Estate planning is an essential aspect of managing one's assets and ensuring the smooth transfer of wealth to the intended beneficiaries. Wills and trusts are two common estate planning tools that individuals can use to manage their assets and distribute their wealth after they pass away. A will is a legal document that outlines how an individual's assets should be distributed after their death. Wills can also be used to name guardians for minor children and to appoint an executor to manage the estate. A trust, on the other hand, is a legal entity that holds and manages assets on behalf of the beneficiary. Trusts can be used to avoid probate, minimize estate taxes, and provide for ongoing management of assets after the grantor's death. Trusts can be revocable or irrevocable and can be created during the grantor's lifetime or through a will. Both wills and trusts have their advantages and disadvantages, and individuals should consult with an estate planning attorney to determine which option is best for their unique situation. When deciding between a will and a trust, individuals should consider the following factors: Estate Size: Larger estates may benefit more from the features and protections offered by trusts. Privacy Concerns: Trusts provide greater privacy than wills, as they are not subject to public records. Type and Complexity of Assets: Trusts may be more suitable for managing complex assets or multiple properties. Family Dynamics: Trusts can provide a more structured and controlled distribution of assets, which may be helpful in situations involving blended families or potential disputes. Tax Implications: Certain types of trusts can offer tax benefits not available through wills. In some cases, combining a will and a trust may be the most effective estate planning strategy. For example, a pour-over will be used to transfer any remaining assets into an existing trust upon the individual's death, ensuring that all assets are distributed according to the trust's terms. Given the complexity of estate planning, individuals are encouraged to consult with estate planning professionals, such as attorneys and financial planners, to determine the most appropriate instruments for their unique circumstances. A will is a legal document that outlines a person's wishes regarding the distribution of their assets and property upon their death. It may also designate guardians for minor children and specify funeral arrangements. A will provides guidance to the executor, who is responsible for carrying out the decedent's instructions and managing the estate during the probate process. A simple will is a straightforward document that outlines the distribution of assets to beneficiaries. It is suitable for individuals with relatively uncomplicated estates and few assets. A testamentary trust will create a trust upon the death of the testator. The assets are managed by a trustee and distributed to beneficiaries according to the terms of the trust. A joint will is created by two individuals, typically spouses, who agree to distribute their assets according to a single set of instructions. This type of will is not commonly used due to its inflexibility. A living will, also known as an advance directive, specifies an individual's medical preferences in the event they become incapacitated or unable to communicate their wishes. Wills are relatively simple to create and can be drafted with the assistance of an attorney or using an online template. Wills offer flexibility, allowing individuals to amend or revoke them at any time during their lifetime. Creating a will is generally less expensive than establishing a trust, making it a more affordable option for many individuals. Wills must go through the probate process, which can be time-consuming, costly, and public. Once a will is submitted to probate, it becomes a matter of public record, which may compromise the privacy of the estate and the beneficiaries. Wills are more susceptible to challenges and disputes, which can lead to family conflicts and legal battles. A trust is a legal arrangement in which assets are transferred to a trustee, who manages and distributes the assets according to the terms of the trust. Trusts can be established during a person's lifetime or upon their death and may be used for various purposes, such as asset protection, tax planning, or providing for a beneficiary with special needs. A revocable trust, also known as a living trust, allows the grantor to maintain control over the trust's assets during their lifetime and make changes or revoke the trust if necessary. An irrevocable trust cannot be altered or revoked by the grantor once established. It offers greater asset protection and potential tax benefits compared to a revocable trust. A testamentary trust is established through a will and comes into effect upon the death of the testator. It is subject to probate and provides a more structured distribution of assets to beneficiaries. A special needs trust is designed to provide for the needs of a disabled beneficiary without jeopardizing their eligibility for government benefits. Trusts avoid the probate process, allowing for faster and more private distribution of assets to beneficiaries. Trusts offer a higher level of privacy compared to wills, as they are not subject to public record. Trusts can provide asset protection from creditors, lawsuits, and potential beneficiaries' financial mismanagement. Certain types of trusts, such as irrevocable trusts, can offer tax benefits by removing assets from the grantor's taxable estate. Trusts are generally more complex than wills, requiring more time and expertise to establish and manage. The costs of creating and maintaining a trust are typically higher than those associated with a will. Depending on the type of trust, grantors may face limitations on their ability to control or modify the trust's terms. Wills and trusts are two important estate planning tools individuals can use to manage their assets and ensure a smooth transfer of wealth to their beneficiaries after their death. A will is a legal document that outlines how assets should be distributed, while a trust is a legal entity that holds and manages assets on behalf of the beneficiary. Factors to consider when deciding between a will and a trust include estate size, privacy concerns, complexity of assets, family dynamics, and tax implications. Combining a will and a trust may be the most effective estate planning strategy in some cases. Wills are relatively simple and cost-effective to create, offer flexibility, and allow for easy amendments. However, wills are subject to probate, are public record, and may face potential challenges and disputes. Trusts offer benefits such as avoidance of probate, greater privacy, asset protection, and potential tax benefits. However, trusts are generally more complex and expensive to establish and maintain, may limit control, and may face legal challenges. Individuals are encouraged to consult with estate planning professionals to determine the most appropriate instruments for their unique circumstances.Overview of Wills vs Trusts

