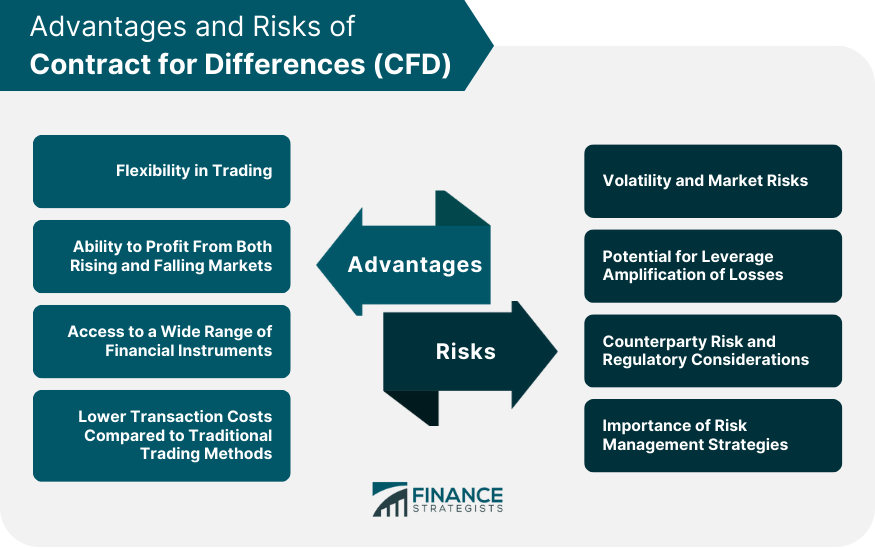

A Contract for Differences (CFD) is a popular derivative trading instrument that allows investors to speculate on the price movements of financial assets without actually owning the underlying asset. CFDs are agreements between a buyer and a seller to exchange the difference in value of a specific asset from the time the contract is opened to the time it is closed. The primary purpose of CFDs is to enable investors to gain exposure to financial markets with greater flexibility and efficiency. CFD trading allows market participants to profit from both rising and falling markets by going long or short on the underlying asset. This versatility has made CFD trading a popular choice among traders and investors who seek to diversify their portfolios and implement various trading strategies. CFDs work by allowing traders to enter into a contract with a broker, who acts as the counterparty. The contract stipulates that the difference between the opening and closing prices of the asset will be exchanged between the trader and the broker. If the asset's price increases, the buyer (long position) receives the difference from the seller (short position), and vice versa if the price decreases. The primary objective of CFD trading is to speculate on price movements and potentially profit from them. Traders use CFDs for various reasons, including portfolio diversification, short-term trading opportunities, and hedging existing positions. The flexibility of CFDs allows investors to trade across various asset classes, including stocks, indices, commodities, and currencies. Some key features of CFDs include the use of leverage, which allows traders to control a larger position with a smaller initial investment. This magnifies potential gains but also amplifies potential losses. Additionally, CFD trading is typically conducted on a margin basis, which means that traders only need to deposit a small percentage of the full value of the position to open a trade. In a CFD trade, there are two primary parties involved: the trader and the broker. The trader speculates on the price movements of the underlying asset, while the broker provides the trading platform, liquidity, and acts as the counterparty to the trade. The underlying asset in a CFD trade can be any financial instrument, including stocks, indices, commodities, currencies, and even cryptocurrencies. The value of a CFD is derived from the underlying asset's price, and traders speculate on the price movements without actually owning the asset. Margin and leverage are essential concepts in CFD trading. Margin refers to the initial deposit required to open a position, while leverage allows traders to control a larger position with a smaller initial investment. Leverage can amplify potential gains, but it also increases the risk of losses if the trade moves against the trader's position. CFD trading offers a high degree of flexibility, allowing traders to go long or short on the underlying asset, depending on their market view. This means that traders can potentially profit from both rising and falling markets. As mentioned earlier, one of the primary advantages of CFD trading is the ability to profit from both rising and falling markets. This flexibility allows traders to capitalize on diverse market conditions and implement a wide range of trading strategies. CFD trading provides access to a broad range of financial instruments, including stocks, indices, commodities, currencies, and even cryptocurrencies. This extensive access allows traders to diversify their portfolios and explore various markets without having to own the underlying assets. CFD trading often has lower transaction costs compared to traditional trading methods, such as stock trading. This is because CFDs do not involve the physical transfer of assets, and therefore, many associated costs, like stamp duty, are eliminated. Additionally, CFD brokers typically offer competitive spreads, which can help reduce overall trading costs. CFD trading carries inherent risks due to market volatility and fluctuations in the prices of the underlying assets. Sudden market movements can result in significant losses, especially when trading with leverage, as gains and losses are magnified. While leverage can amplify potential gains, it also increases the risk of losses if the market moves against a trader's position. This can lead to traders losing more than their initial investment, making risk management crucial in CFD trading. When trading CFDs, traders are exposed to counterparty risk, as the broker acts as the other party to the contract. If the broker becomes insolvent or fails to meet its obligations, traders may face losses. It is essential to choose a well-regulated and reputable broker to mitigate this risk. Implementing effective risk management strategies is crucial when trading CFDs. These strategies may include setting stop-loss orders, diversifying trading portfolios, and limiting the use of leverage. Additionally, regularly reviewing and adjusting risk management strategies can help minimize potential losses and protect capital in volatile market conditions. Traders can employ various trading strategies using CFDs, such as trend following, scalping, swing trading, and arbitrage. These strategies aim to capitalize on short-term price movements and market inefficiencies. CFDs can also be used for hedging purposes, allowing investors to mitigate potential losses in their portfolios. For instance, an investor with a long position in a stock may take a short position in a CFD to protect against potential price declines. Speculative trading using CFDs allows investors to capitalize on short-term price movements in various markets without actually owning the underlying assets. This can lead to potential investment opportunities, provided traders effectively manage risks and understand the dynamics of the assets they trade. A Contract for Differences (CFD) is a derivative trading instrument that allows investors to speculate on the price movements of financial assets without owning the underlying asset. CFD trading involves entering into a contract with a broker, who acts as the counterparty. The contract stipulates that the difference between the opening and closing prices of the asset will be exchanged between the trader and the broker. CFD trading offers various advantages, such as flexibility in trading, the ability to profit from both rising and falling markets, access to a wide range of financial instruments, and lower transaction costs. However, it also carries risks, including market volatility, leverage amplification of losses, counterparty risk, and the need for effective risk management strategies. Developing a sound trading strategy, implementing risk management techniques, and staying informed about regulatory requirements can help mitigate potential risks and enhance the chances of successful trading outcomes.What Is a Contract for Differences (CFD)?

