Capital gains refer to the profit realized when an investment or asset is sold for a higher price than the purchase cost. These gains are typically classified into short-term and long-term based on how long the asset was held. Short-term capital gains are for assets held for a year or less and are usually taxed at ordinary income tax rates. Long-term capital gains for assets held more than a year are taxed at a lower rate, as per U.S. tax laws. Not all asset sales produce capital gains. If an asset is sold for less than its purchase price, a capital loss occurs, which can offset capital gains and reduce tax liability. The exact rate of capital gains, or in some cases the absence of it, can vary significantly. Historically, the zero capital gains rate has its roots in economic strategies designed to encourage investments. Countries like Switzerland, Singapore, The Cayman Islands, Monaco, Belgium, Malaysia, New Zealand, Belize, and Hong Kong, have had periods where capital gains weren't taxed or were taxed under specific conditions. The fundamental reason countries might adopt a zero capital gains rate is to spur economic growth. By eliminating this tax, governments hope to: Attract foreign investments Encourage domestic investments in various sectors Improve liquidity and mobility of assets in the market It's pivotal to differentiate between short-term and long-term capital gains. Short-term gains are typically realized from assets held for a short period (often less than a year), while long-term gains come from assets held for more extended periods. In many tax systems, long-term gains receive preferential rates, which can sometimes be zero. A zero rate can be a significant inducement for investors. Without the concern of losing a portion of their profits to taxes, investors might be more inclined to pour capital into stocks, bonds, and real estate. This influx of capital can lead to increased business ventures, job creation, and overall economic vitality. Startups, often deemed high-risk and high-reward ventures, can especially benefit. Angel investors and venture capitalists might be more willing to finance startups if they know their potential returns won't be diminished by capital gains tax. From a macro perspective, increased investments can spur economic growth. As businesses receive more capital, they can expand, hire more employees, and contribute more significantly to the economy. Moreover, a vibrant stock market can positively impact the broader financial system, fostering confidence and stability. Critics argue that a zero capital gains rate disproportionately benefits the wealthy. The affluent class, often having significant investments, can reap substantial untaxed profits, widening the wealth gap. Governments rely on multiple revenue streams to fund public services, with taxes being a primary source. By forgoing capital gains taxes, governments might face budget deficits, leading to potential cuts in public services or the need to raise other taxes. While investments can spur economic growth, there's a risk of too much speculation. With no capital gains tax, short-term speculative trading might increase, potentially leading to market bubbles and increased volatility. Investors can look at a wider range of investment opportunities, such as equities, bonds, real estate, and even unconventional assets like cryptocurrencies. Without the worry of capital gains tax, investors can freely buy and sell assets to balance their portfolios, optimizing for risk and potential returns without worrying about the tax implications of each transaction. Zero capital gains tax rates can further enhance the benefits of tax-advantaged retirement accounts like IRAs or 401(k)s. These accounts often allow for tax-free growth or on withdrawal, depending on the account type. With no capital gains tax, investors can fully utilize these accounts to grow their retirement savings more effectively, without the drain of taxes on profits. With no capital gains tax to consider, investors may find it more attractive to diversify internationally. This might involve investing in foreign stocks, bonds, or other assets. International diversification can potentially yield higher returns and spread risk across different economies, and without capital gains tax, the profits from these investments can be fully realized. One of the most widespread criticisms is that these policies favor the rich. While it's true that high-net-worth individuals might see substantial untaxed profits, the broader economic benefits, like increased job opportunities and market growth, can be advantageous for the entire population. While governments might face short-term revenue loss, the long-term economic stability and growth a zero capital gains tax environment can foster might lead to increased revenues from other sources, such as sales taxes from heightened consumption. The zero capital gains rate can be a double-edged sword. On the one hand, it promotes investment, boosts startups, and fuels economic growth. On the other hand, it can lead to income inequality, revenue loss for governments, and increase in speculative investments. Investors in countries with such tax structures can take advantage of diversification, tax-advantaged retirement, and international investments without worrying about the tax implications. The criticisms often leveled against zero capital gains rates can be addressed by examining the broader benefits and long-term economic stability it can foster. Therefore, understanding this complex economic strategy is essential for investors, policymakers, and the general public alike. In light of these factors, it's important to seek professional tax planning services to navigate effectively through these complexities and optimize your investment decisions.Overview of Capital Gains

