Exit tax planning refers to the process of organizing your financial affairs in a way that minimizes the tax consequences of leaving a country where you are a tax resident. It involves strategies to reduce or defer tax liabilities that may arise as a result of the sale, transfer or distribution of assets when leaving a country. Understanding and addressing exit tax liabilities can help individuals make informed decisions and optimize their financial outcomes. Proper planning can minimize tax liability, preserve wealth, and facilitate a smooth transition during significant life changes. Exit tax planning becomes particularly relevant in situations such as selling a business, transferring assets to family members, relocating to another country, or retiring from a long-held investment. Capital gains tax is levied on the profit realized from the sale of assets, such as stocks, real estate, or collectibles. The tax rate depends on the holding period and the individual's tax bracket. Income tax may apply to certain transactions, such as the sale of a business or the receipt of deferred compensation. In these cases, the individual's income tax rate will determine the tax liability. Gift and estate taxes may apply when transferring assets to family members or beneficiaries, either during one's lifetime or upon death. Tax rates and exemptions vary depending on the relationship between the giver and the recipient and the value of the assets. An individual's residency status can significantly impact their exit tax liability. For example, U.S. citizens and residents are generally subject to capital gains tax on their worldwide income, while nonresident aliens are typically only taxed on income from U.S. sources. Tax treaties between countries can provide relief from double taxation and determine the allocation of taxing rights. These agreements may reduce or eliminate tax liability in specific situations. Different types of assets may be subject to different tax rates and exemptions, depending on their nature and value. For example, the sale of a primary residence may be eligible for a capital gains tax exclusion, while the sale of an investment property may not. Timing the sale of assets can significantly impact exit tax liability. Long-term capital gains, generally resulting from assets held for more than one year, are typically taxed at a lower rate than short-term capital gains. Tax rates may change over time due to legislative or economic factors. By anticipating and understanding these fluctuations, individuals can make informed decisions about the timing of asset sales or transfers. Contributing to tax-deferred accounts, such as IRAs or 401(k)s, can help individuals defer or minimize exit tax liability until they withdraw the funds in retirement. Donating appreciated assets to a qualified charity can help individuals avoid capital gains tax and potentially receive an income tax deduction. Gifting assets to family members or other beneficiaries may help reduce gift and estate tax liability, depending on the value of the assets and the relationship between the giver and the recipient. Tax loss harvesting involves selling underperforming investments to offset gains from the sale of other investments, reducing overall capital gains tax liability. Asset location optimization involves strategically placing different types of investments in taxable and tax-advantaged accounts to minimize tax liability Proper estate planning, including the use of trusts and wills, can help minimize estate and gift tax liability while ensuring the efficient transfer of assets to beneficiaries. Inheritance tax planning involves understanding and managing potential inheritance tax liabilities that may arise when assets are transferred to heirs. Tax treaties between countries can help prevent double taxation by allocating taxing rights between the countries involved. This can significantly impact exit tax planning for individuals with cross-border financial interests. Tax treaties may also provide tax credits or exemptions that reduce or eliminate exit tax liability in certain situations. The United States imposes an exit tax on certain high net worth individuals who give up their U.S. citizenship or residency. Understanding the rules and requirements surrounding the expatriation tax is essential for those considering this option. Other countries may also impose exit taxes on individuals who leave their jurisdiction. Familiarizing oneself with the tax implications of changing residency is crucial for effective exit tax planning. Cross-border estate planning involves addressing the unique challenges and tax implications of transferring assets across international borders. Proper planning can help minimize tax liability and ensure a smooth transfer of wealth. International wills and trusts can be useful tools for managing assets and addressing estate tax issues in multiple jurisdictions. A tax advisor with expertise in exit tax planning can provide valuable guidance and help individuals navigate the complex rules and regulations surrounding exit taxes. Choosing a tax advisor with experience in exit tax planning and familiarity with one's specific financial situation is essential to achieving the best possible outcomes. Estate planning attorneys can help individuals draft wills, establish trusts, and address other legal issues related to exit tax planning. International tax attorneys can provide guidance on cross-border tax issues and help individuals understand and manage their exit tax liabilities in multiple jurisdictions. Exit tax planning is an essential aspect of personal finance that requires a thorough understanding of tax implications and strategic management of assets. By considering factors such as residency status, tax treaties, and asset types, individuals can optimize their financial outcomes and minimize exit tax liability. Proactive exit tax planning is crucial for individuals facing significant life changes or asset transfers. By engaging in strategic planning, individuals can avoid unnecessary tax burdens and ensure a smooth transition during these events. Effective exit tax planning can lead to substantial financial benefits, including reduced tax liability, preserved wealth, and a more efficient transfer of assets to beneficiaries. Individuals are encouraged to seek the advice of tax and legal professionals when engaging in exit tax planning. These experts can provide valuable guidance and help navigate the complex rules and regulations surrounding exit taxes, ensuring the best possible outcomes for their clients.Definition of Exit Tax Planning