How a Contract for Differences Works

Explanation of CFDs

Purpose and Objectives of CFD Trading

Key Features of CFDs

Mechanics of Contracts for Differences

Parties Involved in a CFD

Understanding the Underlying Asset

Concept of Margin and Leverage in CFDs

Advantages of Contracts for Differences

Flexibility in Trading

Ability to Profit From Both Rising and Falling Markets

Access to a Wide Range of Financial Instruments

Lower Transaction Costs Compared to Traditional Trading Methods

Risks and Considerations of Contracts for Differences

Volatility and Market Risks

Potential for Leverage Amplification of Losses

Counterparty Risk and Regulatory Considerations

Importance of Risk Management Strategies

Applications of Contracts for Differences

Trading Strategies Using CFDs

Hedging and Risk Management Applications

Speculative Trading and Investment Opportunities

Conclusion

Contract for Differences (CFD) FAQs

A Contract for Differences (CFD) is a financial derivative that allows traders to speculate on price movements of various assets without owning the underlying asset.

CFD trading involves entering into an agreement with a broker to exchange the difference in the value of an asset from the time the contract is opened to when it is closed.

CFDs offer benefits such as access to a wide range of markets, the ability to profit from both rising and falling markets, leverage to amplify potential returns, and lower transaction costs compared to traditional trading.

Potential risks include market volatility, the possibility of substantial losses due to leverage, counterparty risk, regulatory considerations, and the importance of implementing effective risk management strategies.

CFD trading is subject to regulations imposed by financial authorities in different jurisdictions. Traders should be aware of the specific rules and compliance requirements set by the regulatory bodies in their country of residence.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.