A Bermuda option is a type of options contract that gives the holder the right to buy or sell an asset at a specific price on pre-determined dates before the contract's expiration. This type of option is a hybrid between an American option, which can be exercised at any time before expiration, and a European option, which can only be exercised at expiration. The purpose of a Bermuda option is to provide flexibility to the option holder in terms of when they can exercise the option. Unlike European options that can only be exercised at expiration, Bermuda options allow exercise on specific predetermined dates before expiration. This flexibility allows the option holder to take advantage of favorable price movements or market conditions during the option's lifespan. Bermuda options are commonly used in financial derivatives to manage risk and optimize investment strategies. The distinguishing characteristic of a Bermuda option is its exercise dates. These options can be exercised only on pre-determined dates before the option's expiration. This characteristic is a middle ground between American options, which can be exercised any time before expiration, and European options, which can only be exercised at expiration. The pricing and valuation of Bermuda options are more complex than European or American options. The reason is the mixed nature of their exercise options, requiring more intricate calculations. The price of a Bermuda option generally falls between the prices of an American and a European option. The main advantage of a Bermuda option is its flexibility. It allows investors to take advantage of price movements at certain points during the option's life, unlike a European option. The disadvantage, however, is that it does not offer the complete freedom of an American option, which can be exercised at any point before expiration. Bermuda options play a niche role in the financial markets. They offer investors an additional tool to manage risk and speculate on the direction of underlying assets. Their unique exercise feature makes them suitable for complex financial strategies that require more flexibility than European options but less than American options. Due to their complexity, Bermuda options are typically traded by sophisticated investors or institutions that have a thorough understanding of options pricing and derivatives trading. They might include hedge funds, investment banks, and professional traders who use these options as part of broader financial strategies. For institutional investors and corporations, Bermuda options offer a unique risk management tool. They provide a way to hedge against potential price movements in the underlying asset at specific times, offering more flexibility than a European option but less risk than an American option. The price of a Bermuda option is influenced by several factors, including the price and volatility of the underlying asset, the time until expiration, the risk-free interest rate, and the dates at which the option can be exercised. To calculate the price of a Bermuda option, one can use modified versions of the Black-Scholes or Binomial pricing models. These models take into account the unique exercise feature of Bermuda options and provide theoretical prices. However, actual market prices might deviate from these theoretical values due to supply and demand dynamics. The price of a Bermuda option generally falls between that of an American and a European option. This is because a Bermuda option offers more exercise flexibility than a European option (thus, it's more valuable) but less than an American option (thus, it's less valuable). The risks associated with Bermuda options are similar to those of other options. They include the risk of the underlying asset's price moving in the opposite direction than expected, the risk of losing the entire investment if the option expires worthless, and the risk related to the option's limited exercise dates. The profit potential of a Bermuda option is theoretically unlimited if the price of the underlying asset moves in a favorable direction. However, the maximum loss is limited to the premium paid for the option. The risk-reward ratio can be favorable, especially if the investor has a strong conviction about the price movement of the underlying asset at the specific exercise dates. Risk mitigation strategies for Bermuda options can include using stop-loss orders to limit potential losses, diversifying the investment portfolio to reduce exposure to any single asset, and carefully analyzing the underlying asset and market conditions before purchasing the option. Common strategies using Bermuda options include speculative trading, where an investor anticipates the direction of the underlying asset's price movement, and hedging, where the option is used to offset potential losses in an existing investment. Suppose an investor anticipates that a stock will significantly increase in value on a specific date - for instance, when a major merger is expected to be approved. The investor could purchase a Bermuda call option with an exercise date that aligns with this event, potentially reaping substantial profits if the merger approval drives the stock price up. Choosing the right strategy depends on the investor's risk tolerance, market outlook, and investment objectives. A thorough analysis of the underlying asset and market conditions, coupled with a clear understanding of the unique features of Bermuda options, is crucial in formulating a successful trading strategy. As with other derivatives, Bermuda options are subject to regulations designed to ensure fair and transparent markets. These regulations may include rules on disclosure, trading practices, and market manipulation. Investors trading Bermuda options need to understand and comply with applicable regulations. These might involve reporting requirements, maintaining appropriate records, and adhering to standards of professional conduct. Regulatory bodies oversee the trading of Bermuda options to protect investors, maintain fair markets, and promote financial stability. They may investigate potential violations of regulations, impose penalties, and issue guidelines for market participants. A Bermuda option is a hybrid financial contract, combining traits of American and European options. It permits the holder to trade an asset at a set price on specific pre-expiration dates. Named after Bermuda, situated between Europe and America, it uniquely offers semi-exercise flexibility, unlike the unrestricted American options and the single-exercise European options. When trading Bermuda options, understanding their characteristics - including their unique exercise dates and pricing structure - is of paramount importance. Incorporating Bermuda options into trading strategies provides opportunities for sophisticated risk management and potential profits. This blend of flexibility and control makes Bermuda options a valuable tool in the complex landscape of financial derivatives. These nuanced instruments, though not as common as their counterparts, offer a distinctive approach to options trading, especially for investors who can navigate their unique intricacies.Definition of Bermuda Option

