Form 8606 is a tax form used by individuals in the United States to report certain nondeductible contributions and distributions made to and from individual retirement arrangements (IRAs). This form is primarily used when individuals have made contributions to a traditional IRA for which they did not claim a tax deduction, as well as when they have made distributions from certain types of IRAs. By filing Form 8606, individuals can accurately report these transactions to the Internal Revenue Service (IRS) and ensure that they are complying with the appropriate tax regulations. This form helps taxpayers calculate the taxable and nontaxable portions of IRA distributions and maintain a clear record of their retirement savings activities. This form isn't for everyone. You must file Form 8606 if you have made nondeductible contributions to a traditional IRA, have taken distributions from a traditional, SEP, or SIMPLE IRA when you've made nondeductible contributions, or have converted these types of IRAs to a Roth IRA. Even those receiving distributions from a Roth IRA may need to file it. A nondeductible IRA is a traditional IRA that contains funds you have contributed post-tax. Unlike standard IRA contributions, these nondeductible contributions do not lower your taxable income for the year they were made. Nondeductible IRAs often serve as an option for those who earn too much to contribute to a Roth IRA or deduct contributions to a traditional IRA. Despite missing out on the immediate tax deduction, your money grows tax-deferred in a nondeductible IRA until you start taking distributions. Form 8606 has three parts, each dealing with a specific aspect of your IRA transactions. Part I: Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs Part I of Form 8606 tracks nondeductible contributions to your traditional IRA during the tax year. It also accounts for distributions from traditional, SEP, and SIMPLE IRAs when you have made nondeductible contributions to these accounts. Part II covers conversions from SEP, SIMPLE, or traditional IRAs to Roth IRAs. This section ensures that any taxes due on the conversion are appropriately calculated and paid. Part III is where you report any distributions from a Roth IRA. This section allows the IRS to determine whether the distribution is a return of contributions (which is tax-free) or if it constitutes earnings (which may be taxable). Completing Part I of Form 8606 requires you to enter your total nondeductible contributions for the year, any distributions you've taken, and the value of all your traditional, SIMPLE, and SEP IRAs as of the end of the year. Part II requires you to detail any amounts you've converted to a Roth IRA and calculate the taxable portion of the conversion. In Part III, you'll need to document any distributions you've taken from your Roth IRA and calculate whether any part of those distributions is taxable. Form 8606 must be filed in several situations, primarily around nondeductible IRA contributions and distributions. If you make nondeductible contributions to your traditional IRA, you must file Form 8606 to track these contributions. This form helps prevent you from being taxed again when you start taking distributions. If you've made nondeductible contributions to your traditional, SEP, or SIMPLE IRA and you take a distribution, you'll need to file Form 8606. This form will help determine the taxable portion of your distribution. Converting any of these IRAs to a Roth IRA requires the filing of Form 8606. This process ensures that the taxable portion of your conversion is calculated and reported correctly. You must file Form 8606 if you receive distributions from a Roth IRA, as the form will help determine whether these distributions are a return of contributions (not taxable) or earnings (potentially taxable). Form 8606 should be filed with your federal income tax return for the year you made nondeductible contributions or took distributions from your IRA. If you forgot to file Form 8606, you should file it as soon as possible to avoid potential penalties. Form 8606 is submitted to the IRS along with your tax return. The exact location depends on your residence and whether you are including a payment with your return. Not filing Form 8606 when necessary can result in a $50 penalty. Additionally, failing to report distributions may result in a 10% excessive contributions tax each year until the issue is resolved. If you discover an error on a previously filed Form 8606, you should file an amended form immediately. This process involves completing a new Form 8606 and attaching it to an amended tax return (Form 1040-X). If the IRS sends a notice about your Form 8606, review the notice carefully and respond promptly. You may need to file an amended form or provide additional documentation. A backdoor Roth IRA conversion, which involves making nondeductible contributions to a traditional IRA and then converting those funds to a Roth IRA, requires careful handling of Form 8606 to ensure that taxes are correctly calculated and reported. The pro-rata rule can complicate the tax situation for individuals with deductible and nondeductible IRA contributions. The rule requires you to consider all your traditional IRAs as one when calculating the tax on distribution or conversion. The IRS provides detailed instructions for completing Form 8606. If you have a complex situation or need additional help, consider contacting the IRS directly or seeking the help of a tax professional. Professional tax advisors can provide personalized guidance based on your individual financial situation. They can also ensure that Form 8606 and other tax forms are completed accurately. Many tax preparation software programs can guide you through completing Form 8606. These programs often include features that check for errors and help optimize your tax situation. The essential purpose of Form 8606 is to track your basis in your IRAs. The basis is the total amount of after-tax money in your accounts, which includes nondeductible contributions and any rollovers of after-tax dollars from workplace plans. By reporting these amounts on Form 8606, you tell the IRS, "I've already paid tax on this money." When it's time to withdraw the funds, this will help ensure you're not taxed again on the same money. Completing Form 8606 may seem daunting at first, but with careful attention and a thorough understanding of your IRA contributions and distributions, it's quite manageable. The key is to take your time and carefully follow the instructions provided by the IRS. Each part of the form addresses a specific transaction type, so ensure you enter the correct information in the correct section. Also, remember to carry forward your nondeductible contributions from previous years. The cumulative total of your nondeductible contributions gives you the basis for your IRA, and it's crucial to keep this current. If you're unsure about any part of the form, it's worth consulting a tax professional. This could help prevent errors that may lead to unnecessary taxes or penalties.What Is Form 8606?

