Form 5329 is a tax form that reports additional taxes on qualified retirement plans, including Individual Retirement Arrangements (IRAs), 401(k) plans, and other tax-favored accounts. The form is filed in conjunction with your annual income tax return. Understanding its purpose, tax implications related to retirement accounts, and the penalties and reporting requirements associated with the form is crucial. The Internal Revenue Service (IRS) uses Form 5329 to determine whether taxpayers owe additional taxes on their retirement accounts due to early withdrawals, excess contributions, or missed required minimum distributions (RMDs). By understanding the form and properly reporting retirement account activity, taxpayers can avoid unnecessary penalties and potential complications with the IRS. Traditional IRAs are individual retirement accounts that allow taxpayers to make tax-deductible contributions. The contributions grow tax-deferred, meaning the earnings are taxed once the funds are withdrawn during retirement. Withdrawals from traditional IRAs are generally considered taxable income and may be subject to a 10% early withdrawal penalty if taken before the age of 59½. Roth IRAs are another type of individual retirement account. Unlike traditional IRAs, contributions to Roth IRAs are made with after-tax dollars. However, the earnings in a Roth IRA grow tax-free, and qualified withdrawals during retirement are not subject to federal income taxes. Roth IRAs also have early withdrawal penalties if funds are taken out before the age of 59½, but the penalties' rules differ from traditional IRAs. A 401(k) plan is an employer-sponsored retirement plan that allows employees to contribute a portion of their pre-tax income to a retirement account. Like traditional IRAs, the contributions and earnings in a 401(k) grow tax-deferred. Withdrawals during retirement are considered taxable income, and early withdrawals are generally subject to a 10% penalty. A 403(b) plan is similar to a 401(k) plan but is designed for employees of tax-exempt organizations, such as public schools, hospitals, and religious institutions. The contribution and withdrawal rules for a 403(b) plan are generally the same as those for a 401(k) plan, including the 10% early withdrawal penalty. The 457(b) plan is another type of deferred compensation retirement plan, primarily for state and local government employees and some non-profit organizations. The contributions and earnings grow tax-deferred, but the 457(b) plan has different rules for early withdrawals. Unlike other retirement plans, there is no 10% early withdrawal penalty for distributions taken before the age of 59½. Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plan for Employees (SIMPLE) IRAs are retirement plans designed for small businesses and self-employed individuals. Both types of plans offer tax-deferred growth and are subject to similar withdrawal rules and penalties as traditional IRAs. Qualified plans are employer-sponsored retirement plans that meet specific IRS requirements, allowing them to offer tax benefits to both employers and employees. Examples of qualified plans include 401(k) plans, 403(b) plans, and defined benefit pension plans. Withdrawals from qualified plans are generally subject to income taxes and may be subject to penalties if taken early. In general, withdrawals from retirement accounts before the age of 59½ are subject to a 10% early distribution penalty and any income taxes owed on the withdrawal. This penalty is designed to discourage individuals from accessing their retirement savings prematurely. However, there are specific circumstances in which the early withdrawal penalty may not apply. There are several exceptions to the early withdrawal penalty for retirement account distributions. These exceptions vary depending on the type of retirement account and the circumstances surrounding the withdrawal. Some common exceptions include: Disability: If an individual becomes permanently disabled, they may be able to take distributions from their retirement account without incurring the 10% early withdrawal penalty. Medical Expenses: Distributions may be taken without penalty to cover unreimbursed medical expenses exceeding a percentage of the taxpayer's adjusted gross income (AGI). First-Time Home Purchase: Individuals may be able to withdraw up to $10,000 from their retirement account without penalty to put towards purchasing their first home. Higher Education Expenses: Distributions may be taken without penalty to cover qualified higher education expenses for the taxpayer, their spouse, or their dependents. Health Insurance Premiums: In some cases, unemployed individuals can withdraw funds from their retirement account without penalty to pay for health insurance premiums. IRS Levy: If the IRS levies a taxpayer's retirement account, the distributions to satisfy the levy are not subject to the early withdrawal penalty. Qualified Reservist Distributions: Certain military reservists called to active duty may be able to take penalty-free distributions from their retirement accounts. Other Exceptions: There are additional exceptions to the early withdrawal penalty for specific types of retirement accounts, such as Roth IRAs and 457(b) plans. Excess contributions occur when an individual contributes more than the annual limit to a retirement account, such as a traditional IRA, Roth IRA, or employer-sponsored retirement plan. The IRS establishes these limits and may change annually due to inflation adjustments. If excess contributions are not corrected by the deadline, the taxpayer will face a 6% excise tax on the excess amount. This tax applies for each year the excess contributions remain in the account. Additionally, the earnings generated by the excess contributions may also be subject to taxes and penalties