Stock buybacks, also known as share repurchases, are when a company buys back its own outstanding shares. This reduces the number of shares available on the market, which can increase the earnings per share (EPS) and boost the stock's price. Companies may choose to do a stock buyback for various reasons, such as returning capital to shareholders, improving the stock's market price, or signaling confidence in their future prospects. However, potential risks are also involved, such as using resources unwisely or taking on too much debt to finance the buyback. One of the primary reasons for a company to initiate a stock buyback is to increase its earnings per share. By reducing the number of outstanding shares, the company's net income is divided among fewer shares, resulting in a higher EPS. When a company repurchases its shares, the number of shares available in the market is reduced. This decrease in supply can result in an increase in the demand for the remaining shares, potentially driving up the stock price. As the number of outstanding shares decreases, the company's earnings are divided among fewer shares, which can lead to an increase in the EPS. A higher EPS can make the stock more attractive to investors and potentially increase the stock price. Stock buybacks can also improve a company's financial ratios, such as return on equity (ROE) and price-to-earnings (P/E) ratio. ROE measures a company's profitability by comparing net income to shareholder equity. A company reduces its equity by repurchasing shares, which can result in a higher ROE. The P/E ratio is a valuation ratio that compares a company's stock price to its earnings per share. A lower P/E ratio can indicate a more attractive valuation. Increasing the EPS through a stock buyback can lower its P/E ratio and make the stock more appealing to investors. Companies with excess cash on hand may choose to initiate stock buybacks to utilize their cash reserves. This can be an alternative to paying out dividends or investing in other projects. Stock buybacks can be an alternative to paying dividends, allowing companies to return value to shareholders without directly paying out cash. By using excess cash for stock buybacks, companies can maintain financial flexibility for future investment opportunities or to weather economic downturns. Stock buybacks can offset the dilution caused by issuing stock options or convertible securities. By repurchasing shares, companies can counteract the increase in outstanding shares that results from these transactions. Stock buybacks can signal to the market that a company's management believes its stock is undervalued and has confidence in the business's future performance. By repurchasing shares, management effectively signals that they believe the company's stock is trading below its intrinsic value. When a company initiates a stock buyback, it can send a positive message to the market, indicating that the management has confidence in its future performance. In open market purchases, companies buy back their shares on the open market, typically through a broker. Flexibility: Companies can choose when and how many shares to repurchase. Discretion: The repurchase process can be done discreetly, with minimal market impact. Price Fluctuations: Market prices can be volatile, and companies may pay more than they initially intended for the shares. Timing: The process can be time-consuming, as companies must adhere to specific trading windows and volume restrictions. In a tender offer, a company offers to buy back a specific number of shares at a predetermined price, usually higher than the current market price. Certainty: Companies can set the price and number of shares to be repurchased, providing a clear cost structure. Speed: Tender offers can be completed relatively quickly compared to open market purchases. Cost: The share premium may be higher than in open market purchases. Disclosure: Tender offers require public disclosure, which can impact the stock price and potentially lead to increased volatility. In an accelerated share repurchase (ASR), a company enters into an agreement with an investment bank to repurchase a predetermined number of shares in a shorter time frame. Speed: ASRs can be executed quickly, minimizing the impact on the stock price. Certainty: Companies can lock in the cost of the repurchase, reducing the risk of price fluctuations. Cost: ASRs can be more expensive than open market purchases due to fees paid to investment banks. Complexity: ASR agreements can be complex and may require additional negotiation and legal oversight. In a Dutch auction, a company sets a price range within which shareholders can submit offers to sell their shares. The company then repurchases the shares at the lowest price, enabling them to buy the desired number of shares. Price Efficiency: Companies can repurchase shares at a lower price than in open market purchases or tender offers. Shareholder Participation: Shareholders can choose the price at which they are willing to sell their shares, allowing for more equitable participation. Complexity: Dutch auctions