Nondeductible contributions refer to after-tax contributions made to retirement savings plans. These contributions are not tax-deductible, meaning they do not lower the individual's taxable income. The purpose of making nondeductible contributions is to increase retirement savings and provide additional flexibility in tax planning. These contributions can be beneficial in certain situations, depending on an individual's financial circumstances and goals. Traditional IRA nondeductible contributions are made when an individual is ineligible for tax-deductible contributions due to income limitations. These contributions help increase retirement savings, despite the lack of immediate tax benefits. After-tax 401(k) contributions are made in addition to pre-tax and Roth contributions. They allow individuals to save more for retirement, beyond the standard contribution limits for pre-tax and Roth contributions. After-tax 403(b) contributions are similar to after-tax 401(k) contributions but are made to a 403(b) plan, which is a retirement plan for employees of certain non-profit organizations, schools, and government agencies. Other qualified plans, such as 457 plans and SIMPLE IRAs, may also accept after-tax contributions. These contributions provide additional retirement savings options for individuals who have maximized their pre-tax and Roth contributions. Nondeductible contributions do not provide an upfront tax deduction. Individuals must pay taxes on the income used to make these contributions, unlike pre-tax contributions to retirement plans. Since nondeductible contributions are made with after-tax dollars, they do not reduce an individual's taxable income. However, they may still provide tax benefits in the future, such as tax-deferred growth and the potential for tax-free withdrawals. Earnings on nondeductible contributions grow tax-deferred, meaning taxes on the earnings are not due until the funds are withdrawn in retirement. This allows for potential compounding growth over time. When funds from nondeductible contributions are withdrawn in retirement, the earnings portion is subject to ordinary income tax rates. The original contributions, however, are not taxed again since they were made with after-tax dollars. Individuals who make nondeductible contributions to a traditional IRA must file Form 8606 with their tax return. This form helps to track the basis of nondeductible contributions and calculate the taxable portion of withdrawals. It is essential to accurately track the basis of nondeductible contributions to ensure the correct taxation of withdrawals. Failure to do so can result in paying unnecessary taxes or penalties on the non-taxable portion of the withdrawals. Nondeductible contributions allow individuals to save more for retirement, even if they have reached the maximum pre-tax or Roth contribution limits. These additional contributions can help individuals build a more substantial retirement nest egg. Nondeductible contributions provide a means of diversifying tax exposure in retirement, as they can be combined with pre-tax and Roth contributions. This diversification can help individuals better manage their tax liabilities during retirement. By converting nondeductible contributions to a Roth IRA, individuals can potentially enjoy tax-free withdrawals in retirement. This strategy, known as a backdoor Roth IRA, can be particularly beneficial for high-income earners who may not be eligible for direct Roth contributions. There are still limits on the total amount of contributions that can be made to retirement accounts each year. Individuals need to be aware of these limits to avoid over-contributing and incurring potential tax penalties. Although nondeductible contributions allow for additional retirement savings, they are still subject to income phase-out limits for traditional IRA contributions. High-income earners may find their ability to make nondeductible contributions restricted by these limits. Accurately tracking the basis in nondeductible contributions can be complex and time-consuming. Individuals must keep detailed records of their contributions and the associated tax forms to ensure the correct taxation of withdrawals in the future. Failure to properly track and report nondeductible contributions and their associated earnings can result in unnecessary taxes and penalties. Individuals must be diligent in their record-keeping and tax reporting to avoid these issues. The backdoor Roth IRA strategy allows individuals to make nondeductible contributions to a traditional IRA and then convert those contributions to a Roth IRA. This enables individuals who are otherwise ineligible for direct Roth contributions to still benefit from tax-free withdrawals in retirement. When converting nondeductible contributions to a Roth IRA, taxes may be due on any earnings generated by the contributions. However, the original contributions are not taxed again since they were made with after-tax dollars. The mega backdoor Roth IRA strategy involves making after-tax contributions to a 401(k) or 403(b) plan, and then rolling those contributions over to a Roth IRA. This strategy allows individuals to contribute significantly more to a Roth IRA than would be possible through direct contributions. Similar to the backdoor Roth IRA, taxes may be due on any earnings generated by the after-tax contributions when they are rolled over to a Roth IRA. However, the original contributions are not taxed again since they were made with after-tax dollars. Nondeductible contributions can be combined with other retirement savings strategies, such as pre-tax and Roth contributions, to create a comprehensive and diversified retirement plan. This approach can help individuals optimize their tax situation and achieve their long-term financial goals. Nondeductible contributions can be a valuable tool for increasing retirement savings and diversifying tax exposure. While they do not provide an upfront tax deduction, they offer potential tax-deferred growth and the opportunity for tax-free withdrawals in retirement. Individuals must accurately track and report their contributions and associated tax forms to ensure the correct taxation of withdrawals and avoid potential tax penalties. Additionally, there are limitations and drawbacks to consider, including contribution limits, income phase-out limits, and the complexity of tracking basis. Strategies involving nondeductible contributions, such as the backdoor Roth IRA and mega backdoor Roth IRA, can provide additional benefits but require careful planning and consideration. Overall, incorporating nondeductible contributions with other retirement savings strategies can help individuals optimize their tax situation and achieve their long-term financial goals. Given the complexity of retirement planning and tax implications, individuals should consider consulting with a financial advisor or tax professional for tailored advice. These experts can help assess one's financial situation, recommend appropriate strategies, and ensure compliance with tax reporting requirements.What Are Nondeductible Contributions?

