A bank account is a financial arrangement between an individual or a business and a banking institution. This relationship facilitates the secure storage of money, easy access to funds, and the facilitation of transactions. It is a primary tool for managing personal finance, providing a mechanism for receiving income, saving for the future, and making payments for goods and services. They are essential in our current economic climate, enabling efficient financial management, facilitating activities like online shopping, automating bill payments, and paving the way for credit history establishment, which is vital when seeking loans or credit cards. Financial institutions offer various bank account types tailored to diverse needs, including accounts for daily transactions, savings, or investing, and understanding these can help in selecting the best fit for one's requirements. This refers to the details of the individual or entity that owns the bank account. It includes the account holder's name, contact information, social security number or other identification numbers, and sometimes their occupation. An account number is a unique identifier for your bank account. It is used for various transactions, including direct deposits, electronic funds transfers, and bill payments. The routing number, also known as the ABA (American Bankers Association) number, is a nine-digit code used in the United States to identify the bank where the account is held. It's crucial for setting up direct deposits and automatic bill payments. Bank information refers to the details of the financial institution where your account is held. It includes the bank's name, address, contact details, and sometimes, the bank's SWIFT code for international transactions. A checking account, also known as a transactional account, is primarily used for day-to-day transactions. It allows for unlimited deposits and withdrawals, making it ideal for paying bills, issuing checks, and debit card purchases. Some checking accounts also offer interest on your account balance. Common features of a checking account include a checkbook, a debit card, online and mobile banking facilities, direct deposit services, and overdraft protection. Most checking accounts also offer unlimited transactions. While checking accounts offer convenience, they usually have lower interest rates compared to savings or investment accounts. Some banks also impose monthly maintenance fees, although these can often be waived by meeting certain conditions like maintaining a minimum balance or setting up direct deposit. A savings account is designed for storing money over the long term. It offers a safe place to keep funds while earning interest. Savings accounts are ideal for setting aside money for future needs or emergencies. Savings accounts typically offer ATM cards for withdrawals, online and mobile banking facilities, and the ability to set up automatic transfers from a checking account. They also accrue interest over time. The main drawback of savings accounts is the federal limit on the number of certain types of withdrawals or transfers you can make each month. Exceeding these limits can result in fees. Also, the interest rates, though higher than checking accounts, can still be relatively low. Certificates of Deposit (CD) are time-bound savings accounts with a fixed interest rate. They are an excellent choice for those with a low-risk appetite and who can commit their funds for a specific period. A CD has a fixed term, typically ranging from a few months to several years. The longer the term, the higher the interest rate. However, the money is inaccessible until the term ends without incurring a penalty. The primary disadvantage of a CD is the lack of liquidity. If you withdraw your money before the term ends, you'll likely have to pay an early withdrawal penalty. Also, if interest rates rise, you'll be stuck with the lower rate until your CD matures. Money market accounts combine features of both checking and savings accounts. They typically offer higher interest rates than regular savings accounts and provide limited check-writing ability. Money market accounts often come with a debit card and check-writing privileges. They also offer a higher interest rate, although this typically requires a higher minimum balance. The main drawback is that money market accounts usually require a higher minimum balance to earn the advertised interest rate or to avoid monthly fees. Also, like savings accounts, they are subject to transaction limits. Retirement accounts such as Individual Retirement Accounts (IRAs) and Roth IRAs are designed to help individuals save for retirement. They offer tax advantages, making them an essential part of long-term financial planning. Both types of IRAs allow individuals to make annual contributions up to a certain limit. Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. The main drawback of IRAs is that they come with contribution limits and strict regulations. Early withdrawals (before age 59 ½ ) usually incur penalties and taxes, and mandatory withdrawals (required minimum distributions) start at age 73 for most IRAs. Opening a bank account begins with selecting the right bank and account type that aligns with your financial goals and lifestyle. Factors to consider include the bank's reputation, accessibility, customer service, and the features and benefits of the account. For instance, if you plan to save money and earn interest, a savings or money market account could be suitable. If you prefer everyday banking transactions, a checking account might be more appropriate. Before opening an account, it's crucial to understand the bank's terms and conditions. These can include the bank's policies on fees, minimum