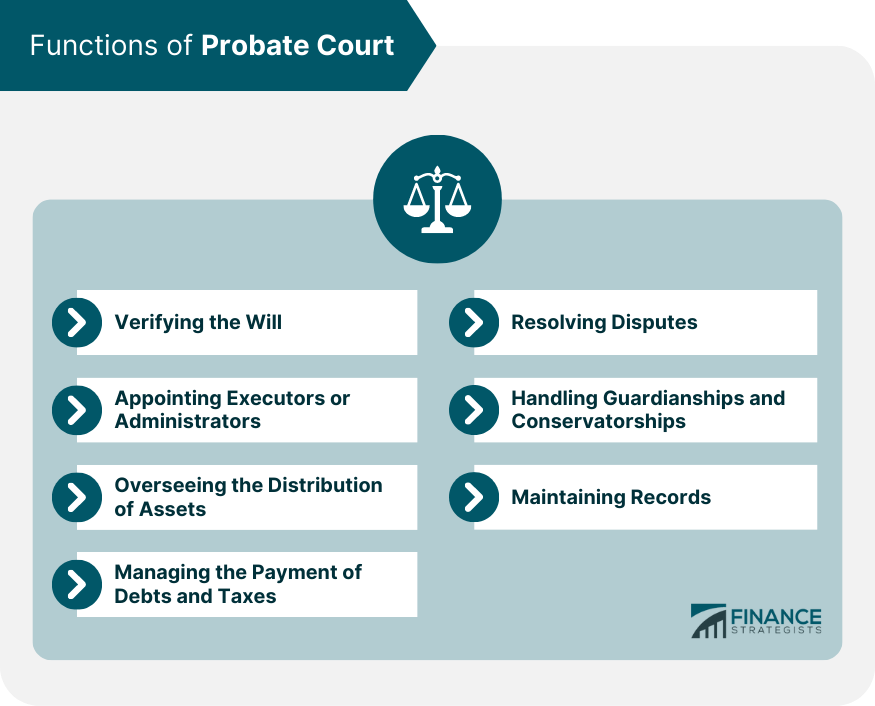

Probate court is a specialized type of court that deals with the property and debts of a person who has died. The primary function of probate court is to ensure that a decedent's estate is distributed according to their will, or if there is no will, according to state law. Probate court also resolves disputes regarding the decedent's will, confirms the validity of the will, and oversees the administration of the estate. Probate courts play a crucial role in estate management. When a person dies, their estate often consists of various assets such as real estate, investments, bank accounts, and personal property. The probate court ensures that all these assets are properly identified, appraised, and distributed to the rightful beneficiaries or heirs. Moreover, the court oversees the payment of any debts and taxes owed by the decedent's estate. The probate court evaluates the legality of the document, checking aspects like the signature, the witnesses, and if it complies with the state law. Once the will is authenticated, the court interprets its instructions, overseeing the execution of the directives and ensuring the estate is managed according to the deceased's wishes. Executors are typically named in the will itself and are entrusted with the responsibility of managing the deceased's estate. Their duties range from gathering assets, paying off debts, filing tax returns, to distributing assets to beneficiaries. However, it's the probate court that gives the executor the legal power to perform these tasks. In cases where no will exists (known as intestacy), or an executor isn't named, the court will appoint an administrator to fulfill the same duties. The process is not as simple as handing over possessions; it involves a detailed inventory of the deceased's assets, determining their value, and ensuring their distribution according to the will. This thorough supervision protects the interests of all beneficiaries, providing assurance that the process aligns with the deceased's last wishes or state law in the absence of a will. As part of their duties, executors or administrators must identify all existing debts, including loans, credit cards, mortgages, and other obligations. It's also crucial for them to be aware of potential taxes owed by the estate, such as estate tax, income tax, and inheritance tax, if applicable. Probate courts oversee this process to ensure all obligations are duly met before the distribution of assets. Disputes are quite common in the administration of estates. These disagreements could arise due to various reasons, including questioning the validity of the will, interpreting its provisions, or disagreements between beneficiaries. In such instances, the probate court acts as the arbitrator, providing an unbiased setting where these issues can be resolved legally and fairly. If the deceased person left behind minor children or adults who cannot make their own decisions, the probate court steps in. It oversees the appointment of a legal guardian who is tasked with the responsibility of caring for these dependents. Similarly, in situations where an adult cannot manage their own financial affairs, the court will establish a conservatorship, appointing someone to handle their financial matters. Keeping accurate records are critical as they serve as the official documents reflecting the administration of the estate. They include a copy of the will, appointment documents of the executor or administrator, an inventory of the deceased's assets, and a record of all claims made by creditors. These records can be vital for legal or financial reasons even years after the probate process has been concluded. The judge presides over the probate court and is responsible for overseeing the entire probate process. They ensure that the proceedings are conducted in accordance with applicable laws and regulations, and they may make decisions on disputes or other matters that arise during the probate process. The executor, also known as the personal representative, is responsible for managing the estate during the probate process. This includes gathering assets, paying off debts, filing tax returns, and distributing the remaining assets to the beneficiaries. The probate attorney assists the executor in navigating the probate process. They provide legal advice, prepare and file documents in court, and represent the estate in any disputes that arise. The beneficiaries are the individuals or organizations that are named in the will to receive the deceased's assets. They have a right to be kept informed about the probate process and to receive their inheritance once all debts and taxes are paid. Creditors are the individuals or entities to whom the