Capital markets refer to the venues where funds are exchanged between suppliers and those who seek capital for their own use. These venues may include the stock market, the bond market, and the currency and foreign exchange (forex) markets. Capital markets are used primarily to sell financial products such as equities and debt securities. Equities are stocks, which are ownership shares in a company, while debt securities, such as bonds, are interest-bearing IOUs. Capital markets are important for the economy, investors, and businesses for a variety of reasons. They facilitate the process of capital formation, which is critical to economic growth. Capital formation refers to the process by which savings are transformed into investments, creating jobs and stimulating economic growth. They enable businesses to access the capital they need to expand their operations and invest in new technologies. This creates jobs and generates economic activity, contributing to overall economic growth. They allow investors to diversify their portfolios, reducing their exposure to any single asset or sector. This helps manage risk and can lead to more stable returns on investment. By issuing stocks or bonds in the capital markets, businesses can raise funds for various purposes, such as expanding their operations, investing in new technologies, or acquiring other businesses. Capital markets function through the process of issuing new securities in the primary market and trading existing securities in the secondary market. Here is a breakdown of how each of these markets works and an overview of market participants, market indicators, and market efficiency. The primary market is where newly issued securities are sold for the first time. Companies issue securities such as stocks, bonds, and other financial instruments in order to raise capital. Investment banks act as underwriters in the process of issuing securities. They purchase securities from the issuing company at a discounted price and then sell them to investors for a higher price. The underwriter's role is to assess the risk of the issuing company and determine the appropriate price at which the securities should be sold to investors. They will then market the securities to investors, who can be individuals, institutions, or other organizations. Once the securities are sold to investors, they are considered in the secondary market. The secondary market is where securities are traded between investors. This includes both public exchanges such as the New York Stock Exchange (NYSE) and over-the-counter (OTC) markets. In the secondary market, investors can buy or sell securities they already own. The price of securities in the secondary market is determined by supply and demand. When demand for a security increases, the price typically increases, and vice versa. Market participants such as brokers, dealers, and market makers facilitate trades between buyers and sellers. Brokers act as intermediaries between buyers and sellers in the secondary market. They help investors buy and sell securities and charge a commission for their services. They do not own the securities themselves but help facilitate trades between buyers and sellers. Dealers buy and sell securities for their own accounts. They make money by buying securities at a lower price and selling them at a higher price. Dealers typically specialize in specific types of securities, such as government bonds or corporate bonds. Market makers are dealers that specialize in maintaining liquidity in certain securities. They provide a bid and ask price for the securities they specialize in and stand ready to buy and sell these securities at those prices. Market indicators such as stock indexes and bond yields are used to measure the performance of capital markets. Stock indexes track the performance of specific stock markets or groups of stocks, such as the S&P 500, which tracks the performance of the 500 largest publicly traded companies in the United States. Bond yields measure the return on investment for a particular bond. Market efficiency is the degree to which prices in the market reflect all available information. In an efficient market, prices will quickly adjust to new information as it becomes available, reflecting the true value of securities. It can be measured by the speed and accuracy with which prices adjust to new information. If prices adjust quickly and accurately, the market is considered to be efficient. If prices take a long time to adjust or do not accurately reflect new information, the market is considered to be inefficient. The table below shows several types of capital markets, each with its unique characteristics and features. The most common types include equities, bonds, commodities, and currencies. Understanding the different types of capital markets and the financial instruments traded in each market is essential for investors, companies, and other market participants to make informed investment decisions and manage their financial risks effectively. Participants in capital markets include a variety of individuals and institutions, each with a unique role and purpose. Here are the key participants in capital markets: Investors are individuals or institutions that buy and sell financial securities to make a profit or achieve specific investment goals. There are three main types of investors: Individual investors who buy and sell securities for their personal investment portfolios Institutional investors or large organizations, such as pension funds, mutual funds, and hedge funds, that manage money on behalf of their clients or members Foreign investors who invest in securities issued in that country Investors play a crucial role in capital markets by providing the capital that businesses and other organizations need to grow and thrive. Traders are individuals or firms that buy and sell securities on behalf of themselves or their clients for short-term gains. Traders use a variety of trading strategies, including: Day Trading. This involves buying and selling securities within a single trading day. Swing Trading. This involves holding securities for several days or weeks to capture short-term price movements. Position Trading. This involves holding securities for several months or even years to capture long-term price movements. Traders help create liquidity in the markets by facilitating the buying and selling of securities. Investment bankers are professionals who help companies and other organizations raise capital by issuing stocks or bonds in the capital markets. They play a crucial role in the primary market by underwriting new securities and helping companies navigate the regulatory requirements associated with issuing securities. Regulators are government agencies or other organizations responsible for overseeing and regulating the capital markets to ensure fair and transparent trading practices. There are several types of regulators that oversee capital markets, including: Securities and Exchange