balance requirements, transaction limits, and interest rates. Reading and understanding these terms can help you avoid unexpected charges and ensure you are using the account to its full potential. While the process can vary between banks, typically, it involves completing an application form and providing the necessary documentation. You may need to deposit a certain amount to activate the account. Many banks now offer online applications, allowing you to open an account without visiting a branch. When opening a bank account, you'll typically need to provide identification (such as a passport or driver's license), proof of address (like a utility bill), and your social security number or taxpayer identification number. Some banks may also ask for employment details or income information. To keep your account active and in good standing, make regular deposits and monitor your withdrawals to avoid overdrafts or falling below minimum balance requirements. Remember that some accounts may limit the number of withdrawals you can make per month. Most banks offer online and mobile banking services, allowing you to manage your bank account from anywhere, at any time. You can check your balance, transfer funds, pay bills, and even deposit checks digitally. These tools can help you manage your finances efficiently and keep track of your transactions. Banks can charge various fees, including monthly maintenance fees, ATM fees, overdraft fees, and foreign transaction fees. Familiarize yourself with these fees to avoid any unexpected charges. Some fees can be avoided by maintaining a minimum balance, linking a savings account for overdraft protection, or using in-network ATMs. Regularly reviewing your bank statements and balances can help you spot any errors, unauthorized transactions, or signs of fraud. It also helps you track your spending, manage your budget, and stay on top of your financial goals. Banks use various security measures to protect accounts, including encryption, two-factor authentication, fraud monitoring, and secure sockets layer (SSL) technology for safe online transactions. They may also provide insurance on your deposits up to a certain amount. While banks provide security measures, it's also essential to take personal measures to protect your account. These can include creating strong, unique passwords, protecting your personal information, regularly updating your contact information, and being vigilant about potential phishing scams. If you notice any suspicious activity on your account or believe your information has been compromised, contact your bank immediately. They can guide you on the next steps, which can include freezing your account, monitoring for further suspicious activity, or setting up a new account if necessary. There may be several reasons to close a bank account. You may be unsatisfied with the bank's services, you may find a better account offering elsewhere, or perhaps you simply have too many accounts and need to consolidate. Regardless, it's essential to ensure that closing an account is the best choice for your financial situation. Before closing your bank account, ensure all checks and pending transactions have cleared and all direct deposits or automatic payments are redirected to a new account. Then, you can usually close the account by visiting your bank branch, calling the customer service line, or sending a written request, depending on your bank's procedures. After the account is closed, destroy any debit cards or checks linked to the account for added security. Be aware of any potential fees for closing an account. Some banks may charge a fee if an account is closed within a certain time after opening. Moreover, closing a bank account may affect your credit score negatively if you have overdraft protection linked to a credit card. Bank accounts play a crucial role in personal finance management. They offer a safe place to keep money, simplify transactions, and can help save for future needs. Moreover, they're instrumental in tracking income and expenses, budgeting, and building a credit history. Having a well-organized bank account system can simplify budgeting. For example, having separate accounts for daily expenses, emergency savings, and long-term goals can make it easier to manage and monitor your finances. Using online and mobile banking tools, you can easily track your income and expenses and adjust your budget as needed. While simply having a bank account does not directly affect your credit score, it can play a role in building credit. For instance, keeping your account in good standing, managing overdrafts, and meeting financial obligations are all behaviors that can positively influence your creditworthiness. Additionally, some banks offer "credit builder" loans or secured credit cards to account holders, which can help build a credit history. A bank account is an essential tool in personal finance, offering a secure place to store money and facilitate transactions. It's composed of various elements, including account holder information, account and routing numbers, and bank details. Bank accounts come in different types - from everyday checking accounts to savings accounts and specialized accounts like CDs and IRAs. Opening a bank account involves choosing the right bank and account type, understanding the terms and conditions, and providing the necessary documentation. Bank accounts must be managed and secured properly, understanding bank fees, monitoring statements, and following security measures. Whether you are starting your financial journey or looking to optimize your existing finances, consider your bank account options carefully and seek advice from banking professionals if needed.What Is a Bank Account?

