The 48-hour rule is a regulation in real estate that offers a safety net to buyers who've submitted a contingent offer on a property. It essentially provides the buyer with a 48-hour window to decide whether to remove their contingencies upon the seller receiving a non-contingent offer from another prospective buyer. The rule is critical to maintaining fair and transparent procedures in real estate transactions. It prevents situations where the original buyer is left in the dark about another offer, thereby preserving the fairness of the process. It serves as an important protection for buyers, offering them a window of opportunity to affirm their interest in the property and take steps to solidify their offer. It also helps sellers by encouraging contingent buyers to move more quickly in removing their contingencies or risk losing the property. This, in turn, can expedite the sale process. The 48-hour rule works to ensure transparency and fairness in real estate transactions. It prevents a seller from accepting a backup offer without giving the original buyer a chance to solidify their commitment to purchase. This fairness element is significant as it offers protection to buyers, particularly in hot markets where multiple offers are common. It also upholds a sense of ethical conduct and trustworthiness in real estate transactions. The 48-hour rule mainly applies to transactions where the buyer's offer is contingent on certain conditions, such as the sale of their current home or securing financing. However, the specifics of when the rule is implemented may vary depending on local laws and the terms agreed upon in the real estate contract. The rule does not typically apply to non-contingent offers. In such cases, the buyer is ready to proceed with the purchase without any conditions, and the seller is free to accept the offer without providing a 48-hour notice to other prospective buyers. Compliance with the 48-hour rule is part of meeting legal and regulatory requirements in real estate transactions. Both buyers and sellers, as well as their agents, need to understand and adhere to the rule to ensure a smooth and compliant transaction process. Failure to comply could lead to legal disputes, delays, or even the nullification of the transaction. Therefore, awareness and understanding of this rule is fundamental for all parties involved in a real estate transaction. The notification period is a vital component of the 48-hour rule. It refers to the timeframe within which the original buyer must be notified of a backup offer. As the name suggests, this period is typically 48 hours. The original buyer has the option to waive contingencies and proceed with the purchase, or they may risk losing the property to another buyer. If the original buyer does not respond within a certain timeframe, the seller can accept the backup offer. The 48-hour rule imposes certain disclosure requirements on the seller. Upon receipt of a backup offer, the seller must promptly notify the original buyer of this development. This notice should be in writing and clearly state the buyer's options and the consequences of failing to respond within the 48-hour window. The seller's obligations to disclose this information underscore the rule's commitment to transparency and fairness. Under the 48-hour rule, the original buyer has several rights and options. They can choose to remove their contingencies and proceed with the purchase, essentially making their offer non-contingent. Alternatively, they can stick with their contingencies, in which case they risk losing the property to the backup buyer. Or, they may decide to withdraw their offer entirely. The rule, therefore, offers a degree of flexibility and choice to the buyer. As part of the 48-hour rule, the seller has certain obligations and responsibilities. They must provide timely and accurate notice to the original buyer, respect the buyer's decision, and proceed accordingly. Failure to uphold these responsibilities could result in legal complications. Therefore, sellers should be diligent in adhering to the rule's requirements. One of the key benefits of the 48-hour rule is the protection of the buyer's interests. By providing a window of opportunity to respond to a backup offer, the rule safeguards the buyer's chance to secure the property. This protection is particularly important in markets with high competition, where multiple offers on a property are common. It prevents a buyer from being blindsided by a sudden change in the seller's