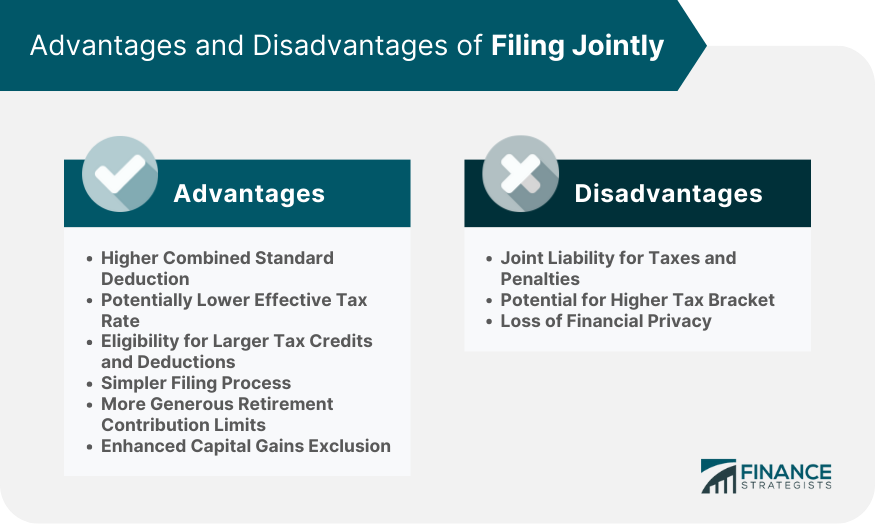

Deciding whether to file taxes jointly or separately as a married couple depends on individual financial circumstances. Filing jointly often offers a higher standard deduction and access to numerous tax credits and can lead to a lower effective tax rate. It also simplifies the filing process since only one return is submitted. Conversely, filing separately might be beneficial when spouses want distinct finances, in cases where one partner has potential tax complications, or when aiming to achieve a specific Adjusted Gross Income (AGI) for particular deductions. However, this method often restricts or eliminates certain tax benefits. It's essential to evaluate factors like income disparities, potential tax deductions, debts, and future financial plans. When you decide to file together as a couple, you are awarded a higher combined standard deduction as opposed to filing separately. This is a quick win in terms of reducing your taxable income. The standard deduction is essentially a dollar amount that reduces the income you're taxed on. The more you can reduce this, the less tax you'll potentially pay. Another potential advantage lies in the tax brackets. Joint filing often results in a lower effective tax rate, especially when there's a significant difference in incomes between spouses. The way the U.S. progressive tax system is structured can favor couples who have disparate incomes. The EITC is a boon for low-to-middle-income families. When filing jointly, many couples find they are eligible for a larger credit compared to filing separately. It’s essentially a reward system to encourage work among low-income individuals, and married couples often get the sweet end of the deal. If you've recently expanded your family through adoption, filing jointly can help you maximize your adoption tax credits. These credits are designed to offset the often substantial costs of adoption, and joint filers usually receive a more substantial credit. For families with children or other dependents, this credit can significantly reduce tax obligations. Couples who file jointly typically qualify for a higher amount, especially if both spouses are working or actively seeking employment. Couples paying off student loans might find solace in the student loan interest deduction. This benefit becomes especially relevant for couples where both partners have student loans. Filing jointly often maximizes this deduction. There’s no doubt about it: filing a single tax return is simpler than filing two. This means less paperwork, fewer calculations, and typically a quicker process. Joint filers, in some cases, enjoy more generous contribution limits for IRAs. Especially if one spouse isn't working, the working spouse can often contribute on behalf of the other, leading to more significant tax-advantaged retirement savings. Should you sell your primary residence, married couples filing jointly typically benefit from a higher capital gains exclusion. This can lead to substantial tax savings, especially in rapidly appreciating housing markets. The major drawback is the joint responsibility. Both spouses are on the hook for any taxes, penalties, or interest owed. If one partner errs, both pay the price. High-earning couples, where both spouses have substantial incomes, might find themselves pushed into a higher tax bracket, leading to a larger tax bill. For those who prefer keeping financial details under wraps, joint filing means laying all cards on the table. This could be a discomfort for some. When spouses prefer not to mingle about their financial matters, filing separately provides a clear delineation. It allows each person to maintain independence and clarity about their financial responsibilities. By filing separately, each spouse is only held responsible for their tax dues. This can be especially comforting if one partner has more complex financial dealings or if there’s uncertainty about accuracy. For couples where