Choosing Between Wills and Trusts

Factors to Consider

Benefits of Combining Wills and Trusts

Consulting With Estate Planning Professionals

Wills

Definition and Purpose

Types of Wills

Simple Will

Testamentary Trust Will

Joint Will

Living Will

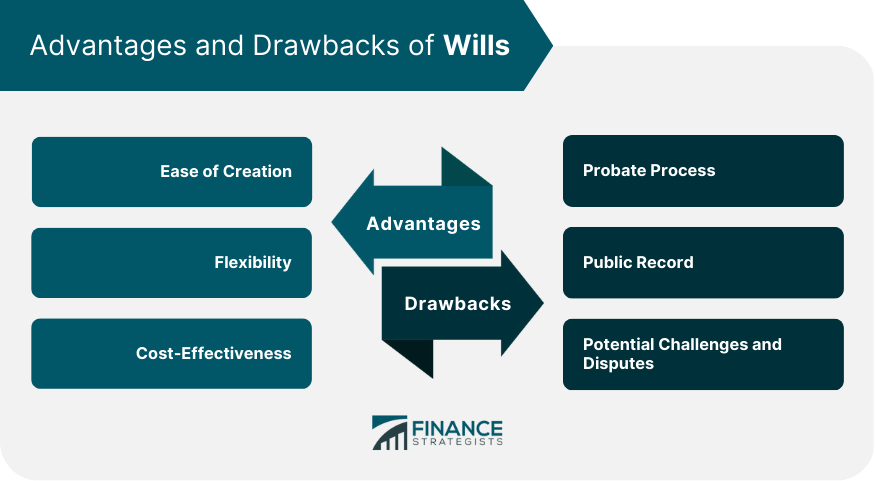

Advantages of Wills

Ease of Creation

Flexibility

Cost-Effectiveness

Drawbacks of Wills

Probate Process

Public Record

Potential Challenges and Disputes

Trusts

Definition and Purpose

Types of Trusts

Revocable Trust

Irrevocable Trust

Testamentary Trust

Special Needs Trust

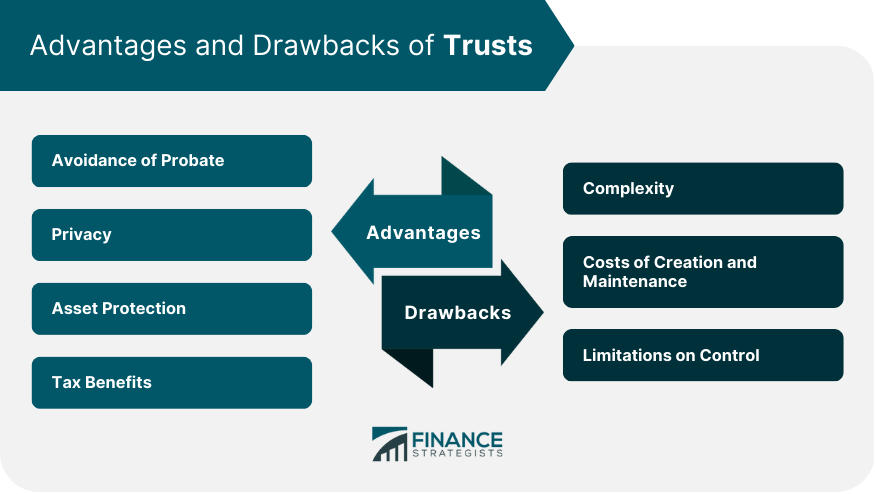

Advantages of Trusts

Avoidance of Probate

Privacy

Asset Protection

Tax Benefits

Drawbacks of Trusts

Complexity

Costs of Creation and Maintenance

Limitations on Control

The Bottom Line

Wills vs Trusts FAQs

Wills and trusts serve different purposes in estate planning. Wills outline a person's wishes for the distribution of their assets upon their death, while trusts involve transferring assets to a trustee who manages and distributes them according to the trust's terms. The primary differences between wills and trusts include their creation process, flexibility, privacy, cost, and the probate process.

When considering wills vs trusts, factors such as estate size, privacy concerns, the type and complexity of assets, family dynamics, and tax implications should be taken into account. Consulting with estate planning professionals, such as attorneys and financial planners, can help you make the most appropriate decision based on your unique circumstances.

Yes, combining wills and trusts can offer a more comprehensive estate planning solution. For example, a pour-over will can be used to transfer any remaining assets into an existing trust upon the individual's death, ensuring that all assets are distributed according to the trust's terms. This combination can provide the flexibility of a will and the asset protection and privacy benefits of a trust.

Wills are generally simpler and less expensive to create than trusts, making them more accessible for many individuals. However, wills must go through the probate process, which can be time-consuming and costly. Trusts, on the other hand, are more complex and can have higher creation and maintenance costs, but they avoid the probate process, offer greater privacy, and can provide asset protection and potential tax benefits.

Wills can be amended or revoked at any time during the individual's lifetime, offering flexibility for changing circumstances. In the case of revocable trusts, the grantor can also make changes or revoke the trust if necessary. However, irrevocable trusts cannot be altered or revoked by the grantor once established. It's essential to understand the specific features and limitations of your chosen estate planning instrument and consult with professionals when considering changes to your will or trust.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.