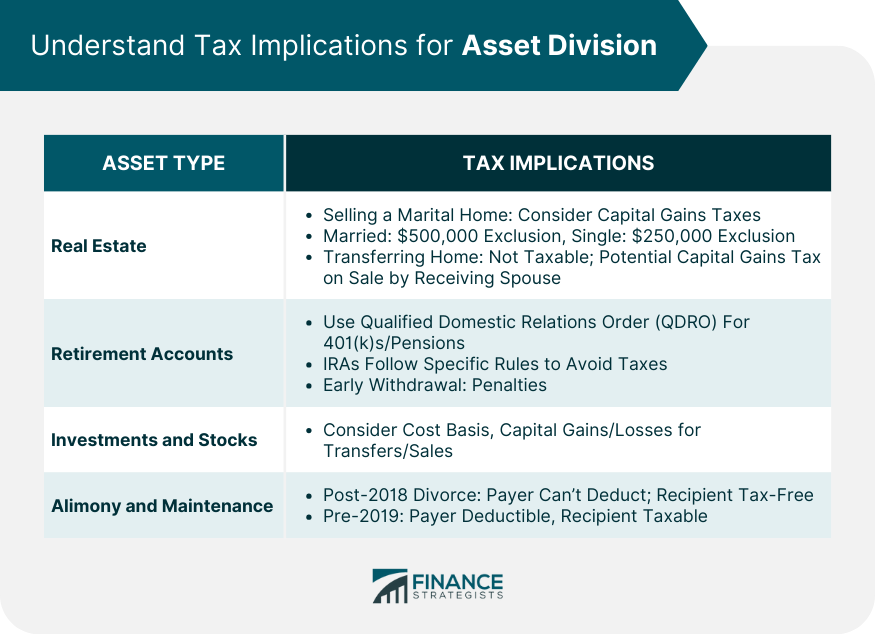

The process of getting divorced can be overwhelming, with the myriad of decisions to be made and paperwork to be filed. Among these considerations is determining your tax filing status. The Internal Revenue Service (IRS) has specific guidelines on how individuals going through a divorce should file their taxes. Choosing between filing as single or married filing separately depends on the specifics of your situation. If your divorce is finalized by December 31st of the tax year, you will file as single. This means that for the entire year, even if you were married for 11 months and divorced on the last day, you're considered single for tax purposes. If your divorce is not yet finalized by the end of the year, the IRS considers you to be married. In this scenario, you have two options: file jointly or choose the status of married filing separately. Filing as a Head of Household can offer more tax benefits than filing as a single or married filing separately. To qualify, you must be unmarried or considered unmarried on the last day of the year, pay more than half the cost of keeping up a home, and have a qualifying person (like a child) live with you for more than half the year. The date when your divorce is finalized plays a critical role in your tax filing status. As previously mentioned, if your divorce is finalized by December 31st, you file as single. However, if it's finalized on January 1st or later, you need to file as married for the preceding year. If you decide to sell your marital home during the divorce, you need to consider capital gains taxes. Married couples can exclude up to $500,000 of gain, while single filers can exclude up to $250,000. It's essential to understand how this works to avoid unexpected tax bills. When one spouse transfers their interest in the marital home to the other as part of the divorce, this is typically not a taxable event. However, if the home is later sold, the receiving spouse might have to pay more capital gains tax. Dividing retirement assets can be tricky. Generally, a document called a Qualified Domestic Relations Order (QDRO) is required to split 401(k)s and pensions without incurring penalties. IRAs don't need a QDRO but do require following specific rules to avoid taxes. Early withdrawal from retirement accounts can result in hefty penalties. It's crucial to follow the necessary procedures, like obtaining a QDRO, to avoid these penalties. Tax implications can arise when transferring or selling investments. It's essential to understand the cost basis of these investments and any potential capital gains or losses. With recent changes in tax laws, alimony has seen shifts in how it's treated tax-wise. Previously, alimony payments were deductible for the payer and taxable income for the recipient. However, for divorces finalized after December 31, 2018, alimony payments are no longer deductible for the payer and are tax-free for the recipient. If you're the recipient, you no longer need to report alimony as income if your divorce was finalized after 2018. If you're the payer, you can't deduct these payments. Understanding tax credits and deductions available can significantly impact your tax bill during a divorce. Determining which parent claims the children is a significant decision. This choice can affect eligibility for various tax benefits. The child tax credit offers a substantial deduction. To claim it, the child must live with you for more than half the year, and you must provide more than half of their support. If you're paying for your child's education, you might be eligible for education credits like the American Opportunity Credit or the Lifetime Learning Credit. When it comes to medical expenses, understanding how to split and claim them between both parents is crucial. This includes health insurance premiums and out-of-pocket expenses. If you and your ex-spouse jointly own a home, you'll need to decide how to split the mortgage interest deduction. The deduction typically goes to the person who makes the payment. TITLE: Tax Credits and Deductions if You Are Getting Divorced Name Changes: If you change your name after a divorce, it's essential to report this change to the IRS and the Social Security Administration to avoid potential complications with your tax return. Tax Debt and Joint Returns: If you filed joint returns in the past, you might be jointly liable for any tax debt. This means the IRS can come after either spouse for the full amount. Innocent Spouse Relief: If your spouse understated tax or claimed improper deductions, and you were unaware, you might qualify for Innocent Spouse Relief. This provision can protect you from being held liable for the understated tax. Considering the complexities of divorce and the myriad of tax implications, seeking advice from a tax expert is invaluable. A tax professional can offer guidance tailored to your unique situation, ensuring that you comply with tax laws and optimize potential savings. In the midst of a divorce, understanding tax implications is paramount. The finalized date of your divorce dictates your tax filing status, with a December 31st cutoff distinguishing between single and married statuses. Notably, selling a marital home introduces capital gains considerations, where exclusions vary based on your filing status. The treatment of alimony has also evolved; for divorces post-December 31, 2018, alimony isn't deductible for the payer and isn't taxable for the recipient. Child-related deductions and credits, particularly the child tax credit, necessitate clear agreements or court decisions, as only one parent can claim. Additionally, post-divorce name changes should be reported to both the IRS and the Social Security Administration to avoid tax return complications. Given these intricacies, consulting a tax professional is indispensable, ensuring personalized guidance tailored to your divorce's unique financial landscape.Determine Tax Filing Status if You Are Getting Divorced