one spouse has a significantly lower income but sizable deductions, filing separately could lead to a smaller tax bill. It’s all about playing the scales of income versus deductions. Your Adjusted Gross Income (AGI) impacts various tax benefits. Sometimes, by filing separately, one can optimize their AGI to qualify for certain deductions that might be phased out at higher joint AGIs. If you’re wary about any underreported income or potential tax issues from your spouse’s side, filing separately can act as a safeguard. You wouldn’t be held responsible for any underpayment resulting from your spouse’s errors or fraudulent activities. Many juicy tax credits and deductions either get reduced or vanish entirely. This means you might say goodbye to benefits like the Earned Income Tax Credit or the Child and Dependent Care Credit. Ironically, while you might choose this to save on taxes, it often results in paying more combined tax than if you had opted for joint filing. Both spouses need to be on the same page regarding decisions like itemizing or taking standard deductions. It requires more coordination. The ability to contribute to Roth IRAs can get reduced or entirely nullified based on the income levels of separate filers. A significant difference in income levels between spouses can greatly affect the choice of filing jointly or separately. When one spouse earns considerably more than the other, the overall taxable amount might be lessened when filed jointly. On the other hand, if both earn significantly, it may bump the combined income into a higher tax bracket. It's crucial to comprehensively evaluate the various tax credits and deductions you may be eligible for. Assess how each potential deduction or credit can impact your overall tax liability. . Remember, certain deductions or credits might be more beneficial when filing jointly, while others may be accessible only when filing separately. Existing debts, especially student loans, back taxes, or outstanding child support, can heavily influence your tax filing decision. These debts can impact potential refunds, and in some cases, joint filing might lead to a portion of the refund being used to offset the owed amount. It's important to understand how these debts might be treated differently based on your filing status. Consider any significant financial moves you're planning in the near future. Purchasing a home, launching a business, or making substantial investments can have tax implications. Assessing how these plans interact with your tax strategy can ensure you make the most advantageous decisions for both the short and long term. Current legal situations, such as an ongoing divorce or separation, can drastically affect your decision. Your legal status and any agreements or court orders in place might dictate the necessity of a specific filing status. Additionally, it's essential to consider any legal implications that could arise from choosing one status over another. Determining whether to file taxes jointly or separately is a nuanced decision that couples must make considering multiple financial and personal factors. While joint filing offers benefits such as a higher standard deduction, more accessible tax credits, and often a lower effective tax rate, it does bring shared liability. On the contrary, filing separately allows for financial independence and can be a strategic choice in specific scenarios despite the potential loss of certain tax benefits. Crucial aspects like income disparity, potential deductions, existing debts, future financial ventures, and any legal situations play pivotal roles in this decision-making process. Given the complexities and the high stakes of tax choices, seeking advice from a tax professional can be invaluable, ensuring both immediate and long-term benefits. Ultimately, couples should weigh the pros and cons, aligning their tax strategy with their broader financial goals.Should You and Your Spouse File Taxes Jointly or Separately?