deceased owed money. They have a right to be notified of the probate process and to file a claim for the money they are owed. Court fees are necessary for filing various legal documents, such as the initial petition to start the probate process, petitions for appointing executors or administrators, and other required filings throughout the process. Additionally, fees may be associated with the publication of legal notices and obtaining certified copies of court documents. The exact amounts can vary from jurisdiction to jurisdiction, but it's important to note that these charges are usually mandated by local laws and are non-negotiable. Engaging the services of a probate attorney is a common practice and can prove invaluable given the complexity of many estates. In some states, attorney fees are determined as a percentage of the estate's value. Alternatively, other regions may allow for fees to be based on an hourly rate or a flat fee. It's crucial to discuss these details upfront to avoid unexpected expenses. Similar to attorney fees, executor fees can be based on a percentage of the estate, an hourly rate, or a flat fee. The complexity of the estate, the amount of work required, and the executor's professional expertise, if any, can also influence the fee. Appraisal costs arise when the estate includes assets that need a professional valuation. These assets can range from real estate and vehicles to jewelry, artwork, or other items of significant value. The accurate valuation of these assets is crucial for a fair distribution among beneficiaries, settling debts and taxes, and even for ensuring proper fees for the executor and attorney. Hiring professional appraisers ensures a fair market value, which can reduce disputes over asset valuation. However, these services come at a cost, which adds to the overall expenses of the probate process. Assets owned jointly with rights of survivorship or tenancy by the entirety automatically pass to the surviving owner when one owner dies. This avoids probate because the asset doesn't need to go through the court process to be transferred. These types of arrangements allow you to name a beneficiary who will receive the assets in an account upon your death. Pay-on-death (POD) can be used for bank accounts, and transfer-on-death (TOD) can be used for securities and in some states, for vehicles and real estate. Like joint ownership, these designations allow assets to pass directly to the beneficiary without going through probate. A living trust, or revocable trust, is a legal entity you create during your lifetime. You transfer ownership of your assets into the trust, and you can control those assets as the trustee. Upon your death, the assets in the trust are distributed by a successor trustee to your beneficiaries, avoiding probate. A living trust also has the advantage of being able to manage your assets if you become incapacitated. Life insurance policies, if payable to an individual or a trust, do not go through probate. The death benefit is paid directly to the beneficiaries named in the policy. By giving away your assets while you're alive, you reduce the size of your estate, and potentially the amount of estate taxes that might be due upon your death. Many states have simplified probate procedures for small estates. If an estate falls below a certain value threshold, the executor may be able to bypass the regular probate process and use a simplified process instead. Probate court is a specialized type of court that deals with the property and debts of a person who has died. Its functions encompass verifying the will, appointing executors or administrators, overseeing asset distribution, managing debt and tax payments, resolving disputes, handling guardianships and conservatorships, and maintaining accurate records. The key players in the probate court process include the judge, executor, probate attorney, beneficiaries, and creditors, each with their respective roles and interests. Understanding the costs associated with probate court is important, including court fees, attorney fees, executor fees, and appraisal costs, as these expenses can impact the estate's overall value. Alternatives to probate court include joint ownership, pay-on-death and transfer-on-death arrangements, living trusts, life insurance policies, gifting assets, and small estate procedures. These offer various options to bypass probate court and ensure a smoother transfer of assets upon death. It is essential to seek legal advice and understand the specific laws and procedures in their jurisdiction. By doing so, individuals can make informed decisions that align with their preferences and ensure the efficient management and distribution of their estates.What Is Probate Court?

