Addressing tax obligations is a critical aspect of managing a deceased person's estate. In many jurisdictions, the answer is yes, you do have to file taxes on behalf of someone who has passed away. The final tax return encompasses the income earned by the individual from the beginning of the fiscal year until the date of their death. It's essential to note that the responsibility for filing this return and addressing any tax liabilities typically rests with the estate's executor or personal representative. Ignoring this duty can result in penalties, interest, and potential legal actions by tax authorities. To ensure compliance, it's advisable to consult with a tax professional or familiarize oneself with local tax regulations specific to deceased individuals. Upon a person's death, the responsibility of addressing their tax matters usually falls on an individual referred to as the 'executor' or 'personal representative.' This role can be explicitly named in the deceased's will. In the absence of a will, or if the named executor is unwilling or unable to act, the court may appoint someone to serve in this capacity. The executor's duties go beyond just tax matters. They encompass gathering the deceased's assets, paying off debts, distributing the remaining assets to beneficiaries, and more. When it comes to taxes, the executor should ensure that all necessary returns are filed, and any owed taxes are paid. Properly fulfilling these duties is not just a matter of respect for the deceased; it's also a legal obligation. Start by identifying the scope of the deceased's financial activities within the year in question. This will give you a sense of the variety and types of documents you'll need to source. Retrieve all W2 forms, which detail the deceased's earnings from employment and taxes withheld. If the individual had multiple employers within the year, ensure you have a W2 from each entity. Gather all 1099 forms. These forms come in various types: 1099-INT: Indicates interest income, commonly from bank accounts or bonds. 1099-DIV: Highlights dividend income from investments. 1099-MISC: Details miscellaneous income, which could be from freelance work, rentals, or other non-employment earnings. Obtain comprehensive bank statements, not just summaries. These should show monthly activities, including deposits, withdrawals, and interest earnings. Source detailed brokerage statements. These should provide a breakdown of stock trades, dividends received, capital gains or losses, and any other investment activities. If the deceased held assets in multiple brokerages, ensure you retrieve records from each institution. If the deceased had potential tax deductions, such as mortgage interest or medical expenses, gather relevant documents like 1098 forms or medical bills. While the deceased's final income tax return often utilizes standard forms, such as the IRS Form 1040, special scenarios arise in the context of posthumous financial activities. In such cases, different tax forms become relevant. Specifically, in the U.S., if the deceased had set up trusts or left behind an estate generating income, the IRS mandates the use of Form 1041. This form is crafted explicitly for estates and trusts, ensuring that income, deductions, and any relevant credits are correctly reported. After diligently compiling all requisite financial documents, the next step is to report every source of income the deceased received from the commencement of the year, January 1st, until their passing. This would encompass wages, rental income, dividends, interest, and other income streams. Parallelly, it's essential to itemize and report deductions pertinent to the same timeframe, ensuring a comprehensive representation of the deceased's financial activity for that part of the year. Before finalizing the submission, it's vital to cross-check all reported figures, ensuring that all income sources and deductions have been accurately captured. Once the tax return has been successfully submitted, the waiting phase begins. It's crucial during this period to monitor any feedback or communication from the tax department. This feedback will provide clarity on the financial standing of the estate: whether taxes are owed or if a refund is due. By making timely payments, the estate