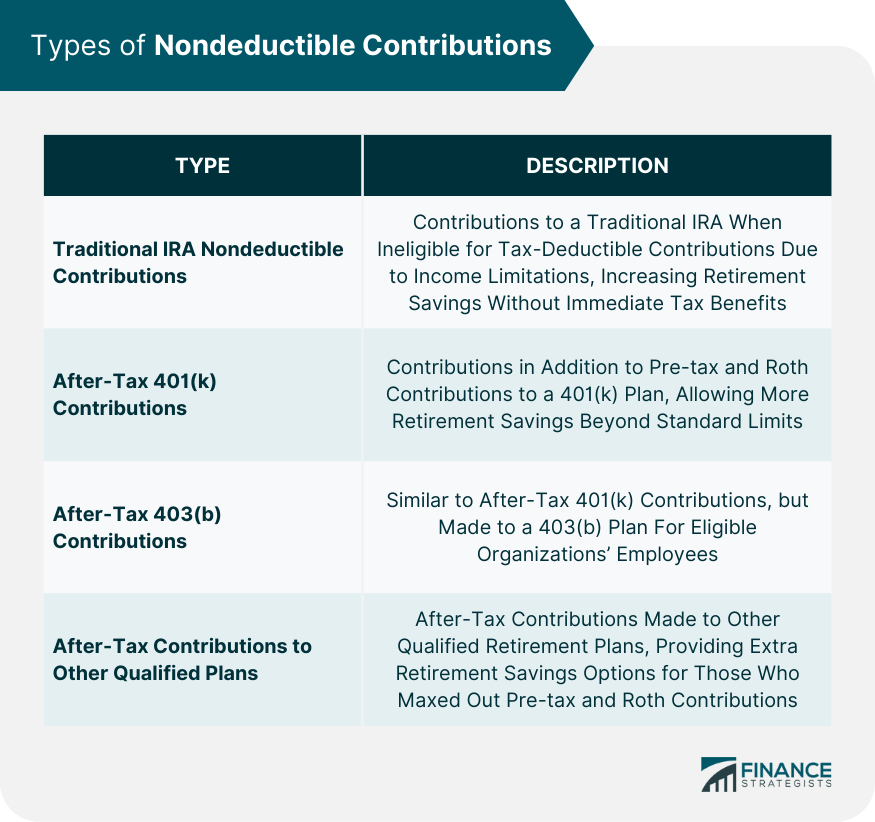

Types of Nondeductible Contributions

Traditional IRA Nondeductible Contributions

After-Tax 401(k) Contributions

After-Tax 403(b) Contributions

After-Tax Contributions to Other Qualified Plans

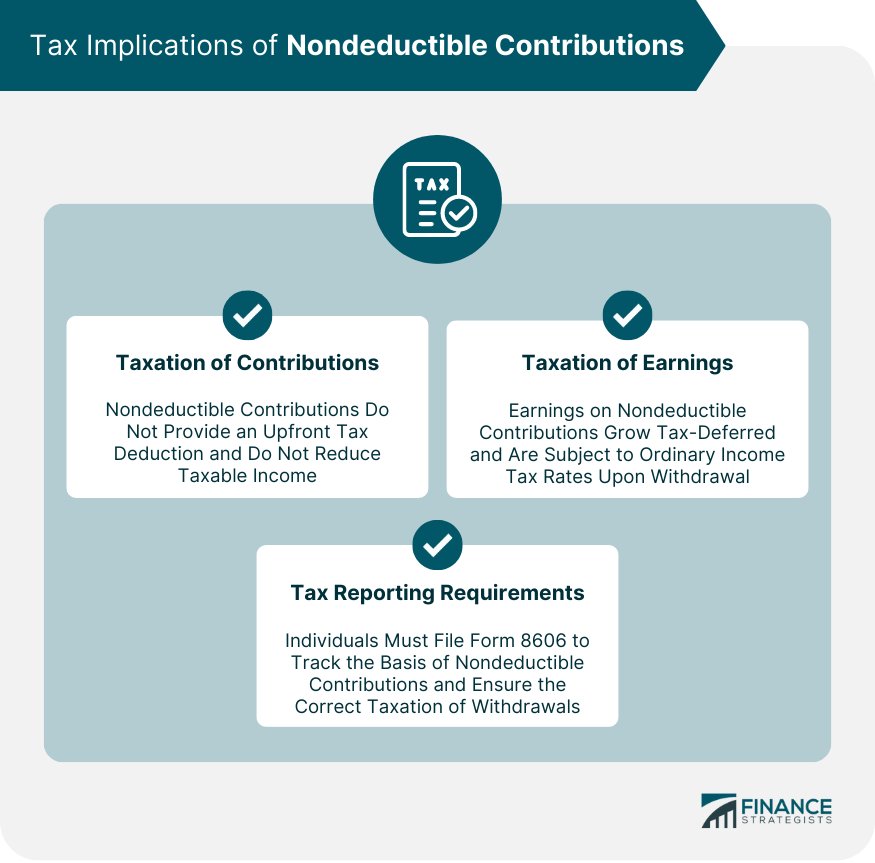

Tax Implications of Nondeductible Contributions

Taxation of Contributions

No Tax Deduction for Contributions

Impact on Taxable Income

Taxation of Earnings

Tax-Deferred Growth

Taxes Due Upon Withdrawal

Tax Reporting Requirements

Form 8606 (Nondeductible IRAs)

Tracking Basis in Nondeductible Contributions

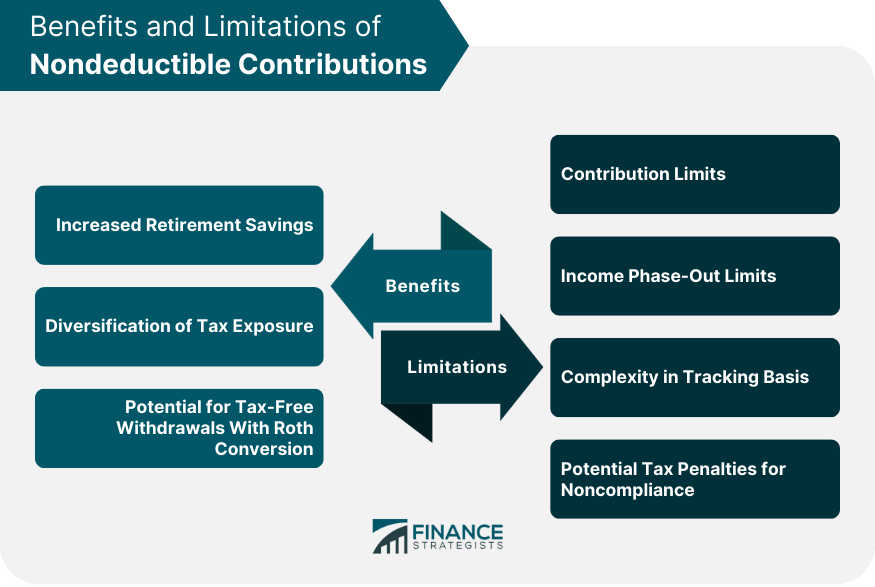

Benefits of Nondeductible Contributions

Increased Retirement Savings

Diversification of Tax Exposure

Potential for Tax-Free Withdrawals with Roth Conversion

Limitations and Drawbacks of Nondeductible Contributions

Contribution Limits

Income Phase-Out Limits

Complexity in Tracking Basis

Potential Tax Penalties for Noncompliance

Strategies Involving Nondeductible Contributions

Backdoor Roth IRA

Mega Backdoor Roth IRA

Purpose and Process

Tax Implications

Integrating Nondeductible Contributions with Other Retirement Savings Strategies

Final Thoughts

Nondeductible Contributions FAQs

Nondeductible contributions refer to after-tax contributions made to retirement savings plans, such as traditional IRAs, 401(k)s, and 403(b)s. Unlike pre-tax and Roth contributions, nondeductible contributions do not provide immediate tax deductions and do not reduce an individual's taxable income.

Nondeductible contributions are made with after-tax dollars, meaning they do not reduce an individual's taxable income. Earnings on these contributions grow tax-deferred, and taxes are due on the earnings portion upon withdrawal. In contrast, pre-tax contributions lower taxable income and are fully taxed upon withdrawal, while Roth contributions are made with after-tax dollars but offer tax-free withdrawals.

Nondeductible contributions can increase overall retirement savings, diversify tax exposure in retirement, and potentially enable tax-free withdrawals through Roth conversions (e.g., backdoor Roth IRA or mega backdoor Roth IRA strategies).

Some limitations and drawbacks of nondeductible contributions include contribution limits, income phase-out limits for traditional IRAs, complexity in tracking the basis in these contributions, and potential tax penalties for noncompliance with tax reporting requirements.

Yes, nondeductible contributions can be combined with pre-tax and Roth contributions to create a comprehensive and diversified retirement plan. Strategies like the backdoor Roth IRA and mega backdoor Roth IRA involve using nondeductible contributions to maximize tax-free withdrawals in retirement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.