Commission (SEC). A US government agency responsible for regulating securities markets and protecting investors. Financial Industry Regulatory Authority (FINRA). A non-governmental organization that regulates broker-dealers and securities firms in the US. European Securities and Markets Authority (ESMA). A regulatory agency of the European Union that oversees securities markets in Europe. Regulators play a crucial role in maintaining the integrity and stability of the capital markets. Financial analysts are professionals who analyze and interpret financial data and market trends to provide insights and recommendations to investors and other stakeholders. They play a crucial role in helping investors make informed investment decisions and assessing the overall health of the capital markets. Capital markets plays a critical role in the economy by providing a platform for companies and other organizations to raise capital, allocate resources, manage risk, and promote economic growth. Here are the key ways that capital markets contribute to the economy: Capital markets facilitate the process of capital formation by providing a means for companies and other organizations to raise capital through the issuance of stocks and bonds. This, in turn, allows these organizations to invest in new projects, expand their operations, and create jobs, all of which contribute to economic growth. Capital markets helps allocate resources efficiently by directing capital to its most productive uses. Investors allocate capital to companies and projects that are most likely to generate the highest returns, which helps ensure that resources are allocated efficiently and effectively. Capital markets help manage risk for investors and businesses by providing a means to diversify their portfolios. Investors can allocate their capital across a range of assets, which helps reduce their exposure to any one asset or market. Similarly, businesses can use derivatives, such as options and futures, to hedge their exposure to price fluctuations in commodities and other inputs. Capital markets promote economic growth by facilitating the flow of capital to its most productive uses. By allowing companies and other organizations to raise capital and invest in new projects, capital markets help drive innovation and technological advancement, which in turn drives economic growth and development. While capital markets provide many benefits to the economy, they are not without challenges and controversies. Here are some of the key challenges and controversies associated with capital markets: Insider trading is the practice of buying or selling securities based on non-public information, which gives the trader an unfair advantage over other investors. Insider trading is illegal and unethical because it undermines the fairness and transparency of the capital markets. Market manipulation refers to the use of fraudulent or illegal tactics to artificially influence the price of a security or market. Examples of market manipulation include pump-and-dump schemes, spoofing, and front-running. Market manipulation can have a significant impact on the integrity of the capital markets and can harm investors. Systemic risk refers to the risk that the failure of one institution or market could cause a broader collapse of the financial system. This type of risk was a key factor in the 2008 financial crisis, which was triggered by the collapse of the subprime mortgage market. Systemic risk can be difficult to manage and can have severe consequences for the economy and society. Regulating capital markets is a complex and challenging task, and regulators must balance the need for investor protection with the need to promote market efficiency and innovation. Some of the challenges associated with regulating capital markets include keeping pace with technological advancements, ensuring fair and transparent trading practices, and preventing fraud and abuse. Financial crises can have a devastating impact on the economy and society, and they are often associated with capital markets. The 2008 financial crisis was triggered by a combination of factors, including the collapse of the subprime mortgage market, excessive risk-taking by financial institutions, and inadequate regulation. The consequences of financial crises can include widespread job losses, bankruptcies, and economic recession. The future of capital markets is shaped by various factors, including technological advancements, changing regulatory frameworks, globalization, and the growing importance of environmental, social, and governance (ESG) investing. Technological advancements, such as blockchain and artificial intelligence, are transforming the way capital markets operate. For example, blockchain technology has the potential to streamline the settlement process and increase transparency and security in transactions. Artificial intelligence is also being used to analyze data and provide insights to investors, traders, and other market participants. Regulatory frameworks are evolving to keep pace with the changing nature of capital markets. Regulators are increasingly focusing on issues such as cybersecurity, data privacy, and market manipulation. In addition, there is a growing trend toward harmonization of regulations across different jurisdictions. Globalization is having a significant impact on capital markets. With the increasing interconnectedness of the global economy, capital is being raised and allocated on a more international scale. This has led to the development of new financial instruments and the expansion of existing markets. ESG investing is becoming increasingly important in capital markets. This approach involves taking into account environmental, social, and governance factors when making investment decisions. As more investors prioritize ESG factors, companies are under increasing pressure to improve their sustainability and corporate responsibility practices. Capital markets play a vital role in the economy by enabling the exchange of funds between those seeking capital and those with capital to offer. This exchange takes place through various markets, including the stock, bond, commodity, and currency markets. Capital markets facilitate capital formation, which is crucial for economic growth, and also help in the allocation of resources and managing risks. The participants in capital markets include investors, traders, investment bankers, regulators, and financial analysts. However, there are some challenges and controversies, such as insider trading, market manipulation, systemic risk, regulatory issues, and financial crises. The future of capital markets is influenced by technological advancements, regulatory frameworks, globalization, and the increasing significance of ESG investing. Seeking professional help from a financial advisor can be beneficial for investors and other market participants to make informed investment decisions and manage financial risks effectively.What Are Capital Markets?