sidesteps the added financial burden that can accrue from delayed settlements, such as interest. Delays or neglect in settling tax liabilities can lead to a cascade of consequences. These can range from monetary penalties, which add to the original debt, to more severe legal ramifications that could complicate the probate process or the distribution of assets to beneficiaries. It's always in the estate's best interest to address any tax liabilities proactively and efficiently. For deceased individuals, the tax code offers certain distinctive deductions, which if leveraged appropriately, can decrease the final tax liability. The IRS provides an avenue to claim medical expenses incurred during the deceased's last illness. If these expenses weren't covered by health insurance or other forms of reimbursement, they might be deductible. However, these medical expenses must surpass a certain threshold in relation to the deceased's adjusted gross income. Documentation like bills, receipts, and insurance explanations of benefits will be vital to validate these claims. While the personal tax return doesn't allow deductions for funeral and burial costs, there's a reprieve when handling estate taxes. These costs can be deducted as administrative expenses on the federal estate tax return. Thus, while they don't reduce income tax, they can reduce potential estate tax liabilities. Keep detailed receipts and contracts from funeral homes, cemeteries, and other service providers for record-keeping and potential audits. Managing an estate isn't just emotionally taxing; it can also come with financial burdens. The good news is that the IRS recognizes this. Expenses incurred in administering the estate, such as probate court fees, legal consultation, or accountant fees, can be deductible on the estate tax return. Maintain thorough documentation of all such costs, ensuring invoices, receipts, and bank statements are well-organized. Here are some frequently encountered challenges and practical guidance on navigating them: Simple errors, from misreported income to overlooked deductions, can invite scrutiny from tax authorities, leading to potential audits or penalties. To mitigate this, use a systematic approach by creating a checklist to ensure all income sources and potential deductions are addressed. Always reconcile reported figures with original documents, ensuring alignment and accuracy. The absence of critical financial records can stall the tax preparation process and potentially lead to inaccurate filings. To address this, reach out to banks, brokerages, or financial institutions linked to the deceased. They often have dedicated teams or procedures for providing financial records, especially in the context of deceased account holders. The deceased might have had intricate financial situations, such as investments in foreign countries, ownership in multiple businesses, or complex trusts. Address this by seeking the expertise of specialists familiar with those specific financial realms, ensuring compliance with all relevant tax regulations. Sometimes, the sheer complexity or emotional weight of the task can become overwhelming. In such cases, engage with reputable tax consultants, accountants, or estate lawyers. Their expertise can illuminate the path forward, ensuring all tax obligations are met while also respecting the legacy of the deceased. In many jurisdictions, it is necessary to file taxes for the deceased individual. The final tax return covers their income from the fiscal year's beginning to their date of passing. The duty to file and address tax liabilities typically falls on the estate's executor or personal representative. Neglecting this duty can result in penalties and legal actions by tax authorities. The executor's role extends beyond taxes, encompassing tasks like asset management and debt settlement. Steps to file the final tax return include compiling documents, gathering income records, and leveraging deductions specific to deceased individuals. Challenges such as accuracy and missing documentation can be managed through systematic approaches and seeking professional help. Seeking guidance from tax professionals can provide clarity and ease the complexities of the process.Do You Have to File Taxes on a Deceased Person?

