E-Mini refers to electronically traded futures contracts on major stock market indices, such as the S&P 500, Nasdaq-100, and Dow Jones Industrial Average. These contracts are smaller in size compared to standard futures contracts, making them more accessible to individual and institutional investors for trading and wealth management purposes. E-Minis play a significant role in wealth management, as they provide investors with a cost-effective and efficient way to gain exposure to major market indices. By offering smaller contract sizes, E-Minis allow for more precise portfolio allocation, risk management, and hedging strategies, which can help investors achieve their financial goals. E-Mini futures contracts were first introduced in 1997 by the Chicago Mercantile Exchange (CME) as a response to the growing demand for electronic trading and smaller-sized contracts. The initial launch featured the E-Mini S&P 500 contract, which quickly gained popularity among traders and investors. Over the years, the range of E-Mini contracts has expanded to include other major indices, as well as commodities and currencies. The primary objective of E-Mini futures contracts is to provide investors with an accessible and efficient means of gaining exposure to major market indices. Due to their smaller size, E-Minis allow for more precise portfolio allocation and risk management strategies. Additionally, E-Minis are traded electronically, offering traders increased speed, transparency, and accessibility compared to traditional floor trading. One of the key characteristics of E-Mini futures contracts is their smaller size compared to standard futures contracts. This smaller size makes E-Minis more accessible to a wider range of investors, including individual traders and smaller institutions, allowing for more precise portfolio management and risk control. E-Mini futures contracts are traded exclusively on electronic trading platforms, such as the CME Globex system. This enables traders to access the market 24 hours a day, five days a week, offering increased trading flexibility and global accessibility. E-Mini futures contracts offer traders the ability to use leverage, allowing them to control a large position with a relatively small amount of capital. However, leverage also amplifies potential losses, making it essential for traders to manage risk carefully. E-Mini contracts also have specific margin requirements, which must be met to maintain open positions. E-Mini futures contracts provide investors with an efficient means of diversifying their portfolios by gaining exposure to major market indices. This diversification can help reduce overall portfolio risk and enhance long-term investment returns. E-Mini futures contracts generally have lower transaction costs compared to trading individual stocks or ETFs, as they do not involve the physical transfer of assets. This can result in cost savings for investors over time. Due to their popularity among traders and investors, E-Mini futures contracts tend to have high trading volumes, resulting in increased liquidity. This liquidity can help facilitate more efficient trade execution and minimize the impact of price slippage. E-Mini futures contracts can be used as part of risk management and hedging strategies, allowing investors to protect their portfolios from adverse market movements. For example, an investor with a long position in an equity portfolio could use E-Mini futures contracts to hedge against potential market declines. E-Mini futures contracts are subject to market fluctuations and can be volatile, especially during periods of economic uncertainty or market turmoil. Investors need to be prepared for potential price swings and must manage their risk accordingly. While the use of leverage allows investors to control larger positions with a smaller amount of capital, it also amplifies potential losses. If the market moves against a leveraged position, the losses can be substantial, and investors may be required to deposit additional funds to maintain their open positions. E-Mini futures contracts have specific margin requirements that must be met to maintain open positions. If the market moves against a trader's position and the account value falls below the required margin level, a margin call may be issued. In such cases, the investor will need to deposit additional funds or liquidate positions to meet the margin requirements. Failure to do so may result in the forced liquidation of positions at a loss. Trend following strategies involve identifying and trading in the direction of a prevailing market trend. These strategies can be applied to E-Mini futures contracts by using technical indicators, such as moving averages or trendlines, to identify potential entry and exit points. Mean reversion strategies are based on the premise that asset prices will eventually return to their historical average or mean. In the context of E-Mini futures trading, this might involve looking for instances when a contract's price deviates significantly from its historical average and then taking a position in anticipation of the price returning to the mean. Breakout strategies involve trading when an asset's price moves beyond a predefined level of support or resistance, indicating a potential trend change or continuation. E-Mini traders can use chart patterns or technical indicators to identify potential breakout points and place trades accordingly. Scalping strategies involve making many short-term trades with the aim of capturing small profits on each trade. E-Mini futures contracts, with their high liquidity and lower transaction costs, can be suitable for scalping strategies. Traders using this approach must be prepared for the fast-paced nature of this trading style and have a solid risk management plan in place. E-Mini futures contracts are regulated by the Commodity Futures Trading Commission (CFTC), which oversees the futures and options markets in the United States. The CFTC sets rules and guidelines to ensure market integrity and protect investors from fraud and manipulation. The National Futures Association (NFA) is a self-regulatory organization for the U.S. futures industry. It establishes and enforces rules and regulations for its member firms. It includes those involved in trading E-Mini futures contracts. NFA membership is required for firms conducting futures trading activities in the United States. E-Mini futures contracts have specific margin requirements and position limits set by the exchanges and regulators to ensure market stability and reduce systemic risk. Traders must be aware of these requirements and limits when trading E-Mini contracts to avoid potential regulatory violations or penalties. E-Mini futures contracts are smaller-sized, electronically traded contracts on major stock market indices, providing investors with a cost-effective and efficient way to gain exposure to these indices. E-Mini contracts are characterized by their small size, electronic trading platform, and leverage and margin requirements, making them attractive to a wide range of investors. While E-Mini futures contracts offer several benefits, such as portfolio diversification, lower transaction costs, and increased liquidity, they also come with risks, such as volatility, leverage risk, and margin calls. Investors must carefully consider these risks and employ appropriate risk management strategies when trading E-Mini futures contracts. With proper knowledge and risk management, E-Mini futures contracts can be a valuable addition to an investor's wealth management toolkit.What Is E-Mini?