when withdrawn. To avoid the 6% excise tax, taxpayers must withdraw the excess contributions and any associated earnings before the tax filing deadline, including extensions. The withdrawn earnings may be subject to income taxes and potentially a 10% early withdrawal penalty, depending on the type of retirement account. When filing Form 5329, taxpayers must report any excess contributions to their retirement accounts, even if they have been corrected. The form includes specific sections for reporting excess contributions to traditional IRAs, Roth IRAs, and other retirement plans. Required minimum distributions (RMDs) are the minimum amounts that must be withdrawn from certain retirement accounts annually, starting when the account owner reaches a specific age (generally 72, but there are exceptions). RMD rules apply to traditional IRAs, SEP IRAs, SIMPLE IRAs, and most employer-sponsored retirement plans. RMDs are calculated based on the account balance at the end of the previous year and the account owner's life expectancy, as determined by the IRS's Uniform Lifetime Table. The RMD amount may vary each year, and account owners must calculate their RMDs for each qualifying retirement account separately. The deadline for taking the first RMD is April 1 of the year following the calendar year in which the account owner reaches the specified age. For subsequent years, the RMD deadline is December 31. Failure to take an RMD by the deadline may result in a significant penalty. If an account owner does not take their RMD by the deadline, they may be subject to a 50% excise tax on the amount not distributed. This penalty is in addition to any income taxes that may be owed on the distribution. If a taxpayer fails to take an RMD, they must report the missed distribution on Form 5329 and calculate the 50% excise tax. S ometimes, taxpayers may be eligible for a penalty waiver if they can demonstrate reasonable cause for the missed RMD and take corrective action. Prohibited transactions are actions not allowed with retirement accounts, such as borrowing from the account or using the account as collateral for a loan. Engaging in a prohibited transaction can result in a 15% excise tax on the amount involved, with an additional 100% tax if the transaction is not corrected. In some cases, taxpayers may make nondeductible contributions to a traditional IRA, meaning the contributions were made with after-tax dollars. If a taxpayer mistakenly claims a deduction for non-deductible contributions, they may be subject to a 6% excise tax on the excess amount. Accumulation distributions are distributions from certain trusts that are subject to an additional tax. This tax is calculated using the rates applicable to the beneficiary's tax bracket and is reported on Form 5329. When completing Form 5329, taxpayers must first identify the sections that apply to their specific situation. The form is divided into nine parts, each addressing a different aspect of retirement account taxes and penalties. Form 5329 includes detailed instructions for each part, which taxpayers should follow carefully to ensure accurate reporting. The nine parts of Form 5329 are: Part I: Additional Tax on Early Distributions: This section reports and calculates the 10% additional tax on early withdrawals from retirement accounts. Part II: Additional Tax on Certain Distributions From Education Accounts: This section reports additional taxes on distributions from Coverdell Education Savings Accounts (ESAs) and Qualified Tuition Programs (QTPs) that are not used for qualified education expenses. Part III: Additional Tax on Excess Contributions to Traditional IRAs: This section reports excess contributions to traditional IRAs and calculates the 6% excise tax. Part IV: Additional Tax on Excess Contributions to Roth IRAs: This section reports excess contributions to Roth IRAs and calculates the 6% excise tax. Part V: Additional Tax on Early Distributions From SIMPLE IRAs: This section reports and calculates the 25% additional tax on early withdrawals from SIMPLE IRAs within the first two years of participation in the plan. Part VI: Additional Tax on Accumulation Distribution of Trusts: This section reports and calculates the additional tax on accumulation distributions from certain trusts. Part VII: Additional Tax on Excess Accumulation in Qualified Retirement Plans: This section reports and calculates the 50% excise tax on missed RMDs. Part VIII: Additional Tax on Excess Contributions to Archer MSAs: This section reports excess contributions to Archer Medical Savings Accounts (MSAs) and calculates the 6% excise tax. Part IX: Additional Tax on Excess Contributions to Health Savings Accounts (HSAs): This section reports excess contributions to HSAs and calculates the 6% excise tax. Form 5329 should be filed with the taxpayer's annual income tax return, typically by the April 15 deadline. However, if a taxpayer receives an extension for their income tax return, the deadline for filing Form 5329 is also extended. Taxpayers should consult the IRS's instructions for Form 5329 to ensure they properly complete and submit it. Understanding and accurately reporting retirement account activity on Form 5329 is essential for avoiding unnecessary penalties and potential complications with the IRS. By being aware of the tax implications of retirement accounts, taxpayers can make informed decisions about their retirement savings and ensure compliance with IRS requirements. If you need help with how to complete Form 5329 or have questions about your specific situation, it is advisable to consult with a tax services professional for guidance. Tax professionals can help you navigate the complexities of retirement account taxation and ensure that you accurately report your retirement account activity to the IRS.What Is Form 5329?