Importance of Capital Markets

How Does a Capital Market Work?

Primary Market

Secondary Market

Market Participants

Market Indicators

Market Efficiency

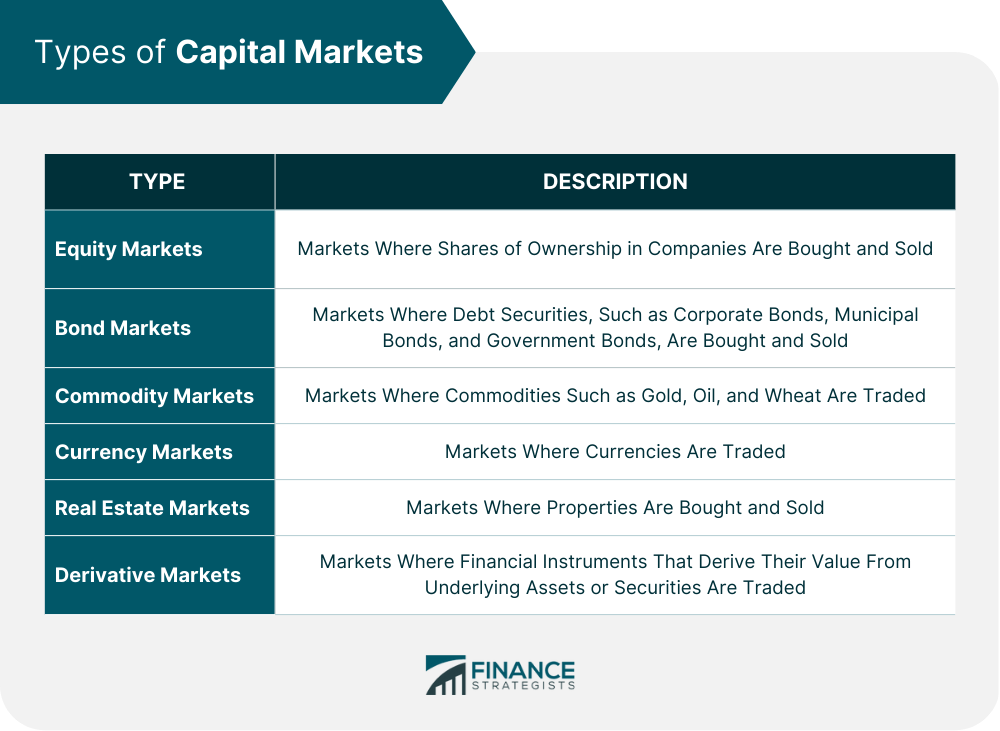

Types of Capital Markets

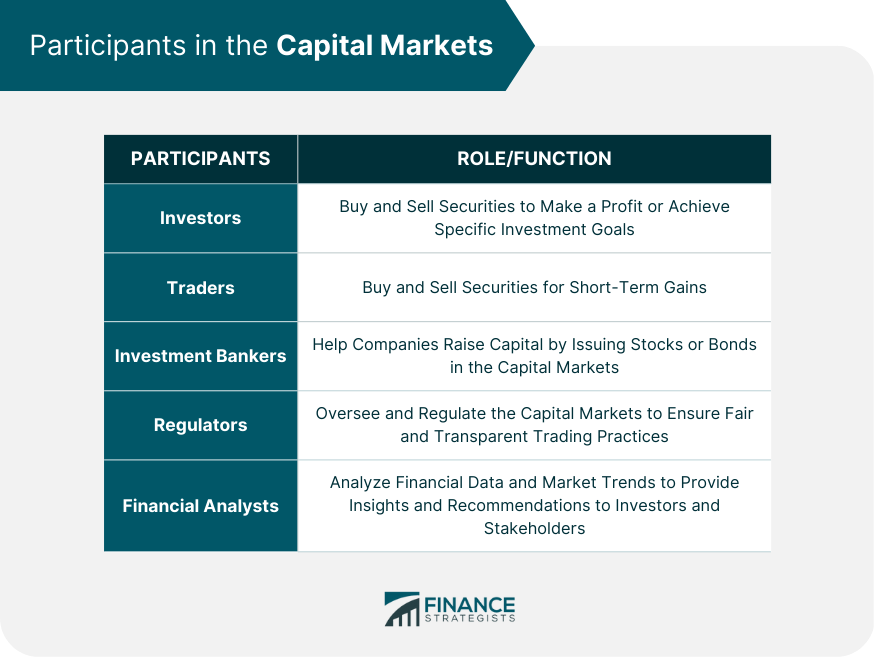

Participants in Capital Markets

Investors

Traders

Investment Bankers

Regulators

Financial Analysts

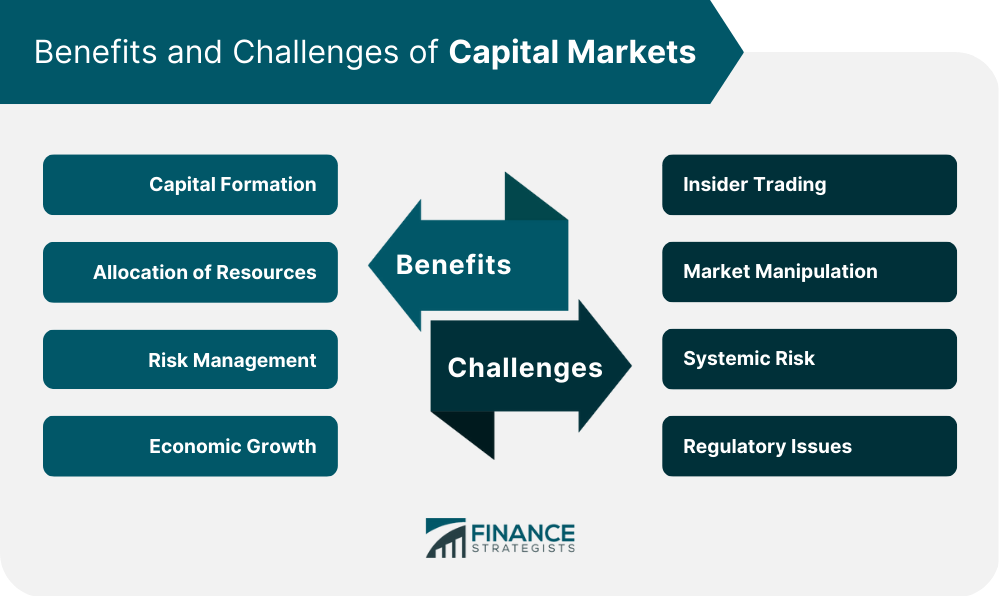

Role of Capital Markets in the Economy

Capital Formation

Allocation of Resources

Risk Management

Economic Growth

Challenges and Controversies in Capital Markets

Insider Trading

Market Manipulation

Systemic Risk

Regulatory Issues

Financial Crises

Future of Capital Markets

Final Thoughts

Capital Markets FAQs

Capital markets are venues where funds are exchanged between suppliers and those seeking capital, such as the stock, bond, commodity, and currency markets.

Capital markets facilitate capital formation, allocation of resources, risk management, and promote economic growth.

Key participants in capital markets include investors, traders, investment bankers, regulators, and financial analysts.

Challenges and controversies associated with capital markets include insider trading, market manipulation, systemic risk, regulatory issues, and financial crises.

The future of capital markets is shaped by technological advancements, changing regulatory frameworks, globalization, and the growing importance of ESG investing.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.