Importance of Exit Tax Planning

Common Scenarios Triggering Exit Taxes

Understanding Exit Taxes

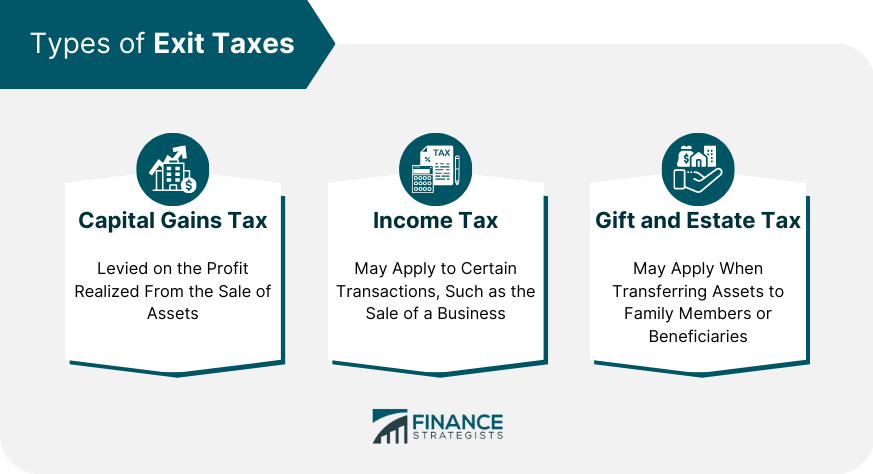

Types of Exit Taxes

Capital Gains Tax

Income Tax

Gift and Estate Tax

Factors Affecting Exit Tax Liability

Residency Status

Tax Treaties

Asset Types and Values

Exit Tax Planning Strategies

Timing of Asset Sales or Transfers

Long-Term vs Short-Term Capital Gains

Tax Rate Fluctuations

Deferring or Minimizing Tax Liability

Tax-Deferred Accounts

Charitable Donations

Gifting Assets

Tax-Efficient Investment Strategies

Tax Loss Harvesting

Asset Location Optimization

Estate Planning Considerations

Trusts and Wills

Inheritance Tax Planning

International Exit Tax Planning

Understanding Tax Treaties

Double Taxation Avoidance

Tax Credits and Exemptions

Expatriation Tax Considerations

US Expatriation Tax

Exit Taxes in Other Countries

International Estate Planning

Cross-Border Estate Planning

International Wills and Trusts

Professional Assistance for Exit Tax Planning

Working With a Tax Advisor

Importance of a Tax Advisor's Expertise

Selecting the Right Tax Advisor

Legal Considerations

Estate Planning Attorneys

International Tax Attorneys

Conclusion

Recap of Key Points

Importance of Proactive Exit Tax Planning

Potential Positive Outcomes From Exit Tax Planning

Encouragement for Individuals to Seek Professional Advice for Exit Tax Planning

Exit Tax Planning FAQs

Exit tax planning refers to the process of organizing your financial affairs in a way that minimizes the tax consequences of leaving a country where you are a tax resident.

Individuals who are tax residents of a country and who are leaving or planning to leave that country may be subject to an exit tax.

Exit tax is usually calculated on the basis of the unrealized capital gains of the taxpayer at the time of leaving the country. The tax rate and other rules may vary depending on the country of residence.

Some strategies for minimizing exit tax may include deferring the realization of capital gains, using tax treaties and exemptions, and structuring your assets and investments in a tax-efficient manner.

It is advisable to start thinking about exit tax planning as early as possible, ideally before you become a tax resident of a country. However, it is never too late to take steps to minimize your tax liability when leaving a country.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.