can be complex and may require additional legal and financial oversight. Uncertainty: The final repurchase price may be uncertain, making it difficult for the company to budget for the buyback. The Securities and Exchange Commission (SEC) regulates stock buybacks to protect investors and maintain fair and orderly markets. This SEC rule provides a "safe harbor" for companies to conduct stock buybacks without being accused of market manipulation, as long as they adhere to specific volume, timing, and price restrictions. Companies that follow the safe harbor provisions of Rule 10b-18 are generally protected from allegations of market manipulation related to their stock buybacks. Companies and their insiders must adhere to insider trading regulations during stock buybacks to avoid potential legal and regulatory issues. The SEC closely monitors stock buybacks to ensure that companies do not engage in market manipulation or other illegal activities. Companies must adhere to specific corporate governance requirements related to stock buybacks, including board approval and shareholder communication. A company's board of directors must approve any stock buyback program, ensuring that it is in the company's and its shareholders' best interest. Companies must communicate their stock buyback plans to shareholders and provide updates on the program's progress. Stock buybacks can have varying effects on shareholders, depending on factors such as the investor's time horizon and the company's financial performance. While short-term investors may benefit from the immediate increase in stock price resulting from a buyback, long-term investors may be more concerned with the company's overall financial health and growth prospects. Stock buybacks can increase shareholder value by raising the stock price, improving financial ratios, and signaling management's confidence in the company's future. Stock buybacks can have varying effects on employees, particularly regarding stock options and compensation plans. Employees with stock options or equity-based compensation plans may benefit from stock buybacks, as the reduced number of outstanding shares can increase the value of their holdings. Stock buybacks can impact company culture and morale, as employees may perceive buybacks as a sign that the company is prioritizing shareholder returns over other initiatives such as employee benefits or business expansion. Stock buybacks can influence market perception, as analysts and investors closely monitor these transactions and their potential impact on stock price and company performance. Analysts and investors may react positively to stock buybacks if they view them as an indication of the company's financial strength and growth prospects. Stock buybacks can influence stock price, leading to an increase in demand for the remaining shares, potentially driving up the price. Stock buybacks have faced criticism and controversy due to concerns over short-term focus, inequality, tax implications, and executive compensation. Critics argue that stock buybacks can encourage a short-term focus, as companies may prioritize share repurchases over long-term investments in research, development, or employee benefits. Stock buybacks have been criticized for exacerbating wealth concentration and inequality, as the benefits of buybacks tend to accrue to wealthy shareholders and corporate executives disproportionately. The tax treatment of stock buybacks has also been a point of contention, as capital gains from buybacks are generally taxed at a lower rate than dividend income. Critics argue that stock buybacks can create conflicts of interest, as executives with equity-based compensation may be incentivized to prioritize buybacks over other initiatives that could benefit the company's long-term growth. Stock buybacks, also known as share repurchases, are a strategy used by companies to buy back their own outstanding shares. This process aims to reduce the number of shares available on the market, potentially increasing earnings per share (EPS) and boosting the stock's price. Companies may choose to perform stock buybacks for various reasons, such as returning capital to shareholders or improving the stock's market price. Stock buybacks can have several benefits, including increasing EPS, reducing the number of outstanding shares and utilizing excess cash. Different methods, with their own advantages and disadvantages, are employed for stock buybacks, including open market purchases, tender offers, and Dutch auctions. There are also legal and regulatory considerations for stock buybacks, with the Securities and Exchange Commission (SEC) setting rules to ensure fair and orderly markets. Critics have raised concerns about stock buybacks, such as the potential short-term focus, exacerbation of inequality, and conflicts of interest regarding executive compensation. These criticisms highlight the need for companies to carefully balance buybacks with long-term investments, consider broader societal implications, and align executive incentives with sustainable growth strategies.What Are Stock Buybacks?