Types of Retirement Accounts and Distributions

Traditional IRAs

Roth IRAs

401(k) Plans

403(b) Plans

457(b) Plans

SEP and SIMPLE IRAs

Qualified Plans

Early Distribution Penalties

General Rule for Early Withdrawals

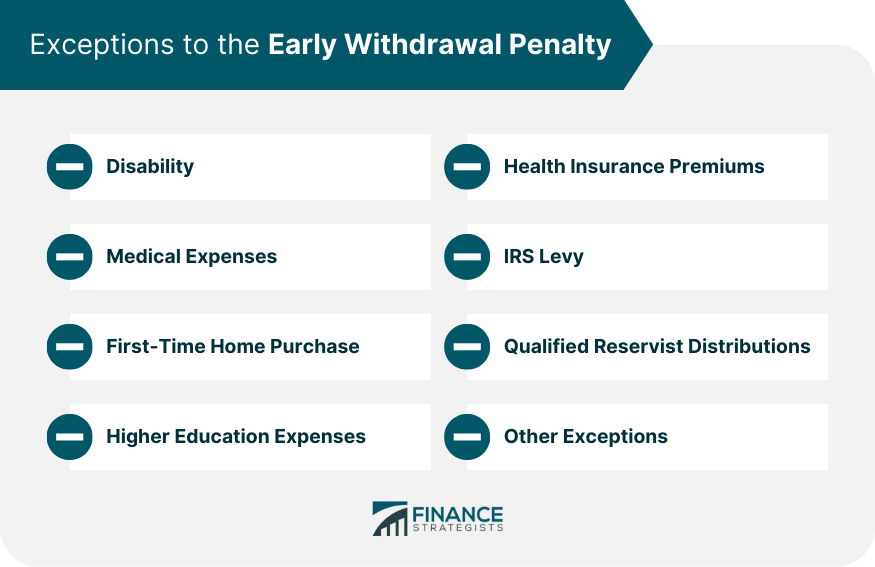

Exceptions to the Early Withdrawal Penalty

Excess Contributions

Defining Excess Contributions

Consequences of Excess Contributions

Correcting Excess Contributions

Reporting Excess Contributions on Form 5329

Required Minimum Distributions (RMDs)

Understanding RMDs

Calculating RMDs

RMD Deadlines

RMD Penalties

Reporting Missed RMDs on Form 5329

Additional Taxes on Qualified Plans

Tax on Prohibited Transactions

Tax on Non-deductible Contributions

Tax on Accumulation Distributions

Completing Form 5329

Identifying Required Sections

Instructions for Each Part

Filing Deadlines and Procedures

Conclusion

Form 5329 FAQs

Form 5329 is a tax form used by taxpayers in the United States to report additional taxes on certain retirement accounts, including individual retirement accounts (IRAs), qualified retirement plans, and Coverdell education savings accounts. It reports and calculates additional taxes on early distributions, excess contributions, and certain other retirement-related transactions.

Taxpayers who have taken early distributions from retirement accounts, made excess contributions to retirement accounts, or engaged in certain other retirement-related transactions that result in additional taxes may need to file Form 5329. This includes individuals who have taken distributions from IRAs or qualified retirement plans before reaching age 59½, and those who have contributed more than the allowable limit to their retirement accounts.

To calculate the additional tax on early distributions using Form 5329, you must enter the total amount of the early distribution on the appropriate form line (e.g., line 1 for IRAs and line 3 for qualified retirement plans). The additional tax is generally 10% of the amount of the early distribution unless an exception applies. You can calculate the tax by multiplying the distribution amount by 10% and entering the result on the designated line.

Yes, several exceptions exist to the additional tax on early distributions reported on Form 5329. Some common exceptions include distributions made after reaching age 59½, distributions due to disability, distributions made as part of a series of substantially equal periodic payments, and distributions used for certain medical expenses or qualified higher education expenses. The form includes instructions for claiming these exceptions.

Yes, you can use Form 5329 to report and correct excess contributions to your IRA or retirement plan. To do so, you must enter the excess contribution amount on the appropriate line of the form (e.g., line 9 for IRAs and line 13 for qualified retirement plans) and calculate the additional tax, if applicable. You may not owe additional tax if you have already corrected the excess contribution by withdrawing it and any associated earnings before the tax filing deadline. The form includes instructions for reporting and correcting excess contributions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.