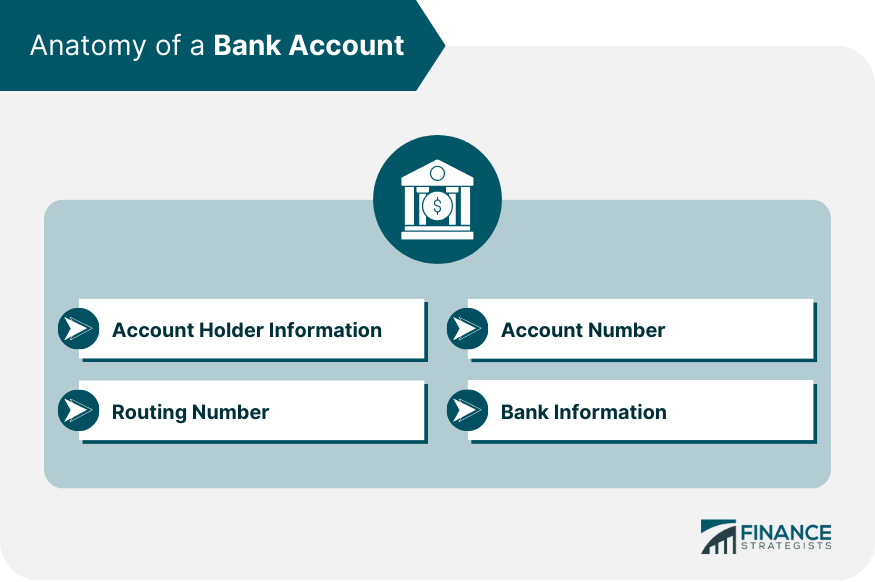

Anatomy of a Bank Account

Account Holder Information

Account Number

Routing Number

Bank Information

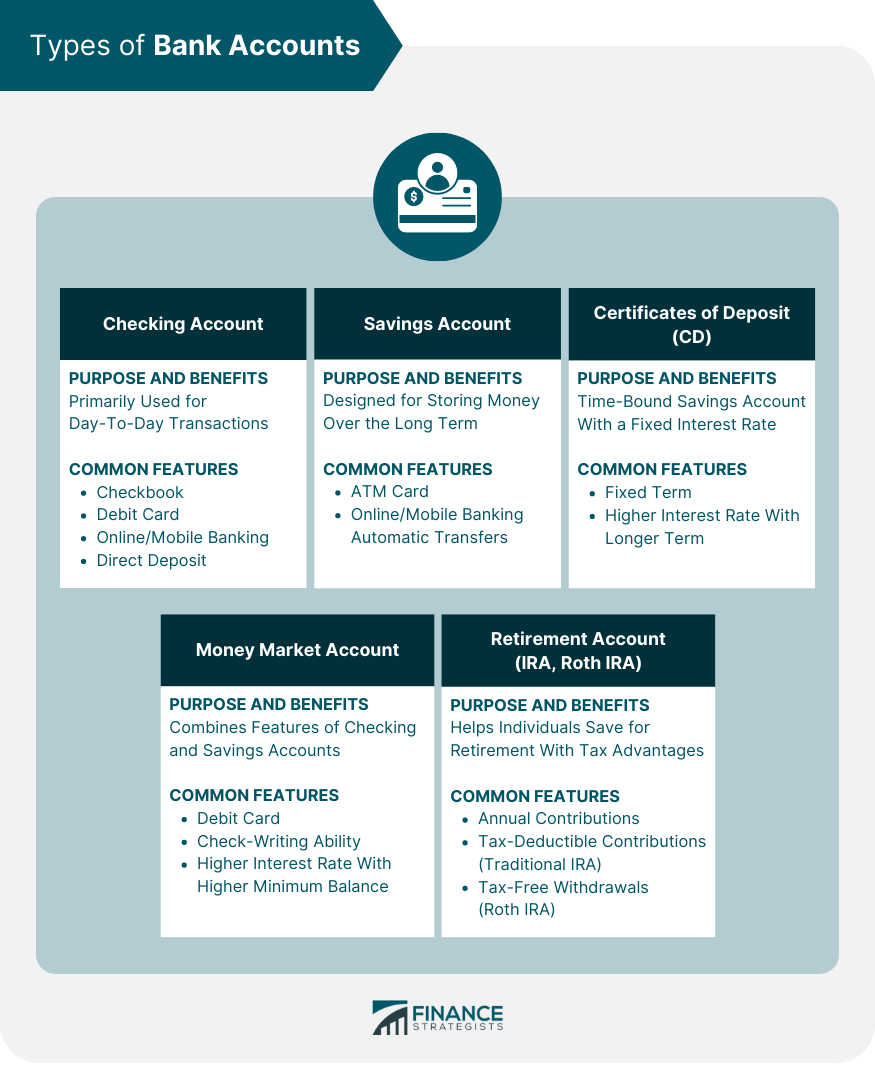

Types of Bank Accounts

Checking Account

Purpose and Benefits

Common Features

Potential Drawbacks

Savings Account

Purpose and Benefits

Common Features

Potential Drawbacks

Certificates of Deposit (CD)

Purpose and Benefits

Common Features

Potential Drawbacks

Money Market Account

Purpose and Benefits

Common Features

Potential Drawbacks

Retirement Account (IRA, Roth IRA)