Background of E-Mini

Origins and Development

Purpose and Objectives

Characteristics of E-Mini

Small Size Contracts

Electronic Trading Platform

Leverage and Margin Requirements

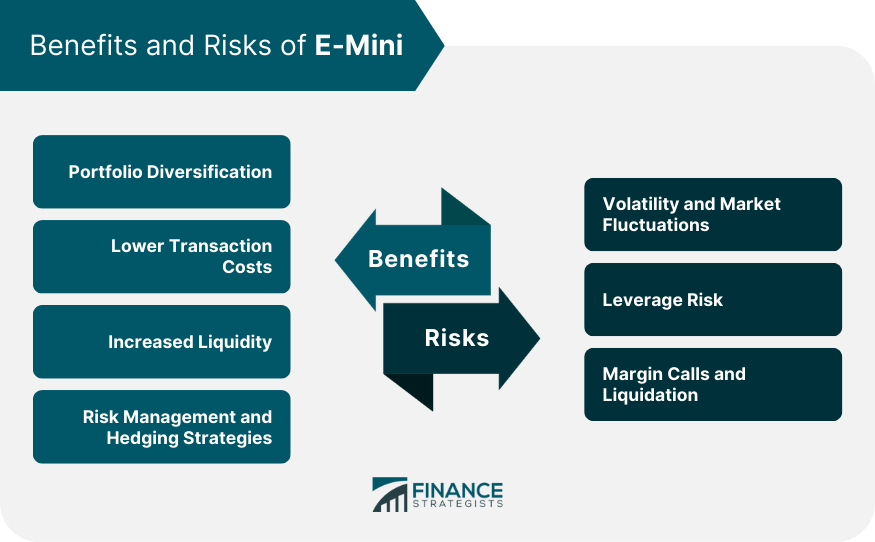

Benefits of E-Mini

Portfolio Diversification

Lower Transaction Costs

Increased Liquidity

Risk Management and Hedging Strategies

Risks Associated With E-Mini

Volatility and Market Fluctuations

Leverage Risk

Margin Calls and Liquidation

E-Mini Trading Strategies

Trend Following Strategies

Mean Reversion Strategies

Breakout Strategies

Scalping Strategies

Regulatory Considerations for E-Mini

Commodity Futures Trading Commission (CFTC)

National Futures Association (NFA)

Margin Requirements and Position Limits

Final Thoughts

E-Mini FAQs

E-Mini refers to electronically traded futures contracts, smaller in size compared to standard contracts, allowing investors to gain exposure to various asset classes.

E-Mini trading offers benefits like portfolio diversification, lower transaction costs, increased liquidity, and the ability to implement risk management and hedging strategies.

Risks in E-Mini trading include market volatility, leverage risk, and the potential for margin calls and liquidation if margin requirements are not met.

Common E-Mini trading strategies include trend following, mean reversion, breakout, and scalping strategies, each tailored to different market conditions and investor preferences.

Yes, E-Mini trading is regulated by entities like the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA), which set margin requirements and position limits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.