Who is Responsible for Filing the Deceased Taxes?

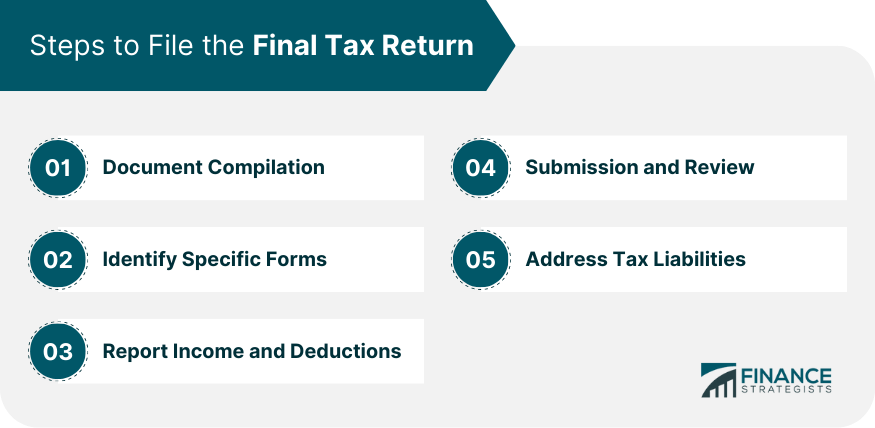

Steps to File the Final Tax Return

Document Compilation

Employment Records

Additional Income Documentation

Banking and Investment Records

Deduction-Related Documents

Identify Specific Forms

Report Income and Deductions

Submission and Review

Address Tax Liabilities

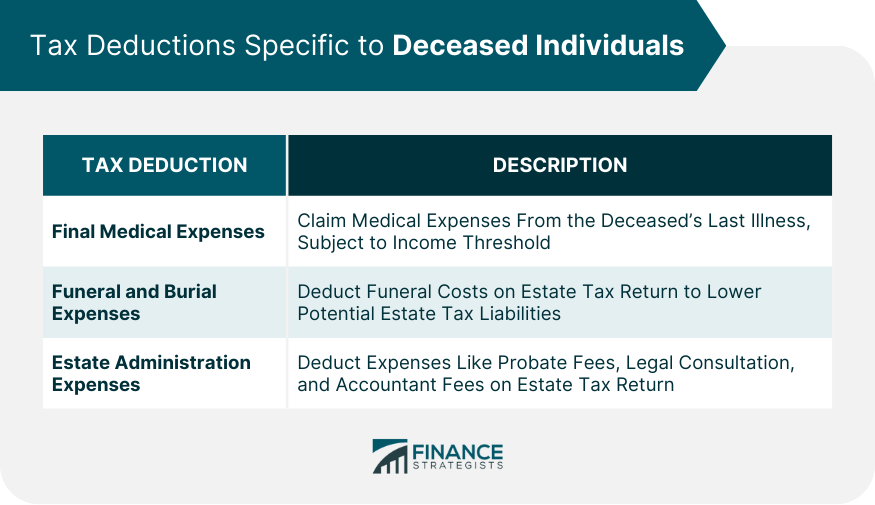

Tax Deductions Specific to Deceased Individuals

Final Medical Expenses

Funeral and Burial Expenses

Estate Administration Expenses

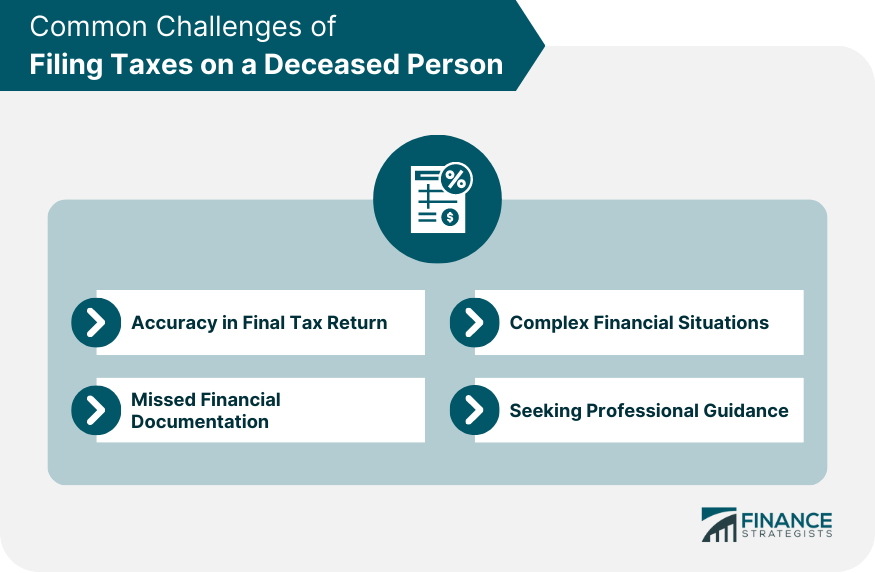

Common Challenges of Filing Taxes on a Deceased Person

Accuracy in Final Tax Return

Missed Financial Documentation

Complex Financial Situations

Seeking Professional Guidance

Conclusion

Do You Have to File Taxes on a Deceased Person? FAQs

Yes, in many jurisdictions, you are required to file taxes for a deceased person's estate, covering their income until the date of their death.

The responsibility typically falls on the estate's executor or personal representative, as designated by the will or appointed by the court.

No, the executor's duties go beyond taxes; they involve managing assets, settling debts, and distributing remaining assets to beneficiaries.

Ignoring this duty can lead to penalties, interest, and potential legal actions by tax authorities against the estate.

Yes, there are specific deductions available for deceased individuals, such as medical expenses during their last illness or funeral and burial costs as estate administration expenses.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.