position. The 48-hour rule provides an opportunity for due diligence and decision-making. For the original buyer, it's a chance to assess their financial readiness, evaluate their interest in the property, and make an informed decision. For the seller, the rule provides a framework to handle multiple offers ethically and transparently. It allows them to explore alternative offers without breaching their agreement with the original buyer. By giving the buyer a 48-hour window to respond, the rule helps minimize rushed or impulsive decisions. It ensures the buyer has enough time to consult with their real estate agent, financial advisor, or family before deciding on their next move. This period can be crucial in preventing regrettable decisions, particularly in high-pressure situations where buyers feel the heat of competition. The 48-hour rule enhances transparency and disclosure in real estate transactions. By requiring the seller to notify the original buyer of any backup offers, it ensures that all parties are kept in the loop and no information is withheld. This transparency fosters trust among parties and reinforces the integrity of the real estate process. Despite its benefits, the 48-hour rule is not without criticism. Some argue that it places undue pressure on the original buyer to make a quick decision. Others believe that it may disadvantage sellers by potentially slowing down the sale process. It's also worth noting that the rule doesn't guarantee the buyer can secure financing or sell their current home within the 48-hour window, which can be stressful for the buyer and uncertain for the seller. Counterarguments against the 48-hour rule question its effectiveness in today's fast-paced real estate market. Some critics argue that in a competitive market, sellers may prefer to work with non-contingent offers rather than deal with contingencies and the associated delays. They point out that savvy buyers often come prepared with pre-approved financing, making the need for financing contingencies - and by extension the 48-hour rule - less relevant. Alternatives to the 48-hour rule often propose longer notice periods to provide the original buyer with more time to solidify their position. Others suggest a more tailored approach, where the notice period could vary based on the nature of the contingencies. While these alternatives present interesting perspectives, it's important to note that any modifications to the 48-hour rule must strike a balance between protecting the buyer's interests and ensuring a smooth, efficient sale process. While the 48-hour rule is widely applied, certain types of real estate transactions are exempted. For instance, it may not apply to cash offers, which are typically non-contingent and can proceed without the need for a notice period. Local regulations may also stipulate exceptions, and parties can mutually agree to exclude the 48-hour rule from their contract. It's essential for buyers and sellers to understand these exceptions to know when the rule applies to their transaction. Emergency situations and waiver provisions can also serve as exceptions to the 48-hour rule. In emergency cases, such as a sudden change in market conditions, parties may agree to bypass the rule to expedite the transaction. Furthermore, the original buyer may opt to waive the 48-hour notice period in their offer. This could make their offer more attractive to the seller, particularly in a competitive market. The 48-hour rule operates within the confines of applicable laws and local regulations. These laws and regulations may provide further exceptions or modifications to the rule. Therefore, it's important for buyers, sellers, and their agents to familiarize themselves with the local legal landscape governing real estate transactions. The 48-hour rule is a protective measure designed to ensure transparency and fairness in real estate transactions. It offers buyers a window to respond when a seller receives a backup offer, thereby preserving the buyer's opportunity to secure the property. The key components of the rule include the 48-hour notification period, disclosure requirements, and the rights and responsibilities of both buyers and sellers. The rule's primary purpose is to balance the interests of both the buyer and seller. It provides a fair chance to the buyer while allowing the seller to consider other offers. It also serves to enhance transparency, promote ethical conduct, and foster trust in the real estate process.What Is the 48-Hour Rule?