Single vs Married Filing Separately: Understanding the Differences

Criteria for When You Can File as Single

Criteria for When You Need to File as Married

Head of Household: Benefits and Eligibility Requirements

Effect of Divorce Decree Date

Understand the Tax Implications of Dividing Assets if You Are Getting Divorced

Real Estate and Primary Residence

Retirement Accounts: Rules and Implications

Investments and Stocks

Alimony and Maintenance

Consider Tax Credits and Deductions if You Are Getting Divorced

Dependency Exemptions

Education Credits

Medical Expenses

Mortgage Interest

Special Considerations of Filing Taxes if You Are Getting Divorced

Working With a Tax Professional if You Are Getting Divorced

Every divorce is unique, and a tax expert can help decipher the nuances of asset division, deductions, and credits that apply to your specific circumstances.Bottom Line

How to File Taxes if You Are Getting Divorced FAQs

Your tax filing status during a divorce depends on the finalized date of your divorce. If your divorce is finalized by December 31st of the tax year, you will file as single. If it isn't finalized by the year's end, the IRS considers you still married, allowing you to file either jointly or as married filing separately.

If you sell your marital home during the divorce, you need to consider capital gains taxes. Married couples can exclude up to $500,000 of gain, while single filers can exclude up to $250,000. The key is understanding how this exclusion applies based on your filing status and the sale's timing.

For divorces finalized after December 31, 2018, alimony payments are no longer deductible for the payer and are tax-free for the recipient. This is a shift from previous regulations where alimony was deductible for the payer and taxable for the recipient.

Only one parent can claim the child tax credit. Typically, the child must live with the claiming parent for more than half the year, and that parent must provide more than half of the child's support. Divorced couples must decide or have a court decision on who gets to claim the child.

If you change your name post-divorce, you should report the change to both the IRS and the Social Security Administration. This ensures that your new name aligns with your Social Security number, preventing potential mismatches or complications when filing your tax return.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.