Advantages of Filing Jointly

Standard Deduction

Tax Brackets

Credits and Deductions

Earned Income Tax Credit (EITC)

Adoption Tax Credits

Child and Dependent Care Tax Credit

Student Loan Interest Deduction

Simplicity

Retirement

Capital Gains Exclusion

Disadvantages of Filing Jointly

Joint Liability

Potential for Higher Tax

Loss of Privacy

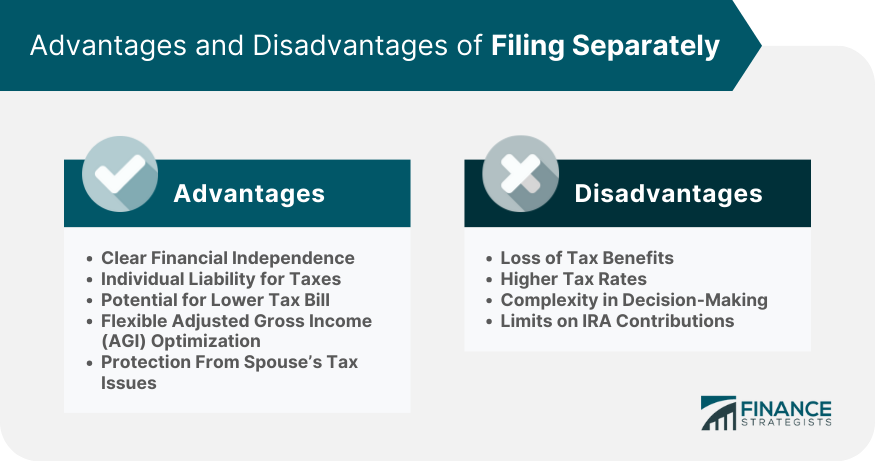

Advantages of Filing Separately

Distinct Finances

Liability

Potential for Lower Tax

Flexible AGI calculations

Protection From a Spouse's Potential Tax Problems

Disadvantages of Filing Separately

Loss of Tax Benefits

Higher Tax Rates

Complexity

Limits on IRA Contributions

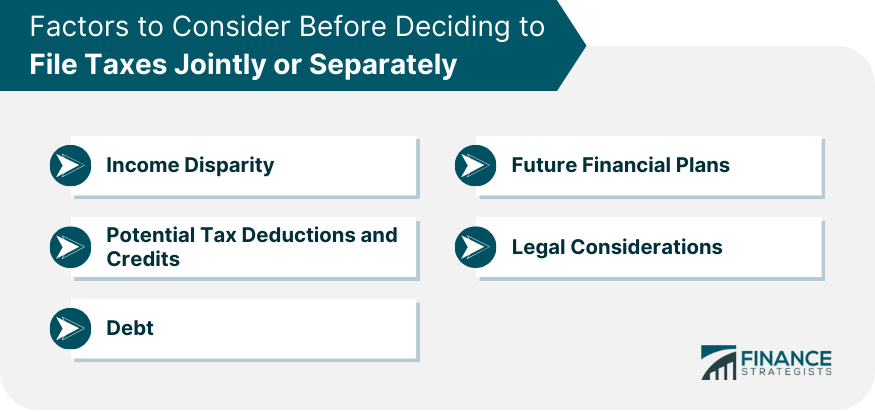

Factors to Consider Before Deciding to File Taxes Jointly or Separately

Income Disparity

Potential Tax Deductions and Credits

Debt

Future Financial Plans

Legal Considerations

Conclusion

Should You and Your Spouse File Taxes Jointly or Separately? FAQs

Filing jointly often offers a higher combined standard deduction, access to several tax credits and deductions, a potentially lower effective tax rate, and the simplicity of filing one tax return.

Filing separately can be beneficial when spouses wish to keep their finances distinct, when one partner has potential tax issues, when there's a significant income disparity combined with large deductions for one spouse, or when aiming to achieve a specific Adjusted Gross Income (AGI) for particular deductions.

Yes, couples who file separately often lose access to tax credits like the Earned Income Tax Credit (EITC) and face restrictions or eliminations on deductions like the student loan interest deduction.

While filing jointly is simpler, the major downside is joint liability. Both spouses become responsible for any taxes, penalties, or interest due. This means if one partner makes an error, both could face consequences.

While it's not mandatory, consulting with a tax professional can provide tailored advice based on your specific financial situation and help you make an informed decision.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.