Purpose and Application of the 48-Hour Rule

Ensuring Transparency and Fairness

Applicability to Certain Types of Real Estate Transactions

Compliance With Legal and Regulatory Requirements

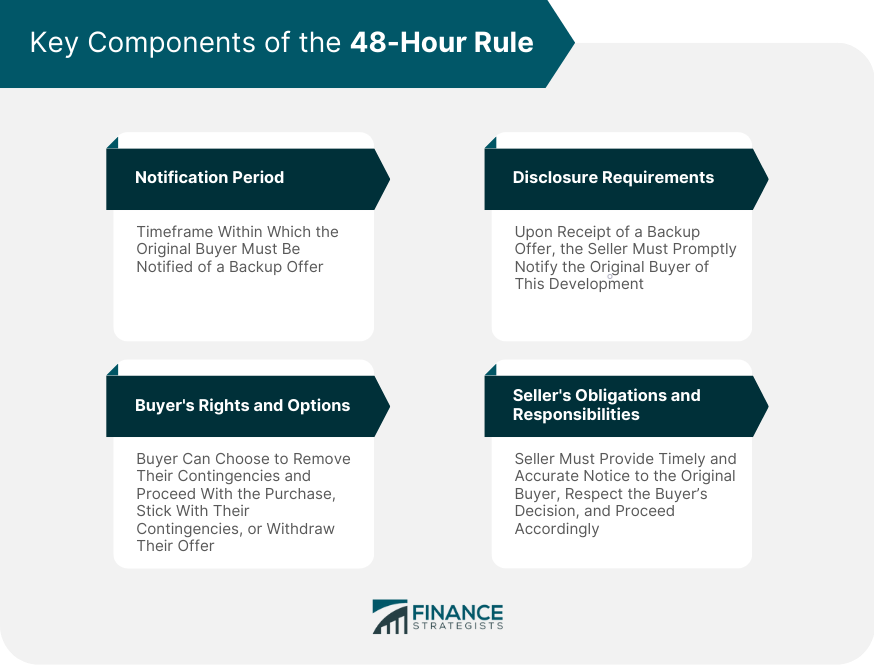

Key Components of the 48-Hour Rule

Notification Period

Disclosure Requirements

Buyer's Rights and Options

Seller's Obligations and Responsibilities

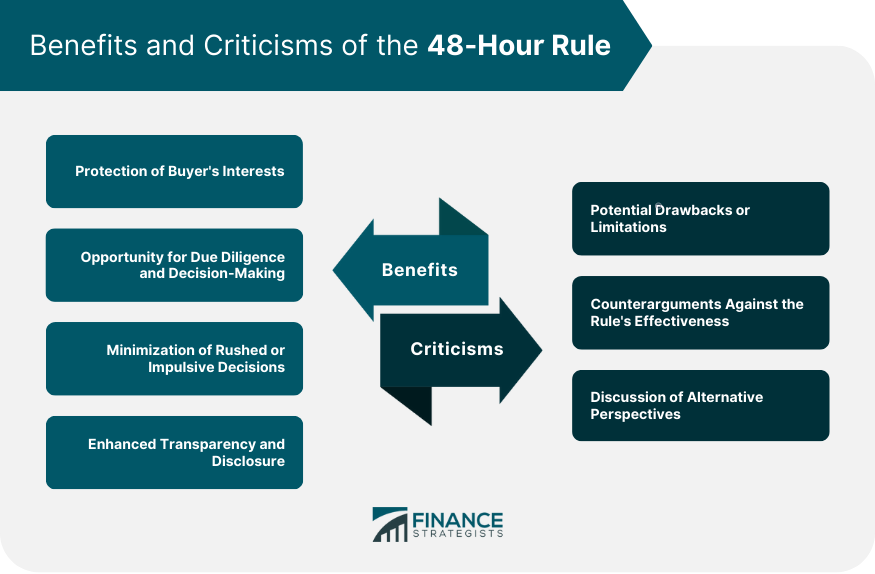

Benefits of the 48-Hour Rule

Protection of Buyer's Interests

Opportunity for Due Diligence and Decision-Making

Minimization of Rushed or Impulsive Decisions

Enhanced Transparency and Disclosure

Criticisms of the 48-Hour Rule

Potential Drawbacks or Limitations

Counterarguments Against the Rule's Effectiveness

Discussion of Alternative Perspectives

Exceptions and Exemptions to the 48-Hour Rule

Certain Types of Real Estate Transactions Exempted

Emergency Situations and Waiver Provisions

Applicable Laws and Local Regulations

Final Thoughts

48-Hour Rule FAQs

The 48-hour rule in real estate is a rule that gives the original buyer a 48-hour window to remove their contingencies upon the seller receiving a non-contingent offer from another buyer.

Both buyers and sellers can benefit from the 48-hour rule. Buyers are given a chance to respond to a backup offer, while sellers can encourage a faster removal of contingencies.

Critics argue that the 48-hour rule may put undue pressure on the original buyer to make quick decisions. Others believe it could slow down the sale process for the seller.

Yes, certain types of real estate transactions may be exempted from the rule, such as cash offers. Other exceptions can include emergency situations, waiver provisions, and local laws and regulations.

If the 48-hour rule is not followed, it could lead to legal disputes, delays, or even the nullification of the transaction. Therefore, compliance with the rule is crucial in real estate transactions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.