Understanding the Zero Capital Gains Rate

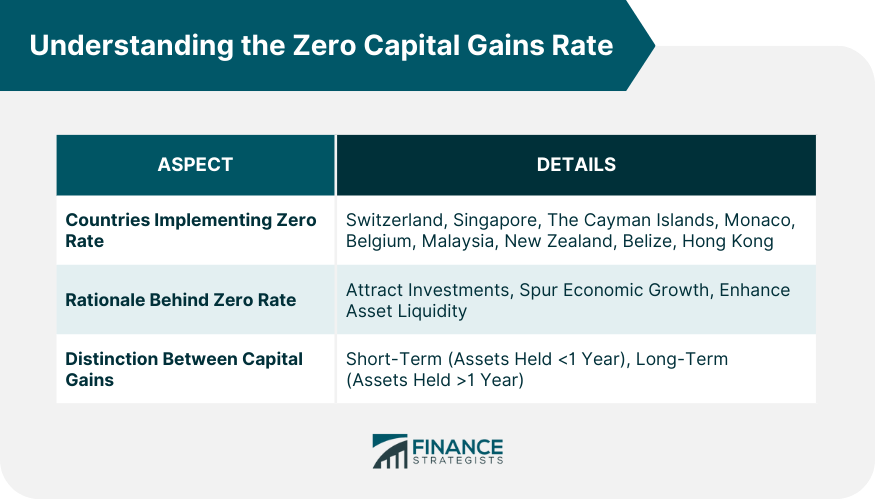

Historical Context and Countries Implementing Zero Capital Gains Rate

Rationale Behind a Zero Rate

Short-Term vs Long-Term Capital Gains

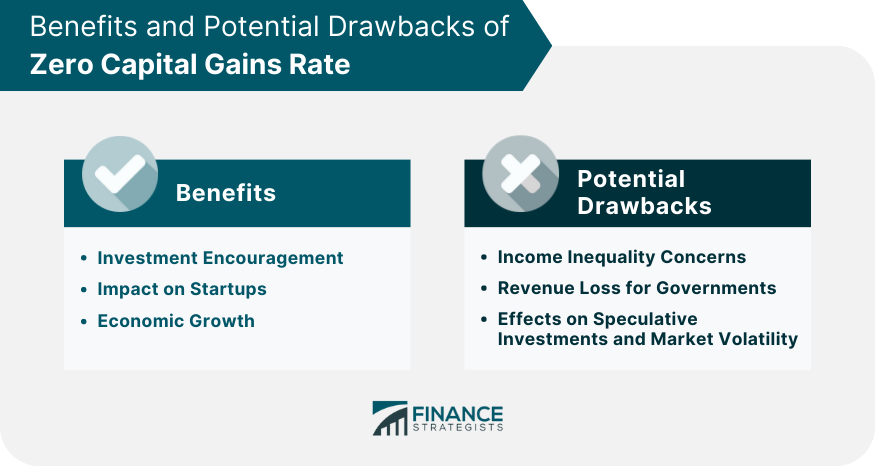

Benefits of Zero Capital Gains Rate

Investment Encouragement

Impact on Startups

Economic Growth

Potential Drawbacks of Zero Capital Gains Rate

Income Inequality Concerns

Revenue Loss for Governments

Effects on Speculative Investments and Market Volatility

Strategies for Investors in Countries With Zero Capital Gains Rate

Diversify Investments

Leverage Tax Advantages for Retirement

Explore International Investments

Rebuttals to Common Criticisms to Zero Capital Gains Rate

Addressing the Myth That Zero Capital Gains Rates Benefit Only the Rich

Economic Stability vs Short-Term Revenue

Final Thoughts

Understanding Zero Capital Gains Rate FAQs

It's a tax policy where profits from the sale of capital assets, like stocks or real estate, aren't taxed.

Countries use it to attract investments, boost economic growth, and enhance asset liquidity and mobility.

It can encourage more investments in stocks, real estate, and bonds, boost startup financing, and spur overall economic growth.

Yes, potential drawbacks include exacerbating income inequality, causing revenue loss for governments, and increasing speculative investments.

Investors may diversify more, leverage tax advantages for retirement, and explore international investments without tax implications.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.