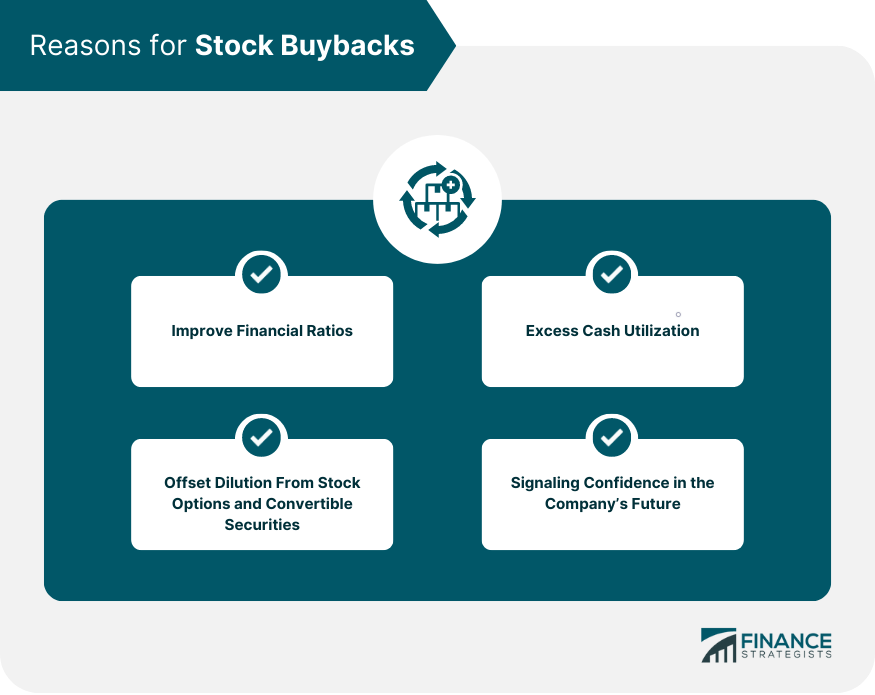

Reasons to Perform Stock Buybacks

Increase Earnings per Share (EPS)

Reduction of Outstanding Shares

Impact on EPS Calculation

Improve Financial Ratios

Return on Equity (ROE)