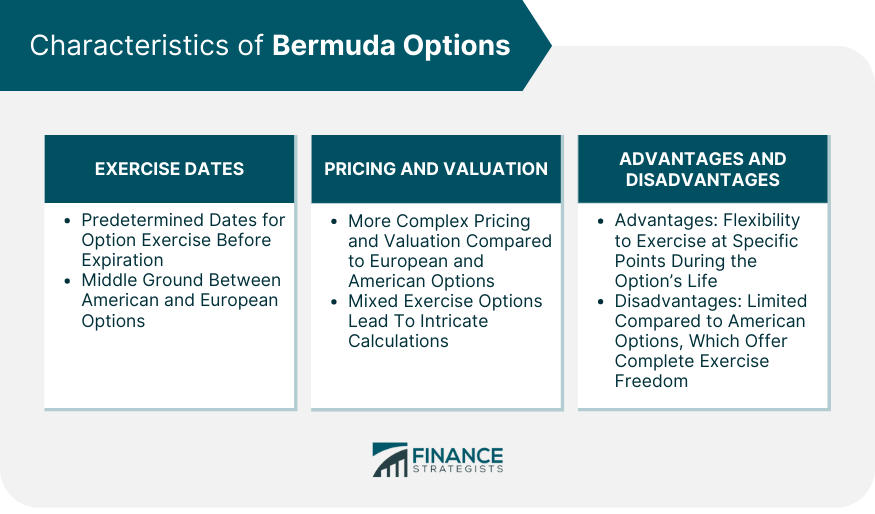

Understanding the Characteristics of a Bermuda Option

Exercise Dates of Bermuda Options

Pricing and Valuation

Advantages and Disadvantages

Bermuda Option in the Financial Market

Role of Bermuda Option in the Financial Market

Types of Investors Who Typically Trade Bermuda Options

Importance to Institutional Investors and Corporations

Pricing of Bermuda Option

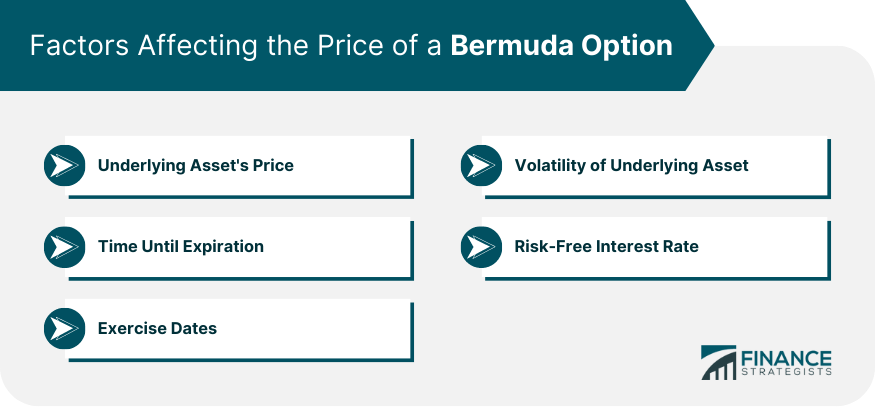

Factors Affecting the Price of a Bermuda Option

Pricing Models: Black-Scholes and Binomial Model

Comparison of Pricing With American and European Options

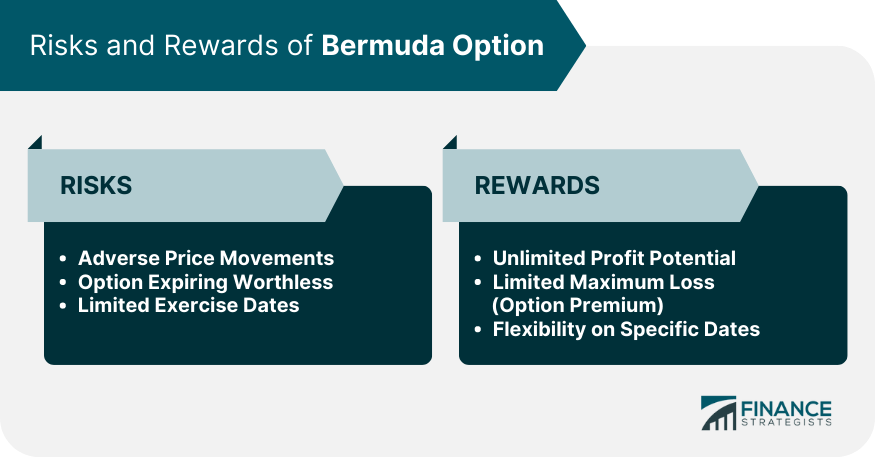

Risks and Rewards of Bermuda Option

Risk Analysis of Bermuda Option

Profit Potential and Risk-Reward Ratio

Mitigation Strategies for Bermuda Option Risks

Bermuda Option Trading Strategies

Common Strategies Using Bermuda Options

Example Scenarios of Bermuda Option Trades

How to Choose the Right Strategy

Regulatory Framework of Bermuda Option

Conclusion

Bermuda Option FAQs

A Bermuda option is a hybrid financial contract, combining traits of American and European options. It permits the holder to trade an asset at a price on specific pre-expiration dates. Named after Bermuda, situated between Europe and America, it uniquely offers semi-exercise flexibility, unlike the unrestricted American options and the single-exercise European options.

The price of a Bermuda option is influenced by several factors, including the price and volatility of the underlying asset, the time until expiration, the risk-free interest rate, and the dates at which the option can be exercised. Pricing models, like modified versions of the Black-Scholes or Binomial models, can be used to calculate theoretical prices.

Bermuda options are typically traded by sophisticated investors or institutions like hedge funds, investment banks, and professional traders. These entities use Bermuda options as part of broader financial strategies due to their unique exercise feature.

The risks of trading Bermuda options include potential adverse price movements in the underlying asset and the risk of the option expiring worthless. However, the profit potential is theoretically unlimited if the price of the underlying asset moves favorably. The maximum loss is limited to the premium paid for the option.

Technology plays a significant role in Bermuda option trading. Algorithmic trading systems and advanced pricing models facilitate the trading and pricing of these options. Also, digital platforms are broadening access to the OTC market, where Bermuda options are usually traded, making these complex instruments more accessible to a broader range of investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.