Who Needs to File It?

Understanding Form 8606

Definition of a Nondeductible IRA

Why Individuals Might Choose a Nondeductible IRA

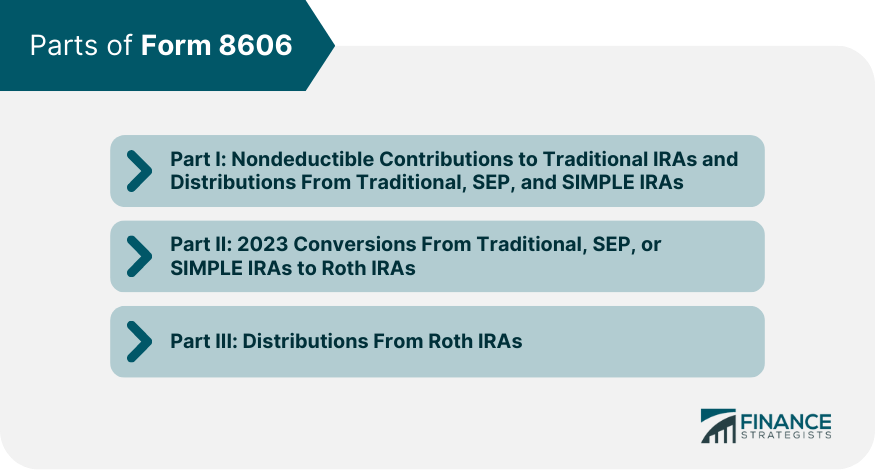

Parts of Form 8606

Part II: 2023 Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs

Part III: Distributions From Roth IRAs

How to Complete Form 8606

Instructions for Part I

Instructions for Part II

Instructions for Part III

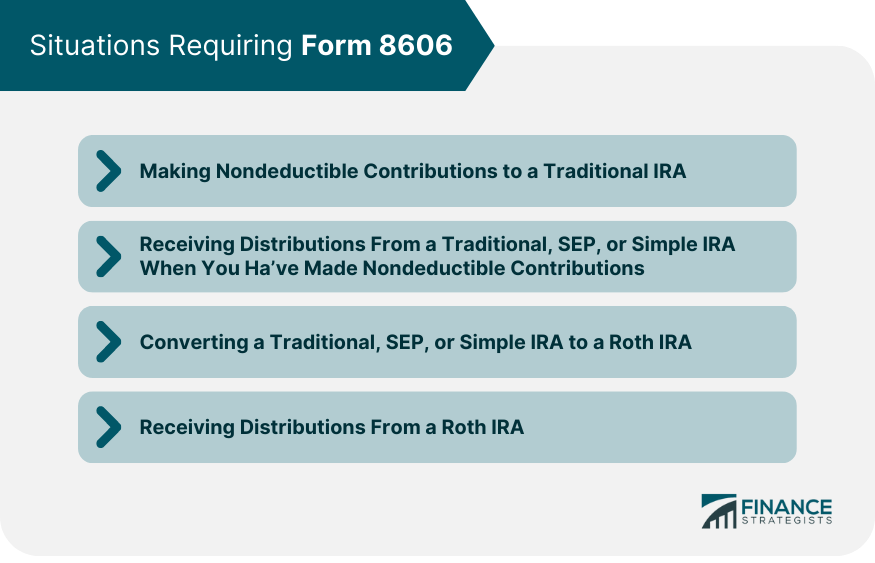

Situations Requiring Form 8606

Making Nondeductible Contributions to a Traditional IRA

Receiving Distributions From a Traditional, SEP, or SIMPLE IRA When You've Made Nondeductible Contributions

Converting a Traditional, SEP, or SIMPLE IRA to a Roth IRA

Receiving Distributions From a Roth IRA

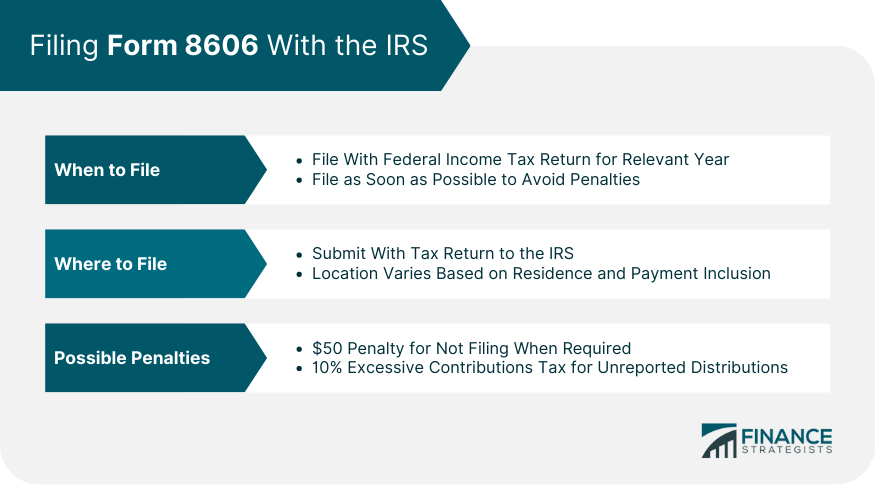

Filing Form 8606 With the IRS

When to File

Where to File

Possible Penalties for Not Filing

Correcting Mistakes on Form 8606

Amending Previously Filed Form 8606

Addressing IRS Notices About Form 8606

Advanced Topics Related to Form 8606

Backdoor Roth IRA Conversions

Pro-Rata Rule Considerations

Resources for Help With Form 8606

IRS Resources

Professional Financial or Tax Advisors

Tax Preparation Software

Conclusion

Form 8606 FAQs

Form 8606 reports nondeductible contributions to a traditional IRA or distributions from a traditional, SEP, or SIMPLE IRA when you've made nondeductible contributions. It's also used when converting these types of IRAs to a Roth IRA or when receiving distributions from a Roth IRA.

You need to file Form 8606 if you've made nondeductible contributions to a traditional IRA, taken distributions from a traditional, SEP, or SIMPLE IRA when you've made nondeductible contributions, converted these types of IRAs to a Roth IRA, or received distributions from a Roth IRA.

If you fail to file Form 8606 when required, the IRS may impose a $50 penalty. Additionally, failure to report distributions could result in a 10% excessive contributions tax each year until the issue is resolved.

If you discover an error on a previously filed Form 8606, you should file an amended form immediately. This involves completing a new Form 8606 and attaching it to an amended tax return (Form 1040-X).

The IRS provides detailed instructions for completing Form 8606. Additionally, professional tax advisors can offer personalized guidance, and many tax preparation software programs can guide you through the process and check for errors

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.