Purpose and Benefits

Common Features

Potential Drawbacks

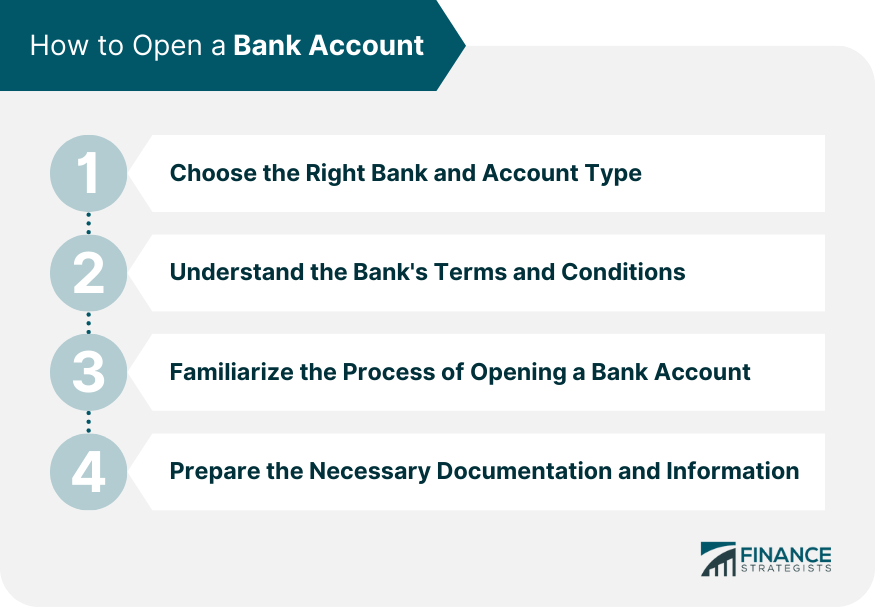

Opening a Bank Account

Choosing the Right Bank and Account Type

Understanding the Bank's Terms and Conditions

Familiarizing the Process of Opening a Bank Account

Preparing the Necessary Documentation and Information

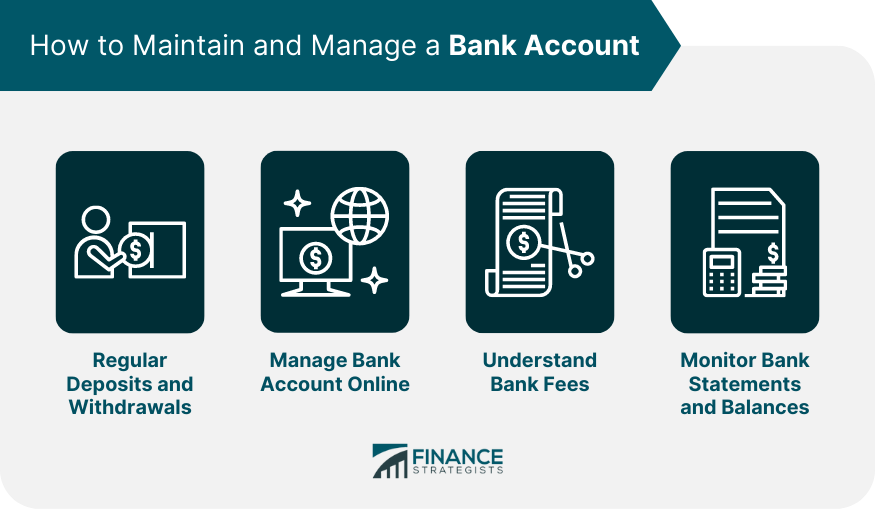

Maintaining and Managing a Bank Account

Regular Deposits and Withdrawals

Managing Bank Account Online

Understanding Bank Fees

Monitoring Bank Statements and Balances

Bank Account Security

How Banks Secure Accounts

Personal Measures for Bank Account Security

Handling Potential Bank Account Threats and Fraud

Closing a Bank Account

Reasons to Close a Bank Account

Process of Closing a Bank Account

Potential Costs and Consequences

Bank Account and Personal Finance

Role of a Bank Account in Personal Finance

Integrating Bank Accounts Into a Personal Budget

Bank Accounts and Credit Score

Final Thoughts

Bank Account FAQs

A bank account is a financial arrangement with a bank, allowing you to safely store money, make transactions, and in many cases, earn interest.

There are several types, including checking accounts for everyday transactions, savings accounts for earning interest, and other specialized accounts like Certificates of Deposit (CD), money market accounts, and retirement accounts such as IRAs.

You can open a bank account by choosing a bank and account type, understanding the terms and conditions, filling out an application, and providing necessary documentation like identification and proof of address.

Secure your bank account by creating strong, unique passwords, protecting your personal information, regularly updating your contact information, and being vigilant about potential scams.

Before closing a bank account, ensure all transactions have cleared, redirect any direct deposits or automatic payments, and understand any potential costs or consequences like fees or impacts on your credit score.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.