Functions of Probate Court

Verifying the Will

Appointing Executors or Administrators

Overseeing the Distribution of Assets

Managing the Payment of Debts and Taxes

Resolving Disputes

Handling Guardianships and Conservatorships

Maintaining Records

Actors in Probate Court

Probate Judge

Executor

Probate Attorney

Beneficiaries

Creditors

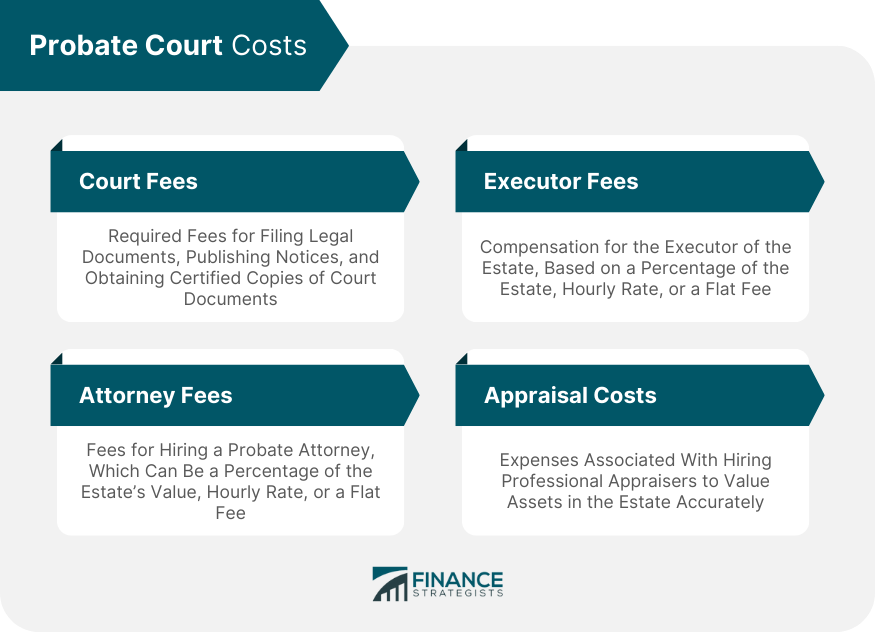

Probate Court Costs

Court Fees

Attorney Fees

Executor Fees

Appraisal Costs

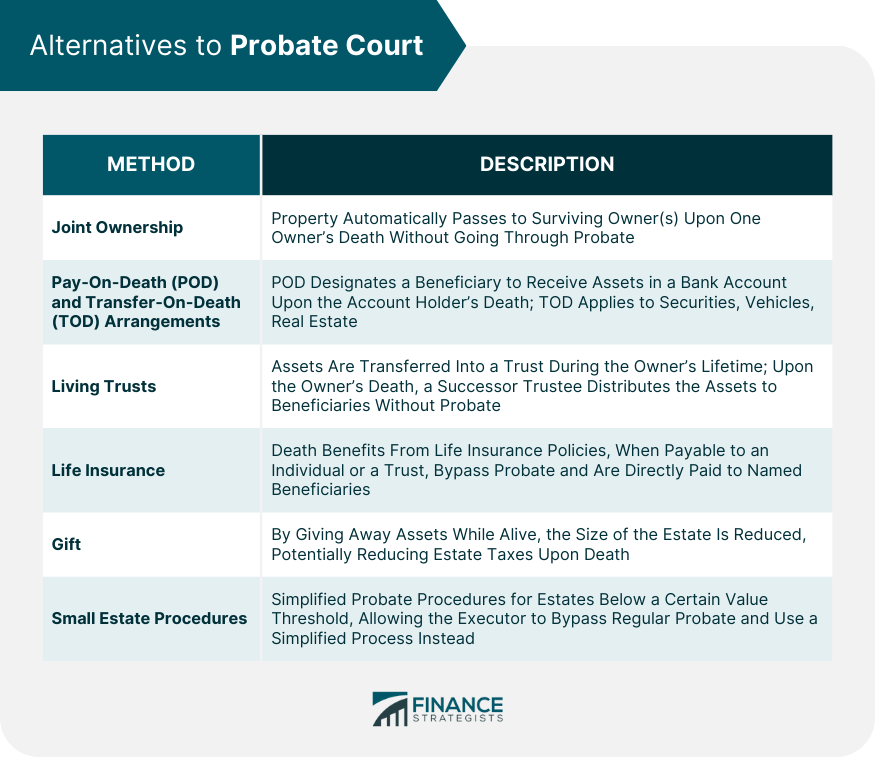

Avoiding Probate Court

Joint Ownership

Pay-On-Death and Transfer-On-Death Arrangements

Living Trusts

Life Insurance

Gift

Small Estate Procedures

Final Thoughts

Probate Court FAQs

A probate court is a specialized court that handles legal matters related to the distribution of a deceased person's assets and the settlement of their debts, also known as the probate process.

Probate courts handle various types of cases, including the validation of wills, appointment of executors or personal representatives, administration of estates, guardianship and conservatorship matters, and resolving disputes over inheritances.

Not all estates have to go through probate court. Whether an estate goes through probate depends on the specific circumstances, such as the value of the assets, whether there is a valid will, and state laws. Some smaller estates may be exempt from probate or may qualify for simplified procedures.

The costs associated with probate court include court fees, attorney fees, executor fees, and appraisal costs. Court fees are required for filing legal documents and obtaining certified copies, while attorney fees cover the services provided by a probate attorney. Executor fees compensate the person responsible for managing the estate, and appraisal costs arise if professional valuation of assets is required. The exact expenses can vary based on jurisdiction and the complexity of the estate.

Yes, it is possible to avoid probate court for your estate by employing various estate planning strategies. These may include creating a living trust, designating beneficiaries for certain assets, establishing joint ownership with rights of survivorship, and utilizing payable-on-death (POD) or transfer-on-death (TOD) designations for financial accounts. Consulting with an estate planning attorney can help you determine the best options for your specific situation.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.