Price-to-Earnings (P/E) Ratio

Excess Cash Utilization

Alternative to Dividends

Maintaining Financial Flexibility

Offset Dilution From Stock Options and Convertible Securities

Signaling Confidence in the Company's Future

Management's Belief in Intrinsic Value

Positive Signal to the Market

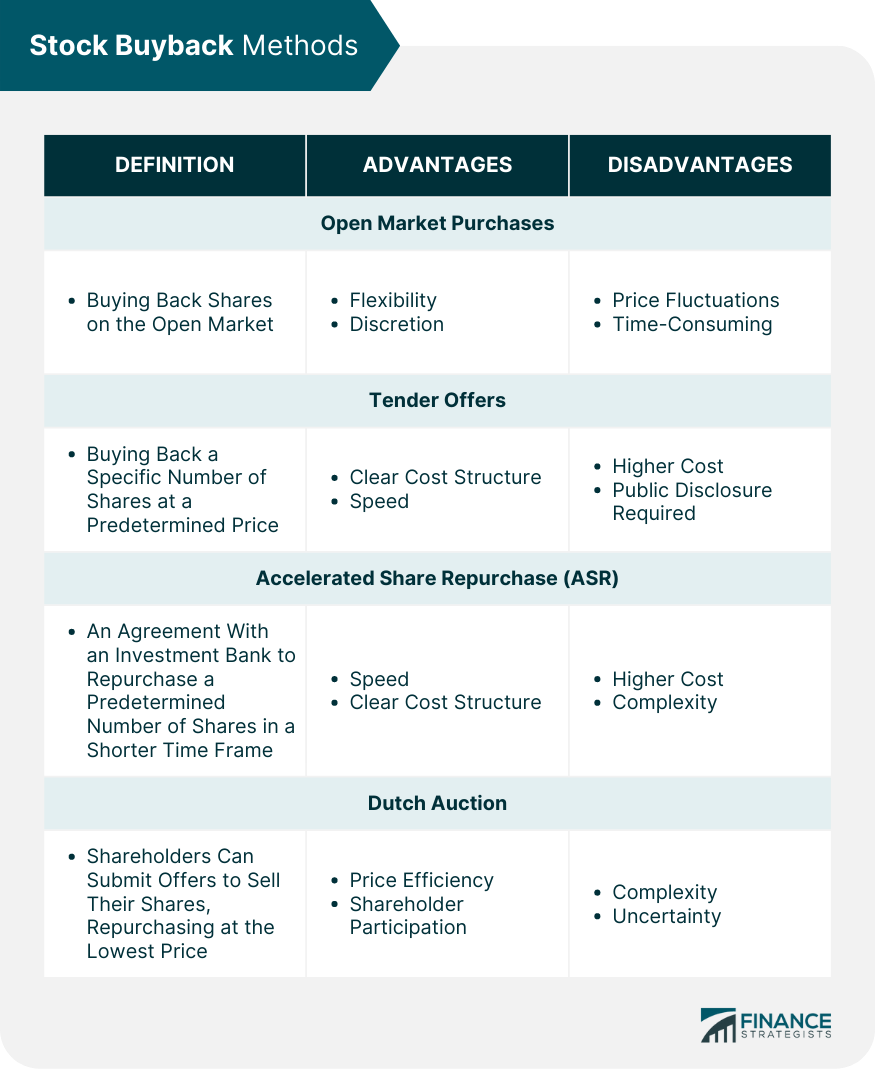

Stock Buyback Methods

Open Market Purchases

Advantages

Disadvantages

Tender Offers

Advantages

Disadvantages

Accelerated Share Repurchase (ASR)

Advantages

Disadvantages

Dutch Auction

Advantages

Disadvantages

Legal and Regulatory Considerations of Stock Buybacks

Securities and Exchange Commission (SEC) Rules

Rule 10b-18

Safe Harbor Provisions

Insider Trading Restrictions

Market Manipulation Concerns

Corporate Governance Requirements

Board of Directors' Approval

Shareholder Rights and Communication

Stock Buybacks and Their Impact on Stakeholders

Shareholders

Long-Term vs. Short-Term Investors

Impact on Shareholder Value

Employees

Stock Options and Compensation Plans

Effects on Company Culture and Morale

Market Perception

Reactions From Analysts and Investors

Influence on Stock Price

Criticisms and Controversies of Stock Buybacks

Short-Term Focus and Potential Misuse of Funds

Inequality and Wealth Concentration

Tax Implications

Executive Compensation and Potential Conflicts of Interest

Conclusion

Stock Buybacks FAQs

Stock Buybacks refer to companies' repurchases of their own outstanding shares to reduce the number of shares on the market, increase earnings per share, and improve the stocks' market prices.

Companies may do Stock Buybacks to return capital to shareholders, increase earnings per share, and signal confidence in their future prospects.

Whether Stock Buybacks are good for shareholders depends on several factors, including the companies' financial health, debt amounts, and current stock prices. Generally, Stock Buybacks are considered positive if they are done when the stocks are undervalued and the companies are in strong financial positions.

Stock Buybacks can increase stock prices by reducing the number of shares outstanding and increasing earnings per share. Moreover, the announcements of Stock Buybacks can enhance investor confidence and stimulate demand for the stocks.

The risks of Stock Buybacks include the possibility that the company may need to use its resources more wisely by repurchasing stock instead of investing in growth opportunities or that the company may be taking on too much debt to finance the buyback. Additionally, if the company's financial condition worsens, the stock price may decline, potentially wiping out any benefits from the Stock Buyback.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.