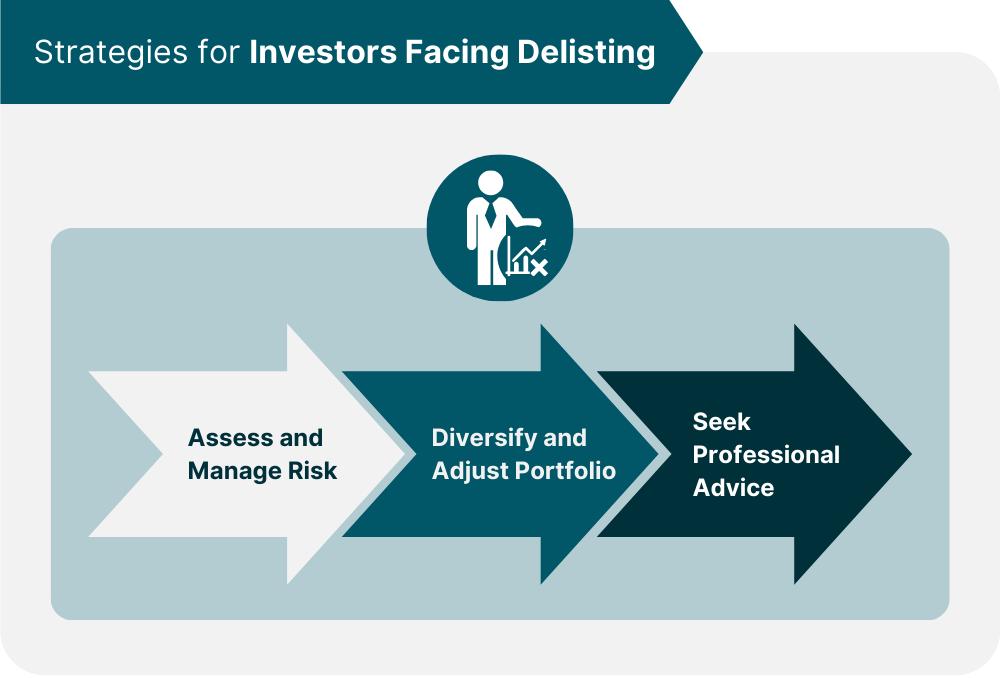

Strategies for Investors Facing Delisting

Assess and Manage Risk

Diversify and Adjust Portfolio

Seek Professional Advice

Conclusion

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.